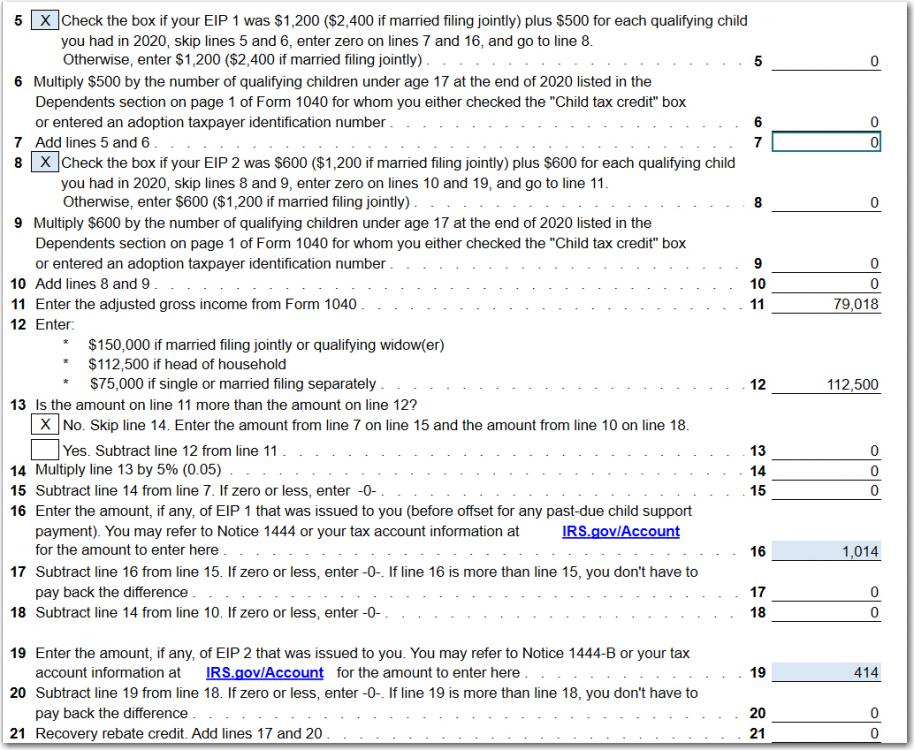

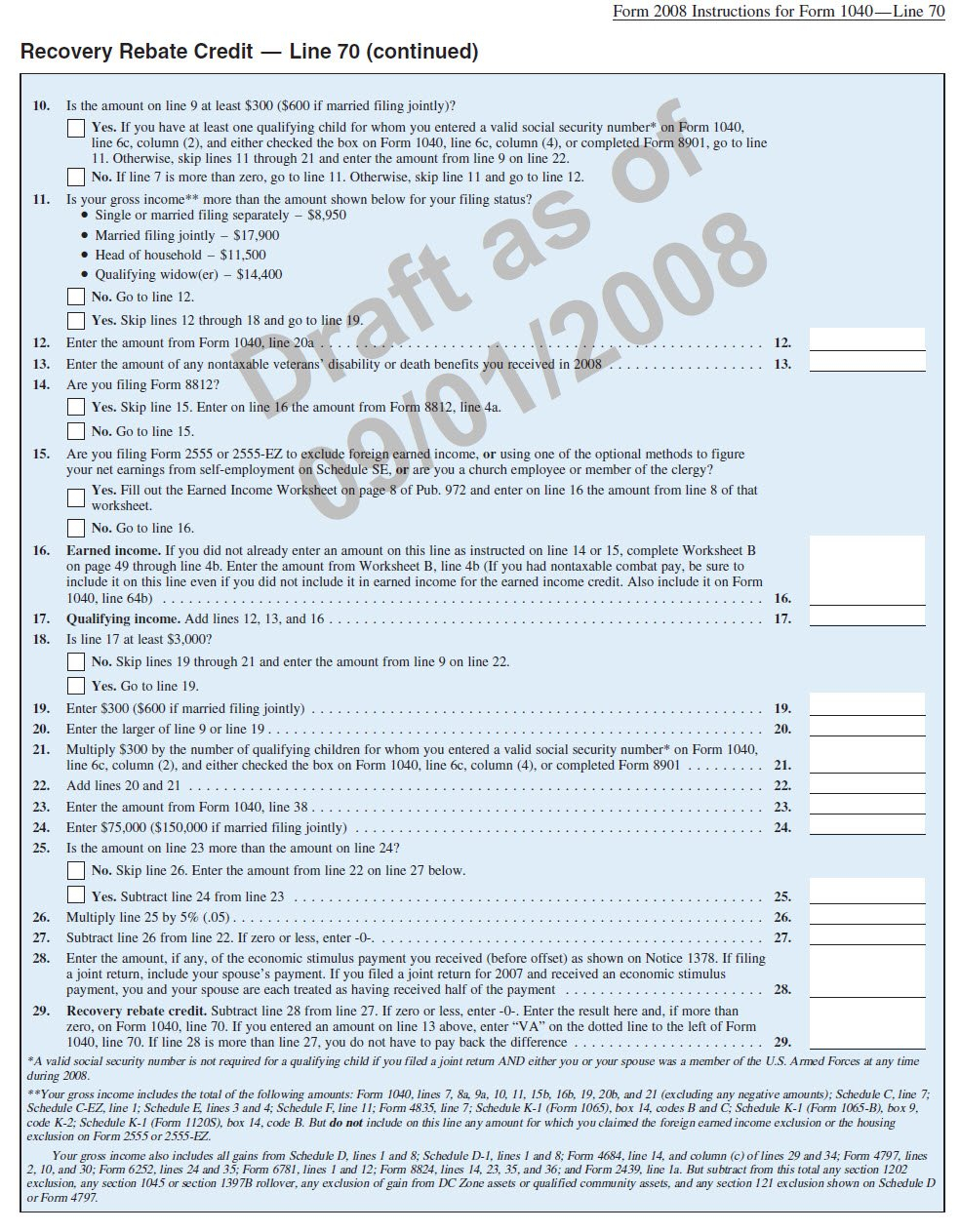

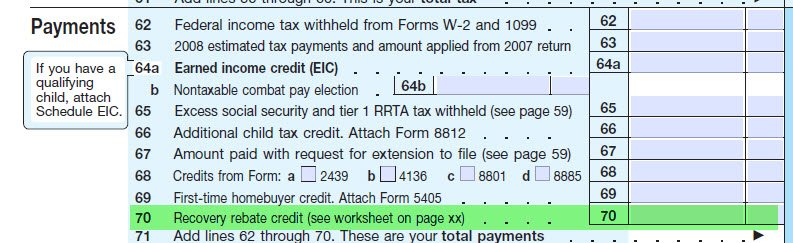

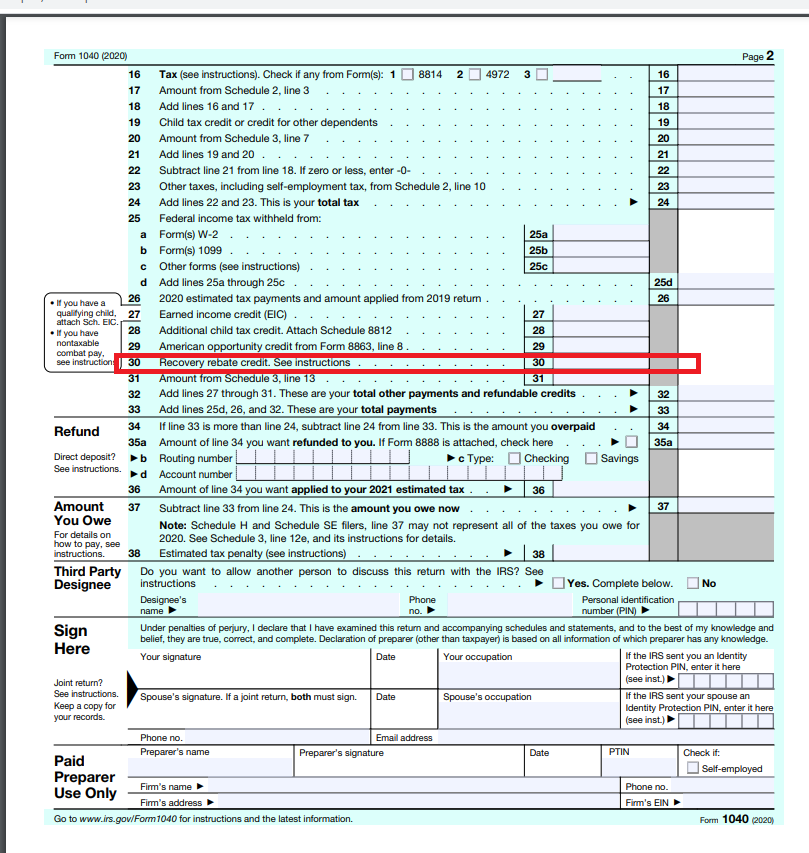

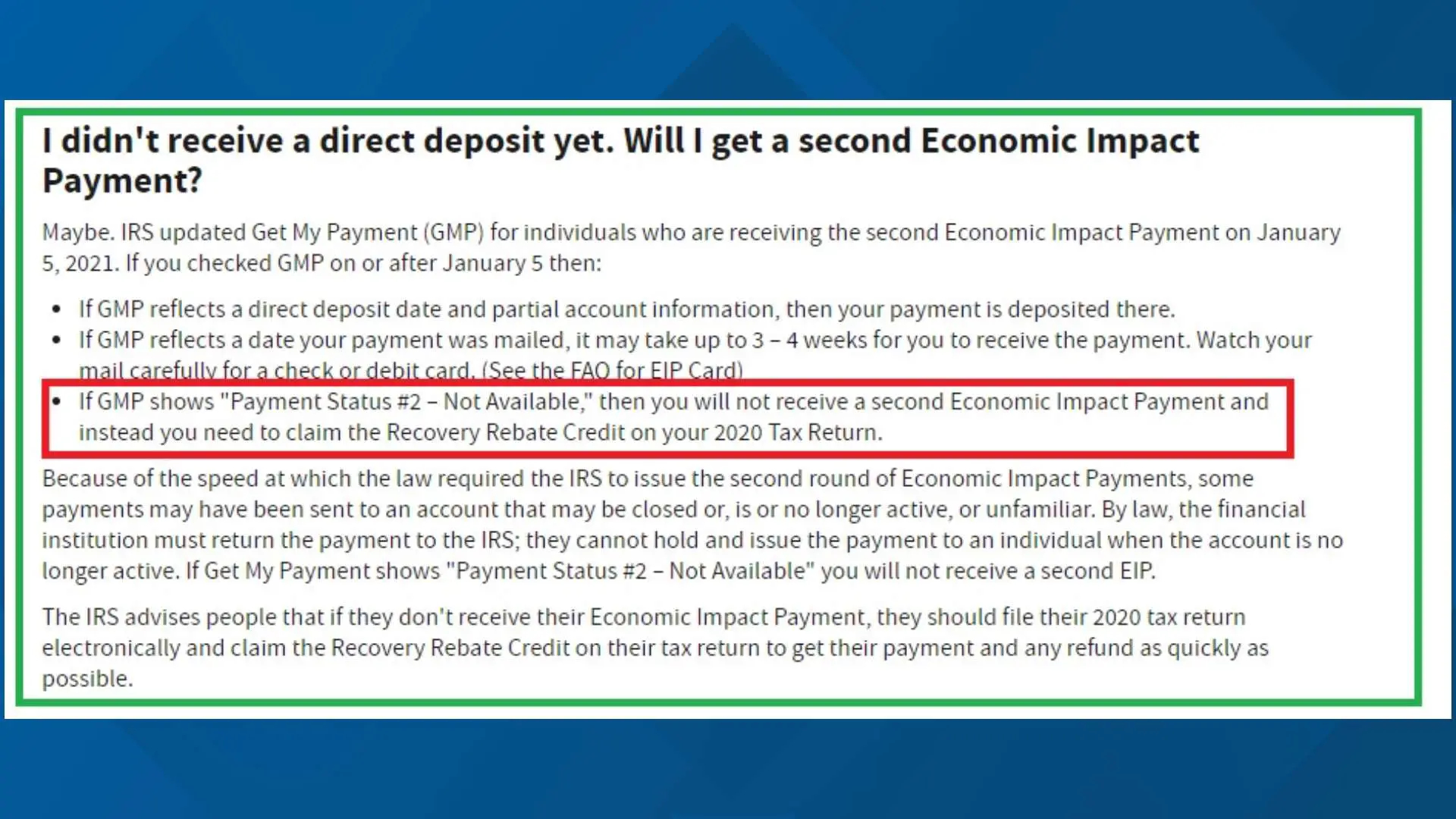

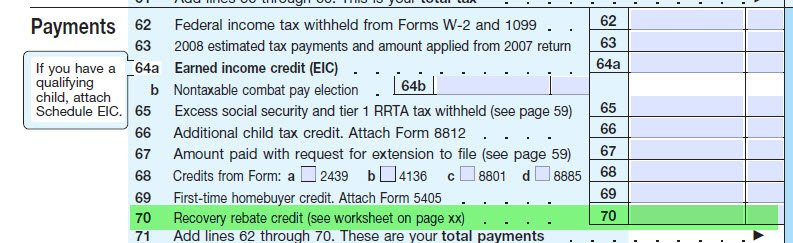

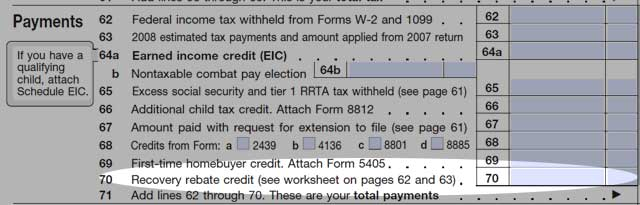

E Recovery Rebate Credit

E Recovery Rebate Credit – The Recovery Rebate offers taxpayers the chance to get the tax return they deserve with no tax return altered. The IRS runs this program and it is free. It is, however, essential to be aware of the regulations and rules regarding the program prior to filing. Here are some details … Read more