What Is Recovery Rebate Credit Mean – Taxpayers can receive a tax rebate through the Recovery Rebate program. This allows them to get a refund on their taxes without having to amend their tax returns. This program is administered by the IRS and is a free service. It is essential to know the guidelines and rules of the program prior to submitting. These are the essential points you need to be aware of about the program.

Recovery Rebate funds are not subject to adjustment.

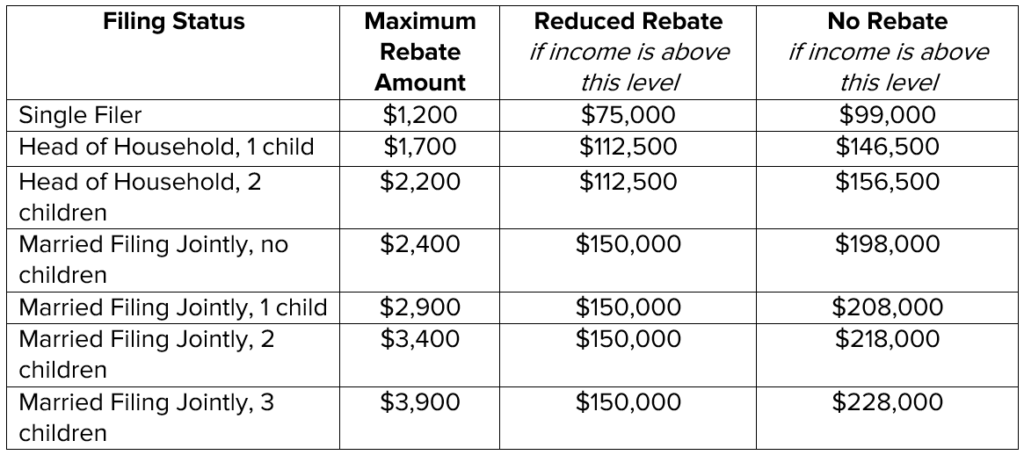

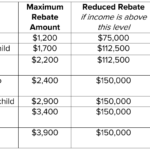

Prior to the tax year, taxpayers who are eligible get recovery credits. That means your tax refund won’t be affected even if you are owed more taxes in 2020 as compared to the year prior. However your rebate for recovery may reduce based on your income. The credit you receive will be reduced to zero if the amount of income you earn exceeds $75k. Joint filers’ credit will reduced at $150,000 for married couples. Household heads will also see their recovery rebate refunds drop to $112,500.

People who did not receive the full stimulus payments could be eligible for recovery credits for tax refunds for 2020. You’ll need an IRS account on the internet and a printed notice listing the total amount received.

It doesn’t offer any tax refund.

The Recovery Rebate is not a tax refund, however it offers tax credit. IRS has issued warnings about errors made when claiming the stimulus cash. The child tax credit is another area susceptible to mistakes. If the credit isn’t used correctly then the IRS will notify you via email.

The Recovery Rebate is available on federal income tax returns until 2021. A qualified tax dependent can receive up $1,400 (married couples having two children) or $4200 (single tax filers).

It could be delayed due to mistakes in math or calculations

You should double-check your information and make any changes when you receive a notice from IRS informing you that there’s an error in the math of the tax return. The incorrect information could cause your refund to be delayed. Fortunately that the IRS has an extensive FAQ section to help you answer your questions.

There are several reasons why your recovery reimbursement could be delayed. The most common reason the reason your recovery refund could be delayed is because there was a mistake in applying for the stimulus funds and also the tax credits for children. The IRS warns taxpayers to double-check tax returns and make sure they are claiming each stimulus money.