What Is The Tax Recovery Rebate – A Recovery Rebate gives taxpayers an possibility of receiving a refund on their tax without having to adjust the tax returns. This program is run by the IRS and is a free service. However, before filing, it is crucial to understand the rules and regulations. Here are some information about this program.

Recovery Rebate Refunds are not subject to adjustment

Recovery Rebate credits are paid to taxpayers eligible for them in advance. If you owe more taxes in 2020 than in the year prior to it the refund you receive will not be adjusted. Your income will impact the amount of your recovery rebate credit. If you earn more than $75k, your credit could decrease to zero. Joint filers who have spouses will see their credit begin at $150,000 and then decline to $150,000. Heads and household members will begin to notice their recoveries rebates beginning to decrease to $112,500.

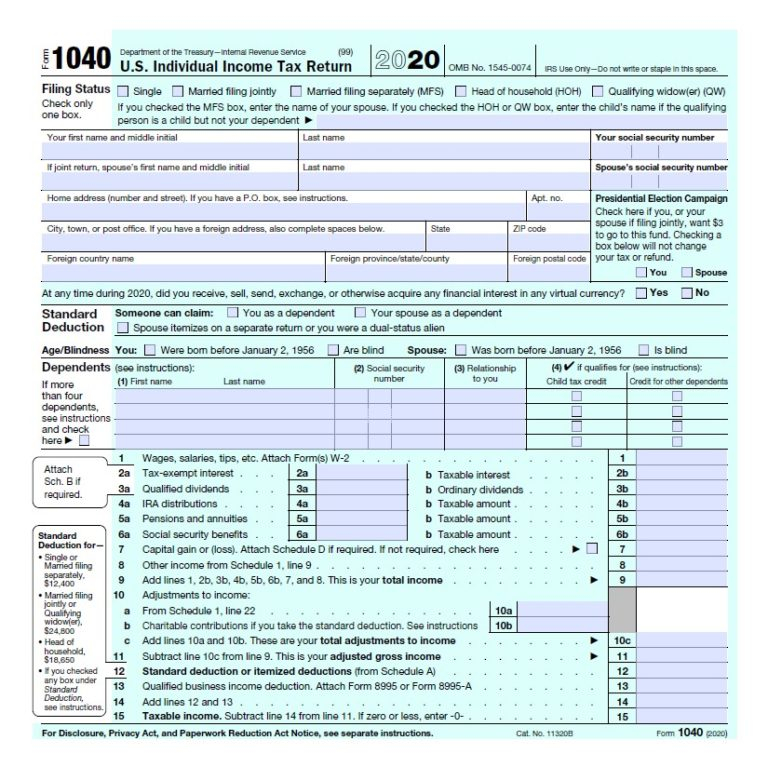

Individuals who didn’t receive full stimulus payments could be eligible for recovery rebate credits on their tax returns for 2020. In order to do this you must have an account online with the IRS and also a paper notice detailing the total amount dispersed to them.

It doesn’t offer any tax refund.

The Recovery Rebate does not provide the tax-free status, but it will grant you the tax credit. IRS has cautioned people about the mistakes they made in applying for this stimulus cash. The child tax credit is another area where mistakes have been committed. The IRS will send a notice to you if the credit has not been properly applied.

In 2021 the federal tax returns for income will be eligible to receive the Recovery Rebate. Tax dependents can be qualified for as much as $1400 (married couples with two children) or up to $4200 (single tax filers).

It is possible to delay it due to mathematical errors or miscalculations

If you receive a letter by the IRS informing you that there was a mathematical error in your tax returns, take the time to review and correct the error. Incorrect information could cause your refund delay. The IRS offers a variety of FAQs that will answer your questions.

There are many reasons your reimbursement for recovery might be delayed. Most often, the reason behind delays is a miscalculation in filing a tax credits or stimulus funds. The IRS urges individuals to double-check their tax returns in order to ensure that every stimulus money is declared correctly.