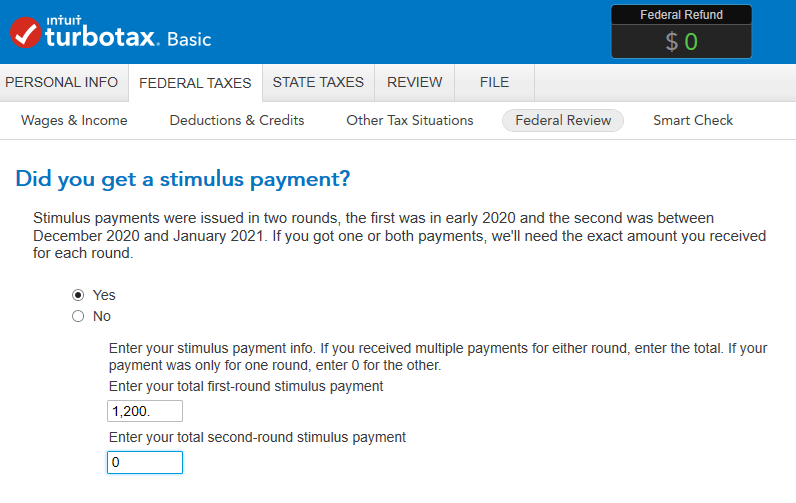

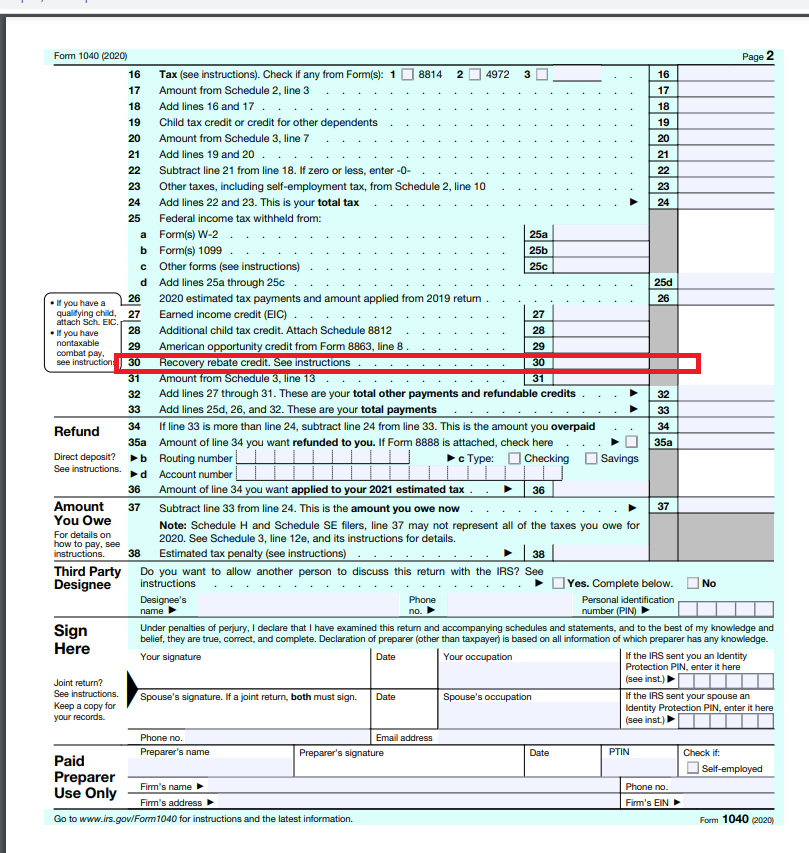

Recovery Rebate Credit Included In Tax Refund

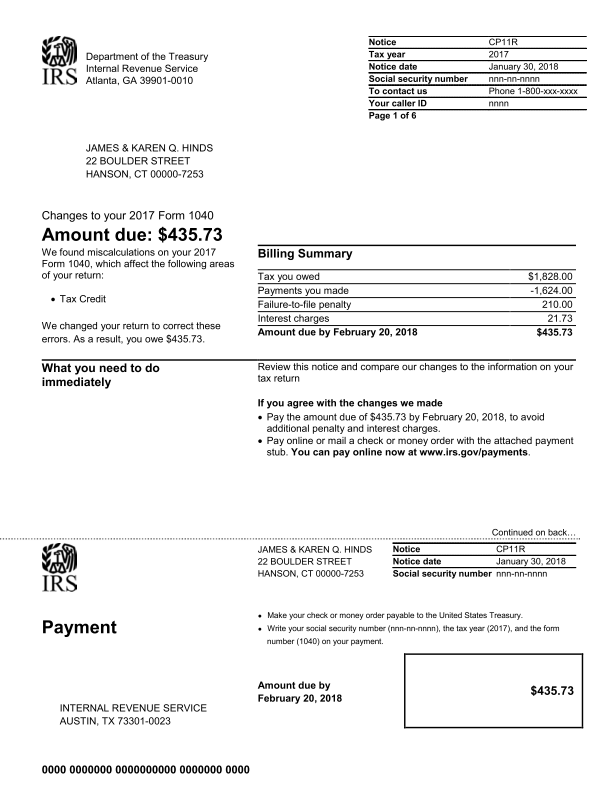

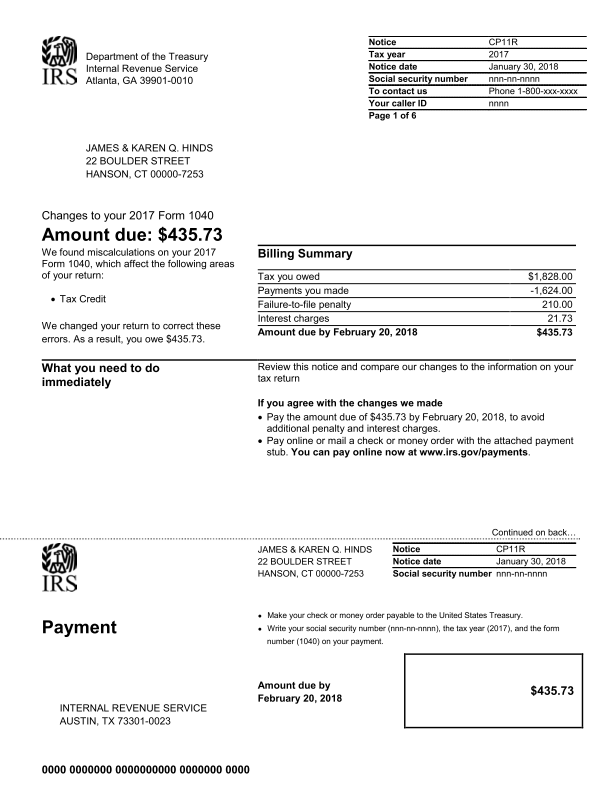

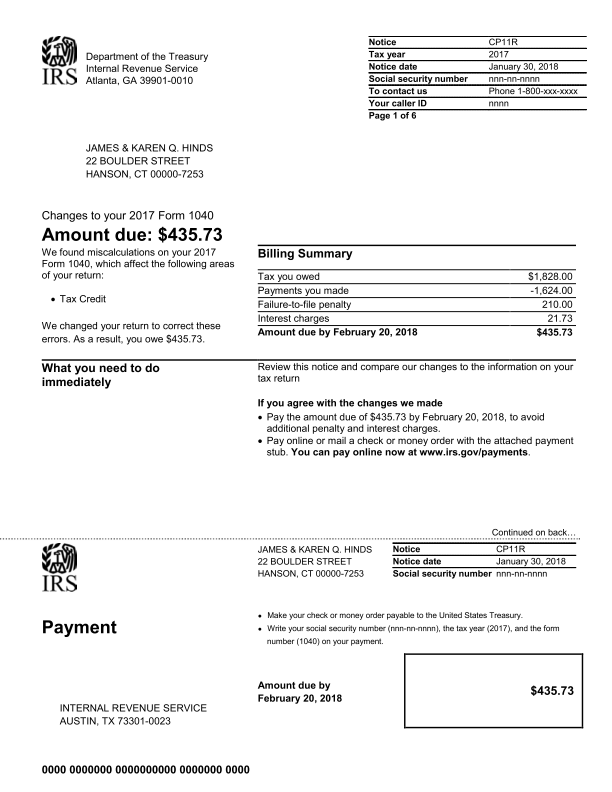

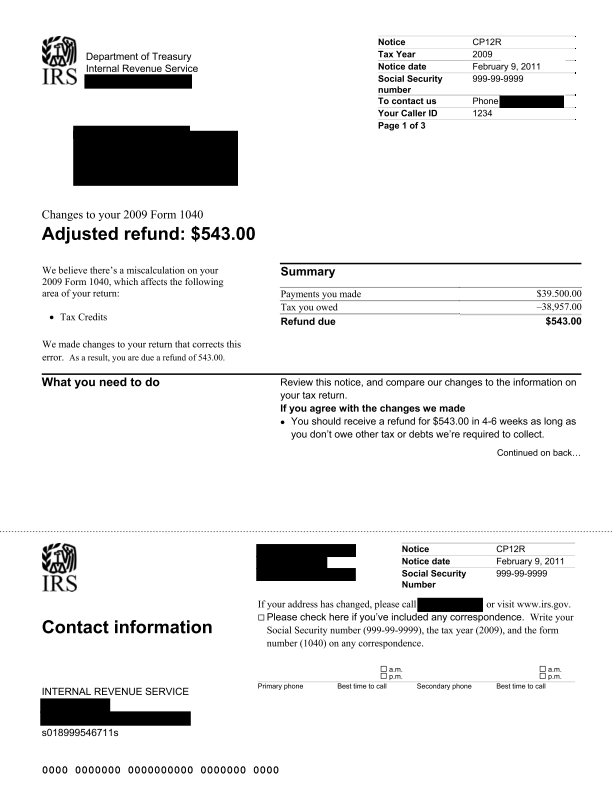

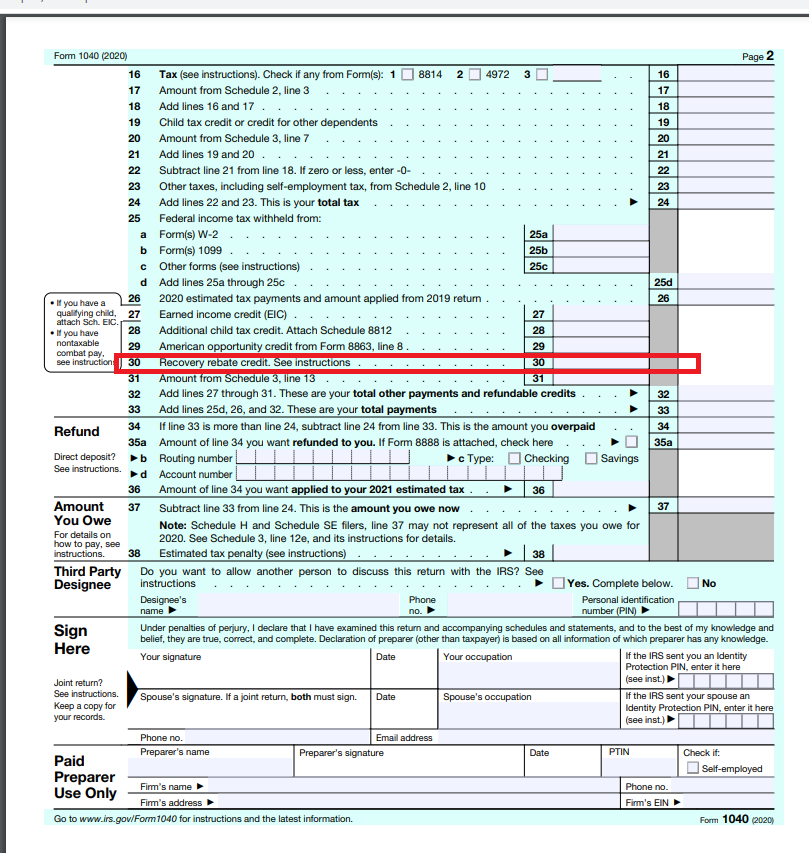

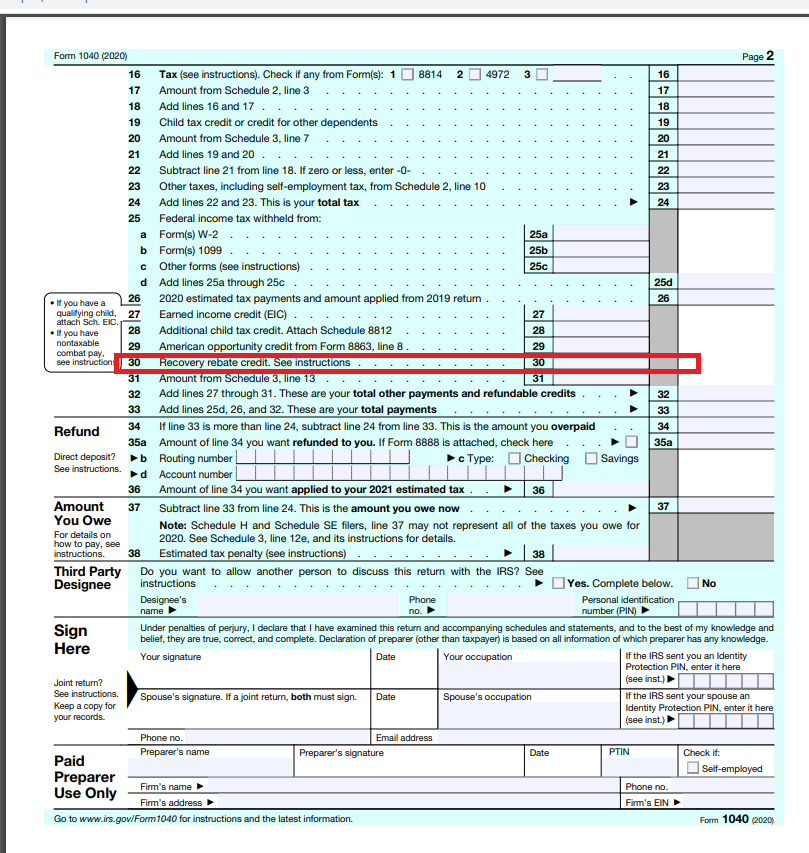

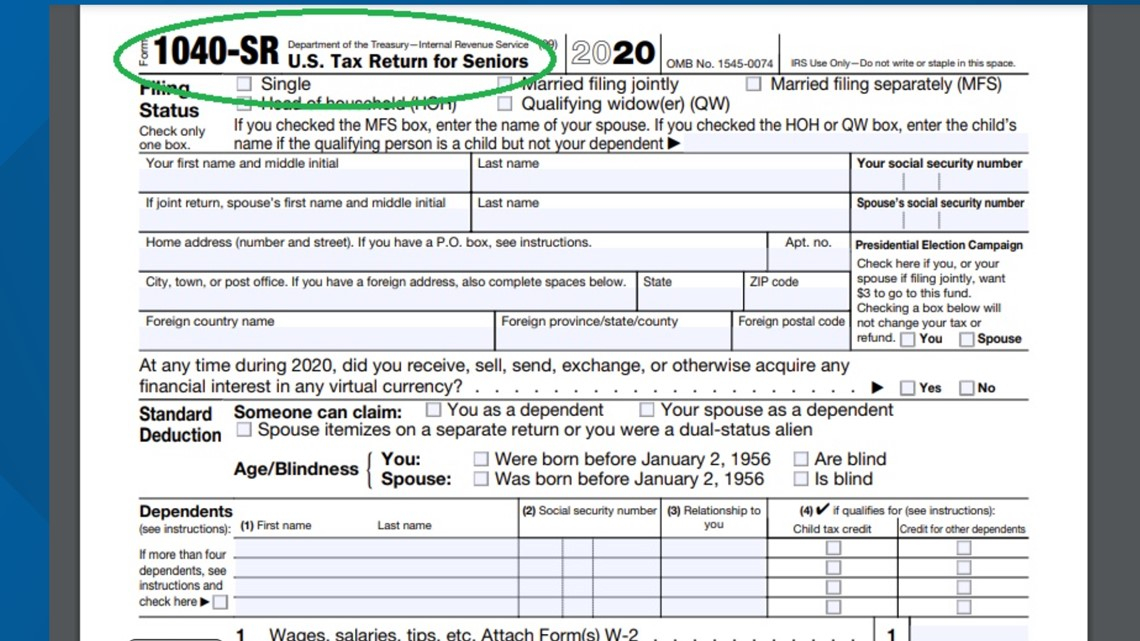

Recovery Rebate Credit Included In Tax Refund – A Recovery Rebate gives taxpayers an chance to get a refund on their tax without the need to alter their tax returns. The IRS administers this program and it’s cost-free. Prior to filing however, it’s crucial to be acquainted of the regulations and guidelines of this program. … Read more