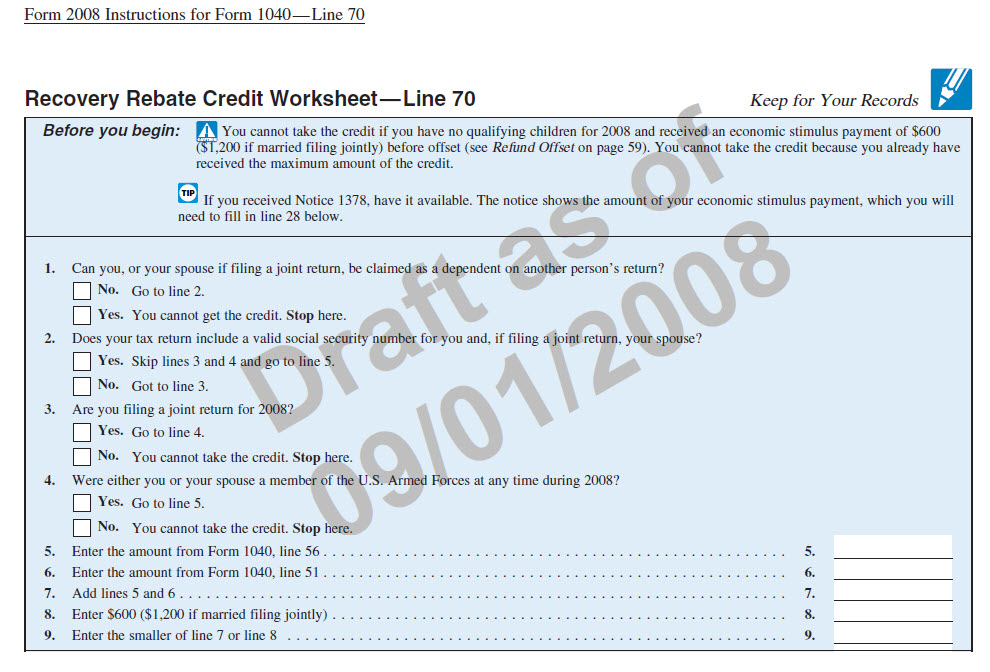

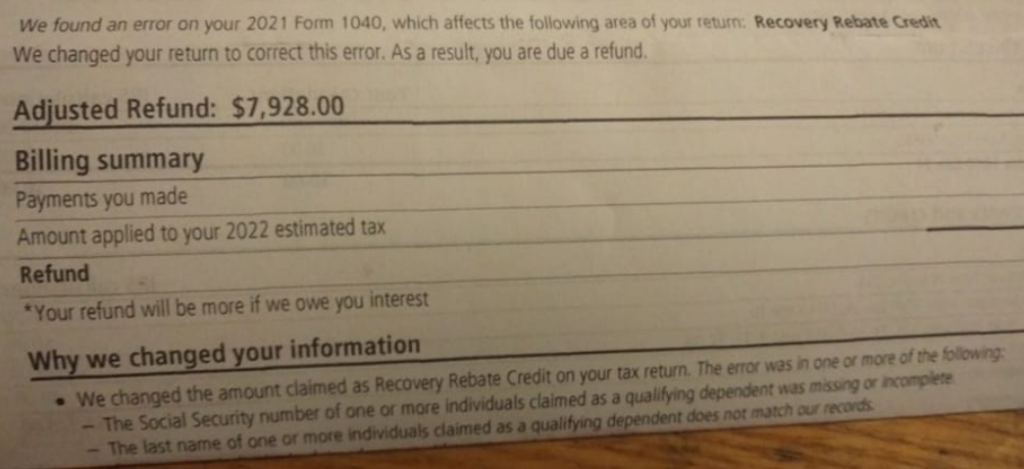

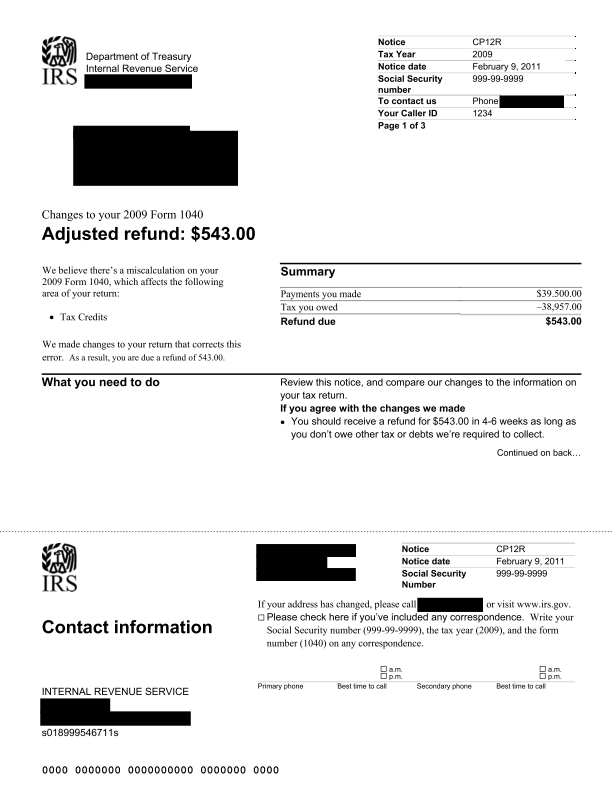

Can The Irs Take My Recovery Rebate

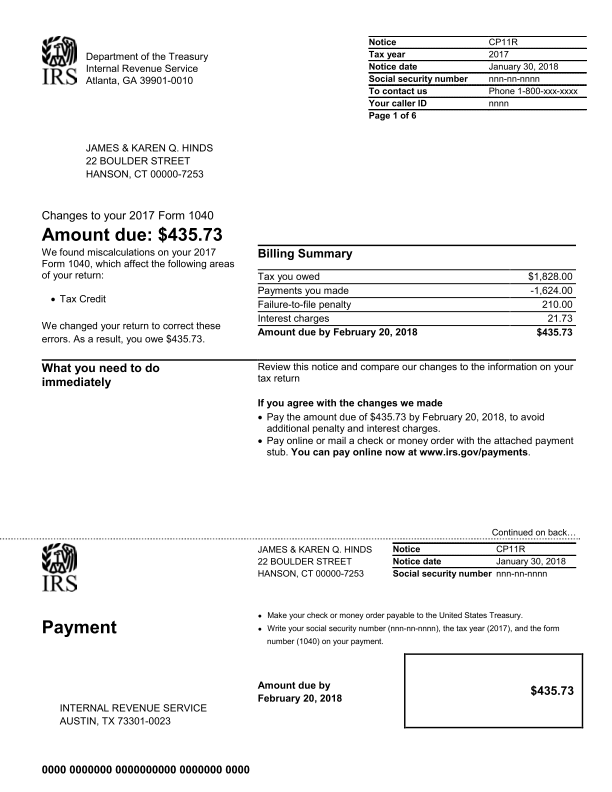

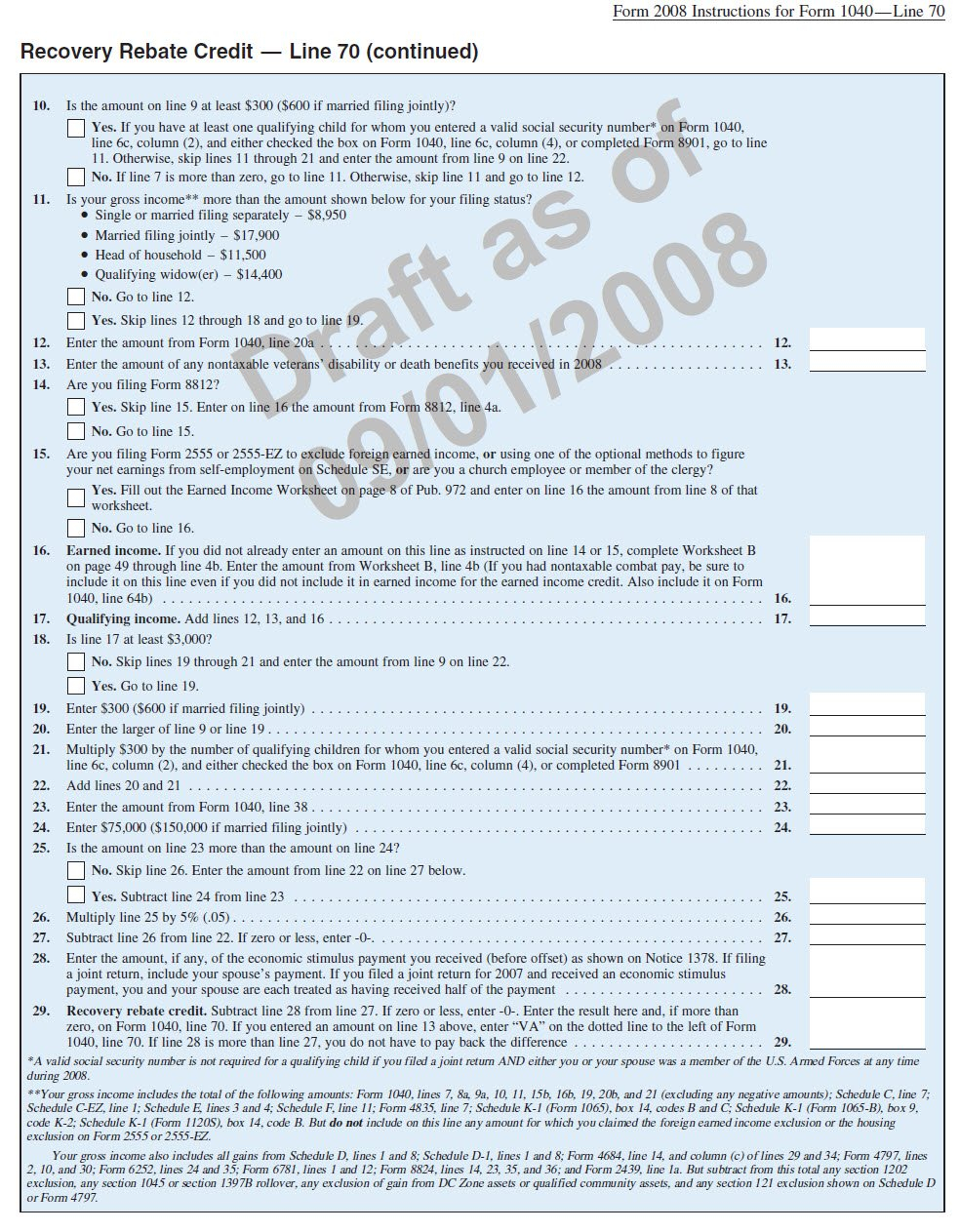

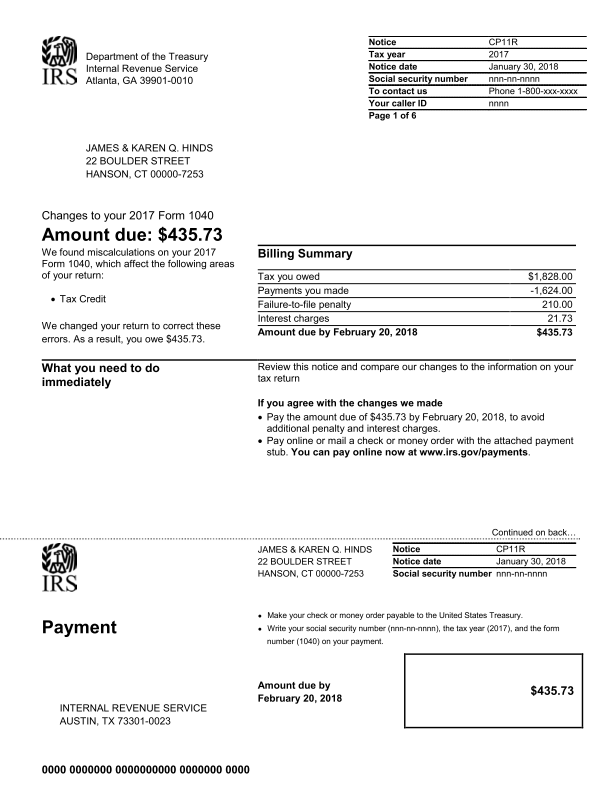

Can The Irs Take My Recovery Rebate – Taxpayers are eligible for a tax rebate via the Recovery Rebate program. This allows them to get a refund on their taxes without needing to alter their tax returns. The IRS manages this program, and it is cost-free. However, prior to filing it is important to be … Read more