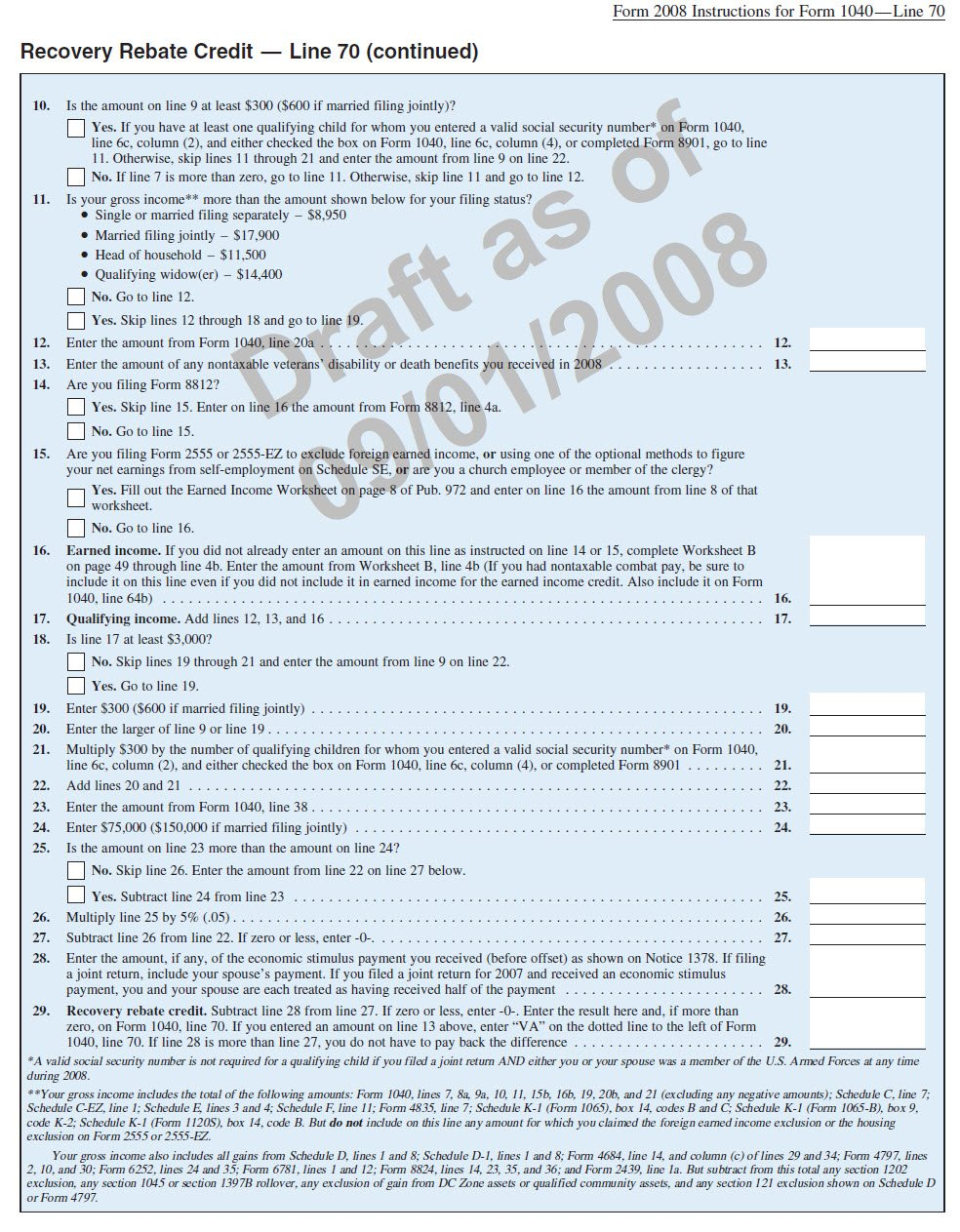

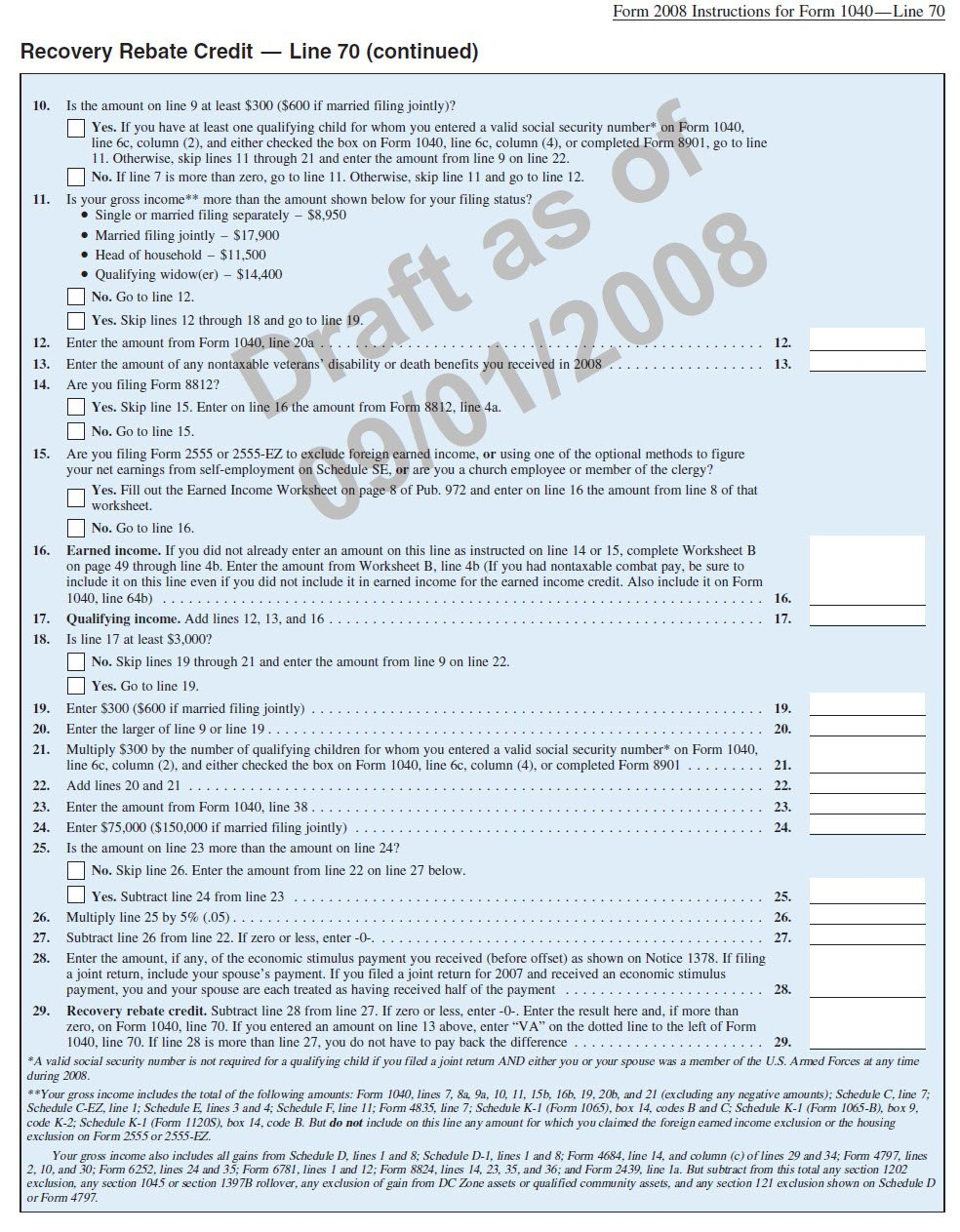

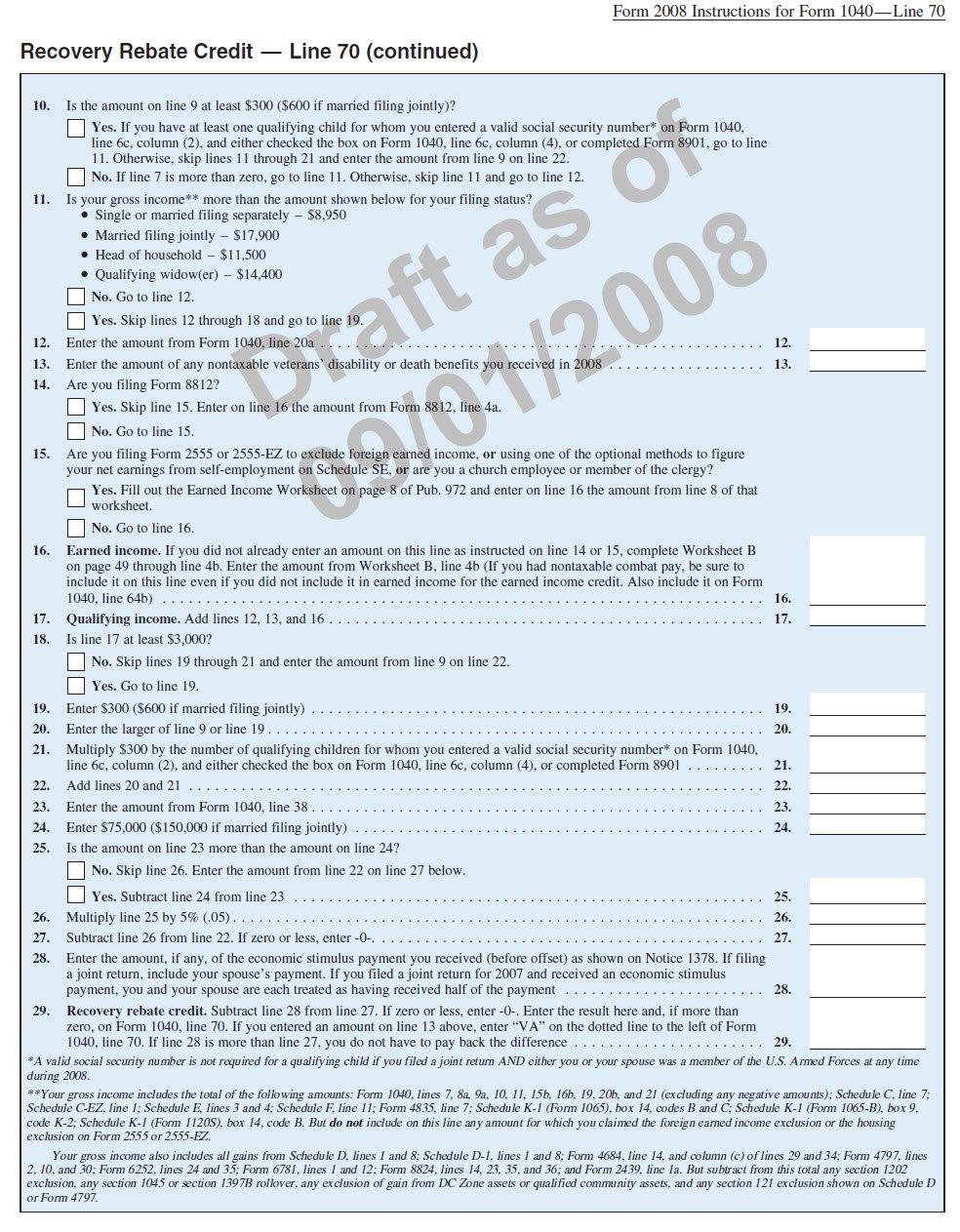

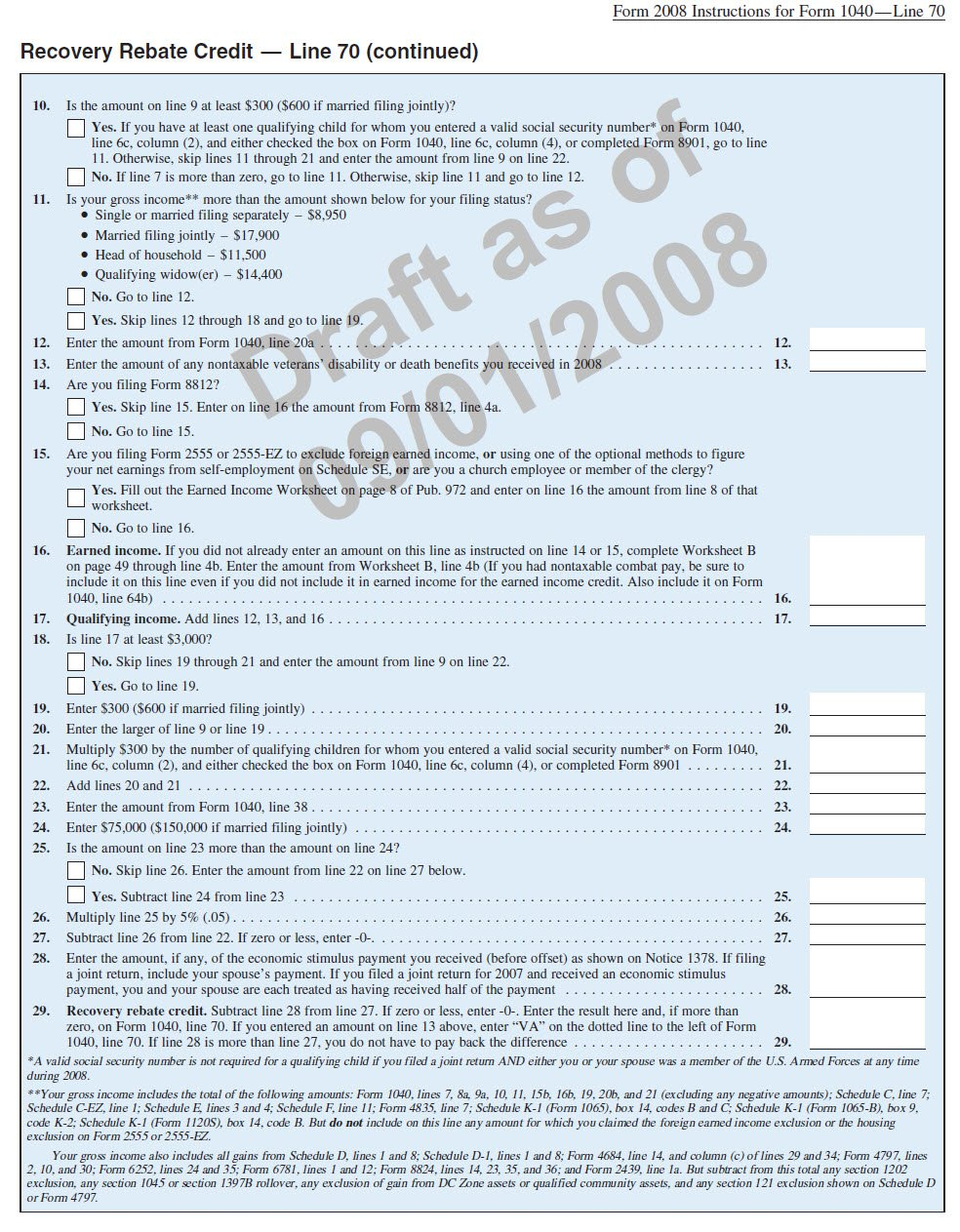

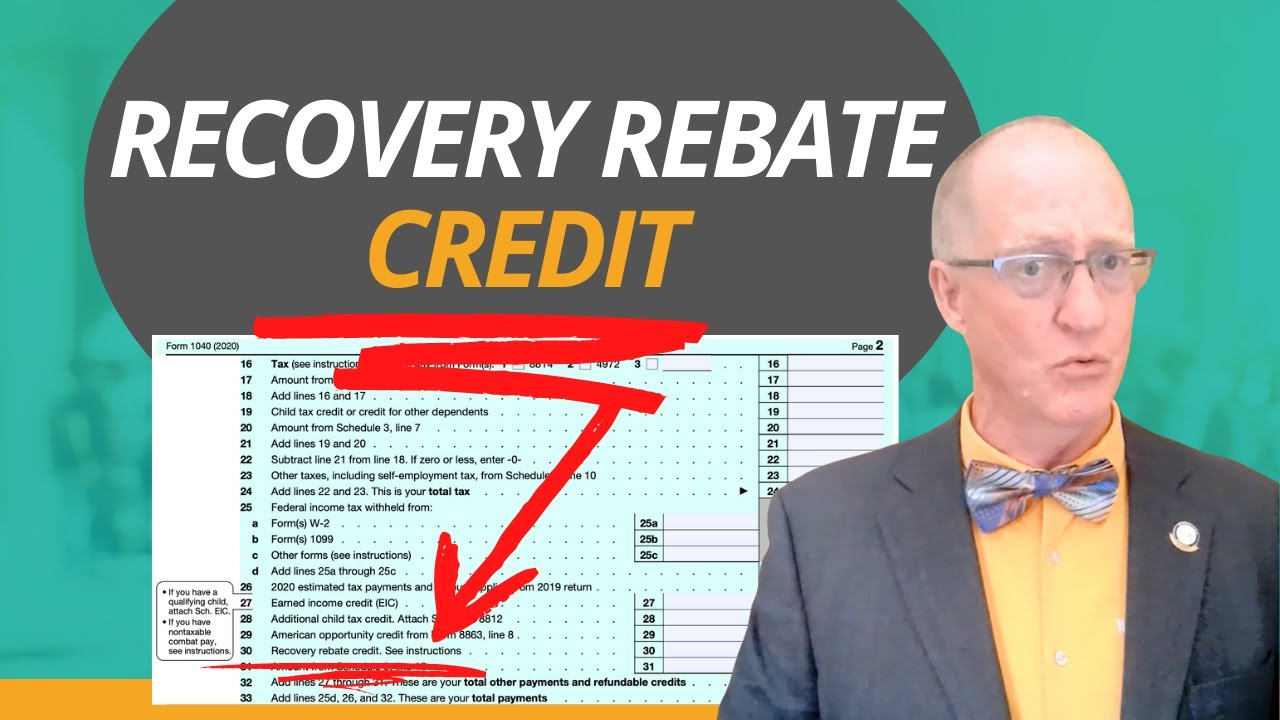

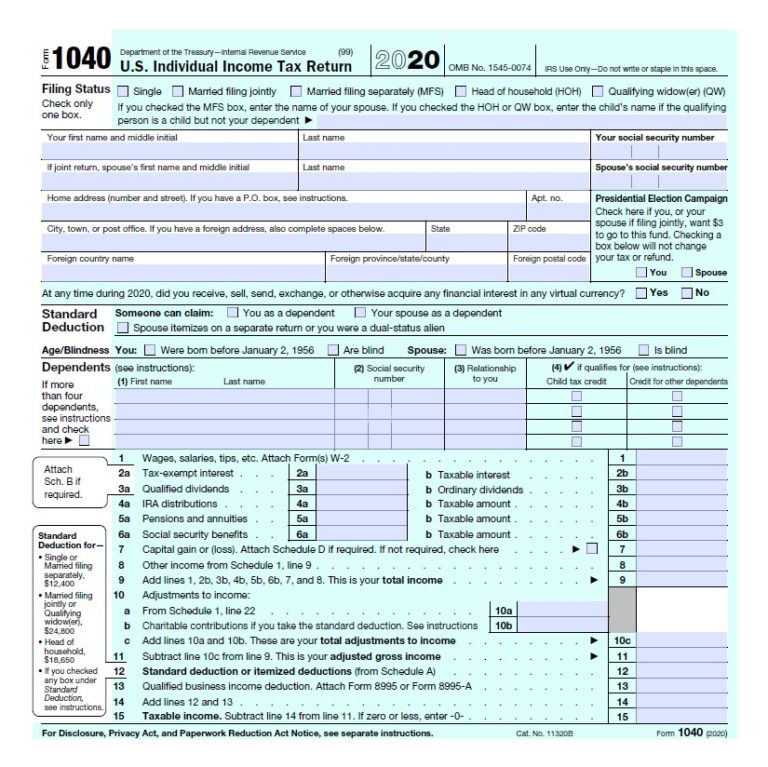

Example Of Recovery Rebate Credit Worksheet

Example Of Recovery Rebate Credit Worksheet – Taxpayers can receive an income tax credit through the Recovery Rebate program. This lets them claim a refund of their tax obligations without needing to alter the tax return. The IRS manages this program, and it’s completely free. It is important to understand the rules and regulations of … Read more