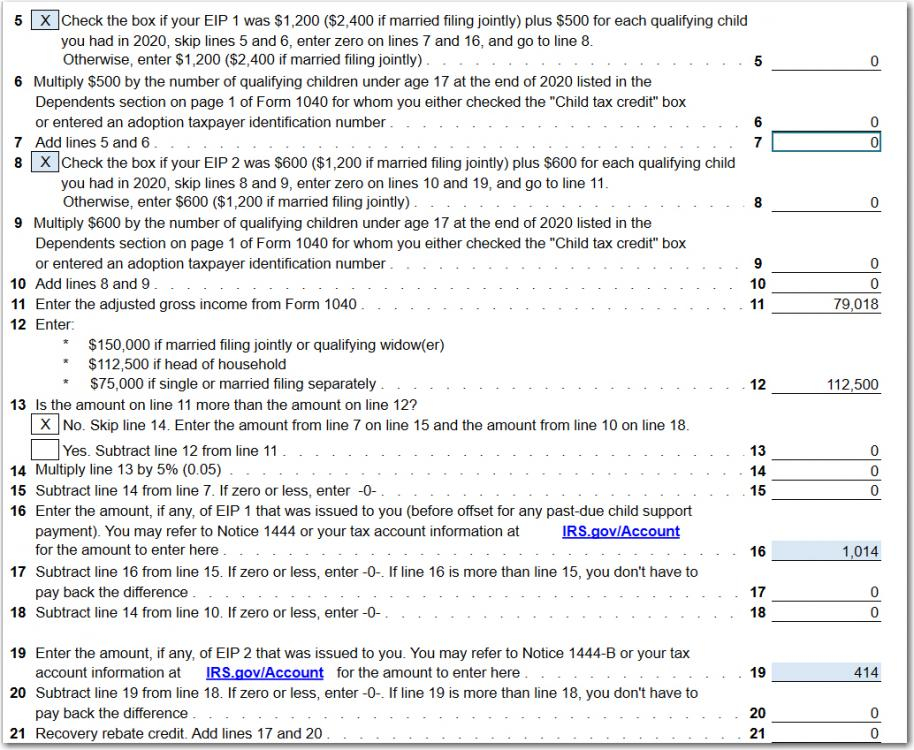

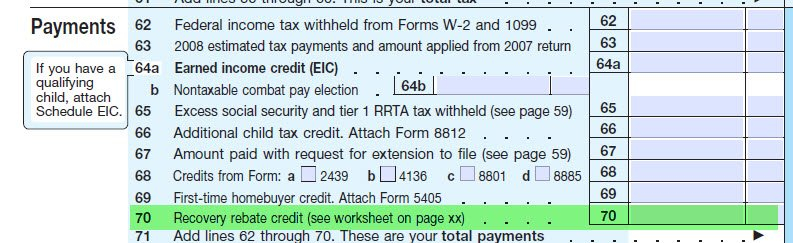

Recovery Rebate Credit Audit

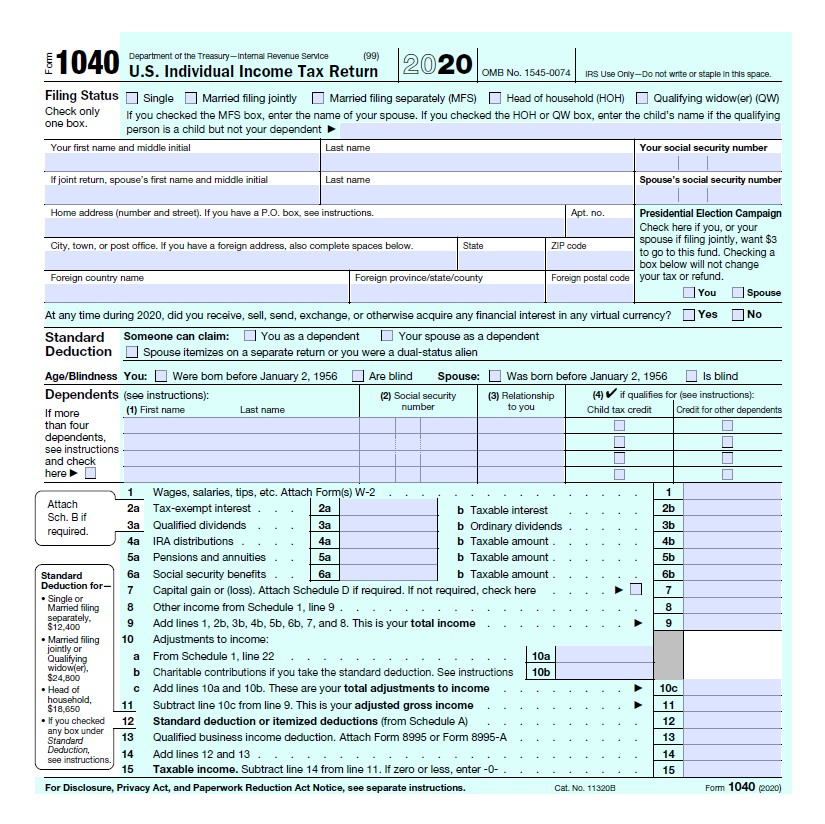

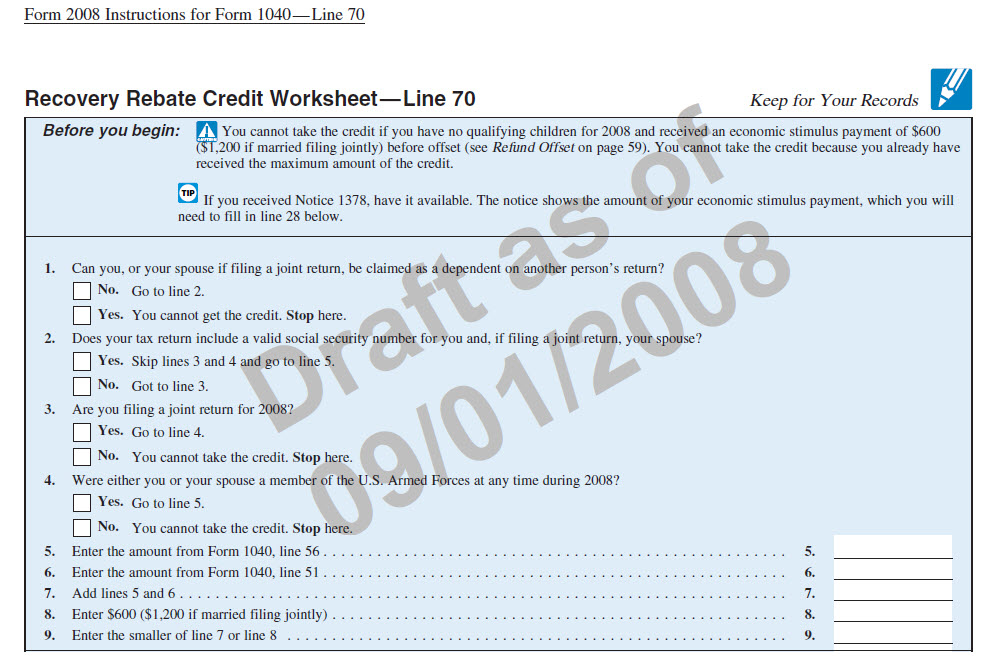

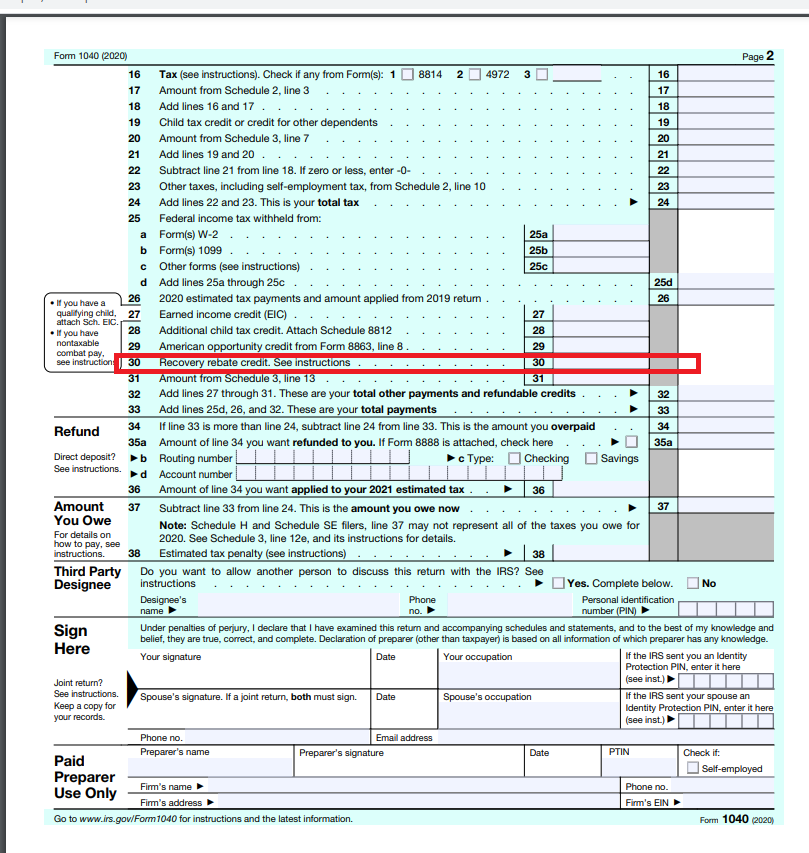

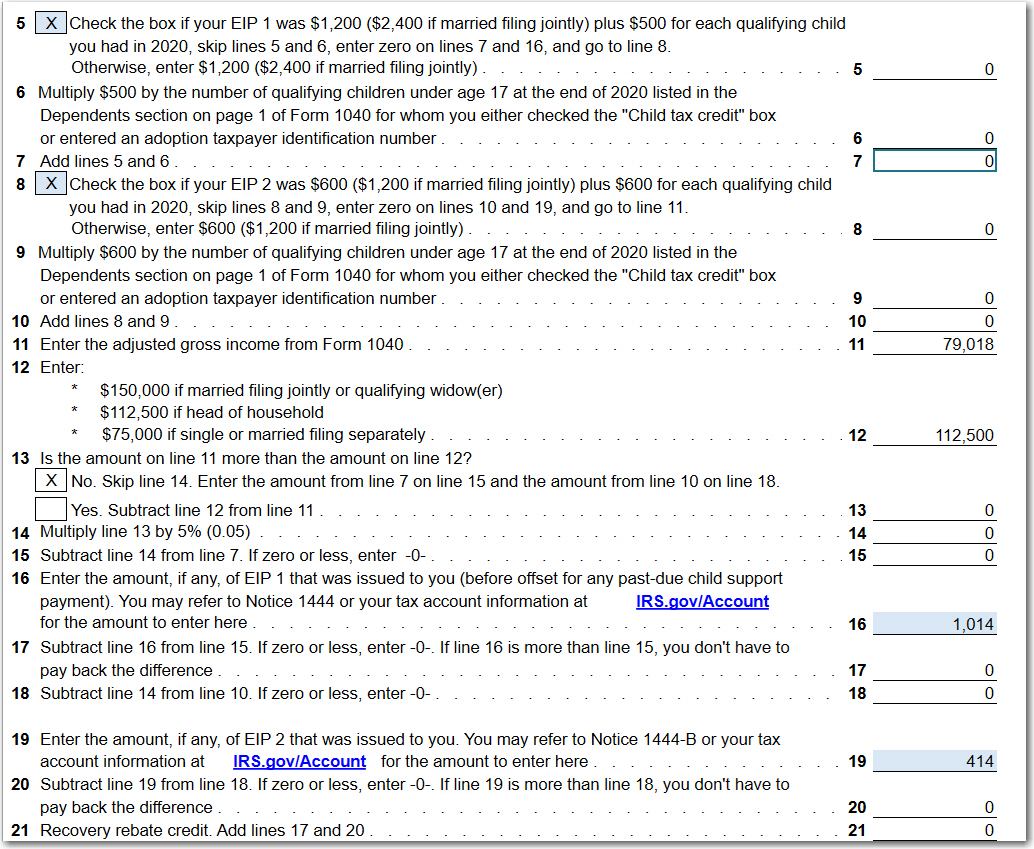

Recovery Rebate Credit Audit – Taxpayers can receive a tax rebate through the Recovery Rebate program. This permits them to claim a refund of their taxes without the need to amend their tax returns. The IRS manages the program and it is a completely free service. However, before filing, it is crucial to be aware … Read more