Recovery Rebate Credit For Third Stimulus Check

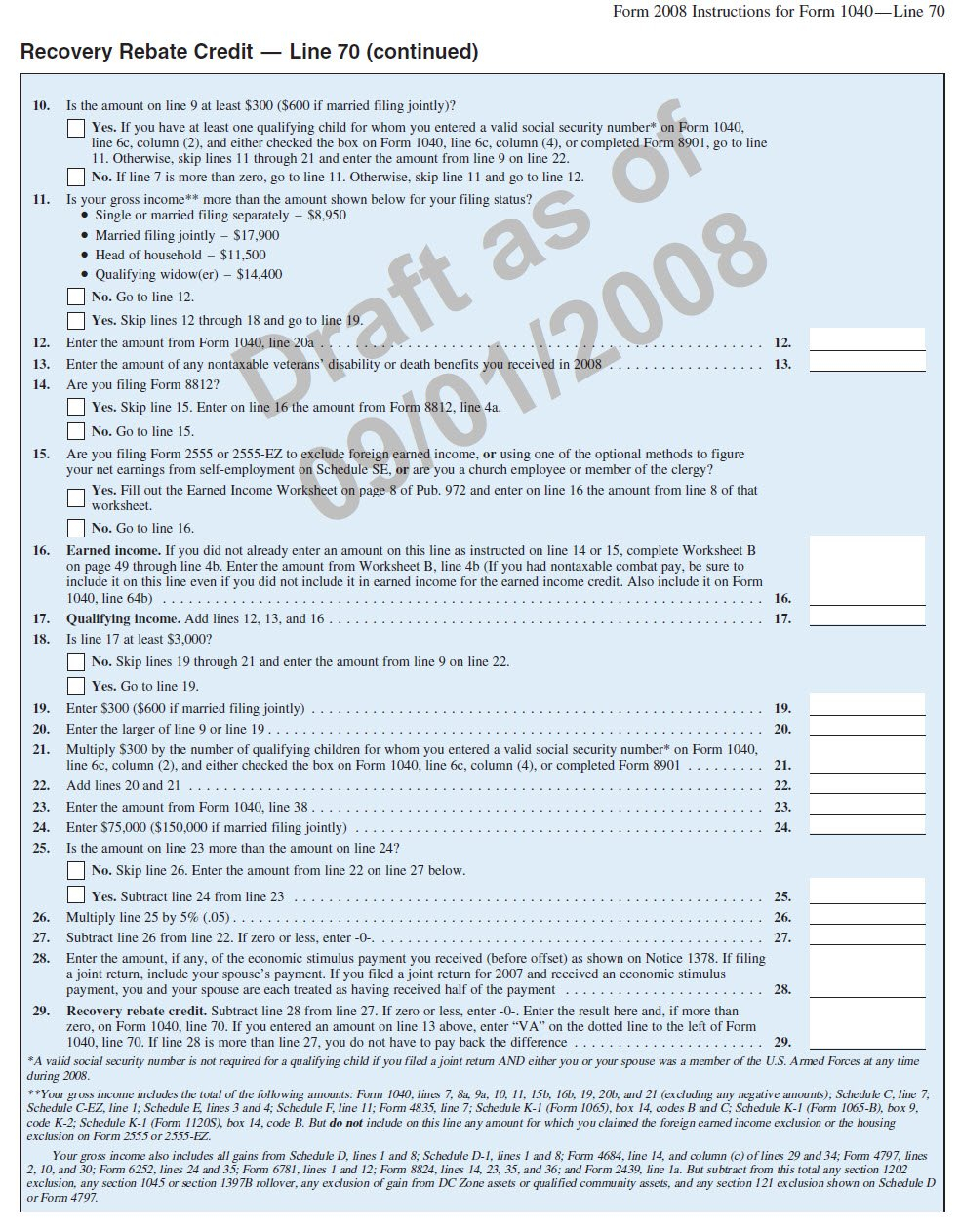

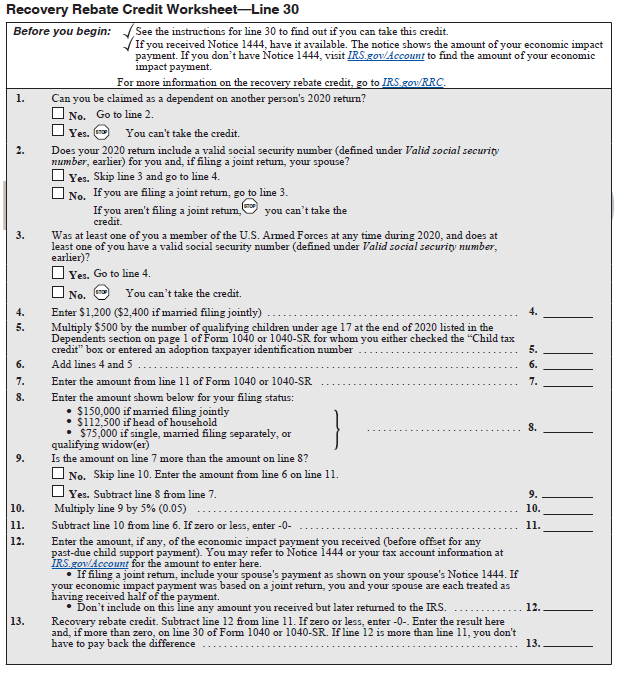

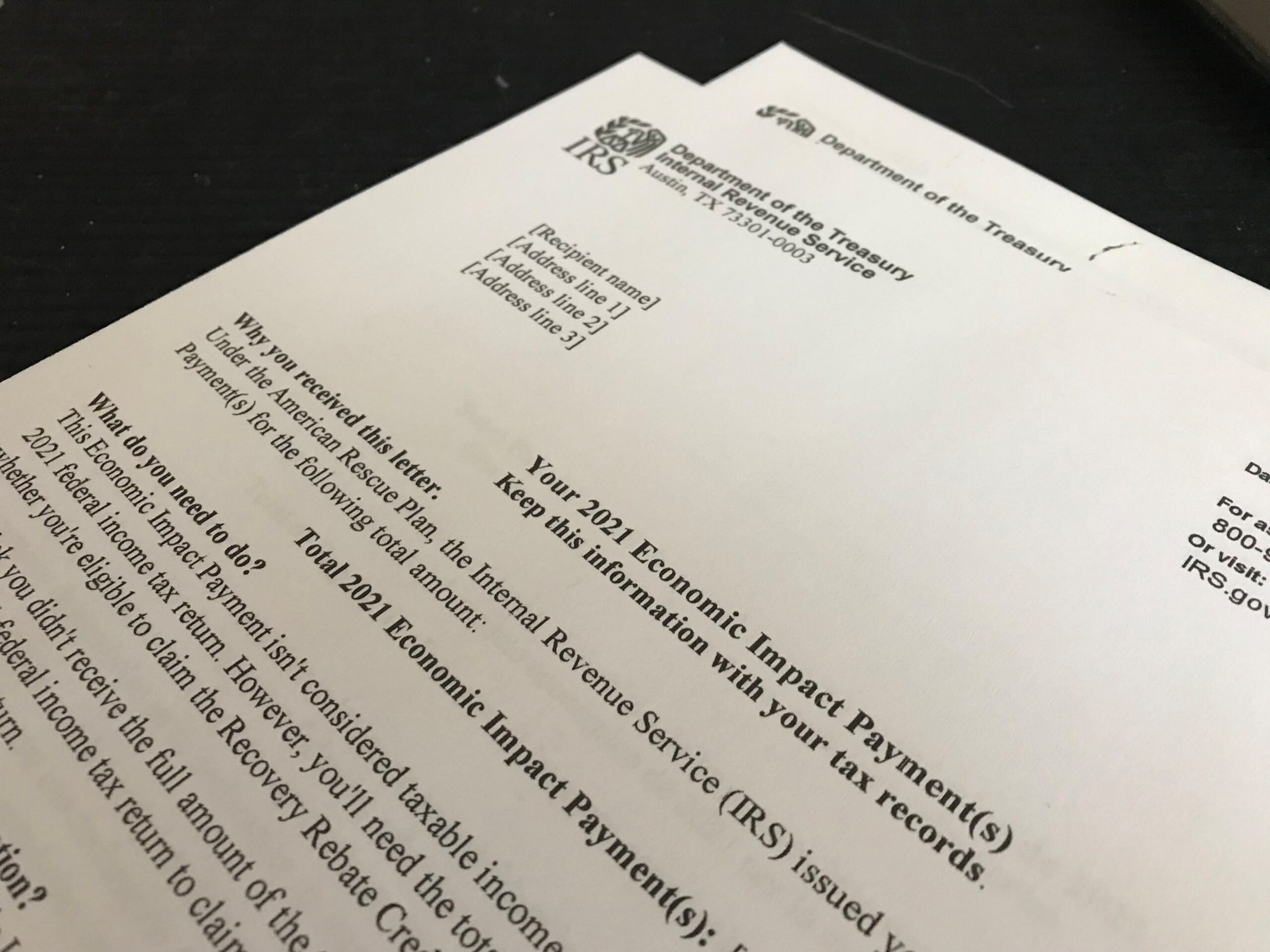

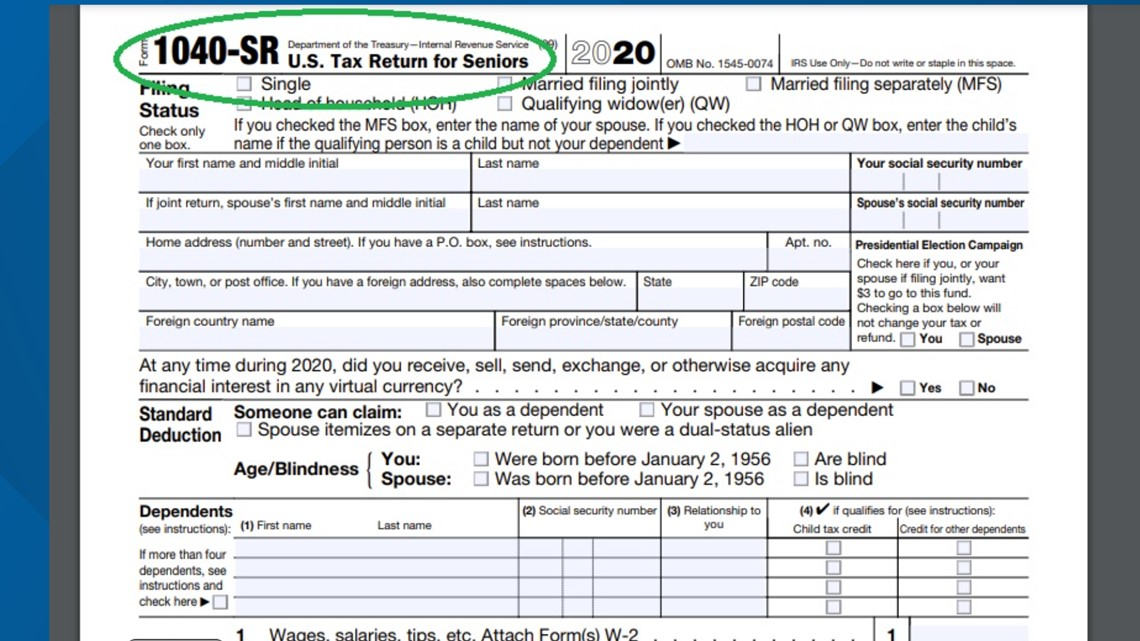

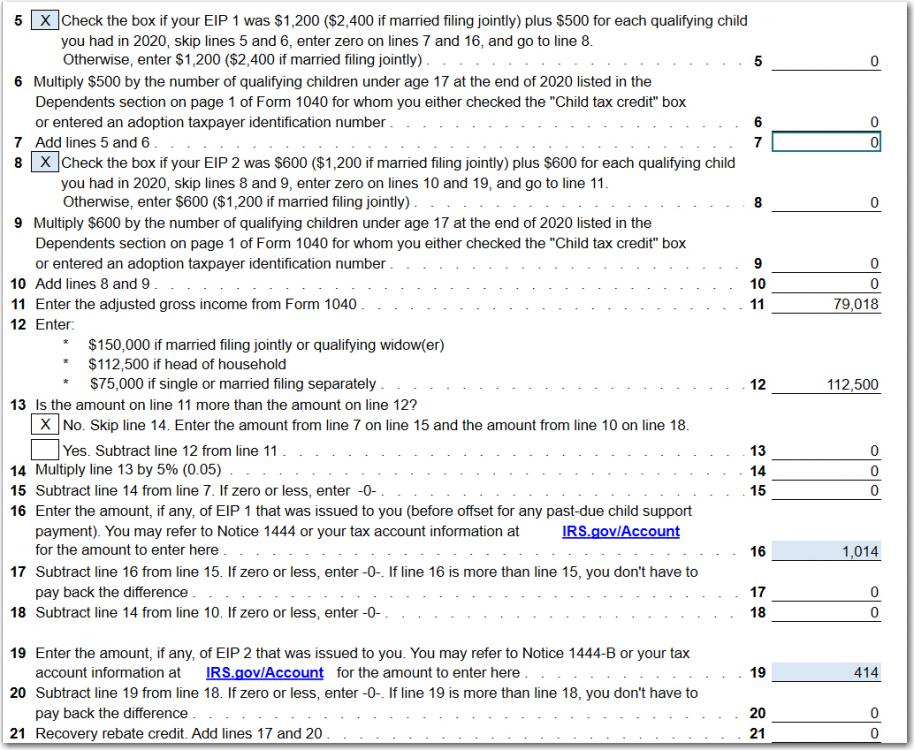

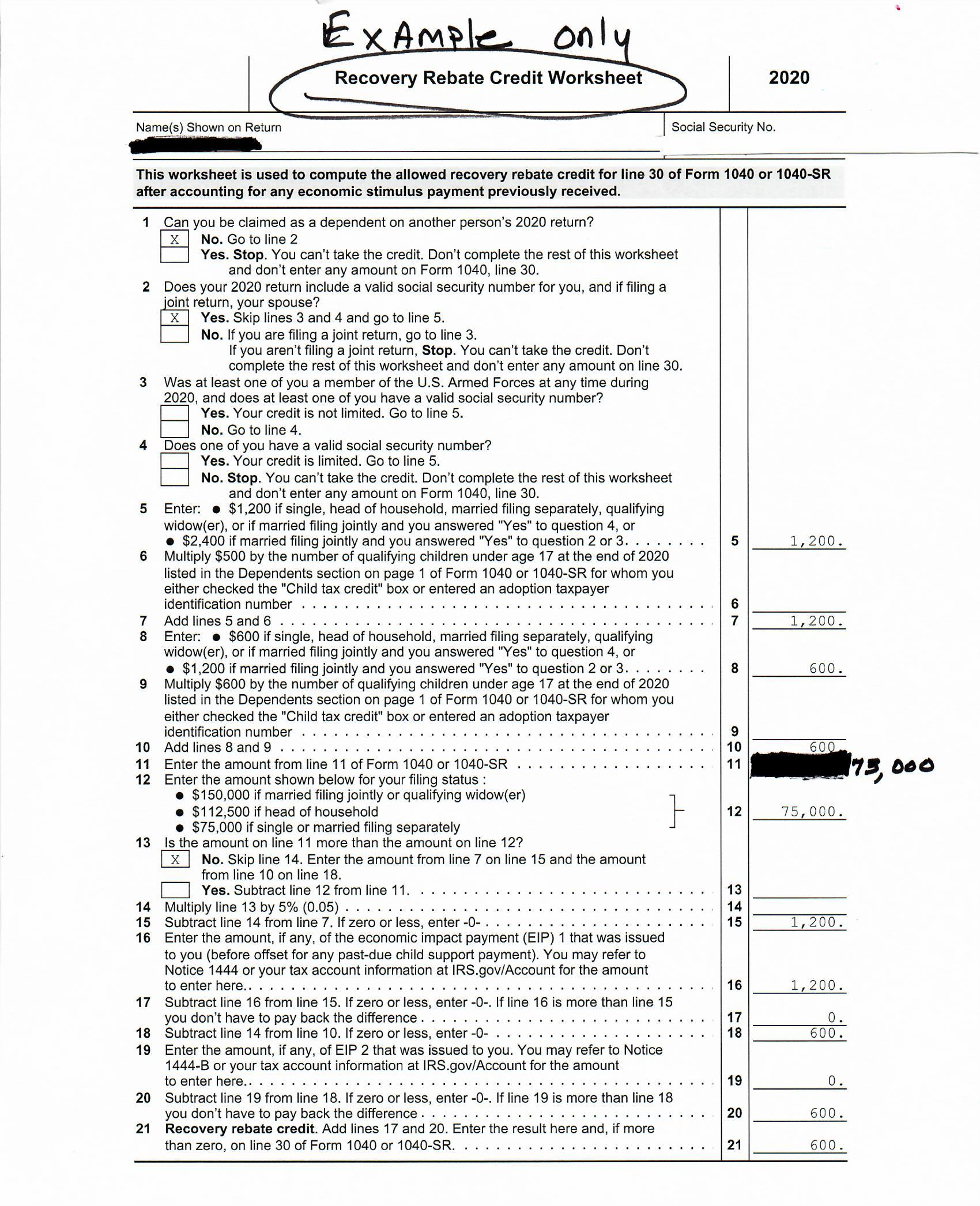

Recovery Rebate Credit For Third Stimulus Check – The Recovery Rebate gives taxpayers an opportunity to receive an income tax refund without the need to alter their tax returns. The program is managed by the IRS and is a no-cost service. It is important to understand the regulations before applying. Here are some details about … Read more