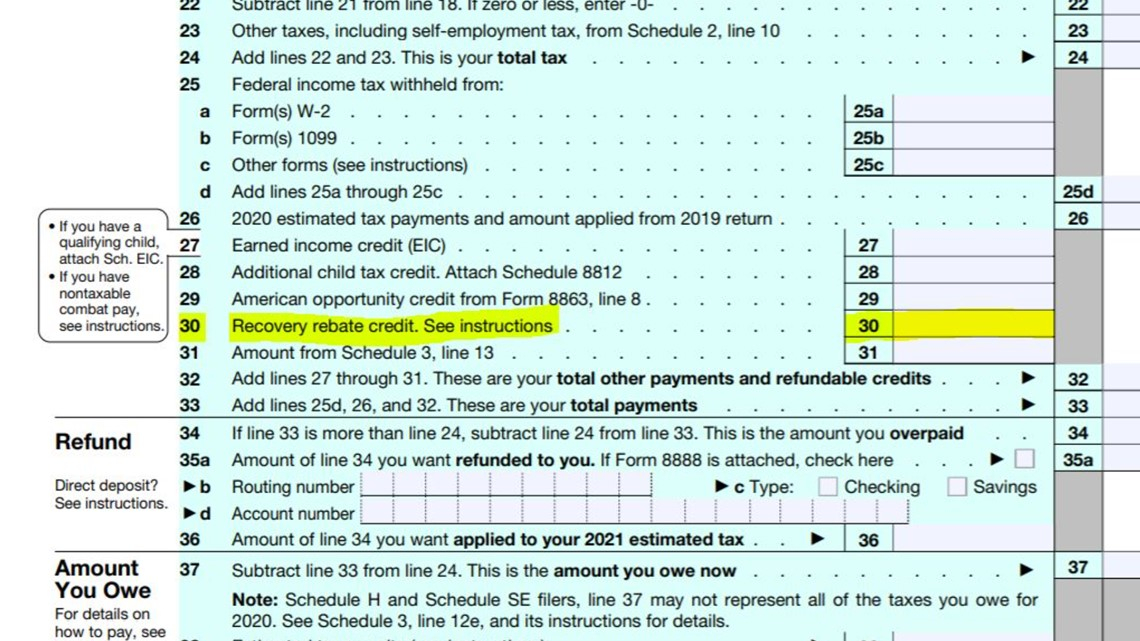

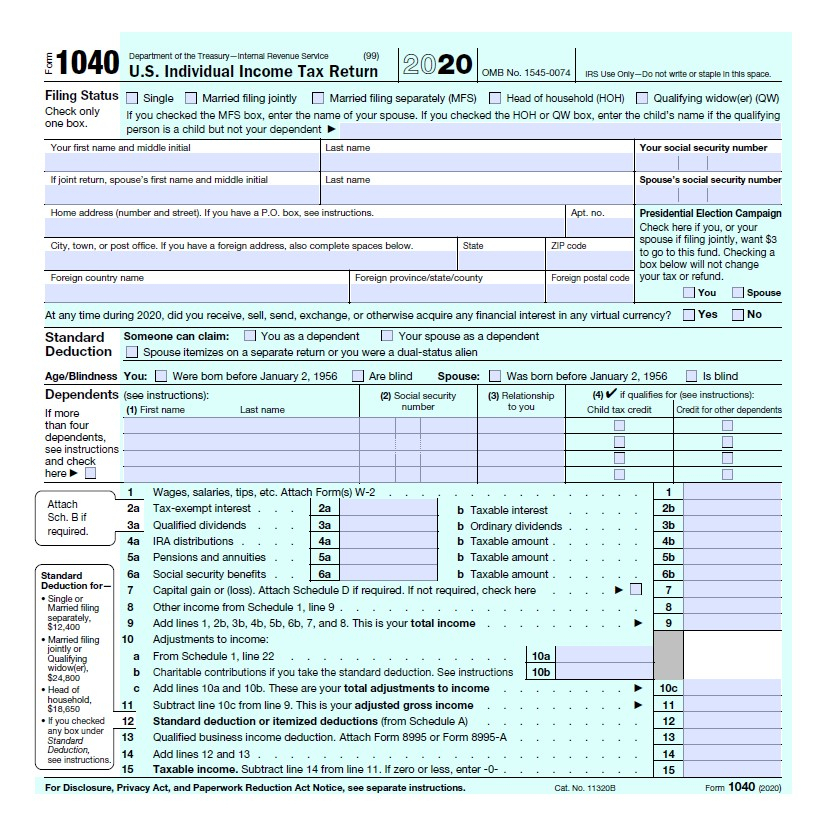

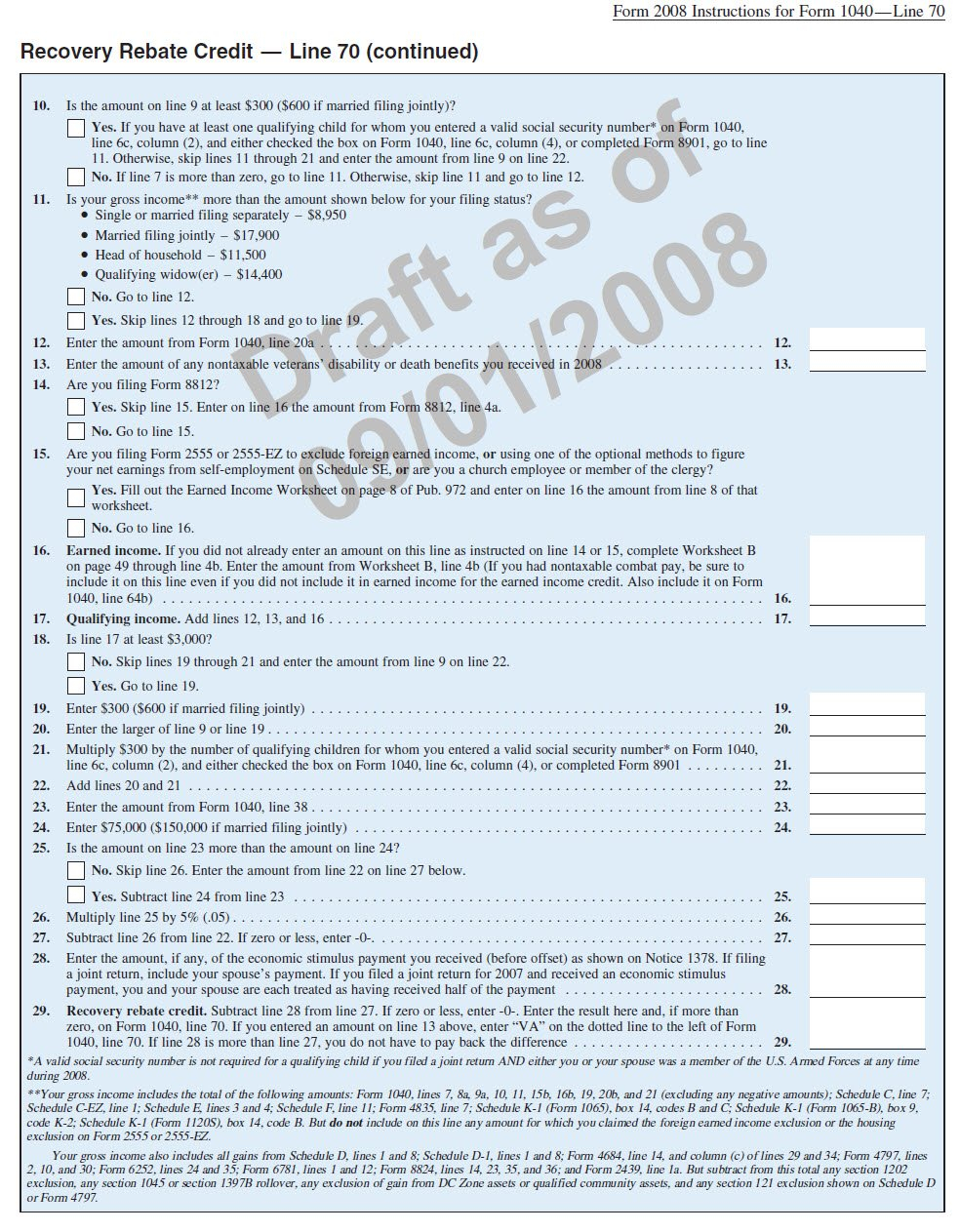

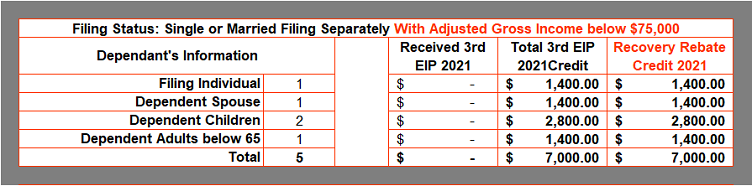

What Line Is The Recovery Rebate Credit

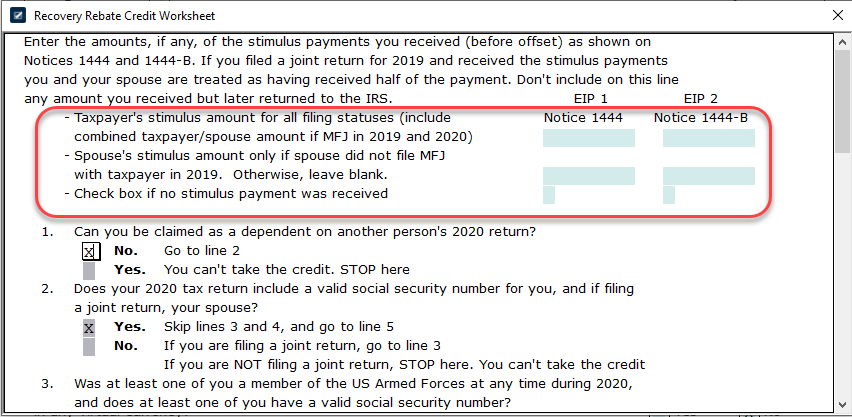

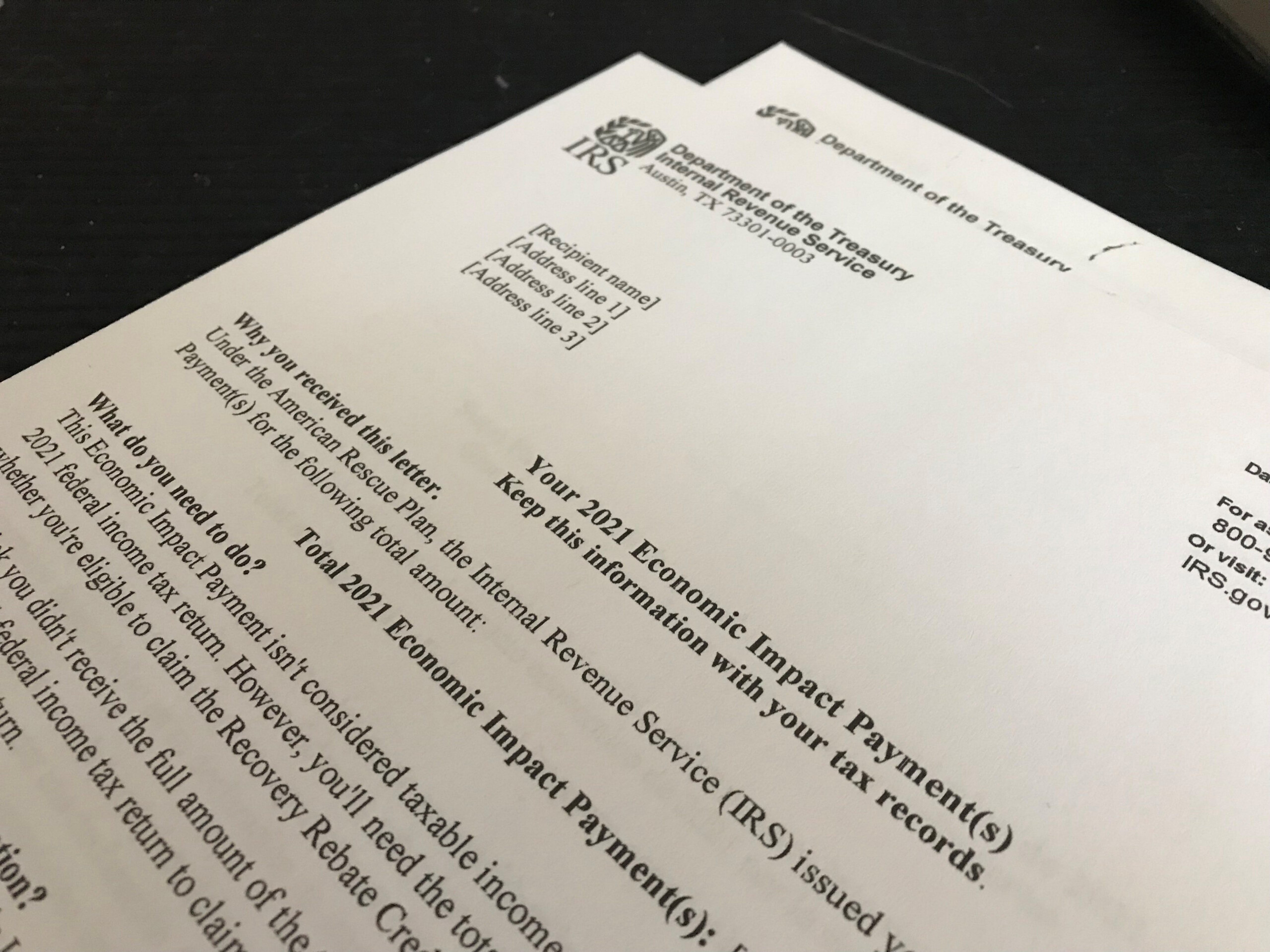

What Line Is The Recovery Rebate Credit – Taxpayers can get tax credits through the Recovery Rebate program. This permits them to get a refund on their tax obligations without having to amend their tax returns. This program is administered by the IRS and is a no-cost service. It is crucial to be familiar with … Read more