Recovery Rebate Credit Refund Delay

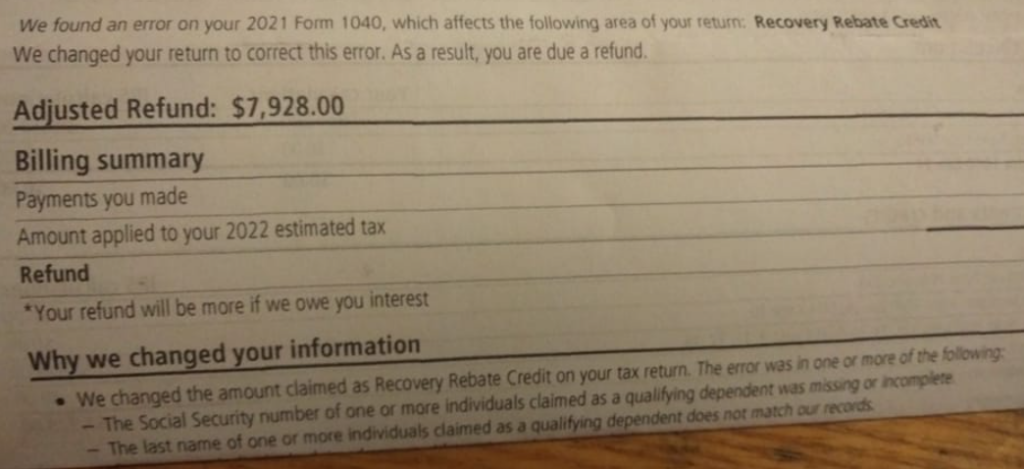

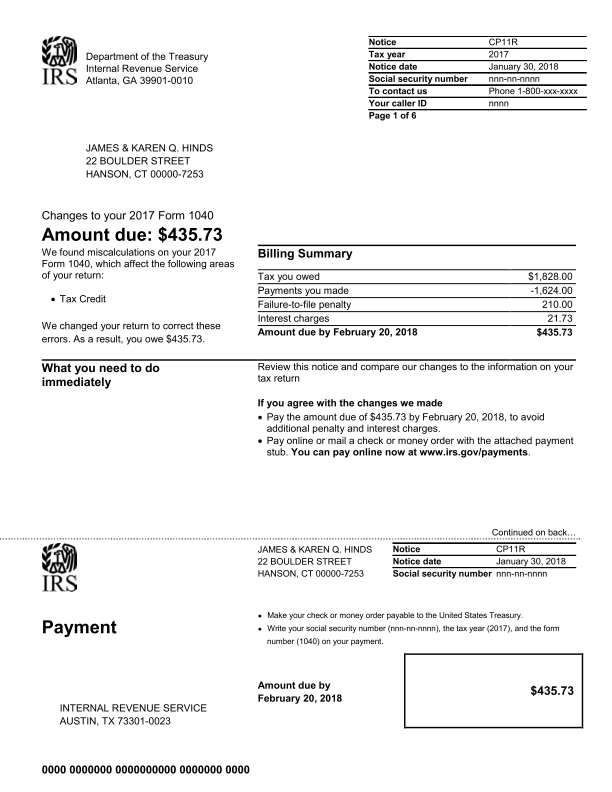

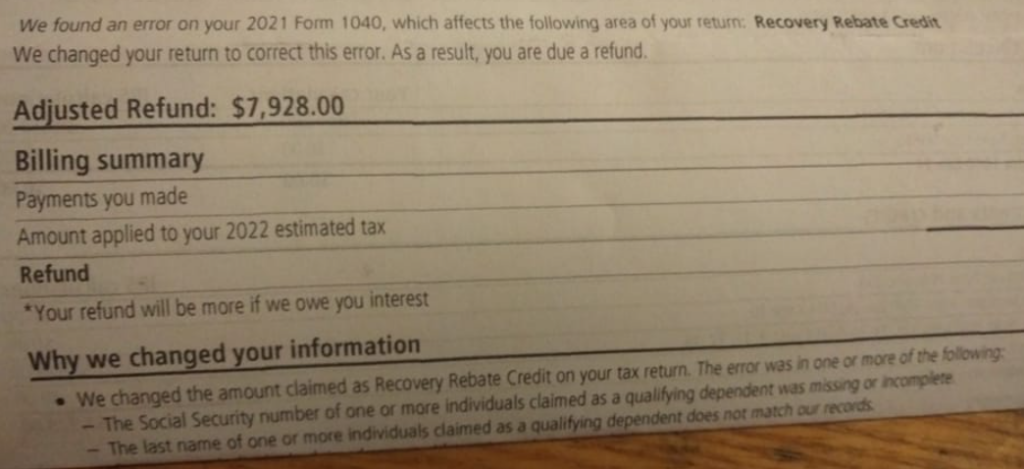

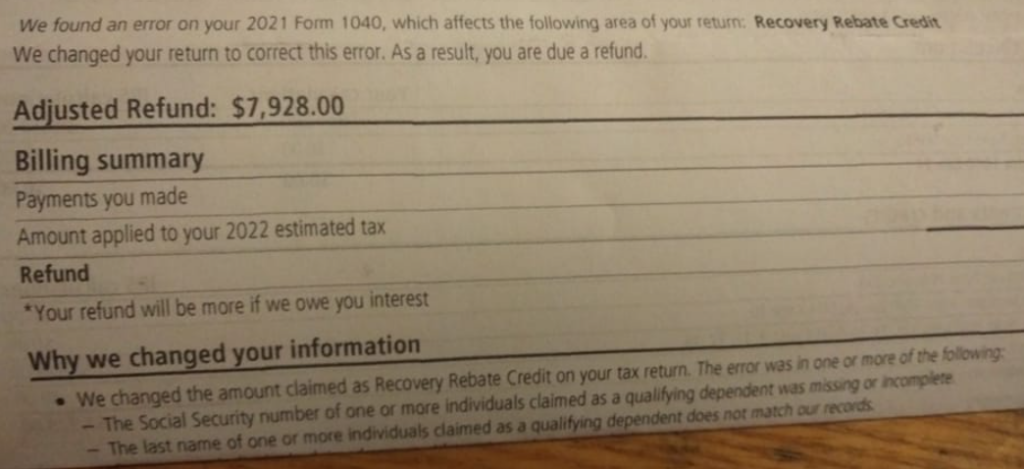

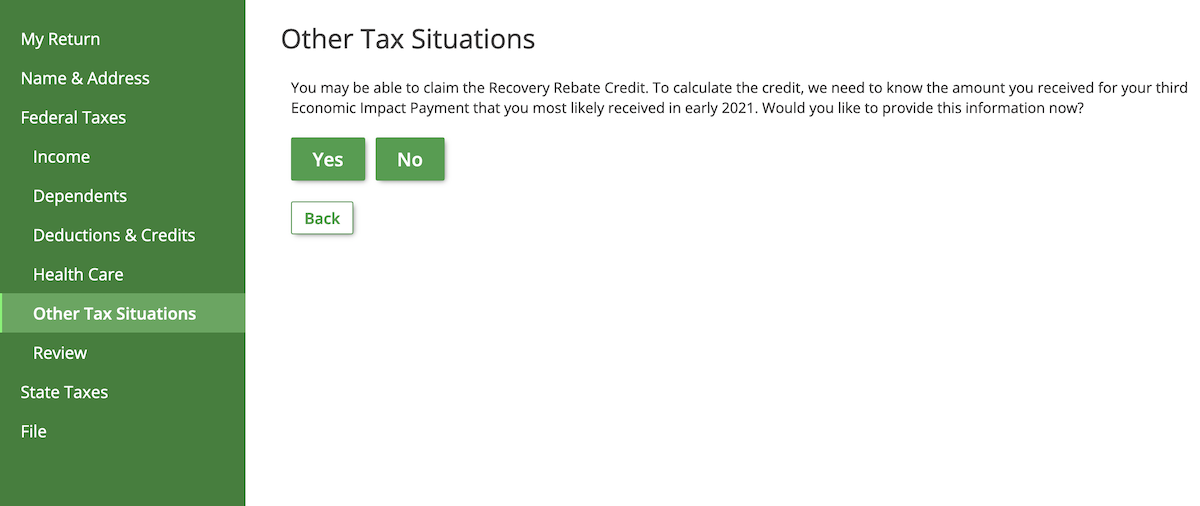

Recovery Rebate Credit Refund Delay – The Recovery Rebate offers taxpayers the chance to get a tax return without having their tax returns modified. The program is provided by the IRS. It’s cost-free. It is, however, essential to be aware of the regulations and rules regarding the program prior to filing. Here are some information … Read more