Does Claiming The Recovery Rebate Credit Delay My Refund

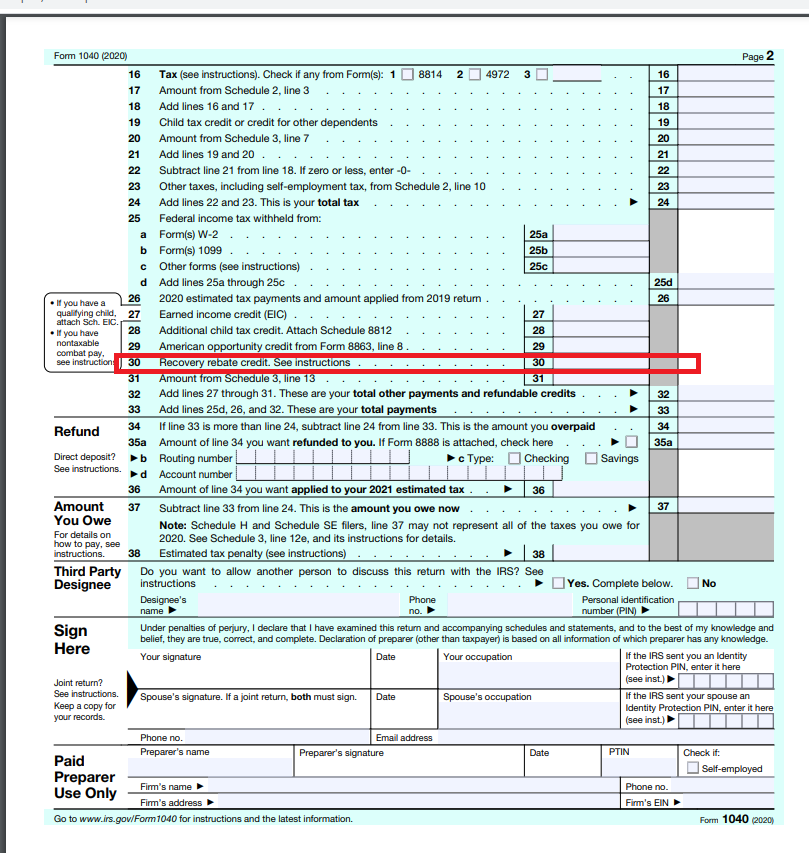

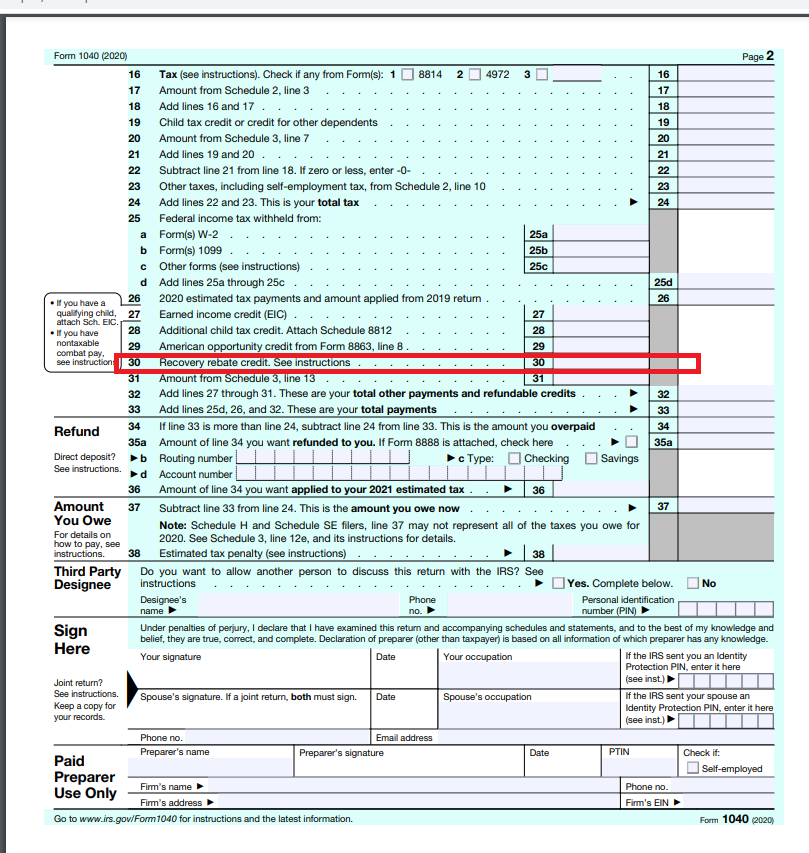

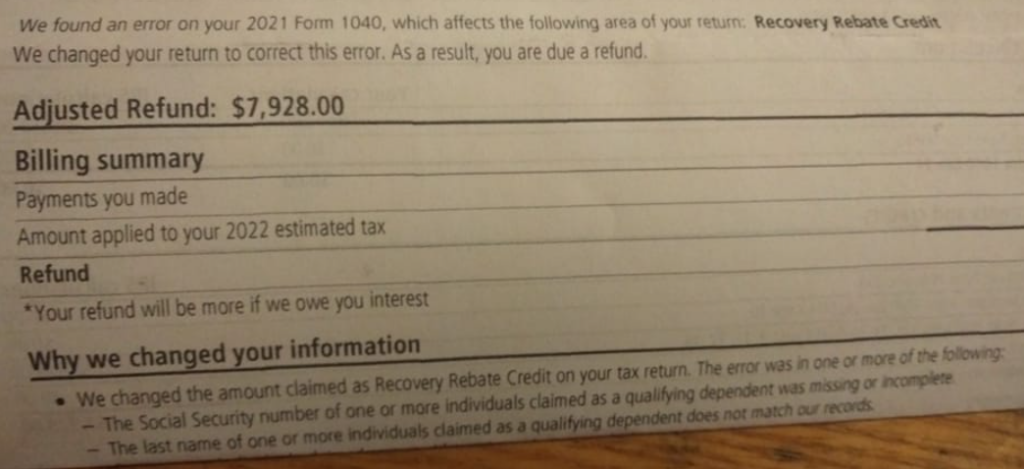

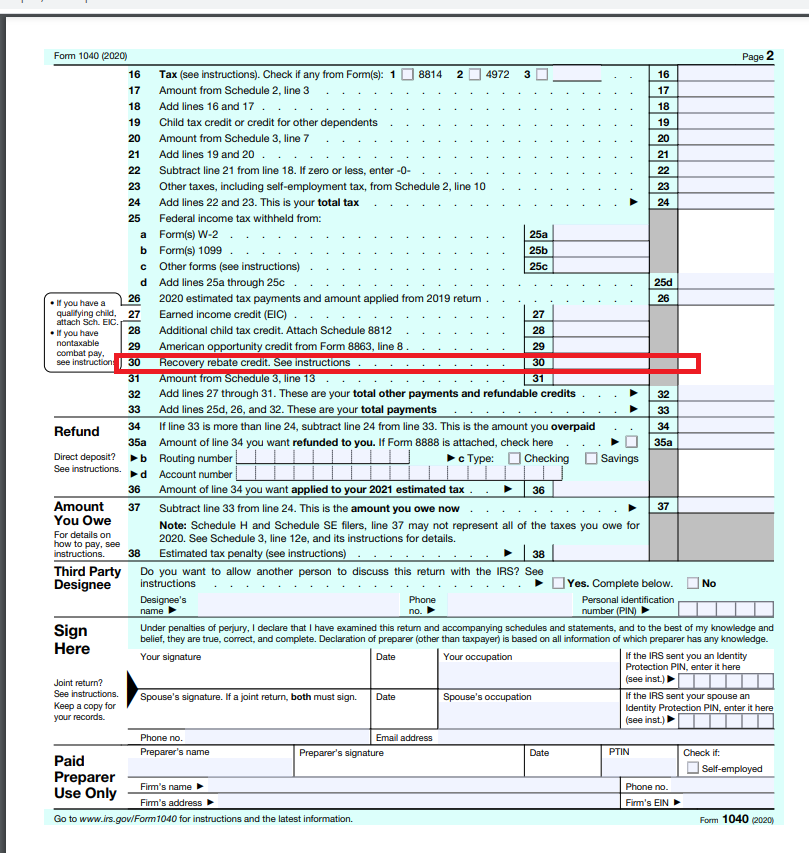

Does Claiming The Recovery Rebate Credit Delay My Refund – Taxpayers can get an income tax credit via the Recovery Rebate program. This allows them to receive a tax refund for their taxes without the need to amend the tax return. The IRS administers the program, which is a free service. It is crucial to … Read more