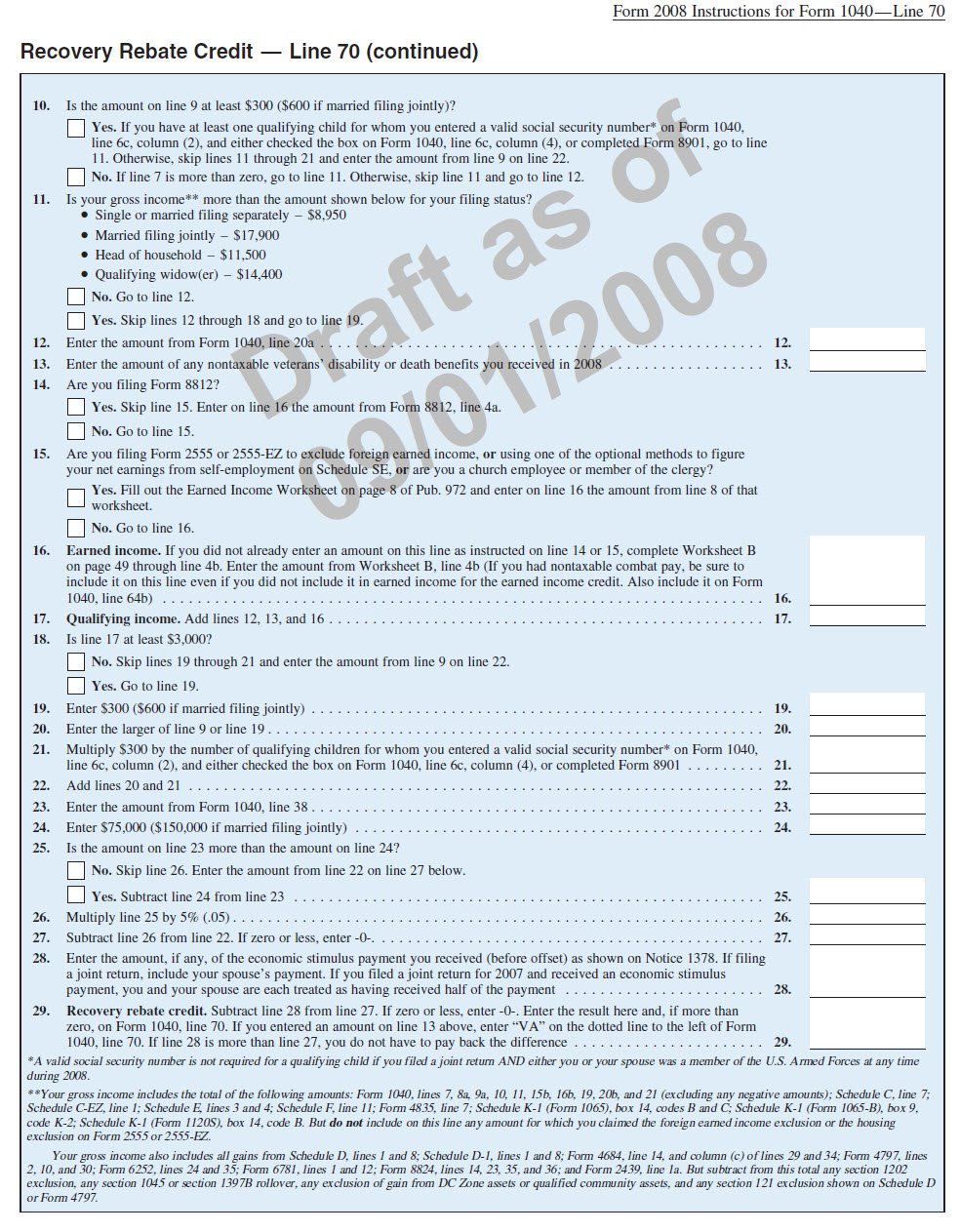

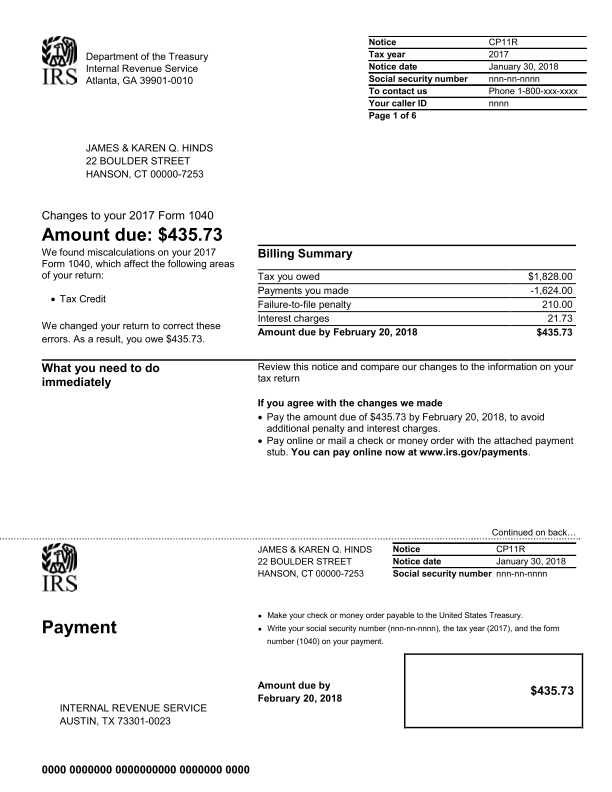

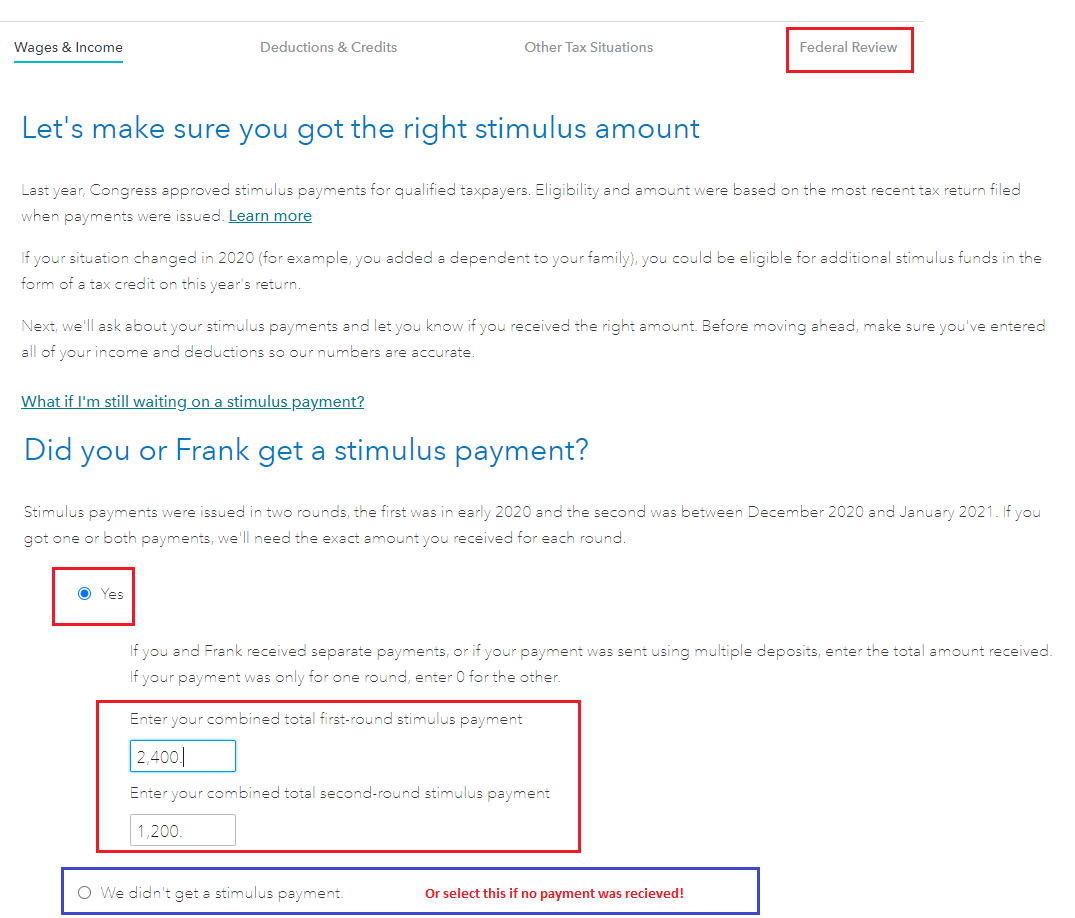

Recovery Rebate Credit Irs Letter

Recovery Rebate Credit Irs Letter – The Recovery Rebate offers taxpayers the opportunity to receive the tax return they deserve without having their tax returns modified. The IRS manages this program, and it’s completely free. It is important to understand the rules before you apply. Here are some information regarding this program. Recovery Rebate refunds … Read more