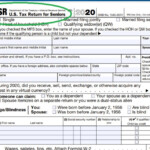

Tax Line 30 Recovery Rebate Credit – The Recovery Rebate gives taxpayers an opportunity to receive an income tax refund without having to adjust the tax returns. This program is run by the IRS and is a completely free service. However, prior to filing it is essential to know the regulations and rules. These are just some facts about the program.

Refunds from Recovery Rebate do not have to be adjusted

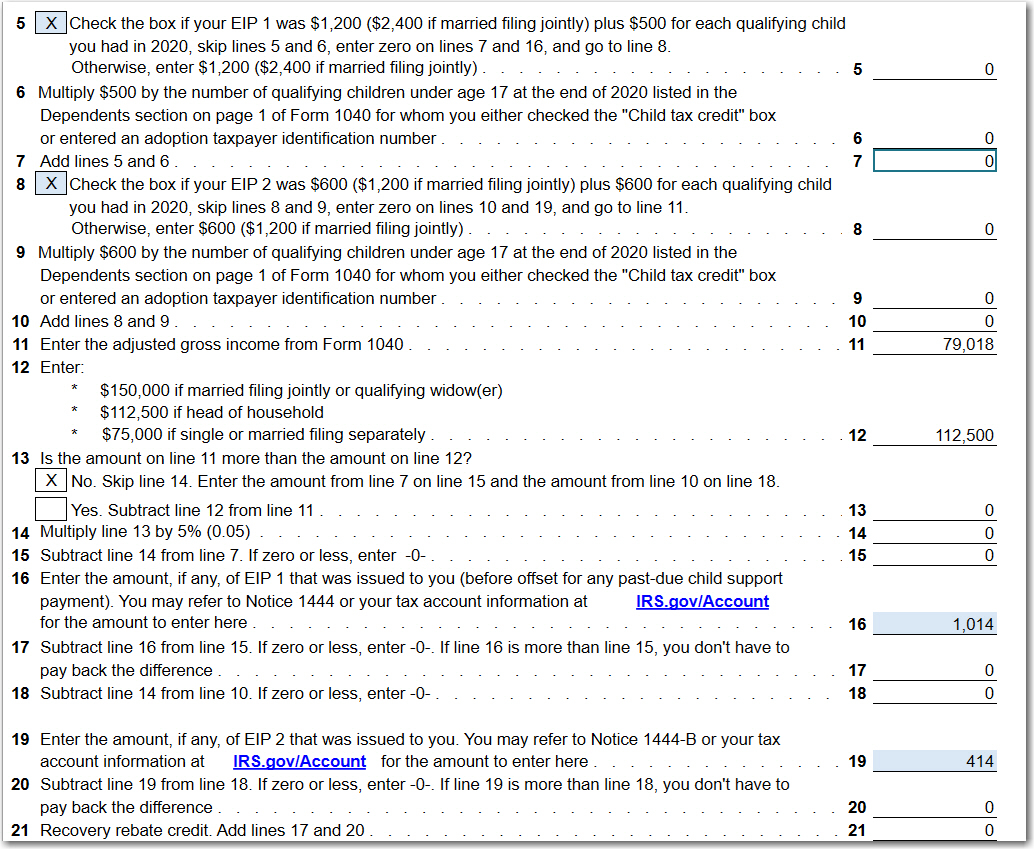

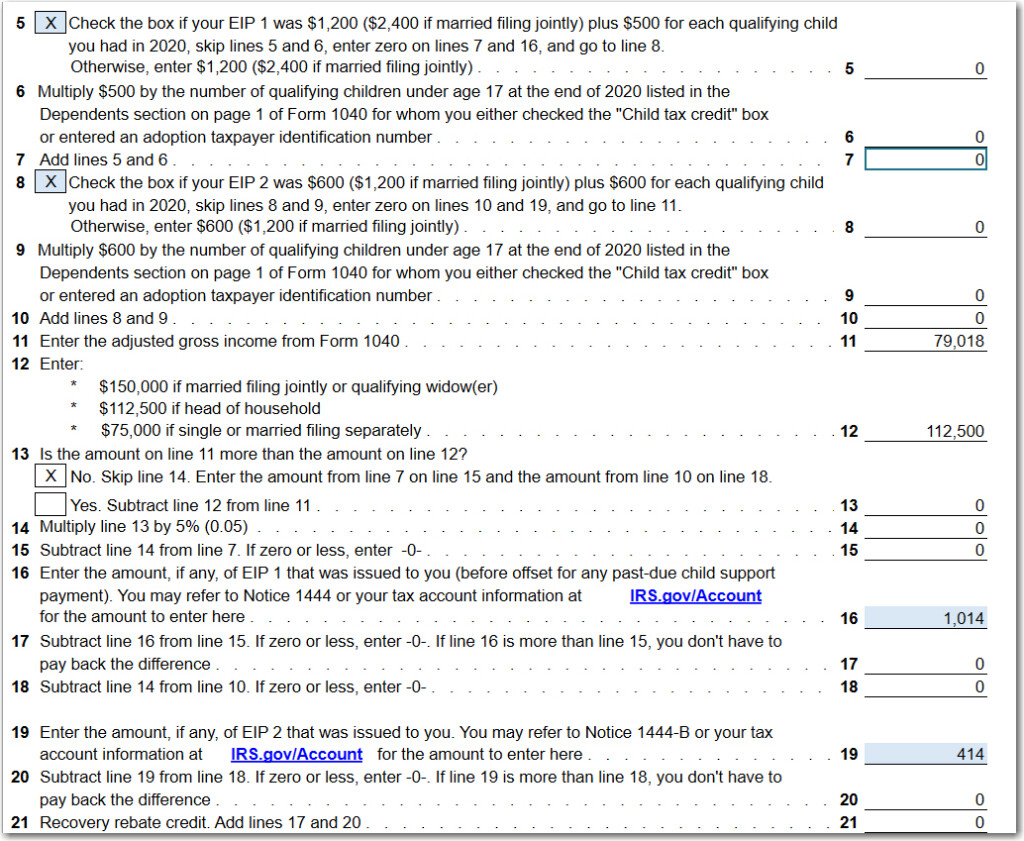

Taxpayers who are eligible for Recovery Rebate credits will be notified in advance. This means you won’t need to adjust the amount of your refund if you owe higher taxes in 2020 than you did in 2019. However, your recovery rebate credit may reduce based on your income. Your credit rating will decrease to zero if your income exceeds $75,000. Joint filers with a spouse will drop to $150,000 and heads of household will receive their rebates for recovery reduced to $112,500.

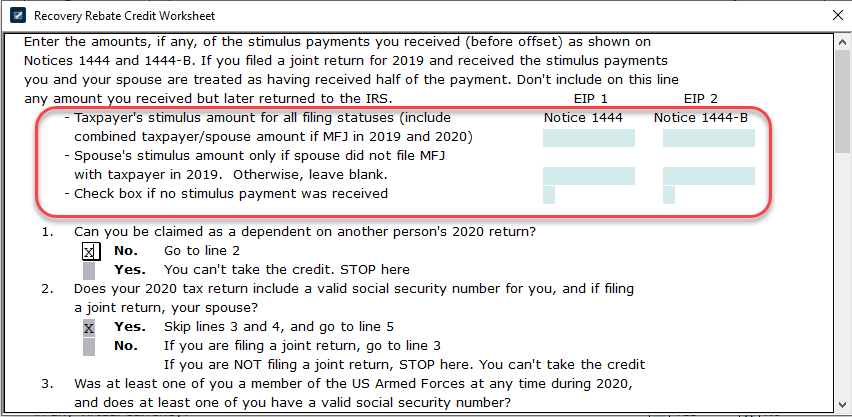

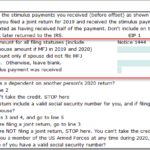

If they did not receive all of the stimulus money but they still have the option of claiming tax recovery credits in 2020. They’ll require an IRS online account as well as an official notice of the amounts they have received.

It doesn’t provide a tax refund.

Although the Recovery Rebate will not give you a refund on your tax bill, it will grant taxpayers with tax credits. IRS has cautioned people about the mistakes they made in applying for this stimulus money. The child tax credit is another area where mistakes were made. If the credit isn’t applied correctly, the IRS will notify you via email.

For 2021, federal income tax returns are eligible to receive the Recovery Rebate. You can receive as much as $1,400 for each tax dependent that is eligible (married couples with two kids) and up to $4200 for single filers.

It may be delayed due to math errors or miscalculations

If the IRS sends you a letter informing you that your tax return contains errors in math It is crucial to take the time to look over your information and make any corrections that are required. If you don’t provide accurate information, your refund may be delayed. There are answers to your questions within the comprehensive FAQ section of IRS.

There are many reasons that your recovery rebate may not be processed on time. The most typical reason for why your recovery rebate may be delayed is because you made a mistake in applying for the stimulus money as well as the child tax credit. The IRS has advised taxpayers to double-check tax returns and make sure that they claim each stimulus money properly.