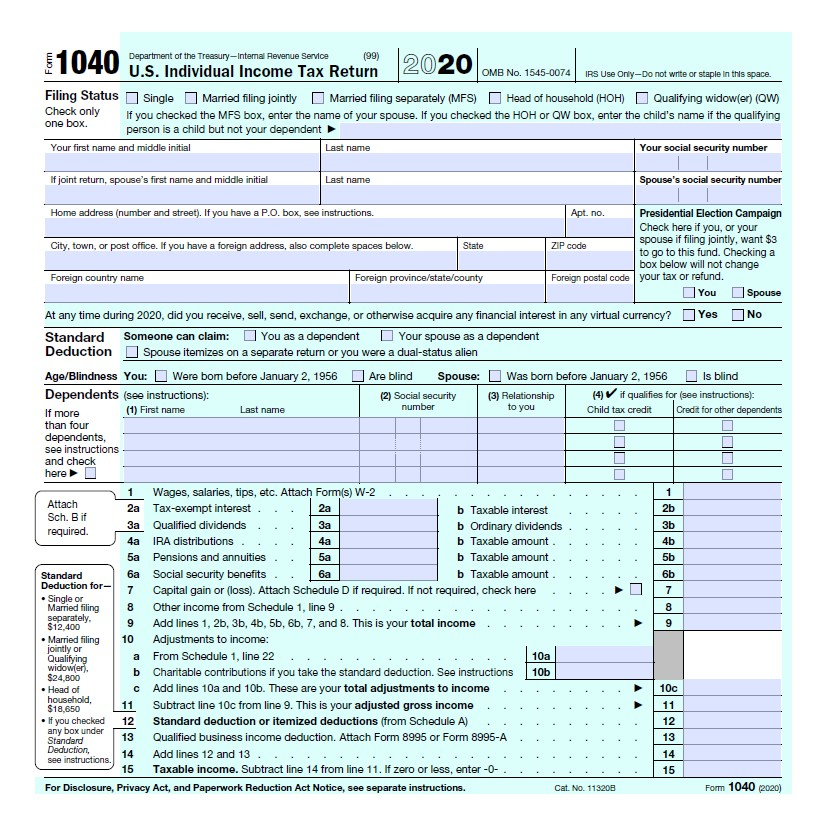

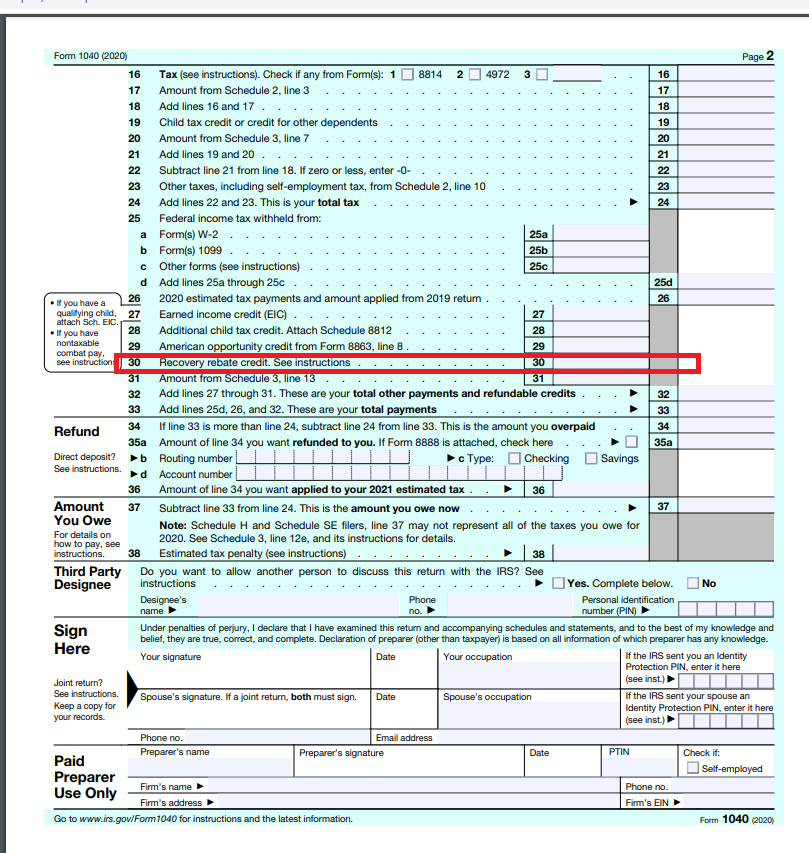

Recovery Rebate Credit Rrc

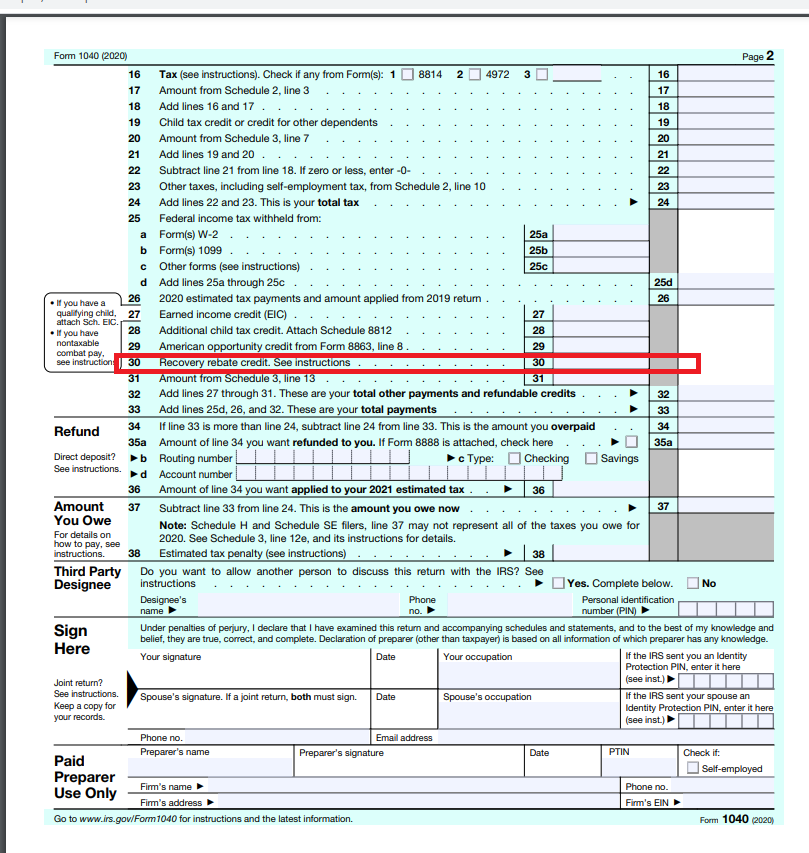

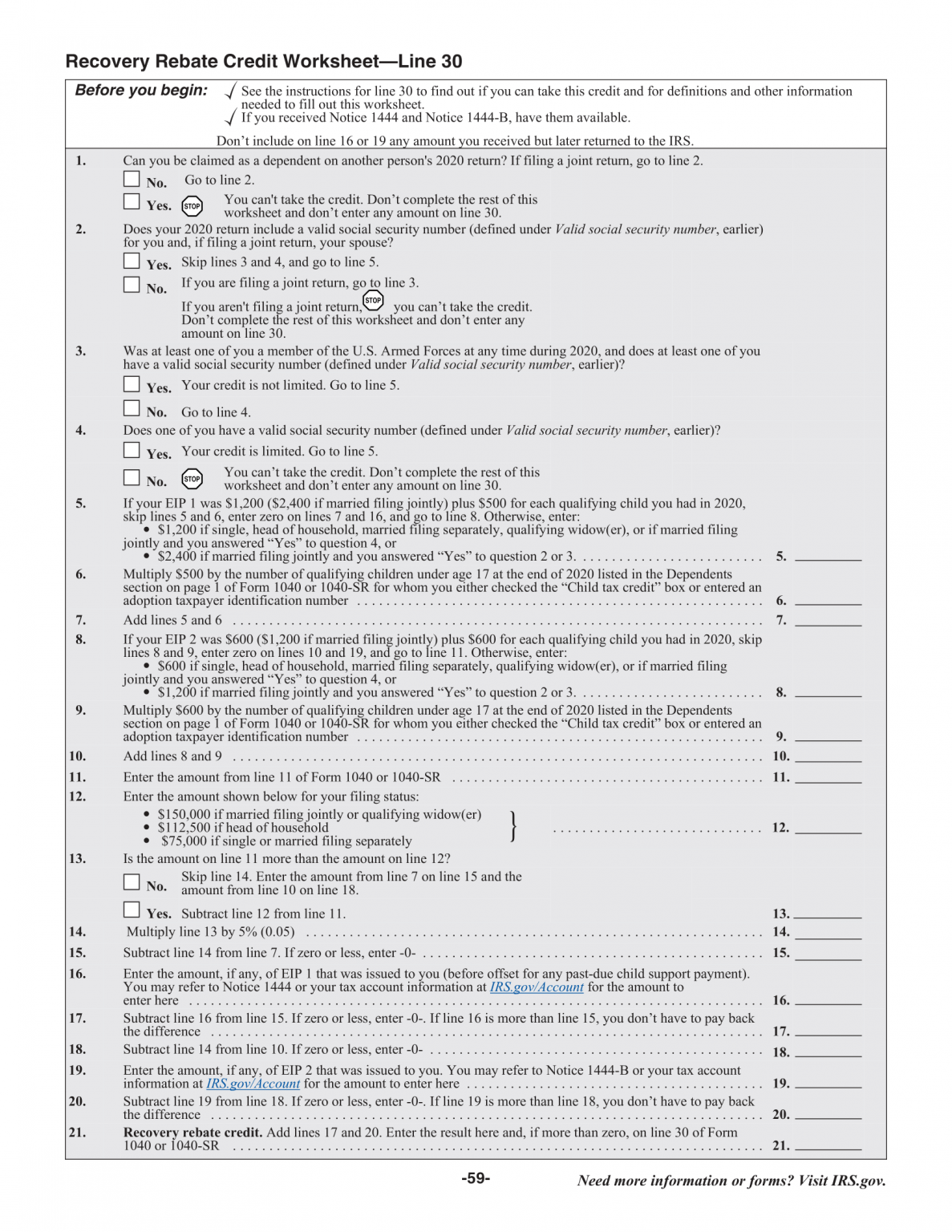

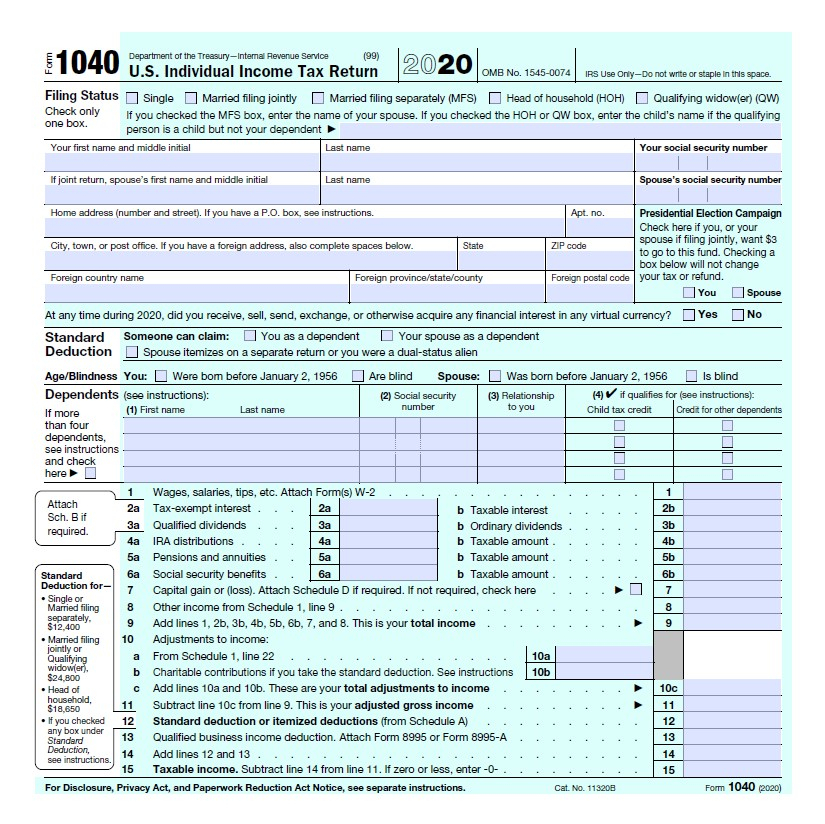

Recovery Rebate Credit Rrc – The Recovery Rebate is an opportunity for taxpayers to receive a tax refund without adjusting their tax returns. The IRS runs this program and it’s free. It is important to understand the rules and regulations of the program prior to submitting. Here are some details regarding this program. Recovery Rebate … Read more