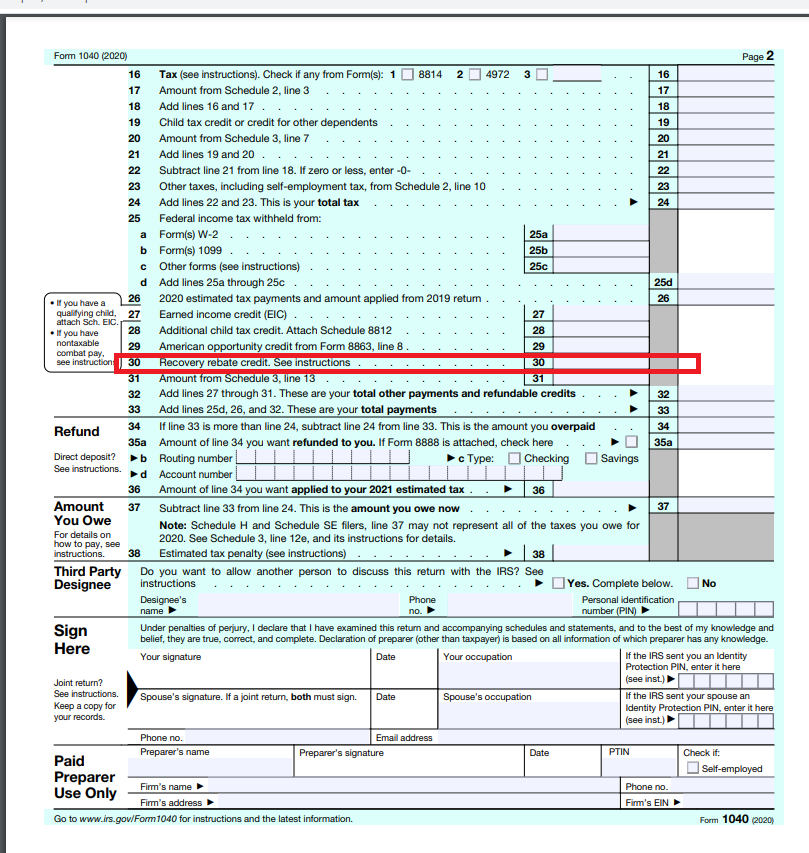

Recovery Rebate Filing

Recovery Rebate Filing – The Recovery Rebate gives taxpayers an chance to get the tax deduction they earned without having to adjust the tax returns. This program is administered by the IRS and is a completely free service. When you are filing however, it’s important that you are familiar with the rules and regulations of … Read more