Recovery Rebate Credit Form Irs

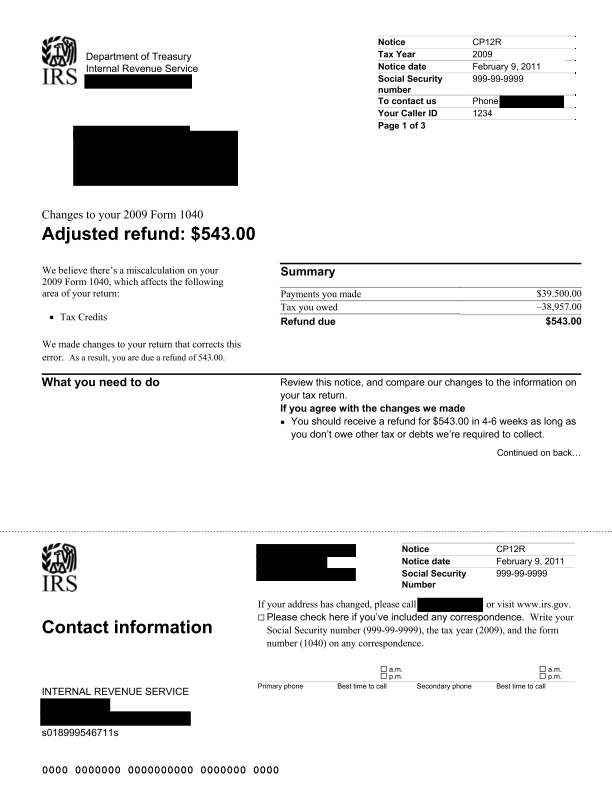

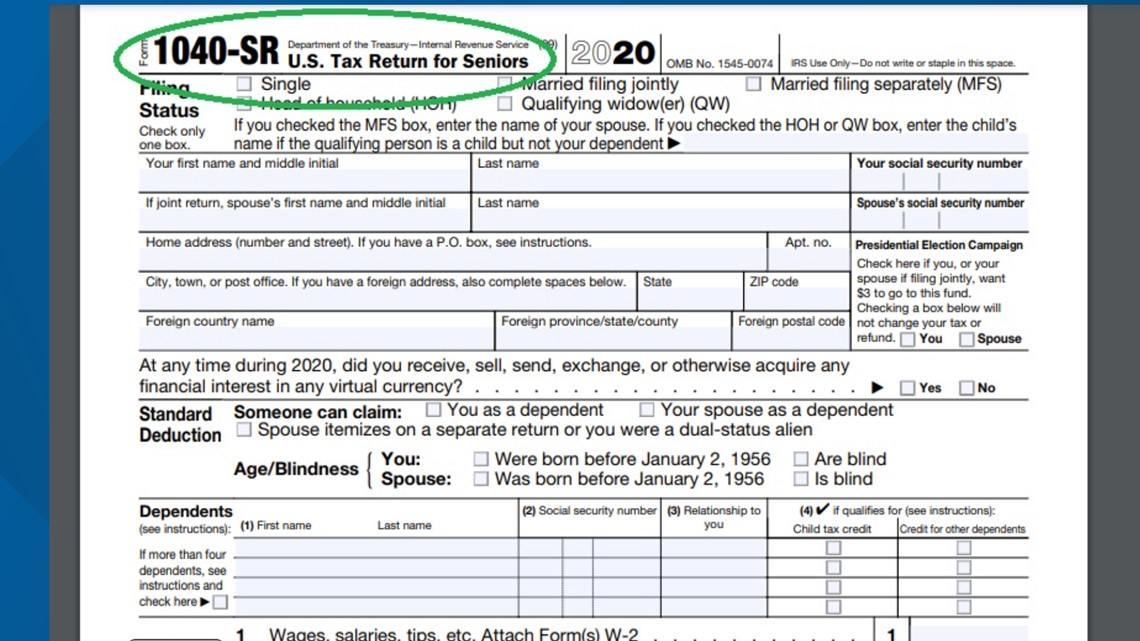

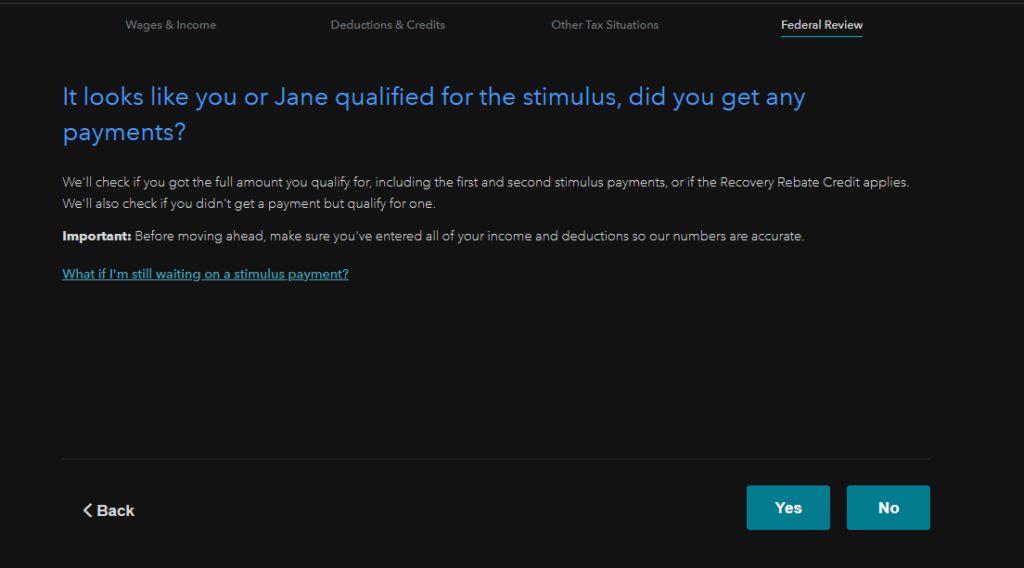

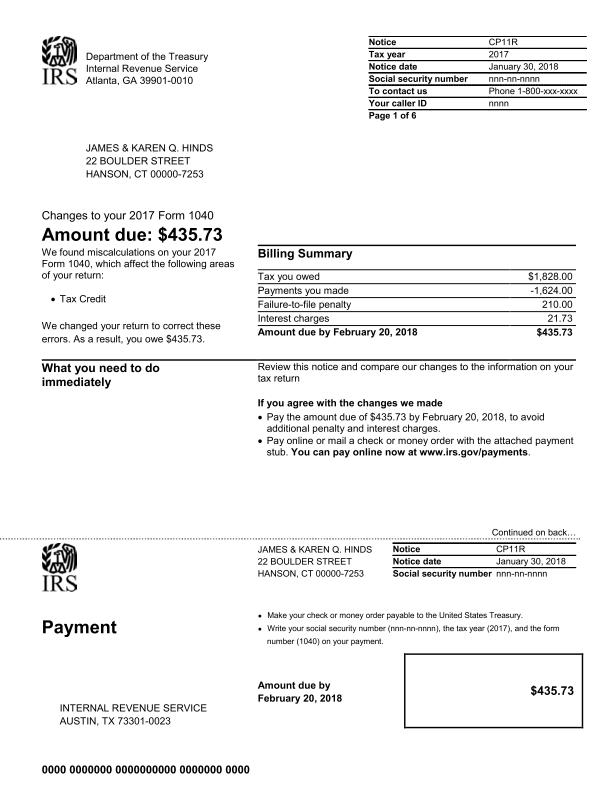

Recovery Rebate Credit Form Irs – The Recovery Rebate offers taxpayers the opportunity to receive an income tax return, with no tax return altered. The program is provided by the IRS. It’s completely free. It is crucial to understand the guidelines and rules of the program before you submit. Here are some things to know … Read more