Third Recovery Rebate – Taxpayers can receive an income tax credit via the Recovery Rebate program. This allows them to get a refund on their taxes without having to amend their tax returns. This program is run by the IRS and is a free service. Prior to filing, however, it is crucial to be acquainted with the regulations and rules of this program. Here are some of the facts you need to know about the program.

Refunds received from Recovery Rebate do not have to be adjusted

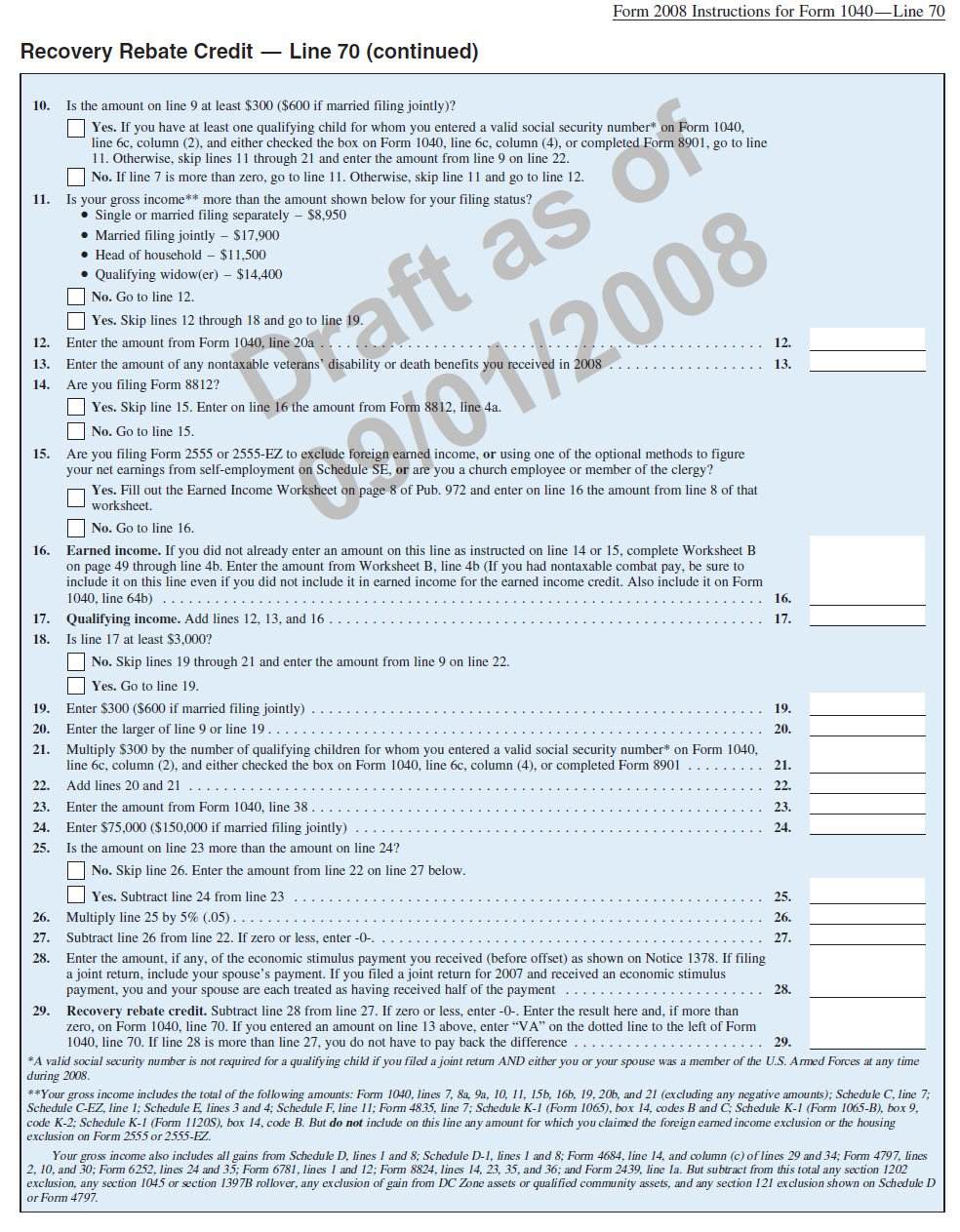

Prior to the tax year, taxpayers who are eligible are eligible to receive recovery credits. This means that you do not need to adjust the amount of your refund if have higher tax obligations in 2020 than for the year 2019. However, depending on the amount of your income, your recovery credit could be cut. Your credit could be cut to zero if the earnings you earn are greater than $75k. Joint filers’ credit will cut to $150,000 for married couples. Heads of households are also likely to see their rebates decrease to $112,500.

People who did not receive the full amount of stimulus funds can still claim rebate credits for recovery on their taxes in 2020. To do this you must have an account online with the IRS and also a paper notice listing the total amount dispersed to them.

It does not provide any tax refund

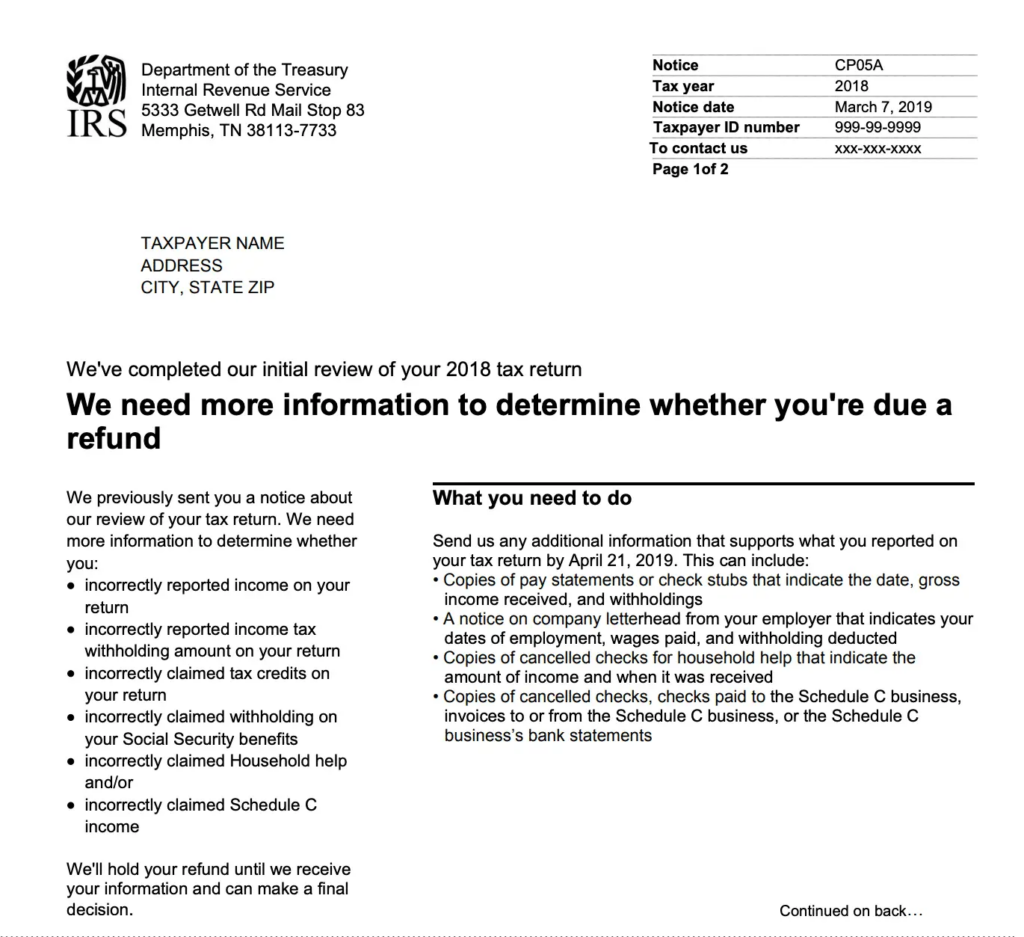

While the Recovery Rebate will not give you a tax refund, it will give you tax bill, it will grant taxpayers with tax credits. IRS has been advising people of their mistakes in applying for this stimulus funds. Another area where mistakes were made is the child tax credit. The IRS will issue a letter to you in the event that the credit was not applied correctly.

In 2021, federal tax returns for income will be eligible to receive the Recovery Rebate. For married couples with at least two kids, you can earn up to $1400, and for single filers , up to $4200.

It can be delayed due to errors in math or calculations

If you receive a letter with the message that the IRS discovered a math mistake on your tax return, it is recommended that you take a moment to check and correct your tax return information. If you don’t provide correct details, your refund could be delayed. The IRS provides a variety of FAQs that will answer your questions.

There are several reasons why your recovery reimbursement could be delayed. The most frequent reason is that you’ve committed a mistake in claiming the stimulus funds or the child tax credit. The IRS has advised taxpayers to double-check their tax returns as well as be sure they’re declaring each stimulus payment.