Turbotax Recovery Rebate Credit How To Claim – A Recovery Rebate is an opportunity taxpayers to claim a tax refund without adjusting their tax returns. The IRS runs this program and it is cost-free. When you are filing however, it’s crucial to be acquainted of the regulations and guidelines of this program. These are the essential points you need to be aware of about the program.

Recovery Rebate funds are not subject to adjustment.

Taxpayers who qualify for credits under the Recovery Rebate program will be informed in advance. If you owe tax more in 2020 than you did in 2019, your refund will not be adjusted. Your income will affect the amount of your rebate credit. Your credit rating will decrease to zero if your earnings exceeds $75,000. Joint filers, who jointly file with a spouse will have their credit drop to $150,000. Heads of households and joint filers will begin to see the recovery rebates decrease to $112,500.

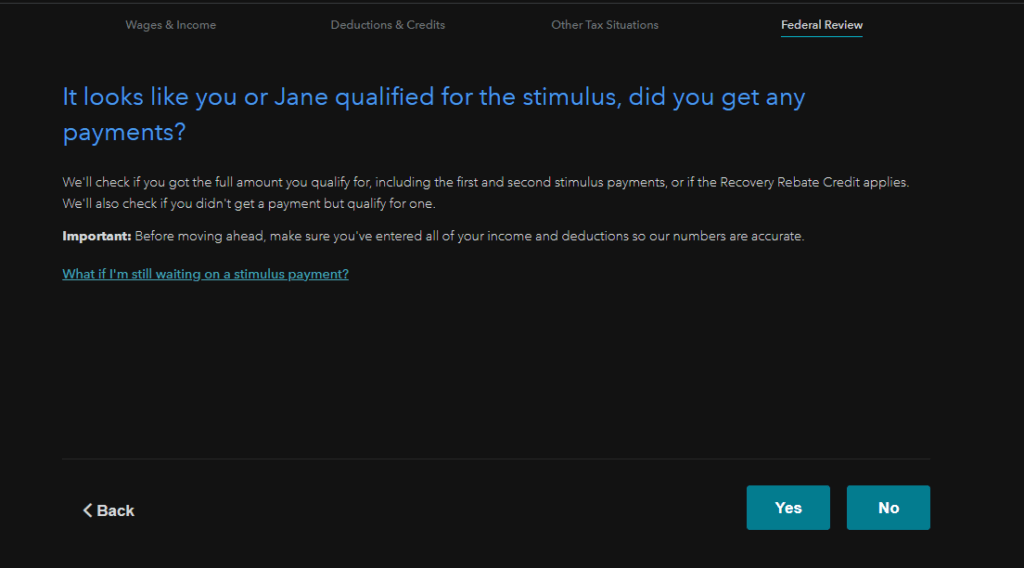

Although they did not receive the full stimulus payment, people can still get refund rebate credits towards their tax obligations in 2020. You’ll need an IRS account online and an official printed document stating the amount you received.

It doesn’t allow the tax return to be filed.

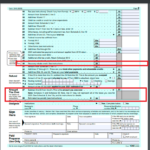

While the Recovery Rebate does NOT provide a tax return for you but it does give tax credits. IRS has warned taxpayers about making mistakes when applying for the stimulus cash. The IRS has also made errors in the application of child tax credits. If you fail to apply the credit in a proper manner The IRS could issue a notice.

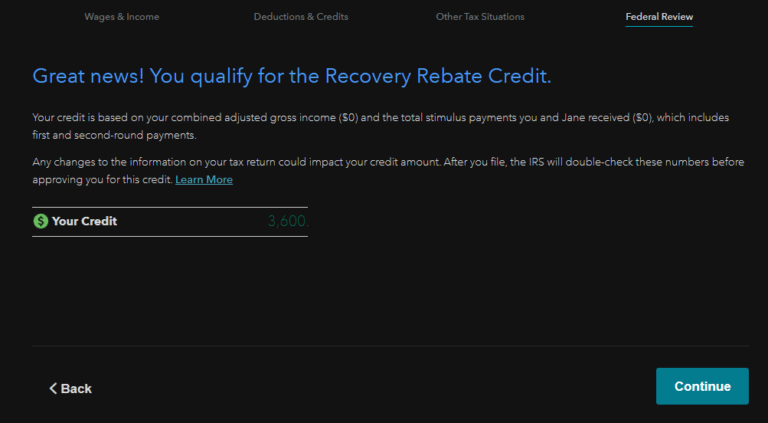

For 2021, the Federal income tax returns are eligible to receive the Recovery Rebate. If you’re a married couple with two kids and count as tax dependent, you can receive upto $1,400 or upto $4200 for filers who are single.

It may be delayed due to errors in math or calculations

If you get a letter from the IRS that says that you have a math error in your tax return it is recommended that you take a moment to review your tax return and make any adjustments that are required. Incorrect information can cause a tax refund to be delayed. Fortunately that the IRS has an extensive FAQ section that can answer your questions.

There are many reasons why your recovery rebate might be delayed. The most common reason your recovery rebate may be delayed is because there was a mistake while making an application for stimulus money and also the child tax credit. The IRS recommends that taxpayers check their tax returns twice in order to confirm that every stimulus money is properly claimed.