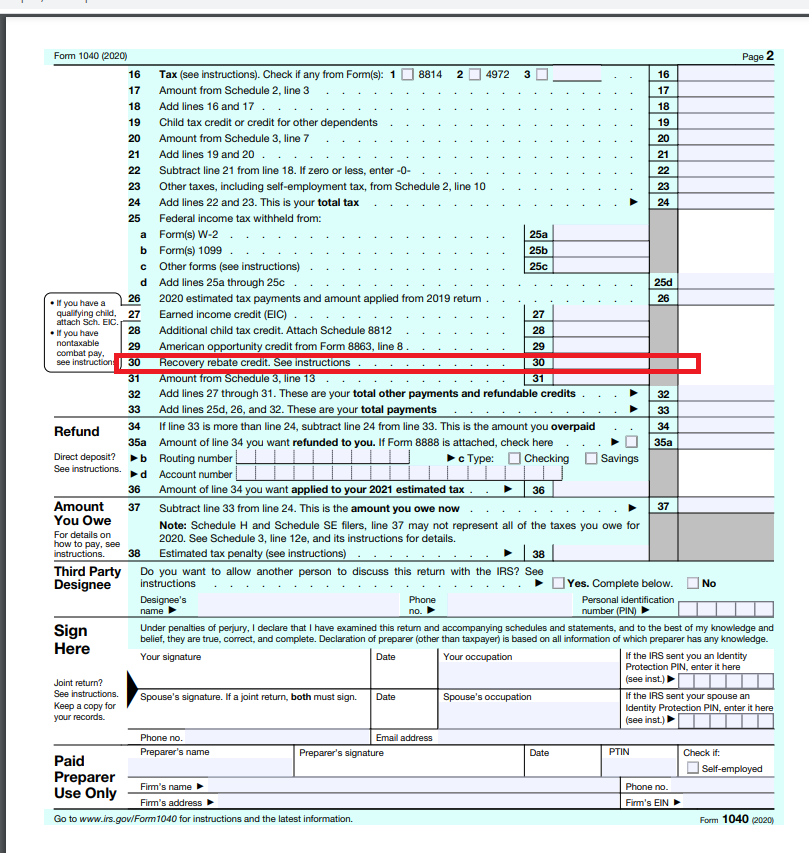

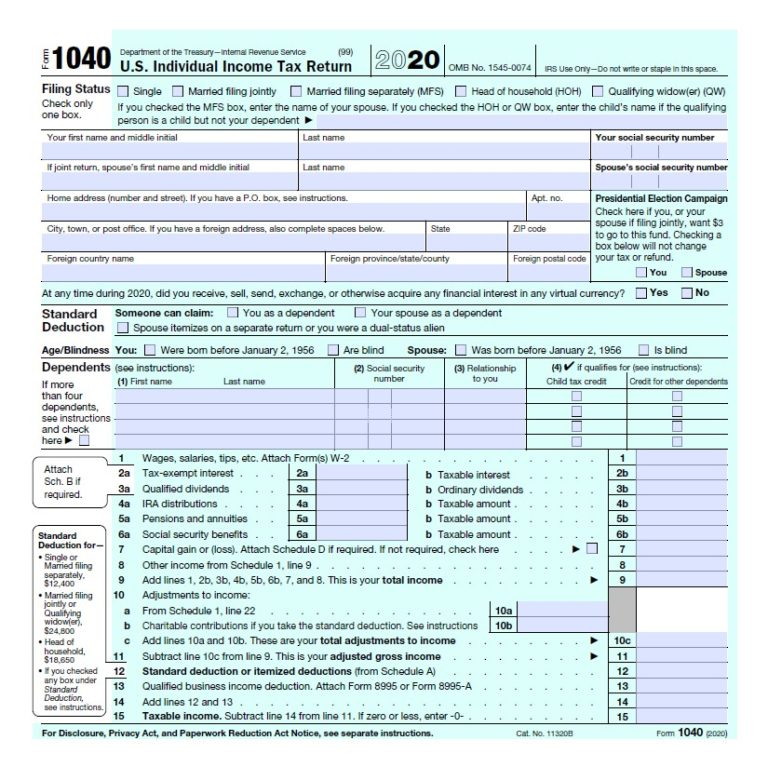

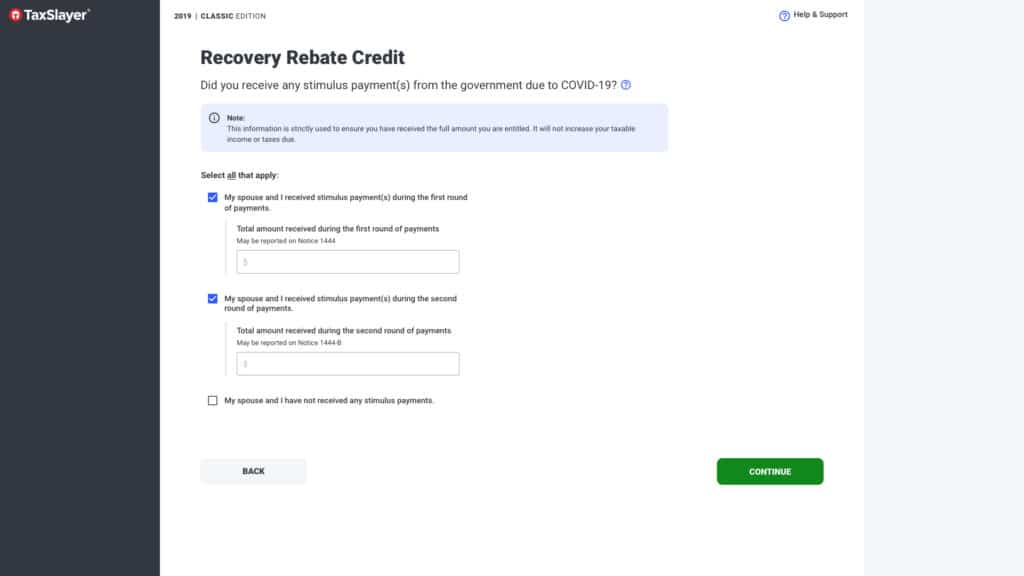

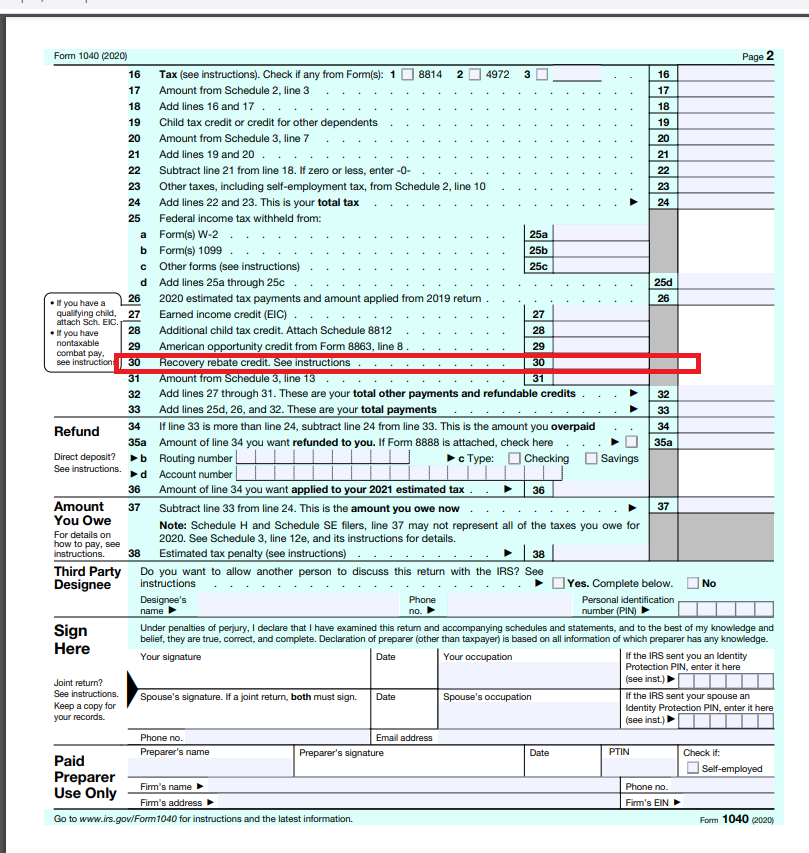

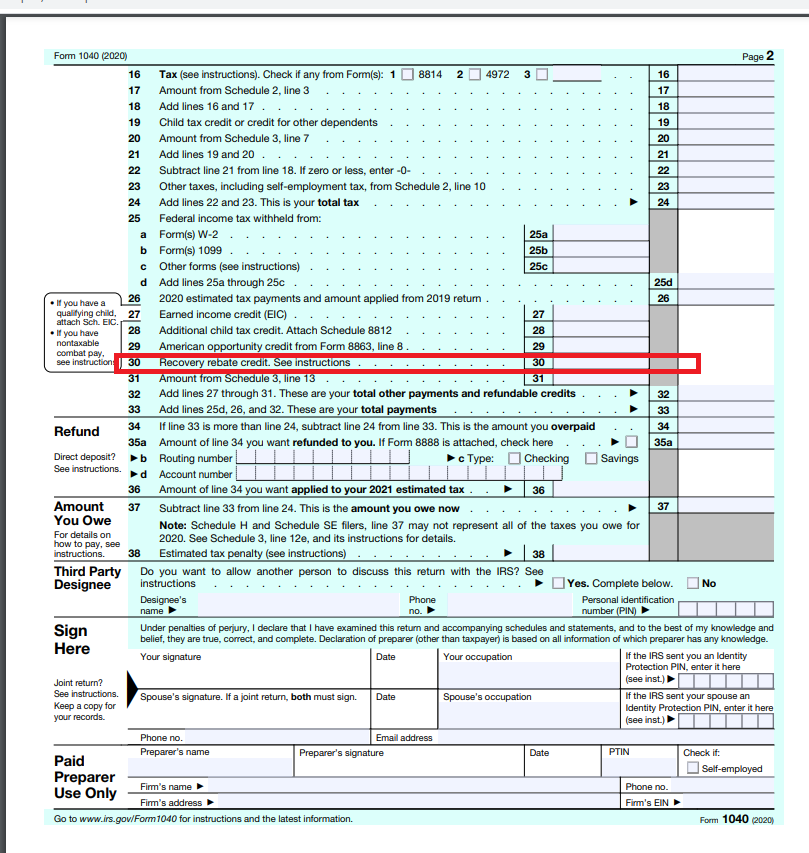

What Is Tax Recovery Rebate Credit

What Is Tax Recovery Rebate Credit – The Recovery Rebate offers taxpayers the possibility of receiving the tax return they deserve without having their tax returns adjusted. This program is administered by the IRS and is a no-cost service. However, it is crucial to understand the regulations and rules for this program before you file. … Read more