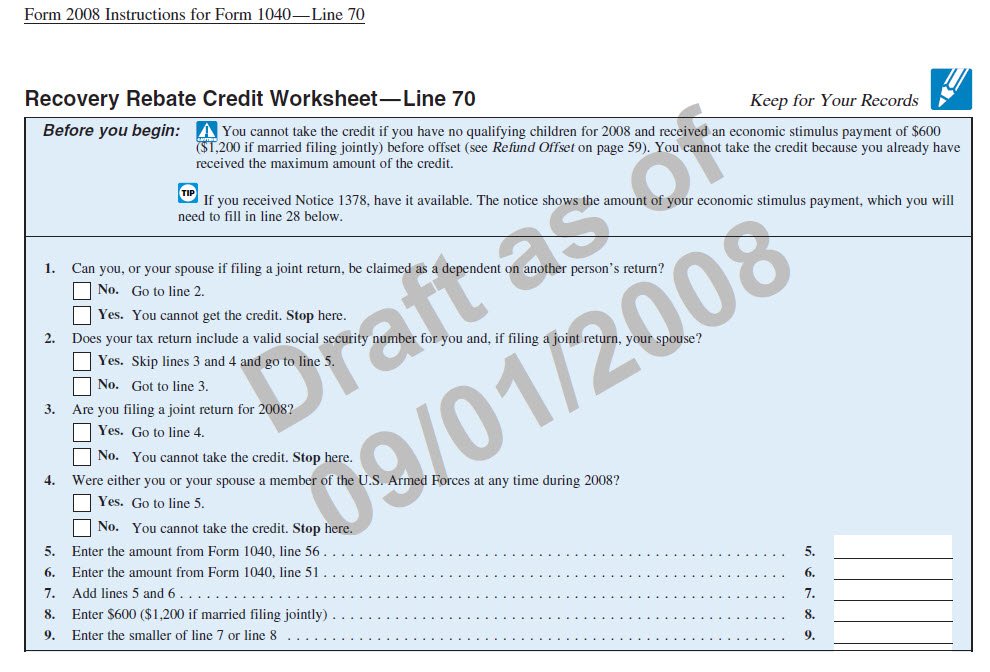

Who Can Get The Recovery Rebate Credit – The Recovery Rebate allows taxpayers to receive a tax refund without having to modify their tax returns. The IRS runs this program and it’s completely free. However, prior to filing it is important to know the regulations and rules. These are just a few facts about this program.

Recovery Rebate Refunds are not subject to adjustment

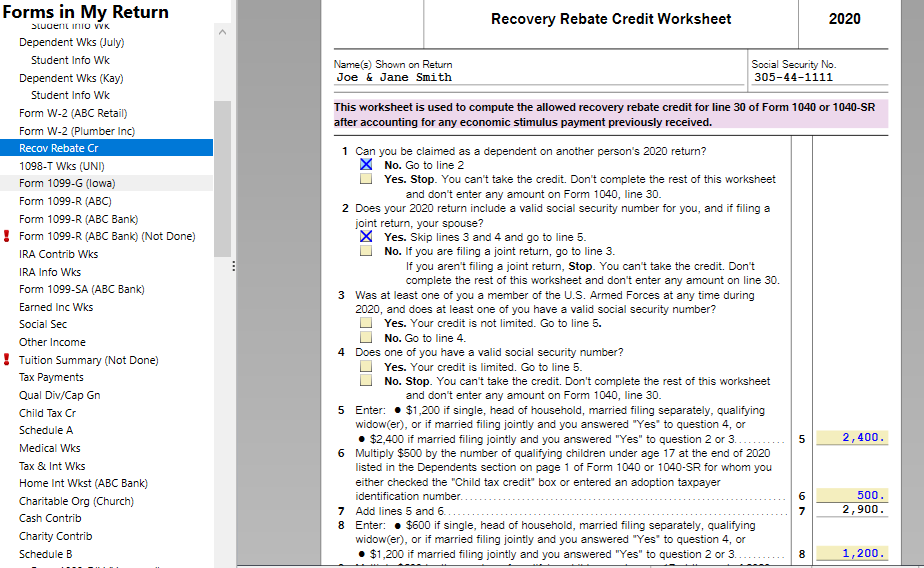

Taxpayers eligible for Recovery Rebate credits are notified prior to. This means you won’t need to change the amount of your tax refund if you are liable for higher taxes in 2020 than you did in 2019. However, depending on the amount of your income, your recovery credit might be reduced. Your credit will be reduced to zero if your earnings you earn are greater than $75k. Joint filers with a spouse will drop to $150,000. Heads of households will begin to see their recovery rebate refunds reduced to $112,500.

Even if they did not receive all of the stimulus funds but they still have the option of claiming tax recovery credits in 2020. You will need to have an IRS account online and an official printed document stating the total amount they received.

It does NOT provide a refund of tax

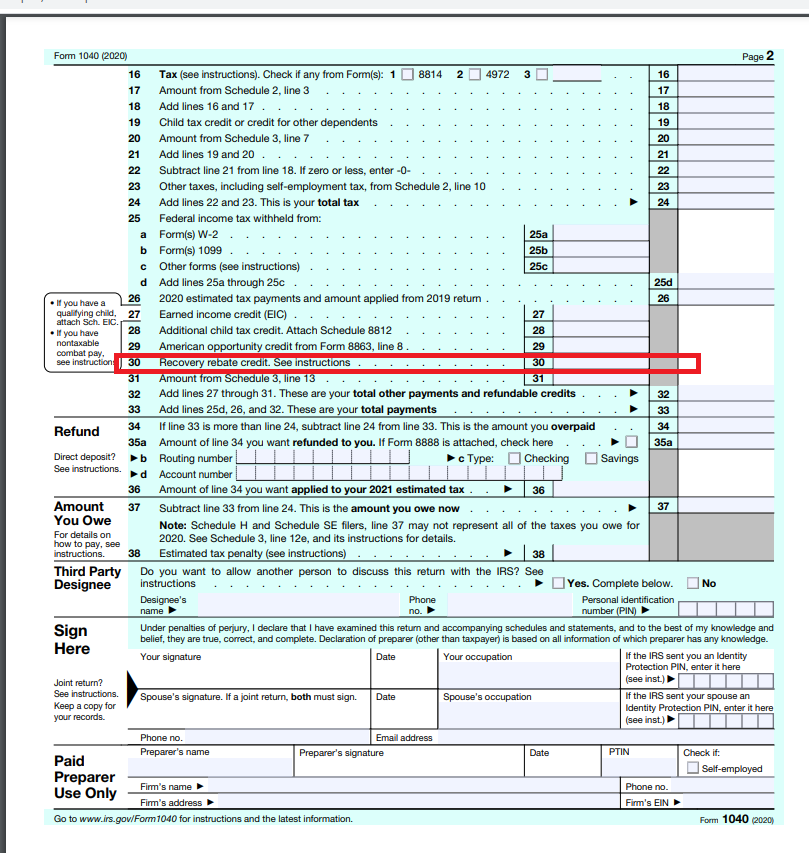

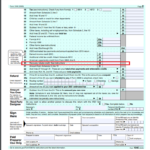

Although the Recovery Rebate will not give you a tax refund, it will give you taxes, it will provide you with tax credits. IRS has issued warnings about errors made when claiming this stimulus cash. The child tax credit is another area that has been subject to errors. If the credit isn’t applied correctly, the IRS will notify you via email.

The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021. Tax dependents can be eligible for as much as $1400 (married couples with two children) or up to $4200 (single taxpayers).

It is possible to delay it due to mathematical errors or mistakes

If you get a letter informing you that the IRS has found a math error in you tax return, it is recommended that you take a moment to check and correct your tax return information. You may have to wait for your refund if you provide inaccurate information. There are answers to your questions within the vast FAQ section of IRS.

There are a variety of reasons why your recovery rebate might not be processed in time. An error in the way you claim child tax credit or stimulus money is one of the most common reasons for delays. The IRS suggests that taxpayers double-check their tax returns to make sure they are declaring every stimulus payment.