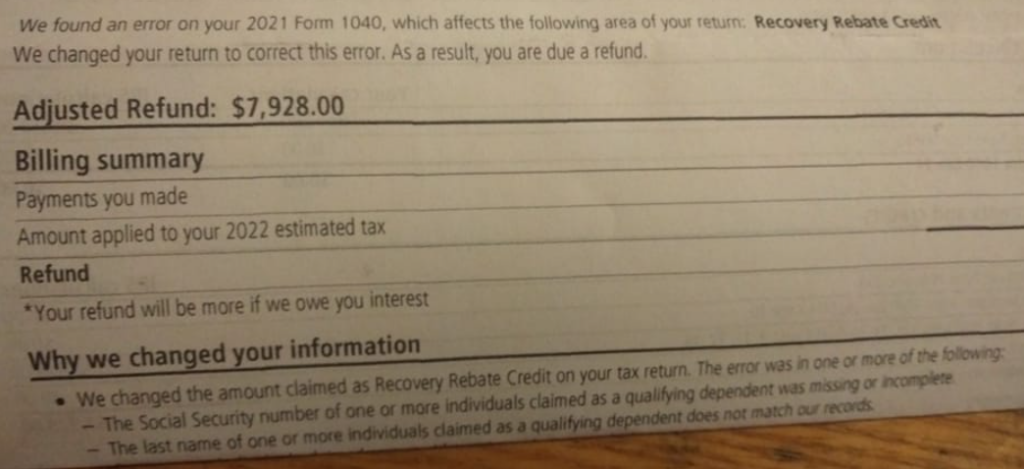

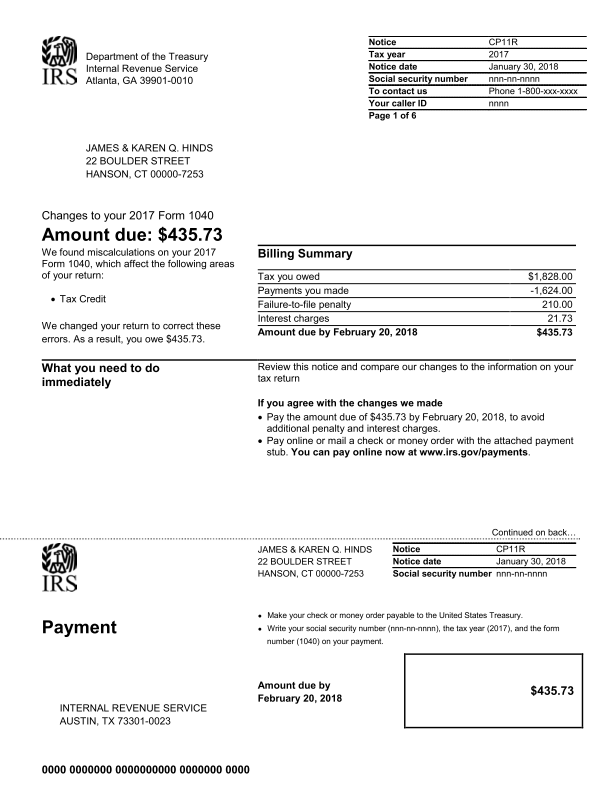

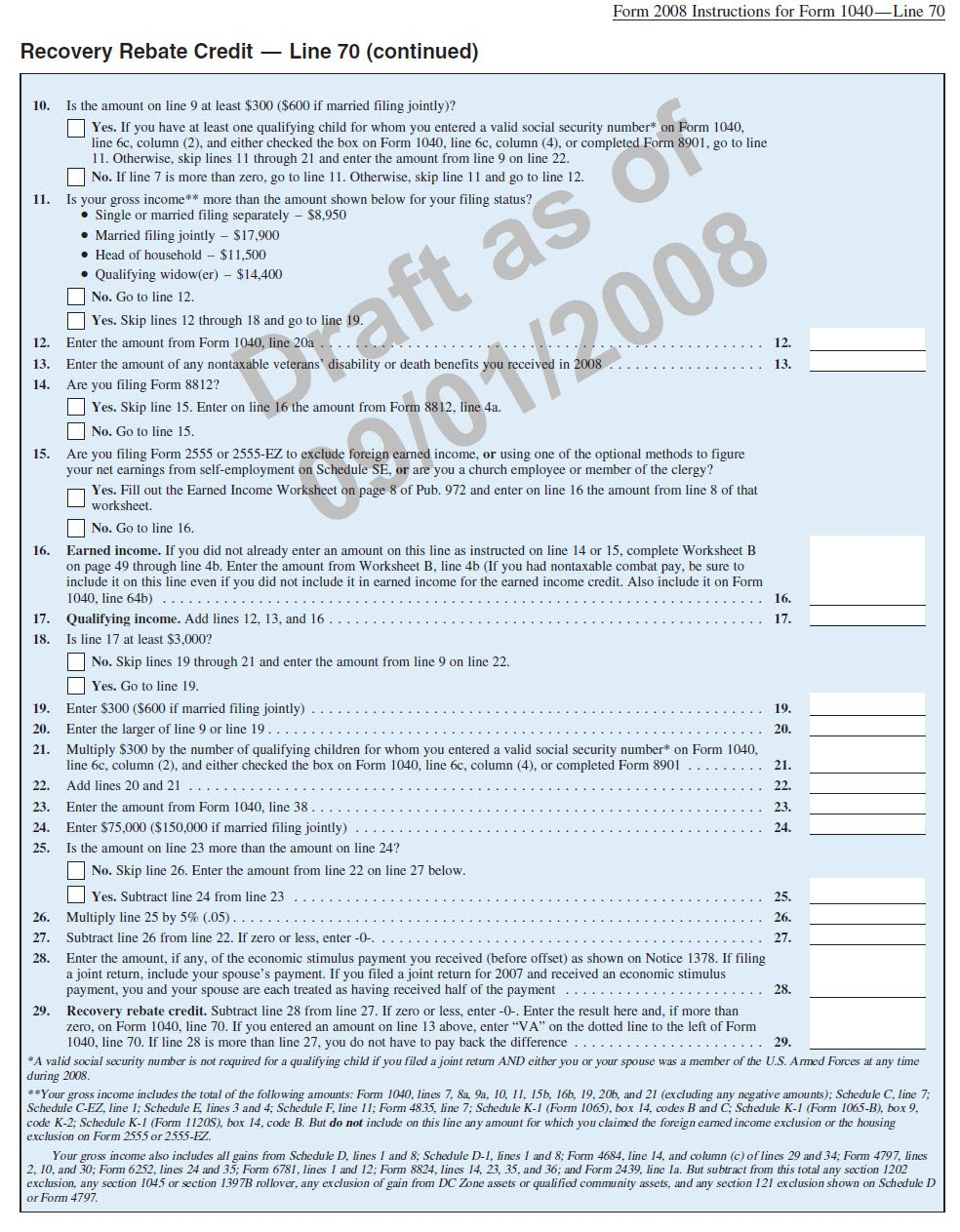

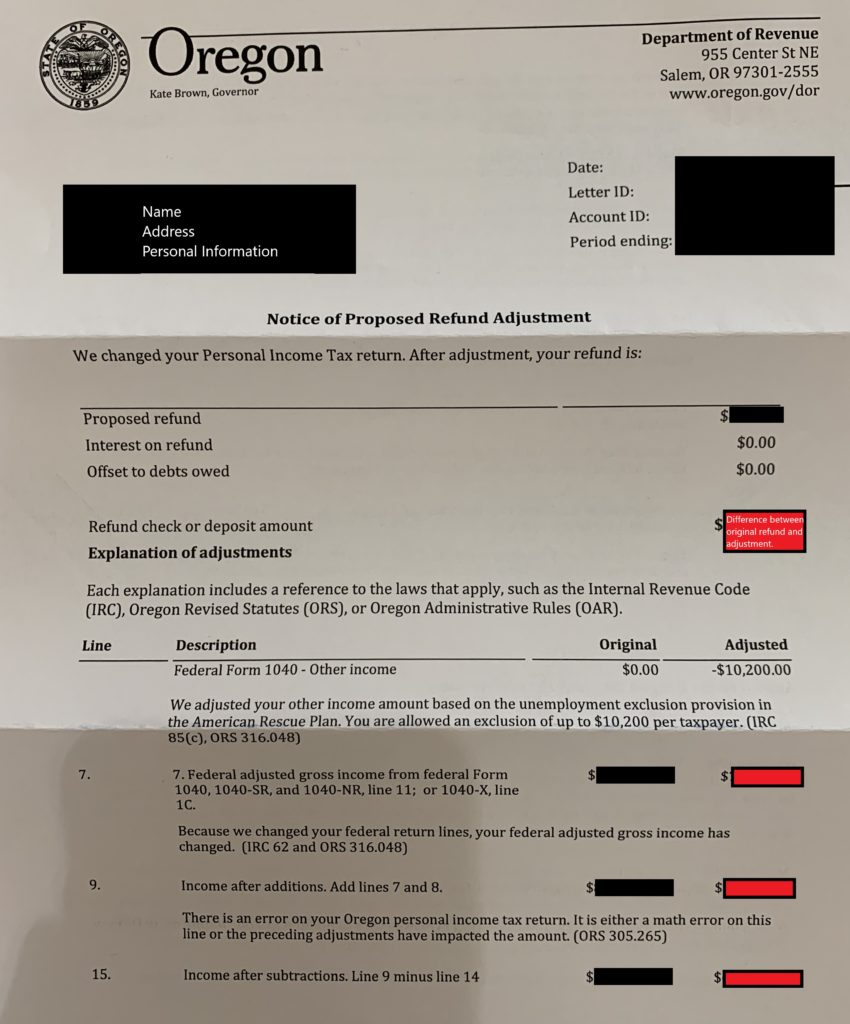

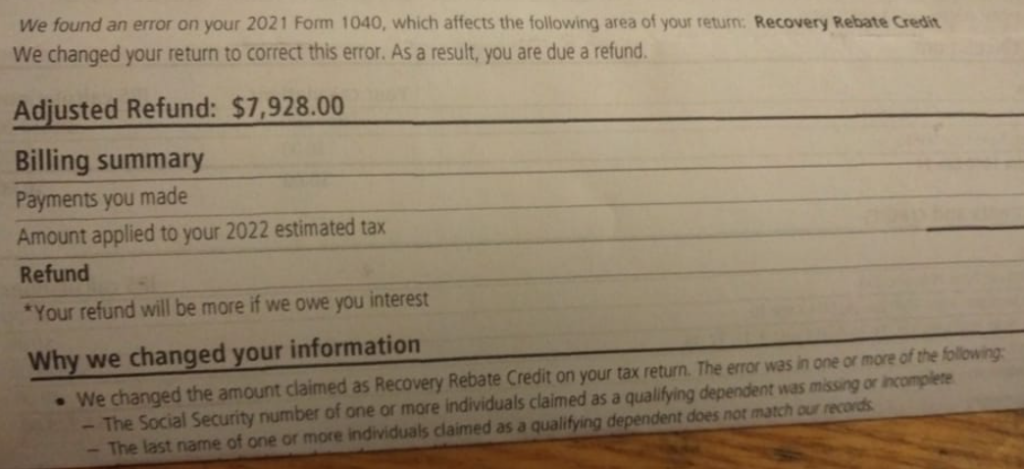

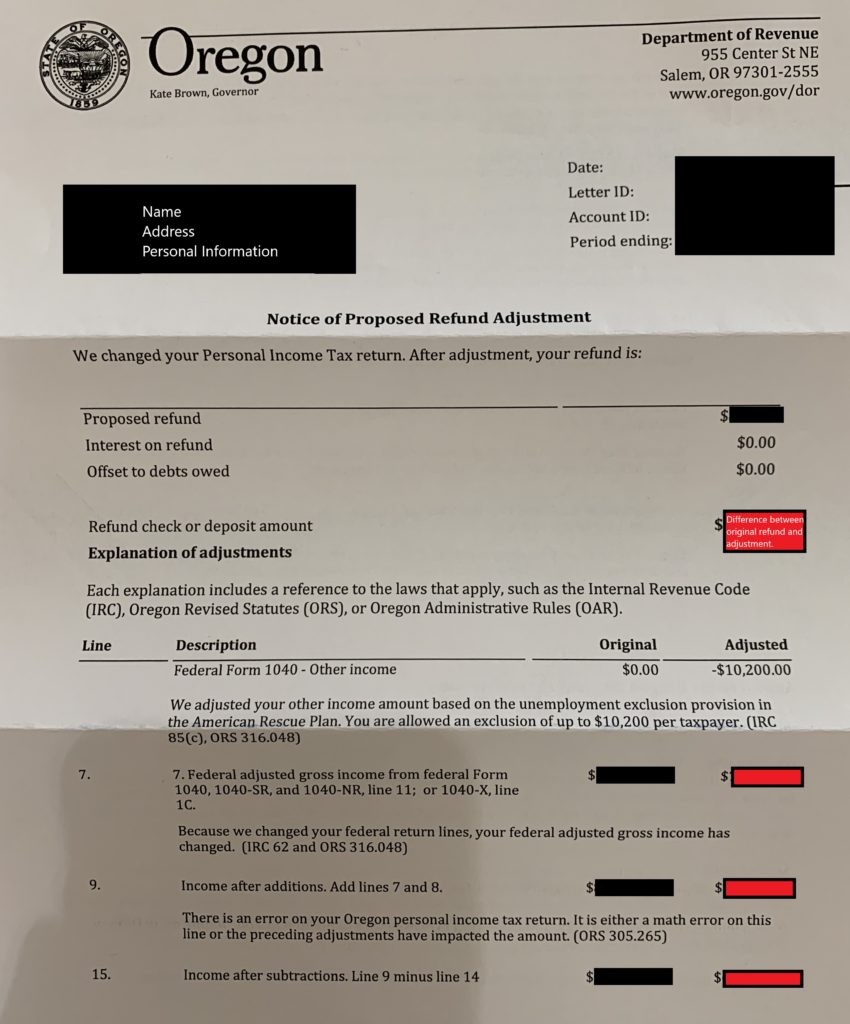

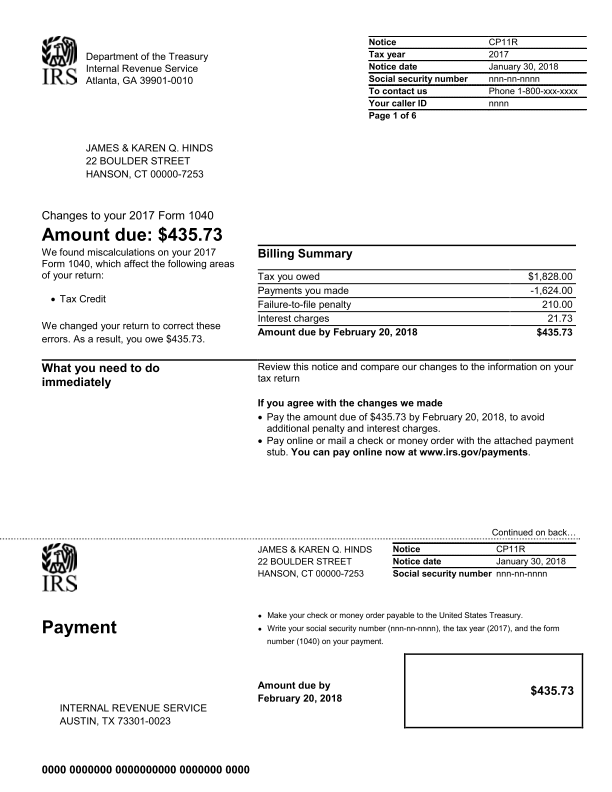

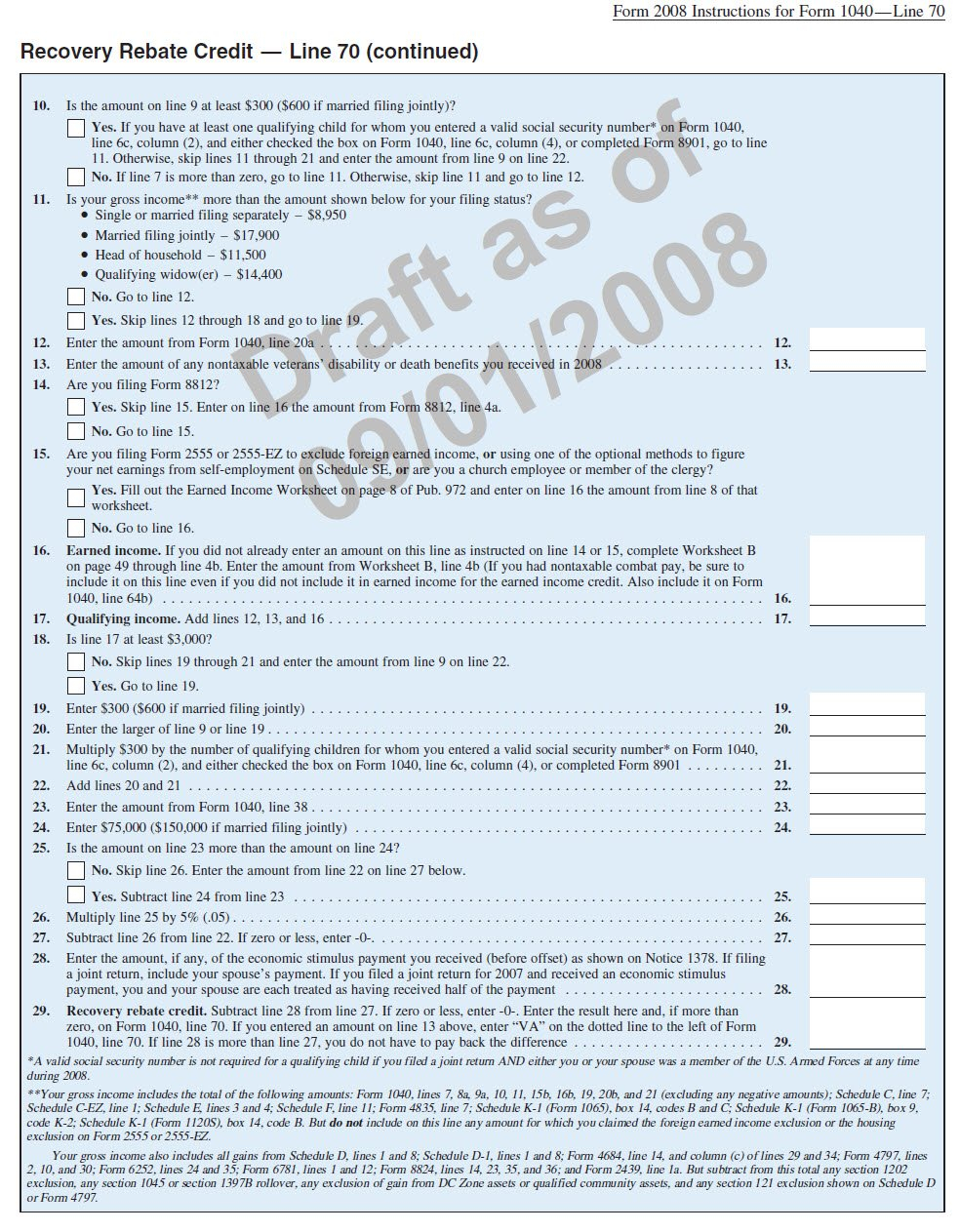

Irs Notice Regarding Recovery Rebate Credit

Irs Notice Regarding Recovery Rebate Credit – The Recovery Rebate offers taxpayers the chance to get the tax return they deserve with no tax return modified. This program is administered by the IRS and is a free service. It is important to know the rules and regulations of this program before submitting. Here are some … Read more