Change The Amount Claimed As Recovery Rebate Credit

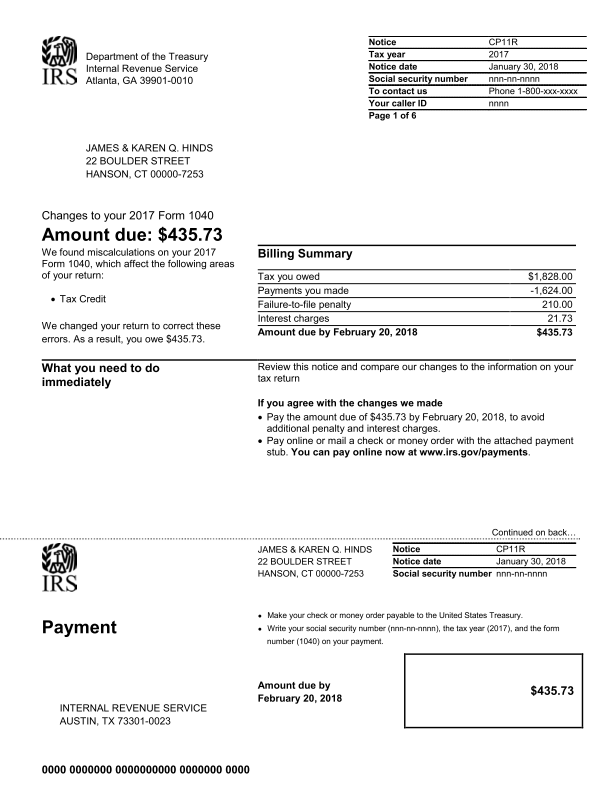

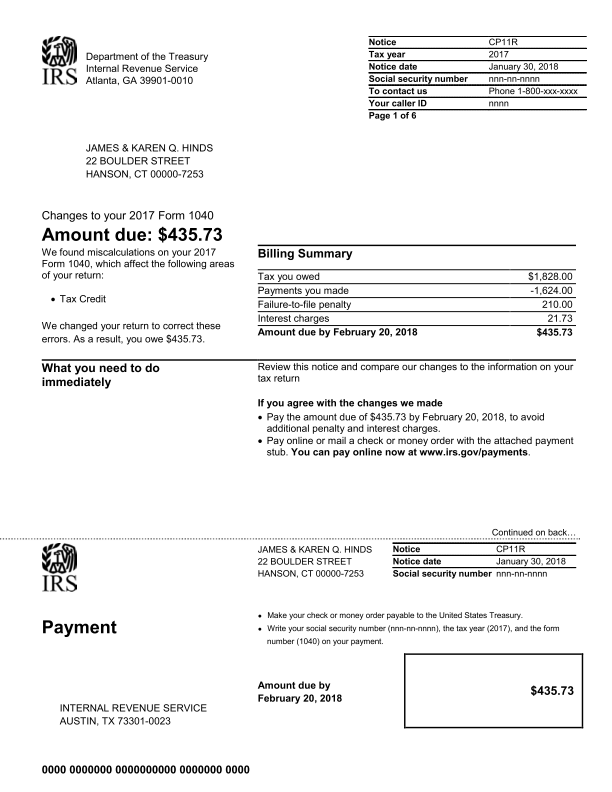

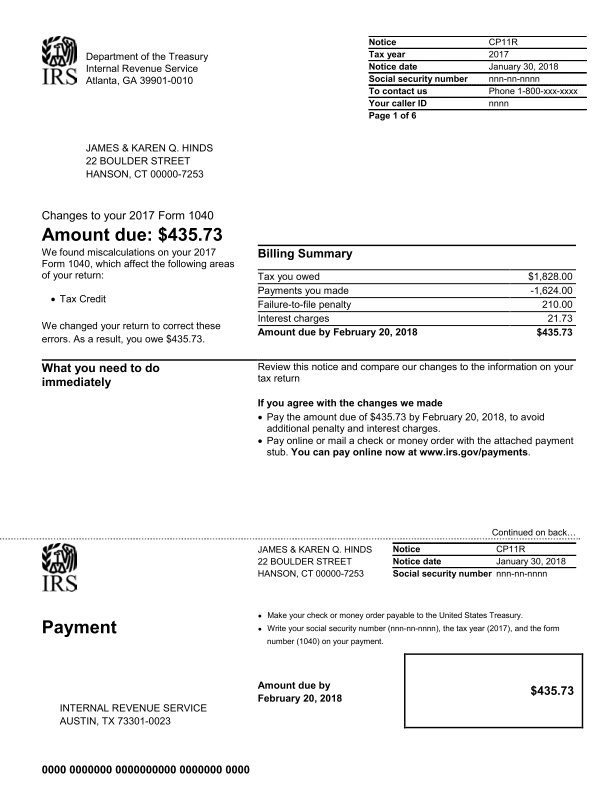

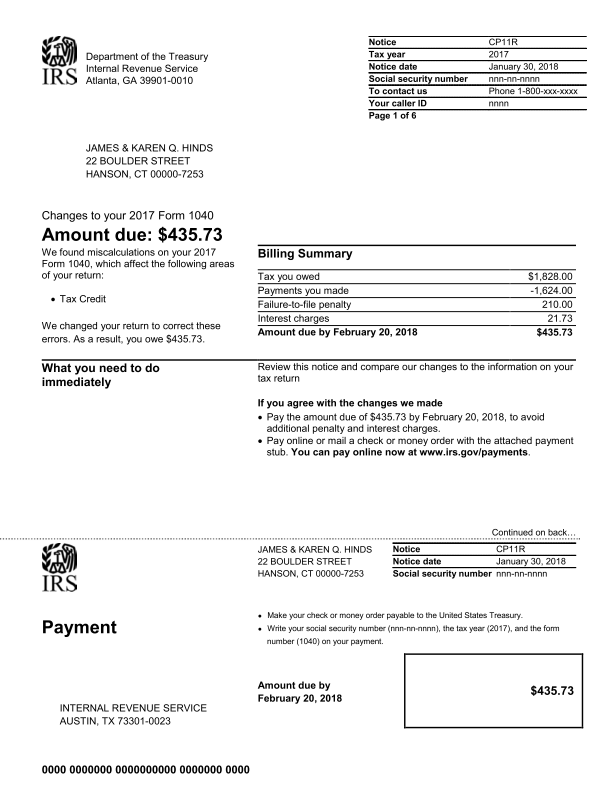

Change The Amount Claimed As Recovery Rebate Credit – Taxpayers are eligible for an income tax credit through the Recovery Rebate program. This allows them to receive a tax refund for taxes, without having to amend the tax return. This program is provided by the IRS. It is, however, essential to be aware of the … Read more