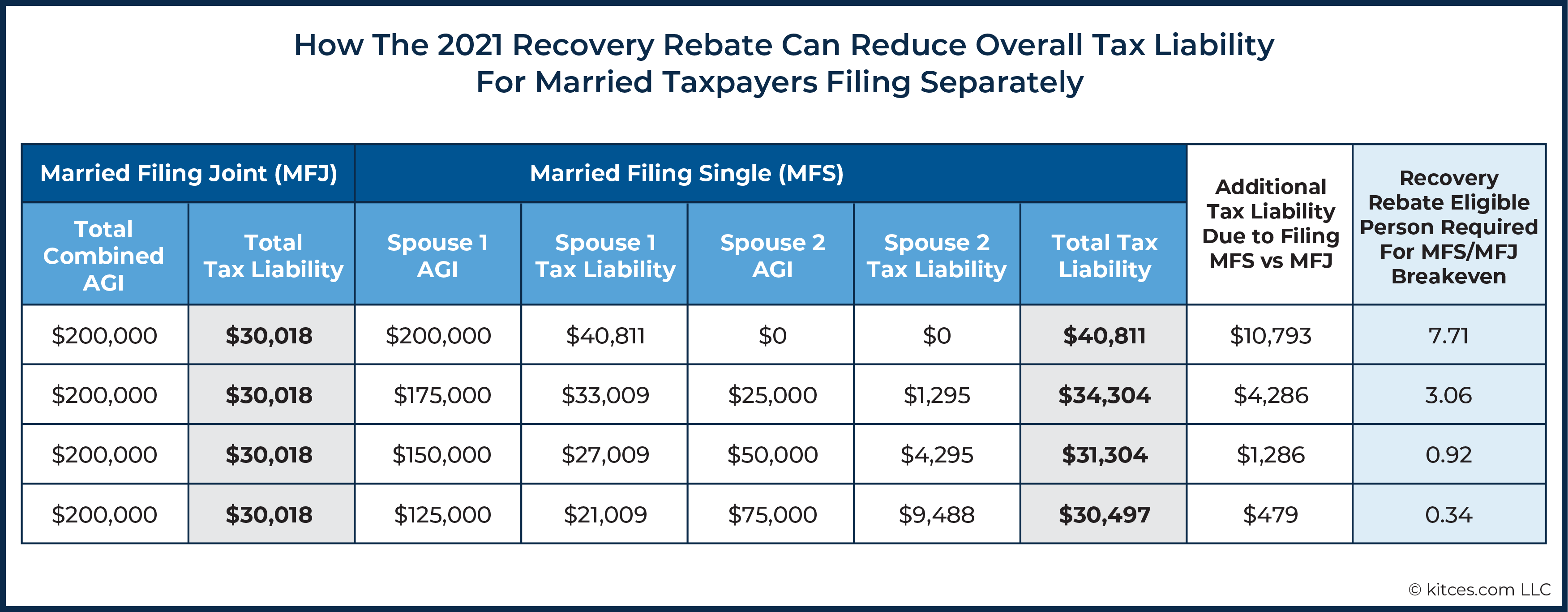

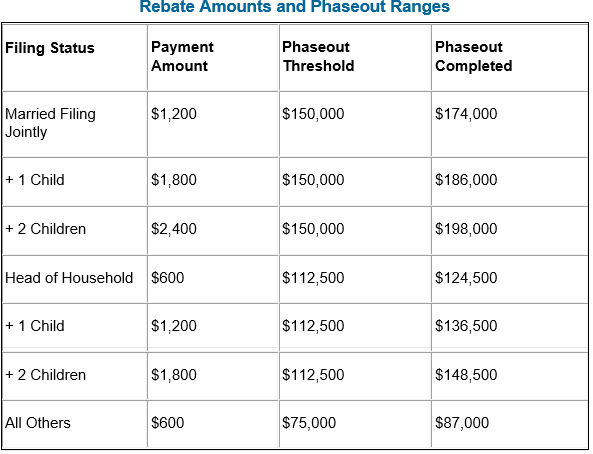

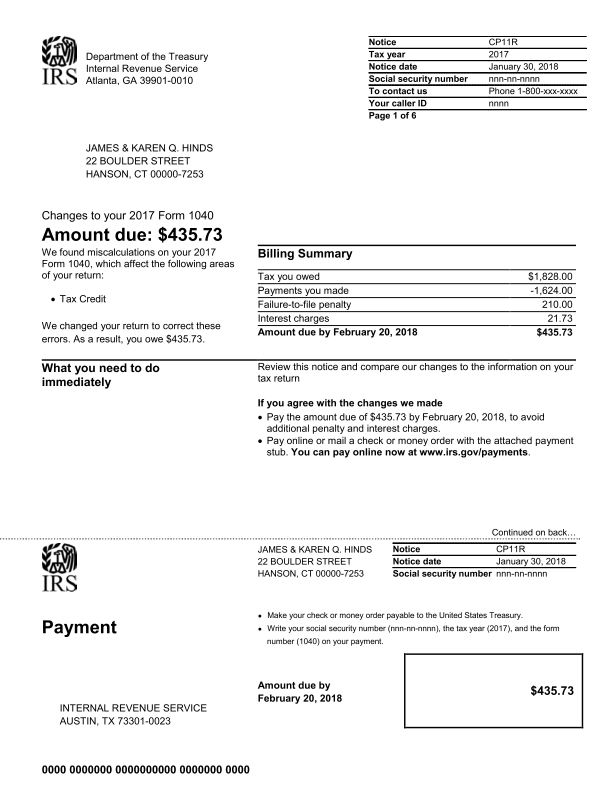

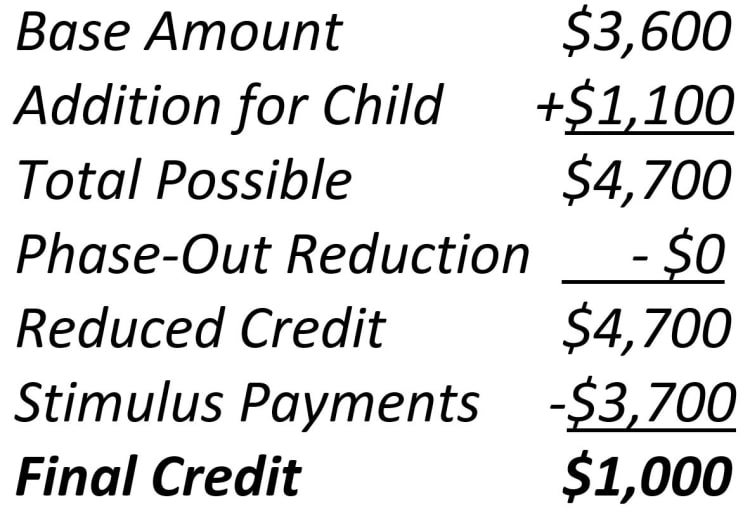

Recovery Rebate Threshold

Recovery Rebate Threshold – The Recovery Rebate gives taxpayers an possibility of receiving a refund on their tax without needing to modify their tax returns. The program is offered by the IRS. However, it is essential to be aware of the rules and regulations regarding this program before you file. Here are some information about … Read more