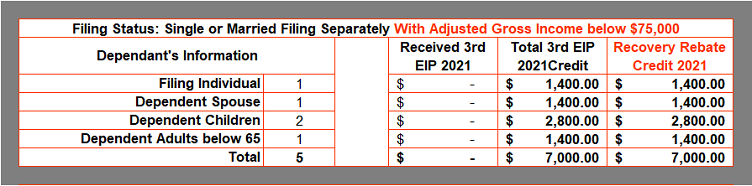

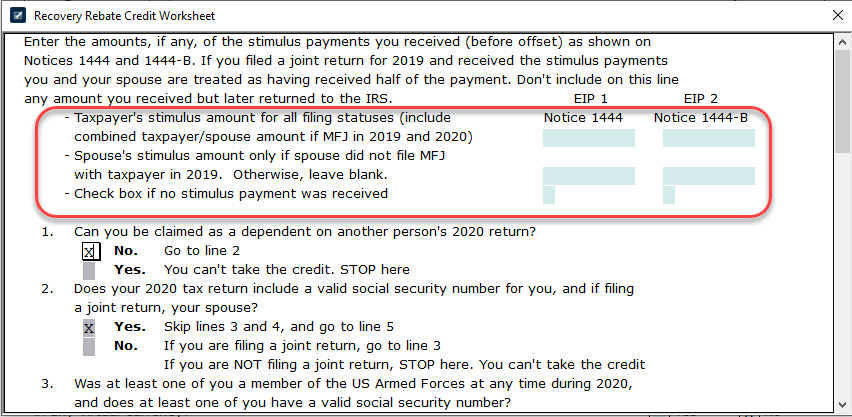

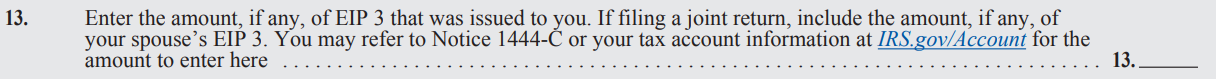

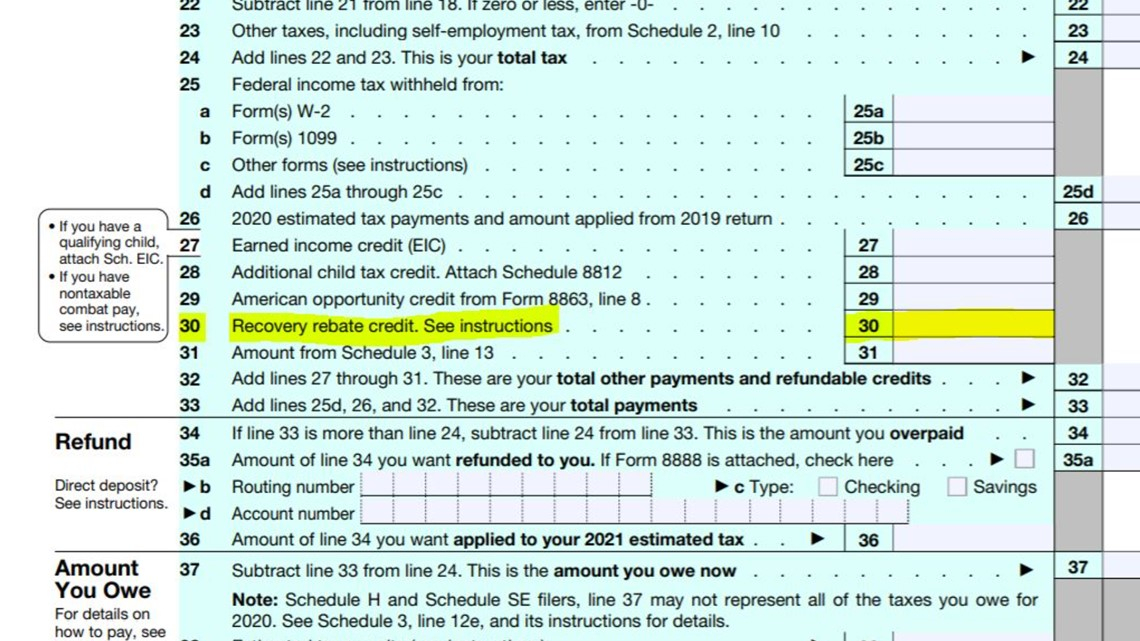

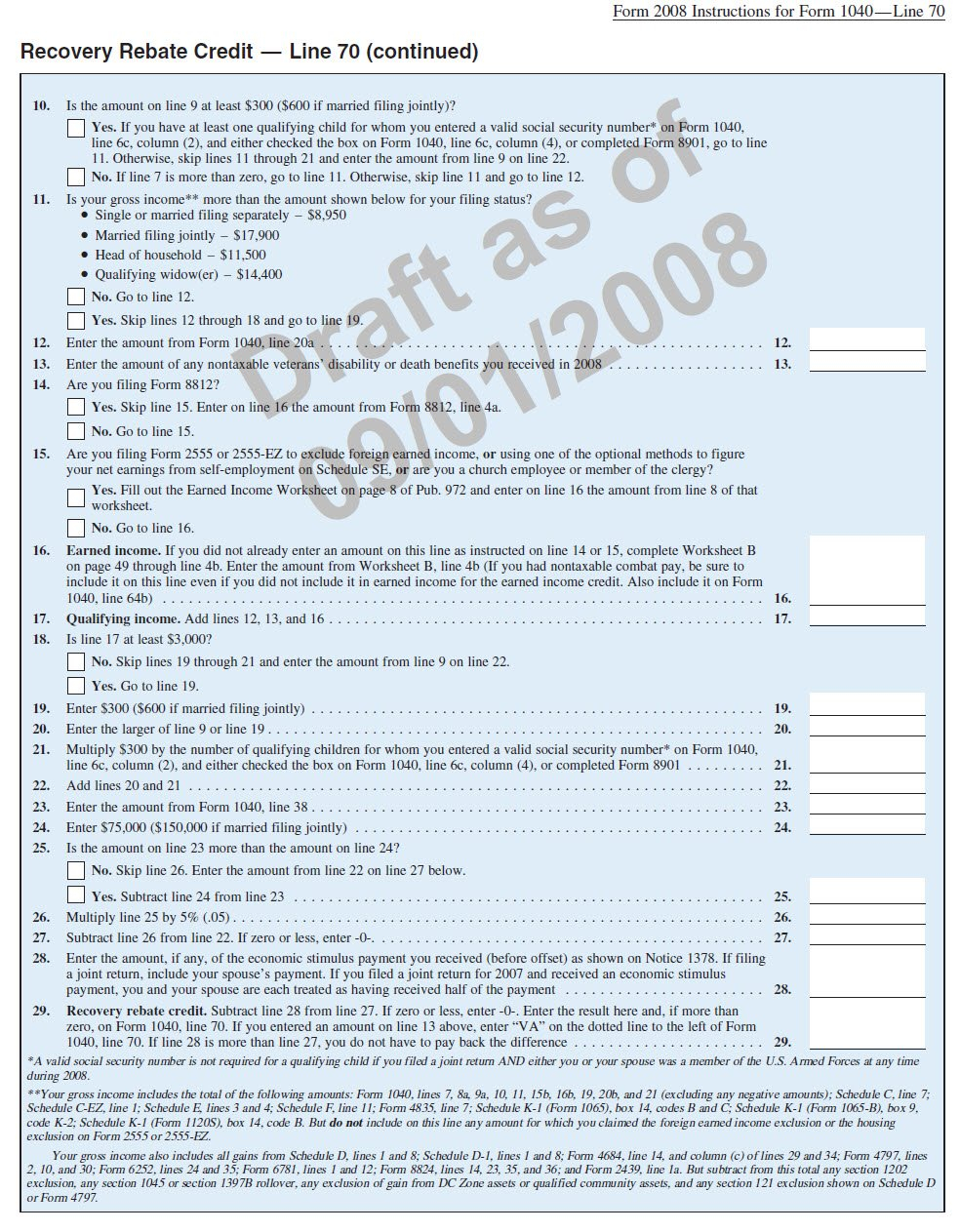

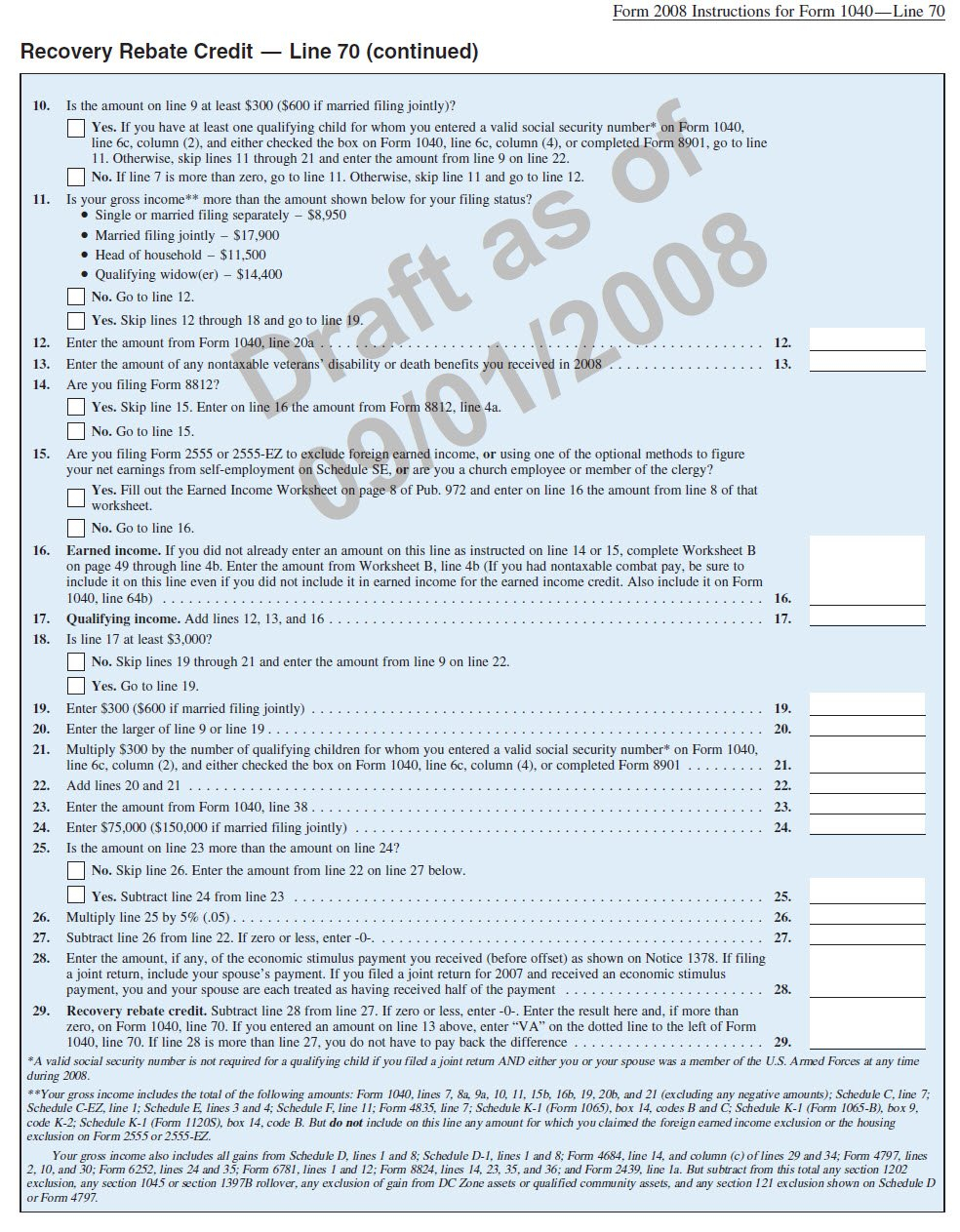

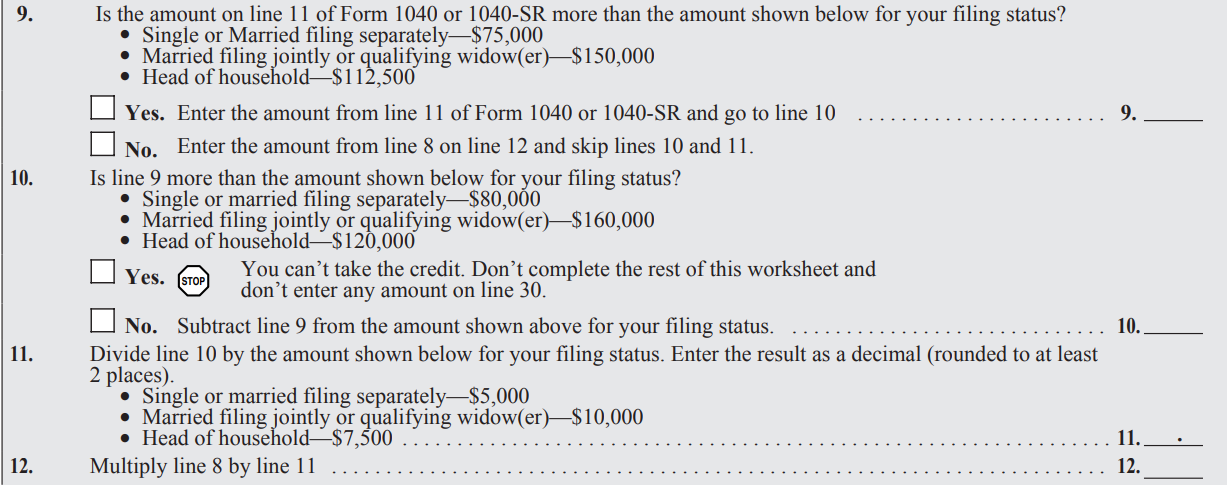

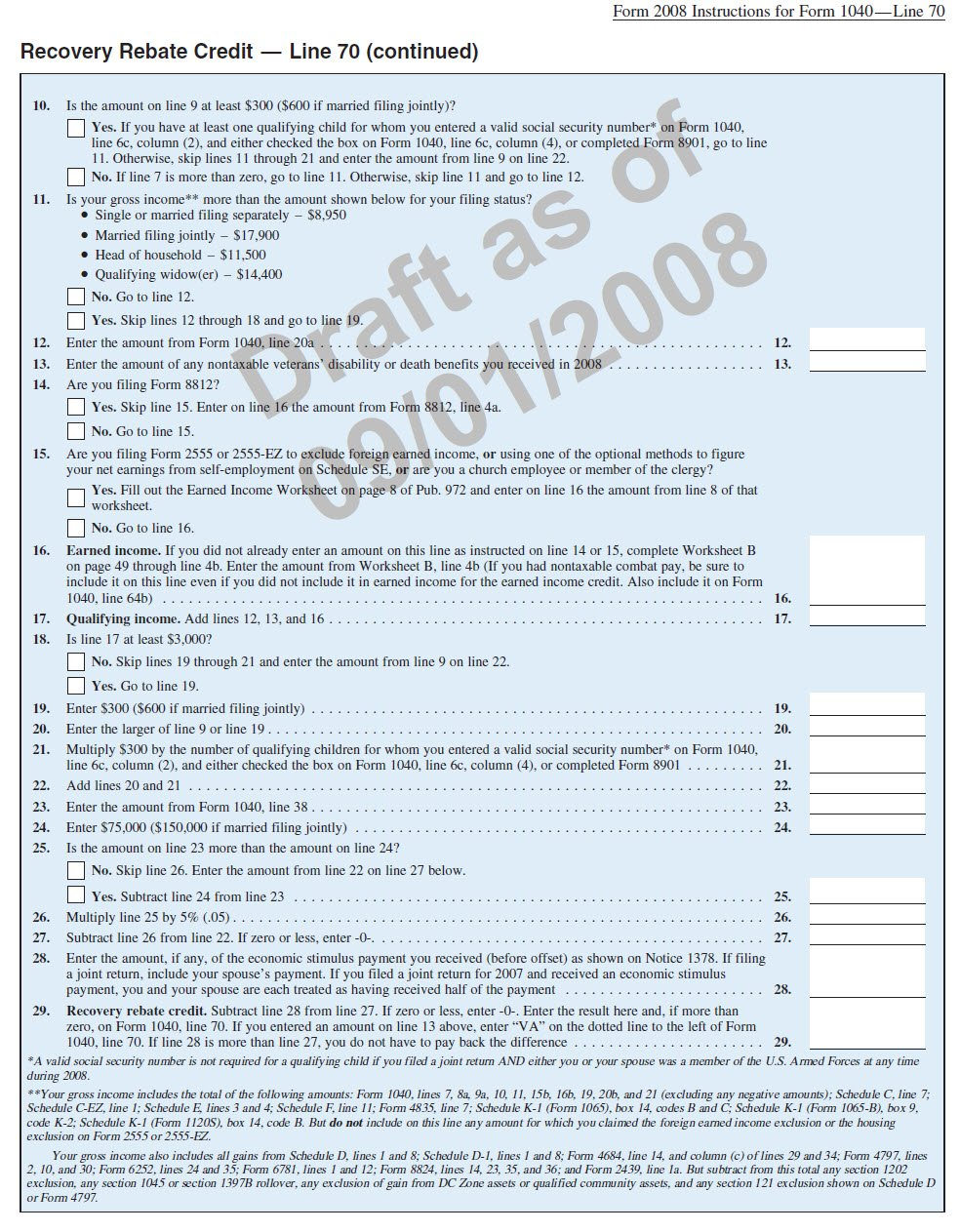

Rebate Recovery Credit Worksheet

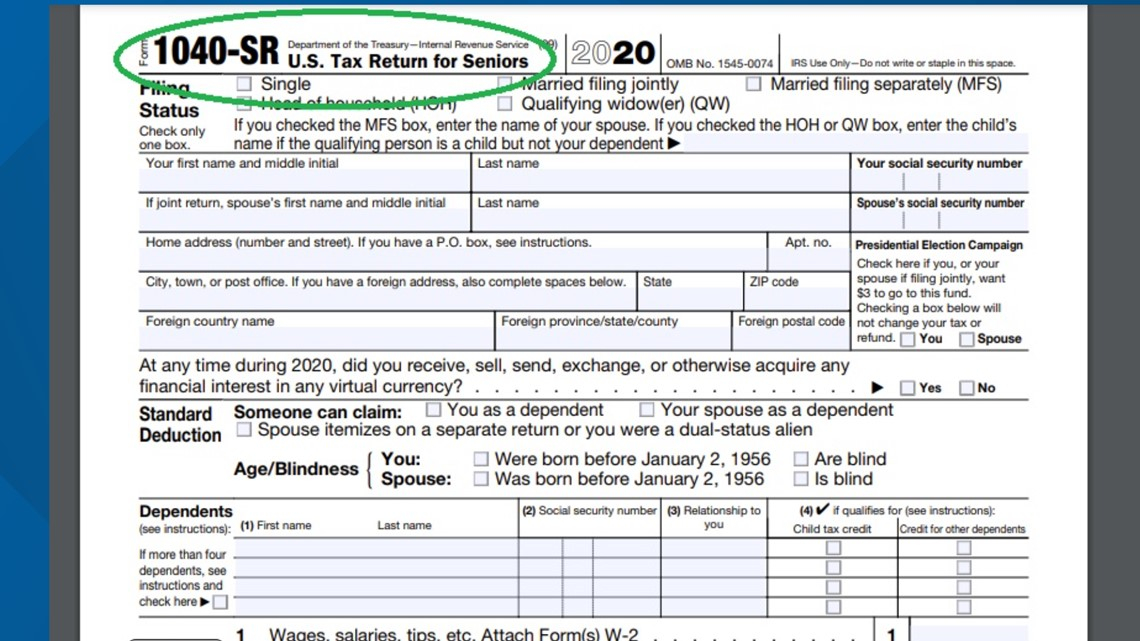

Rebate Recovery Credit Worksheet – The Recovery Rebate is an opportunity for taxpayers to get an income tax refund, without having to alter their tax returns. The IRS administers the program that is a no-cost service. But, before you file it is essential to be aware of the regulations and rules. Here are a few … Read more