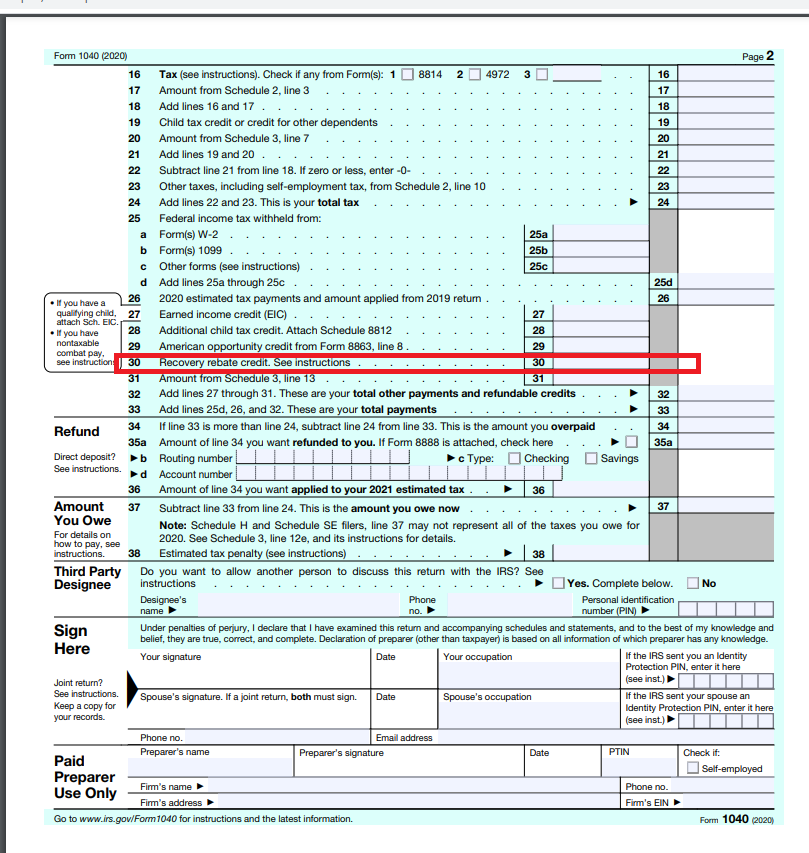

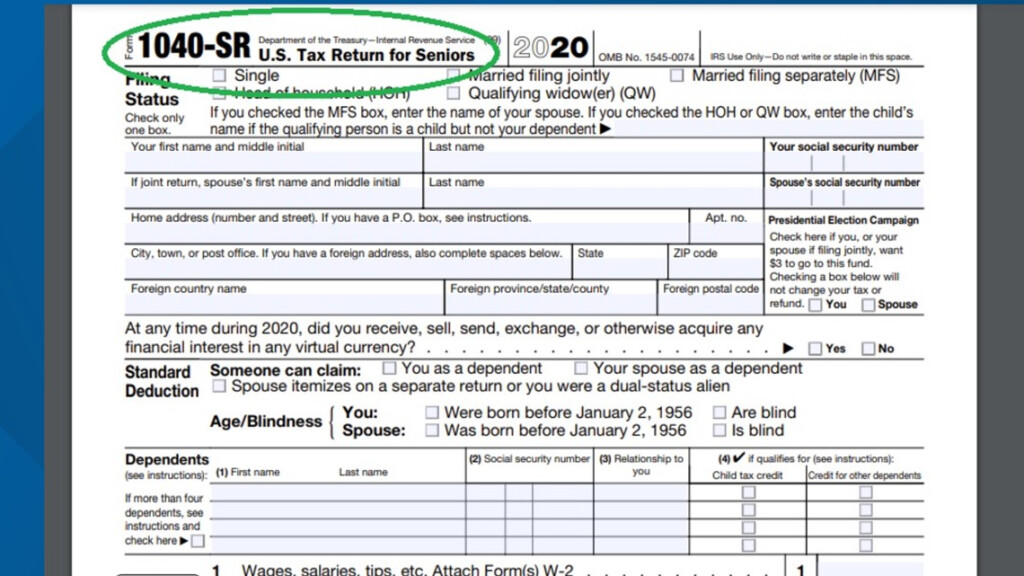

What Tax Form For Recovery Rebate Credit – Taxpayers are eligible for an income tax credit via the Recovery Rebate program. This permits them to get a refund on their taxes without needing to alter their tax returns. This program is run by the IRS and is a free service. But, before you file it is essential to understand the regulations and rules. Here are some details about the program.

Refunds from Recovery Rebate do not have to be adjusted

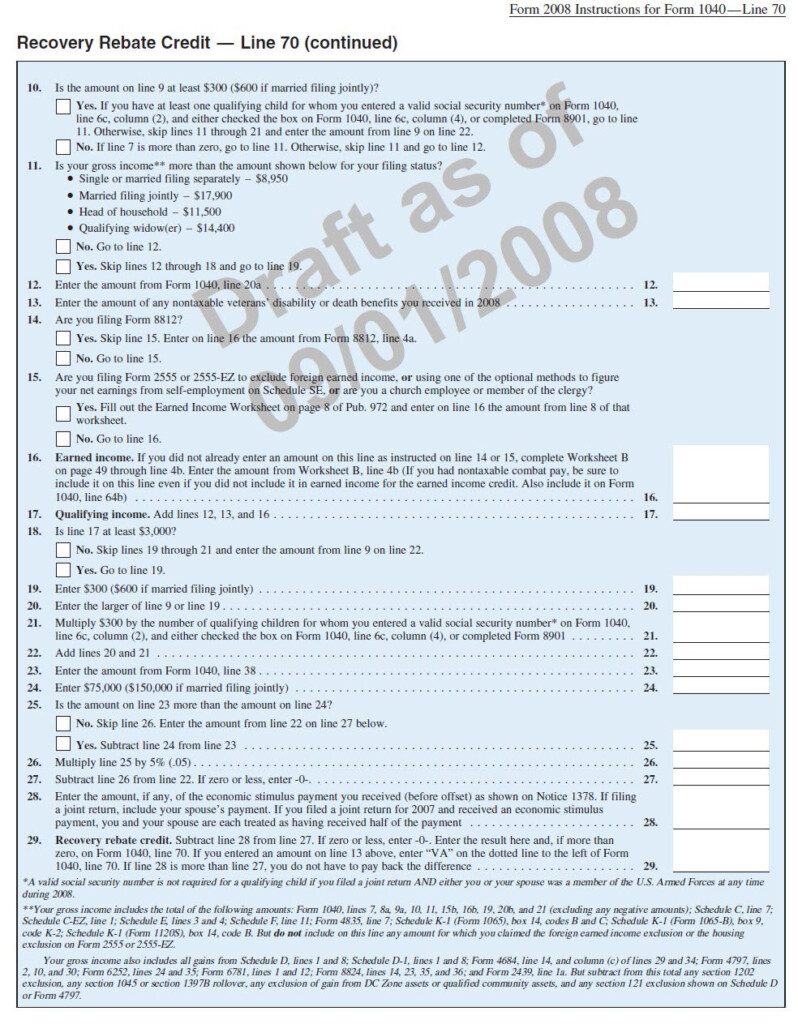

Eligible taxpayers are eligible to be eligible for Recovery Rebate credits advance. If you owe tax more in 2020 than you did in 2019 your refund is not adjusted. Your income will affect the amount of your rebate credit. If you earn more than $75k, your credits will decrease to zero. Joint filers with a spouse will see their credit start to decline at $150,000 and heads of household will see their recovery rebate refunds decreased to $112,500.

Even though they didn’t receive the entire stimulus amount People can still claim credit for recovery rebates on their tax bills in 2020. To be eligible, they’ll need an IRS-registered account online along with a printed notice detailing the amount distributed to them.

It doesn’t offer a tax refund

Although the Recovery Rebate doesn’t provide you with a tax return , it does provide you a tax credit. The IRS has issued warnings about mistakes in claiming this stimulus money. Child tax credits are another area where mistakes were committed. If the credit isn’t used correctly then the IRS will send you an email.

For 2021, the Federal income tax returns for 2021 are eligible to receive the Recovery Rebate. If you’re a married couple with two children , and count as tax dependent, you could get as much as $1,400, or $4200 for single filers.

It could also be delayed due to math mistakes and miscalculations

If you receive a letter from the IRS sends you a notice saying that your tax return has an error in math, it is important to take the time to look over your information and make any necessary corrections. If you fail to provide correct information, your refund may be delayed. The IRS provides a variety of FAQs to answer all your questions.

There are several reasons why your recovery reimbursement could be delayed. An error in the way you claim the child tax credit or stimulus funds is one of the most frequently cited reasons for delays. The IRS has warned people to double-check tax returns and make sure they declare every stimulus payment properly.