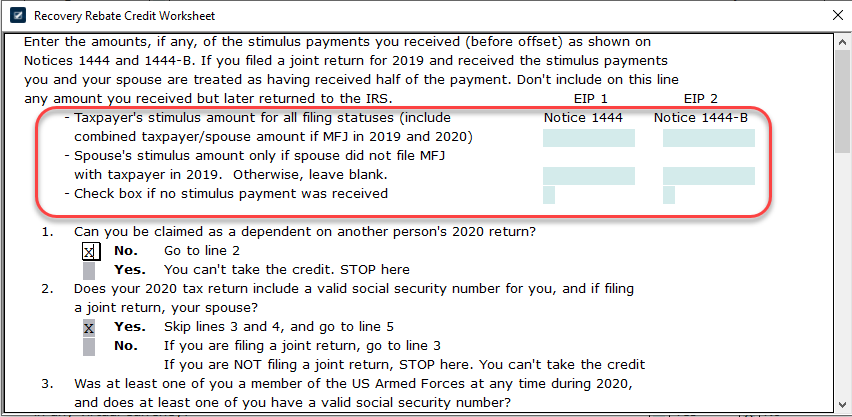

Letter About Recovery Rebate Credit

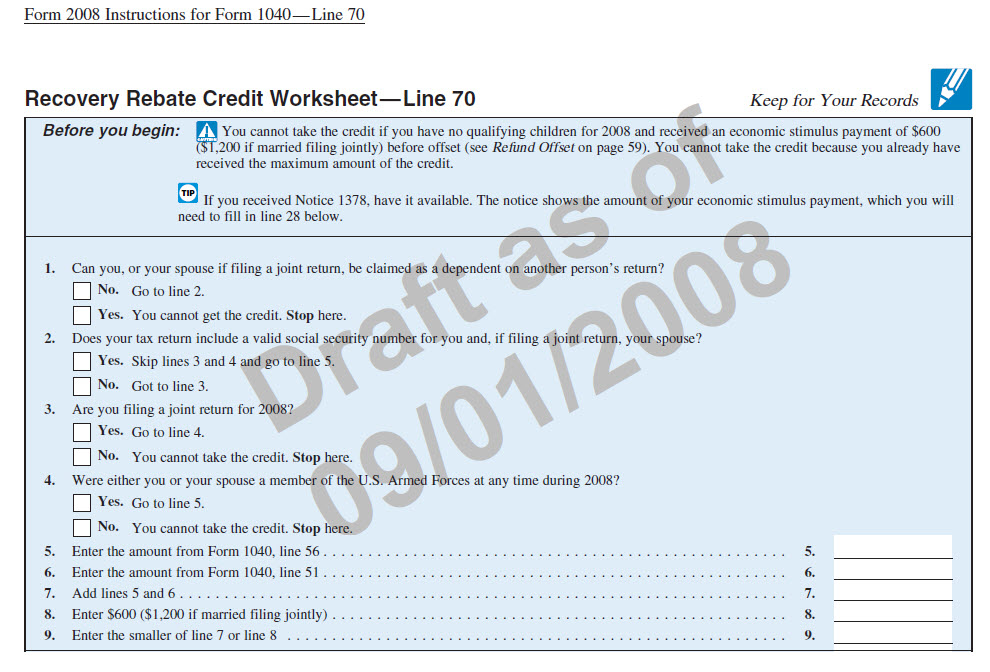

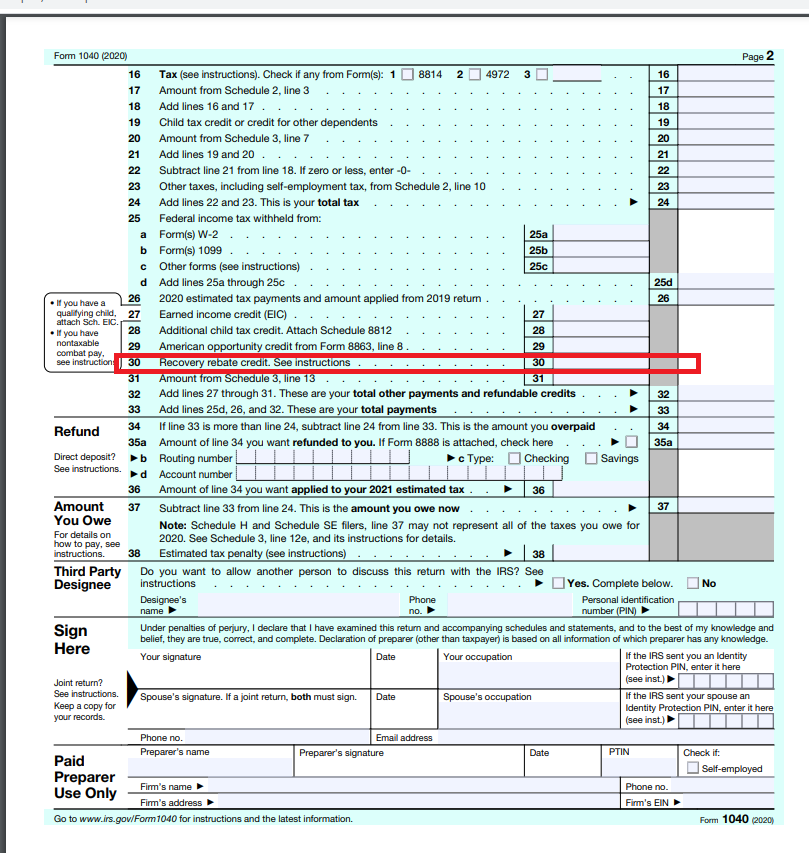

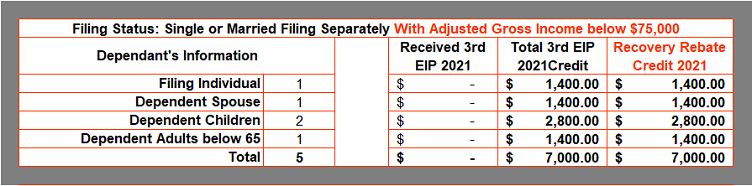

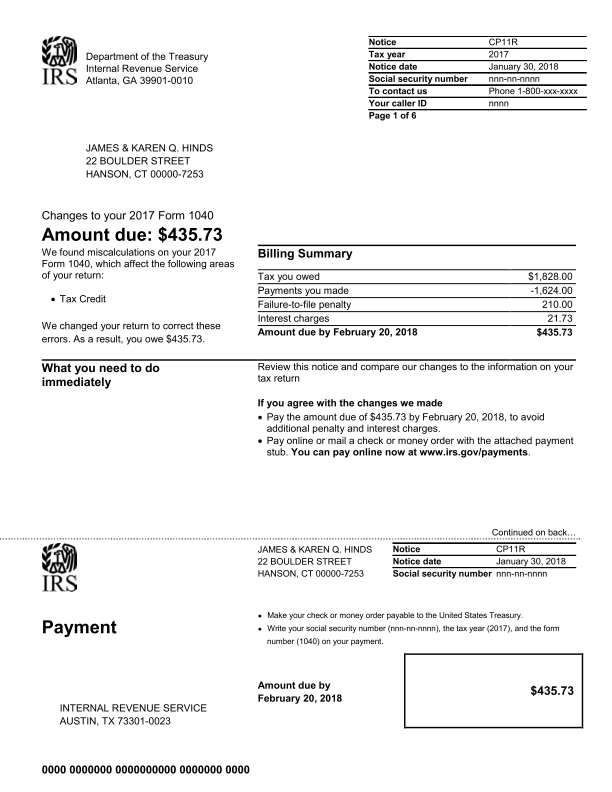

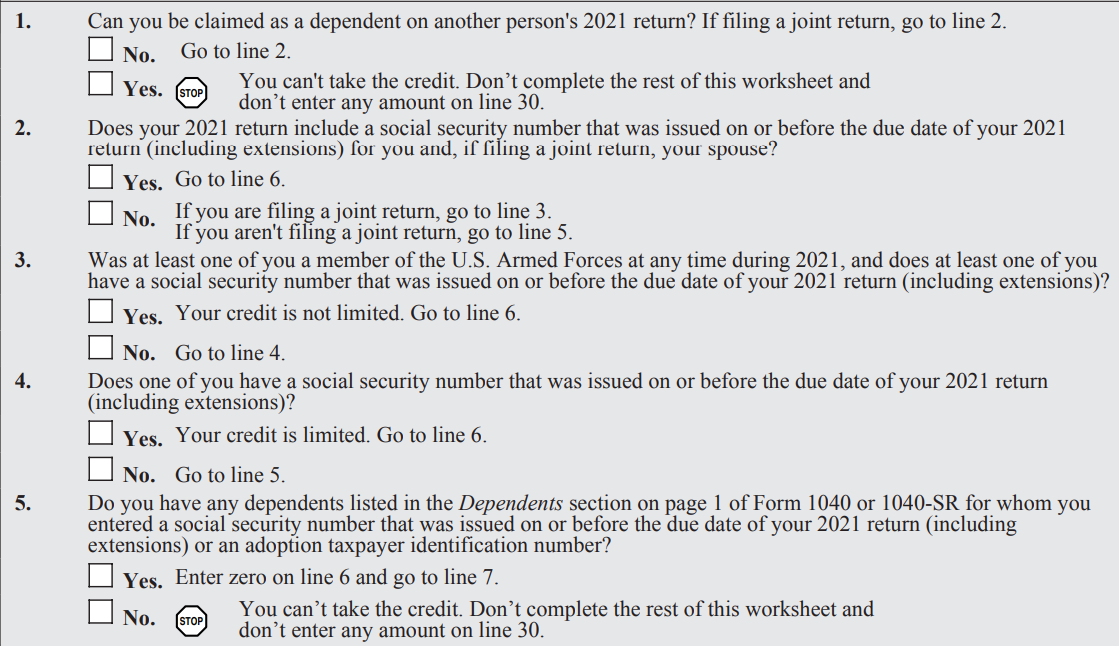

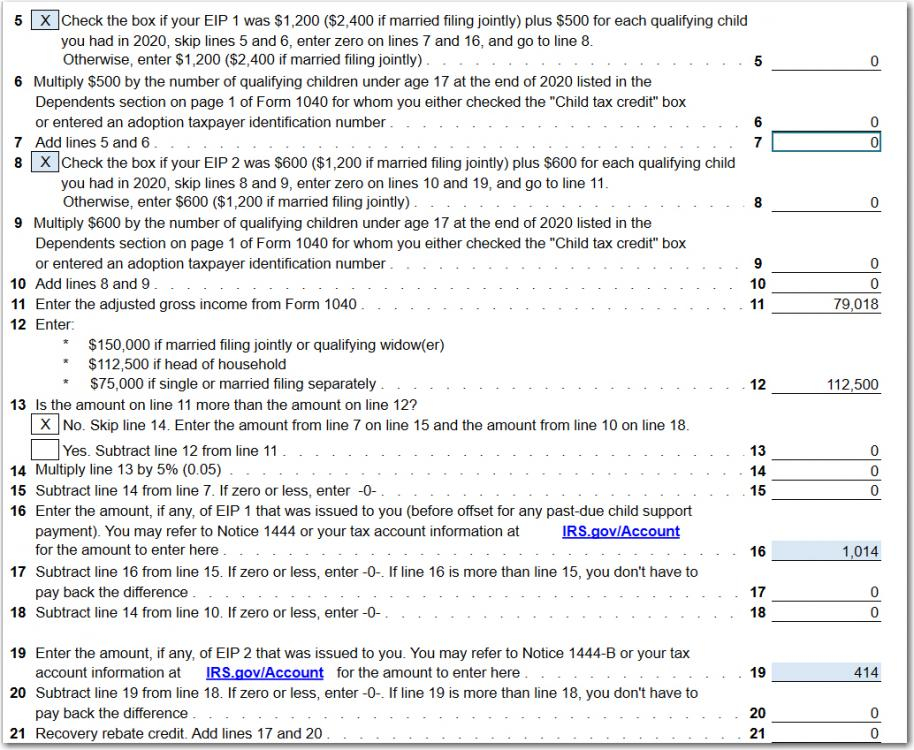

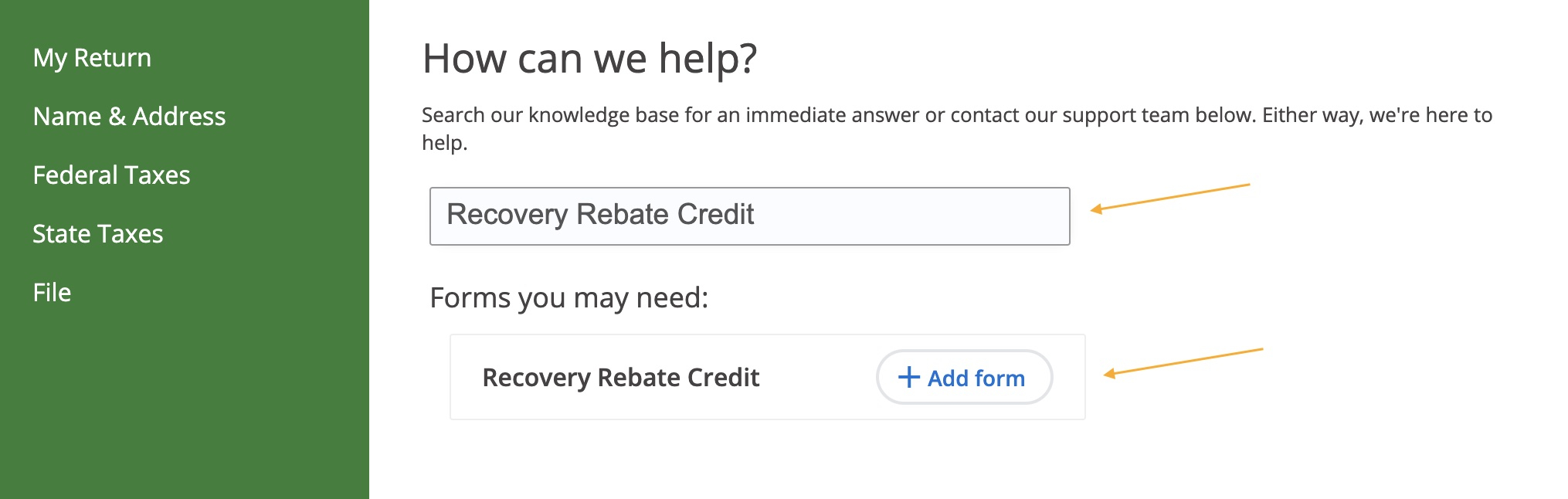

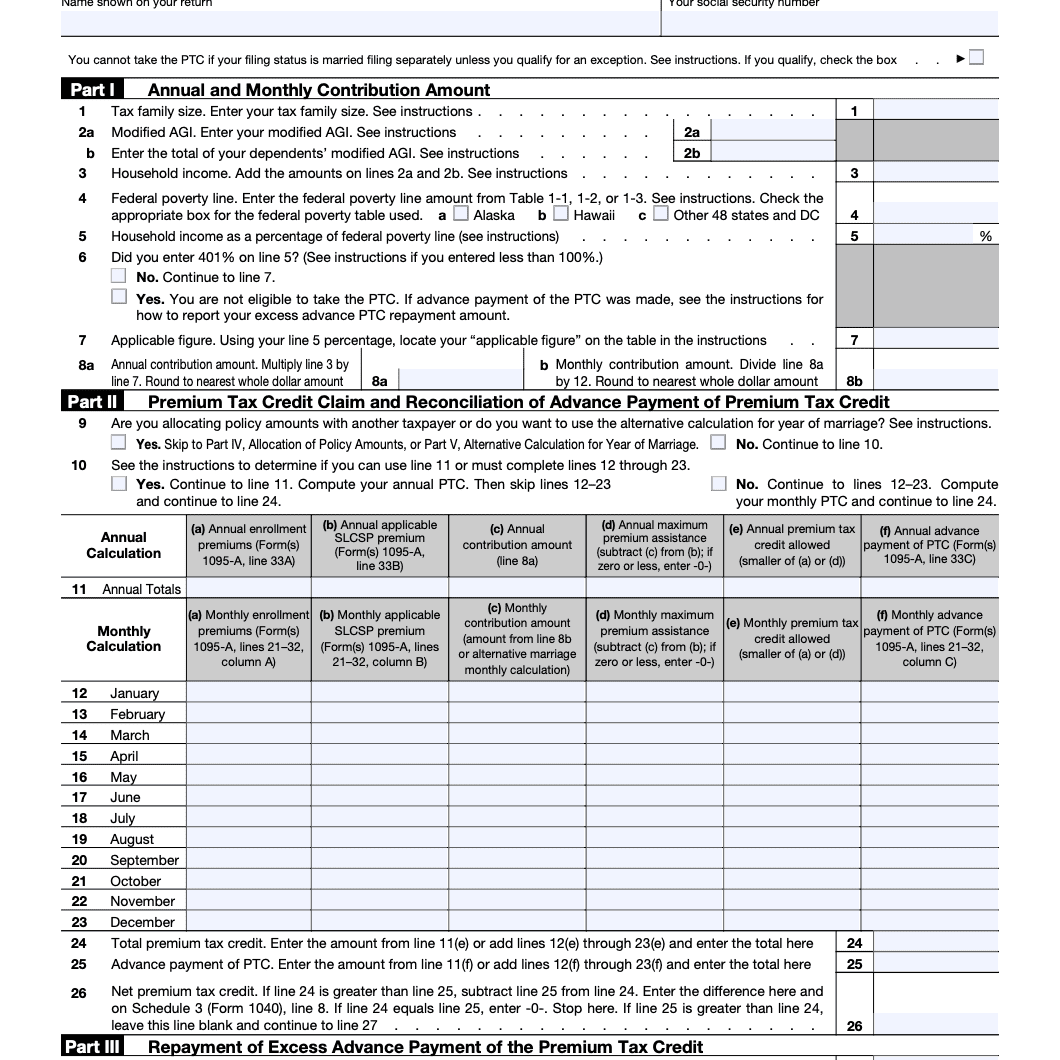

Letter About Recovery Rebate Credit – Taxpayers can get tax credits via the Recovery Rebate program. This lets them claim a refund of their taxes without needing to alter the tax return. This program is administered by the IRS. It is crucial to understand the guidelines before applying. Here are some of the facts regarding … Read more