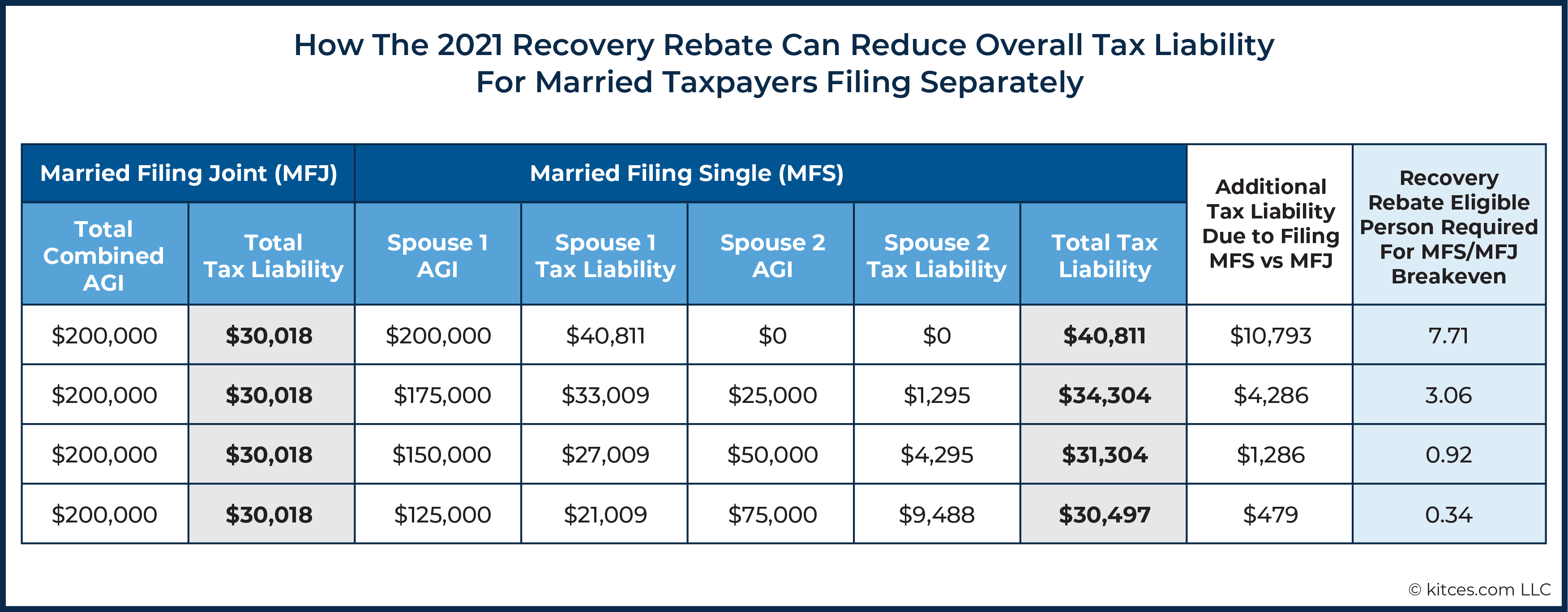

3rd Recovery Rebate Credit

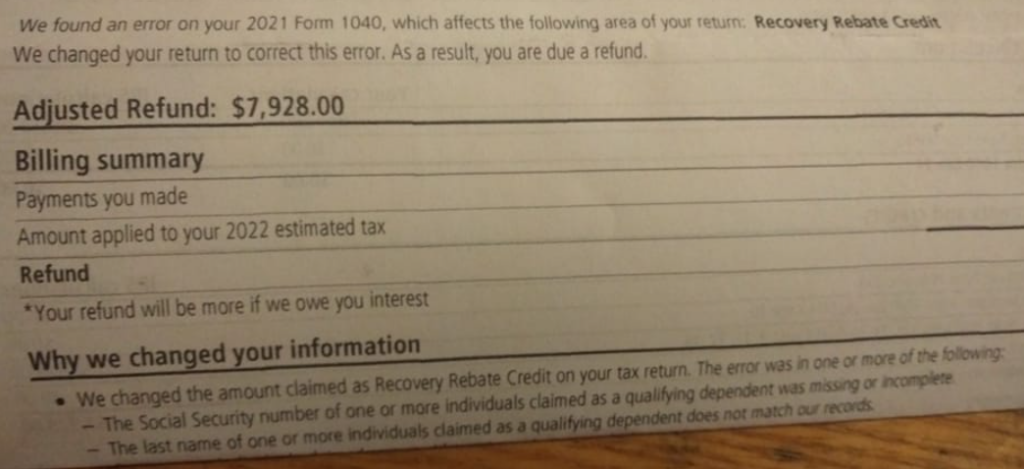

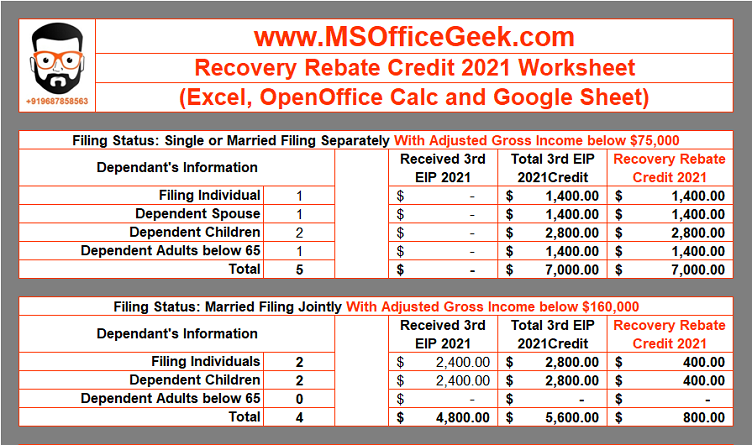

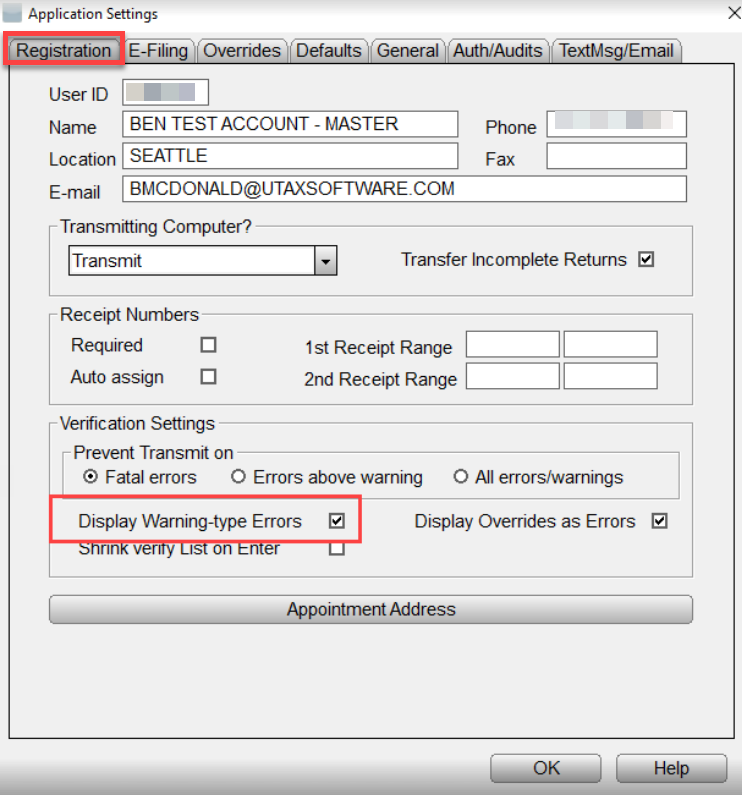

3rd Recovery Rebate Credit – The Recovery Rebate allows taxpayers to receive a tax refund without having to adjust the tax return. The IRS administers this program and it is free. It is essential to be familiar with the rules and regulations of the program before submitting. Here are some information about this program. Recovery … Read more