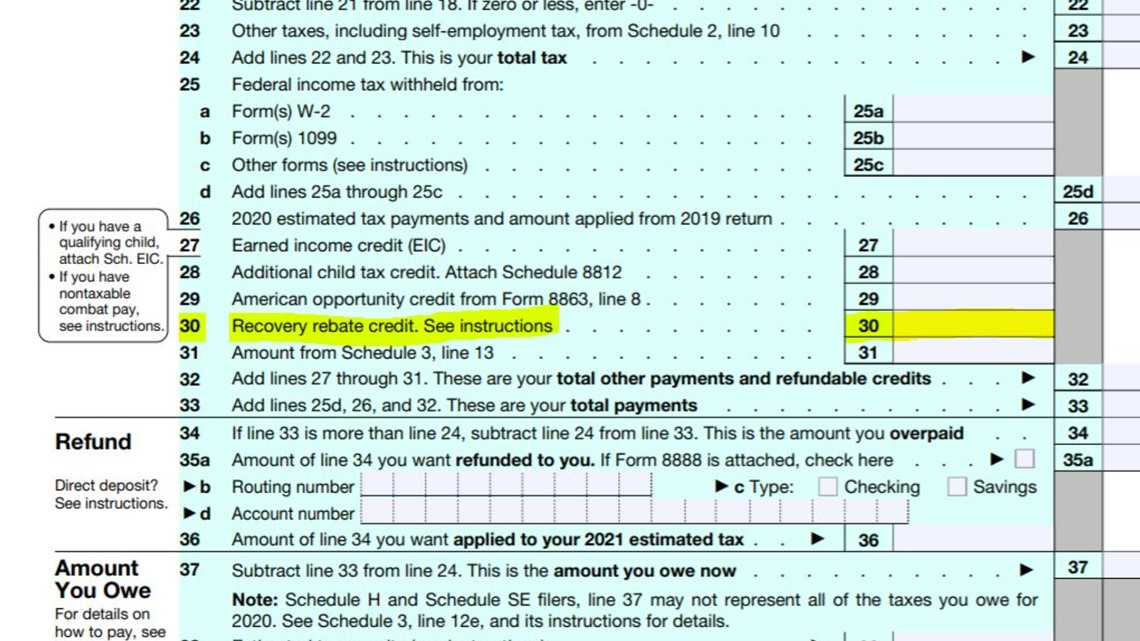

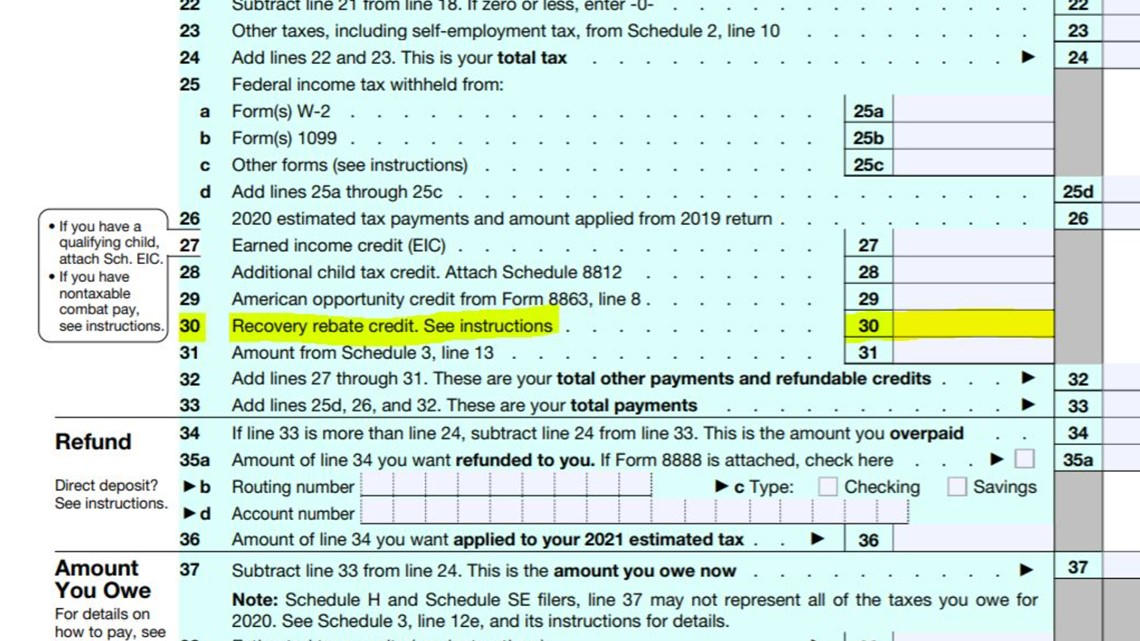

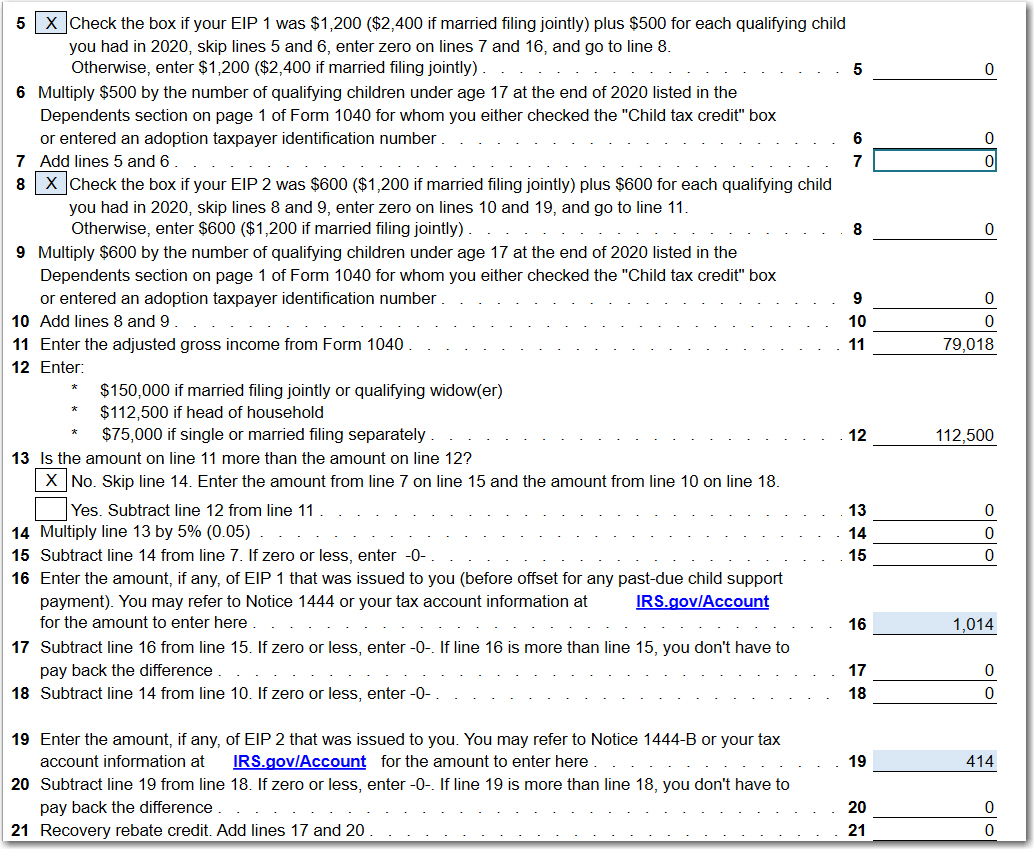

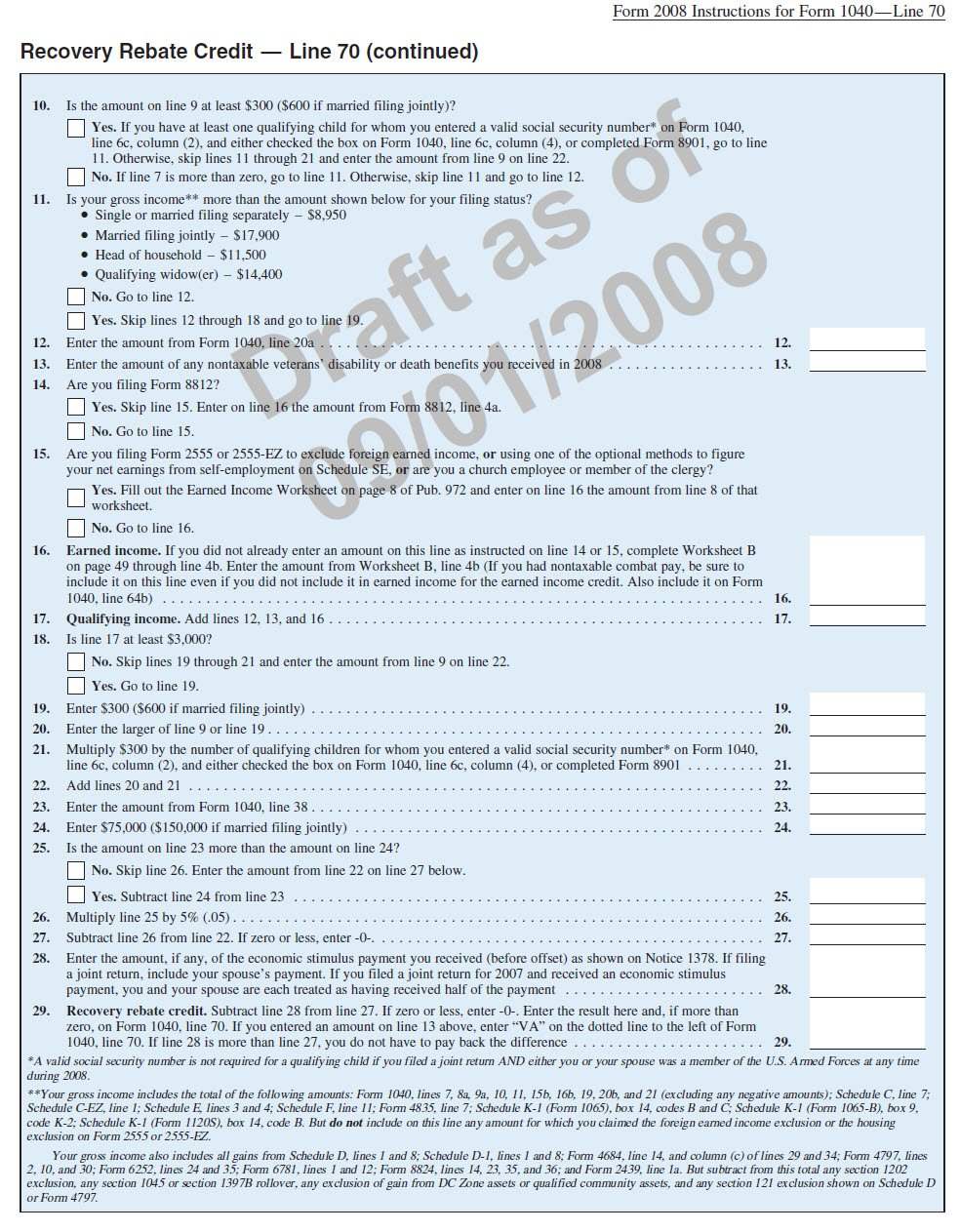

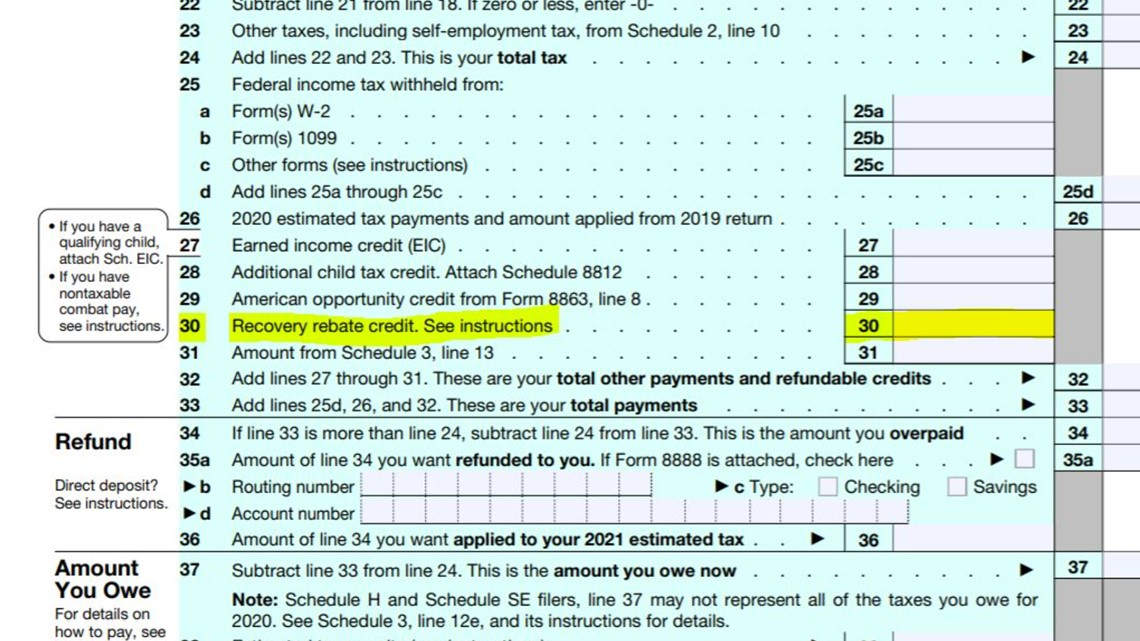

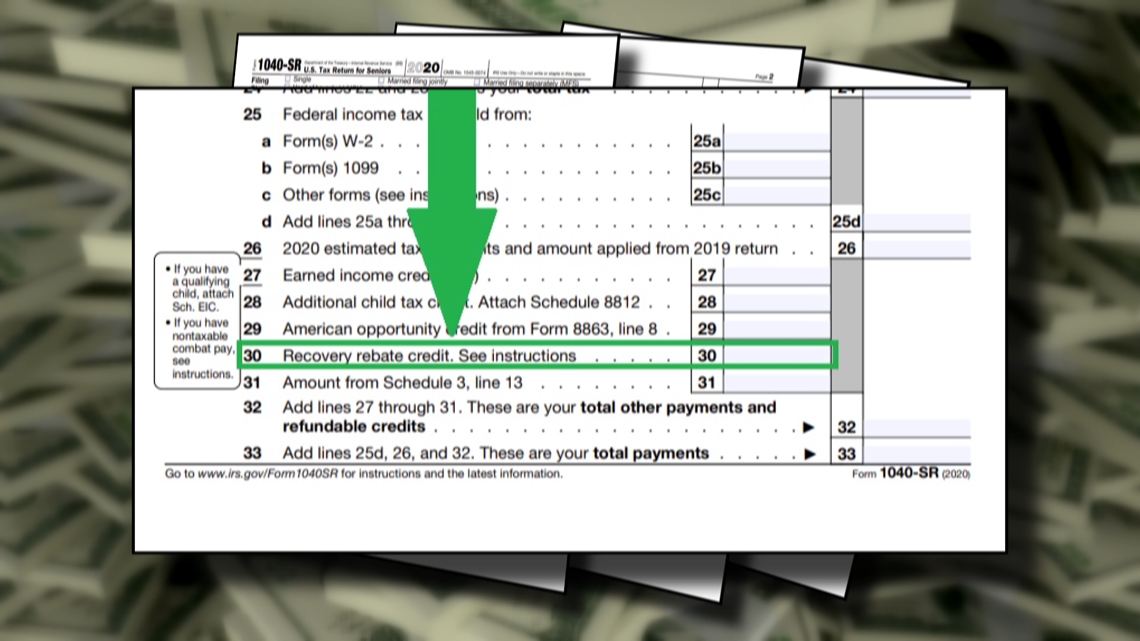

Check Recovery Rebate Credit

Check Recovery Rebate Credit – A Recovery Rebate is an opportunity for taxpayers to receive an amount of tax refund without altering their tax return. The program is provided by the IRS. It’s completely free. However, it is important to know the regulations and rules governing this program before you file. Here are some information … Read more