Recovery Rebate Credit On 2023 Return

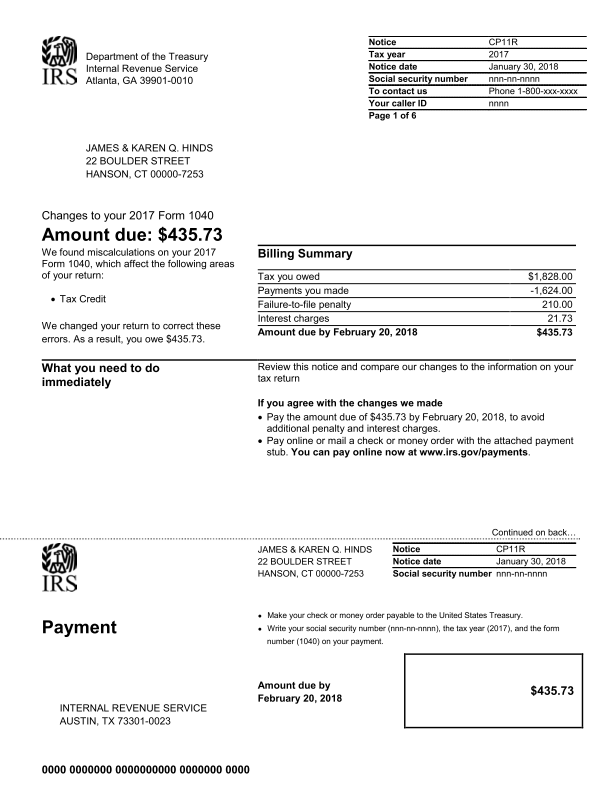

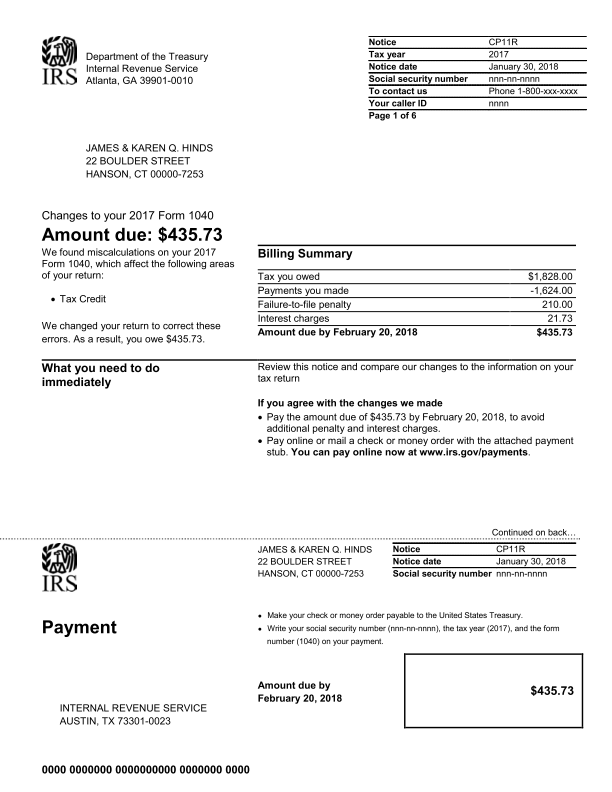

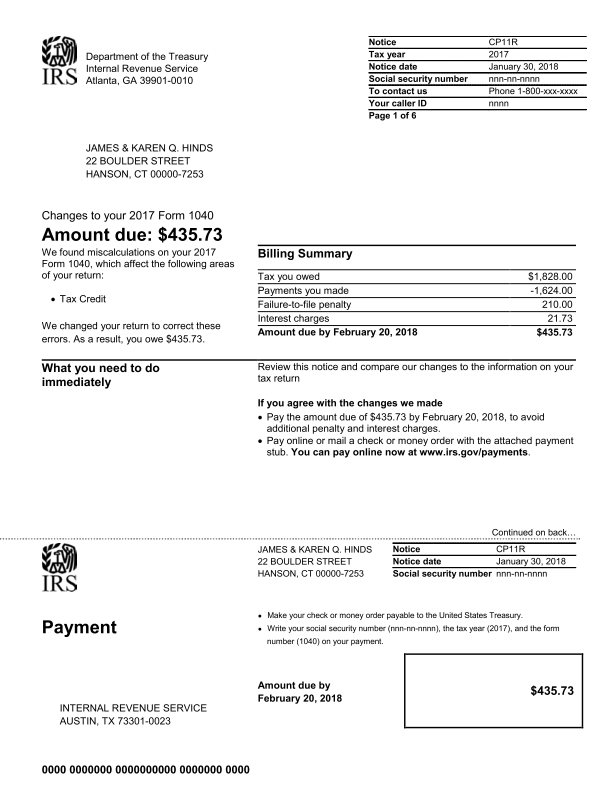

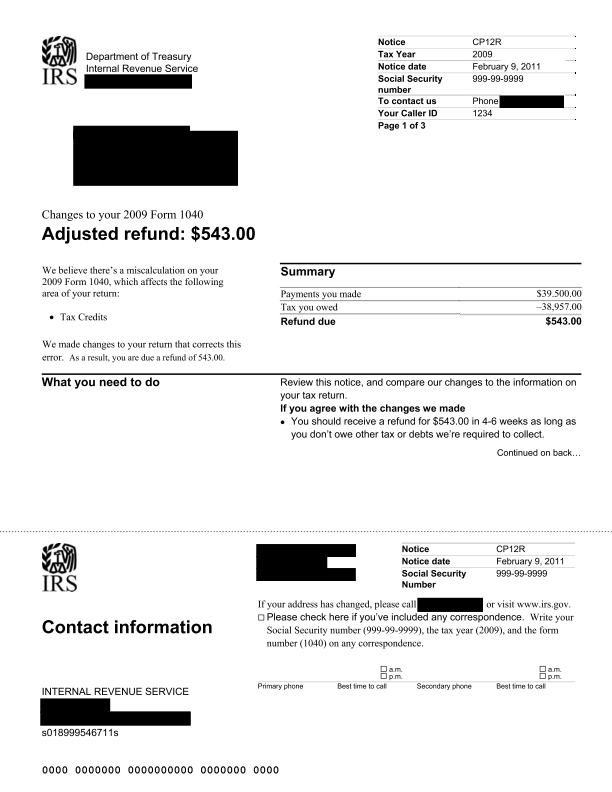

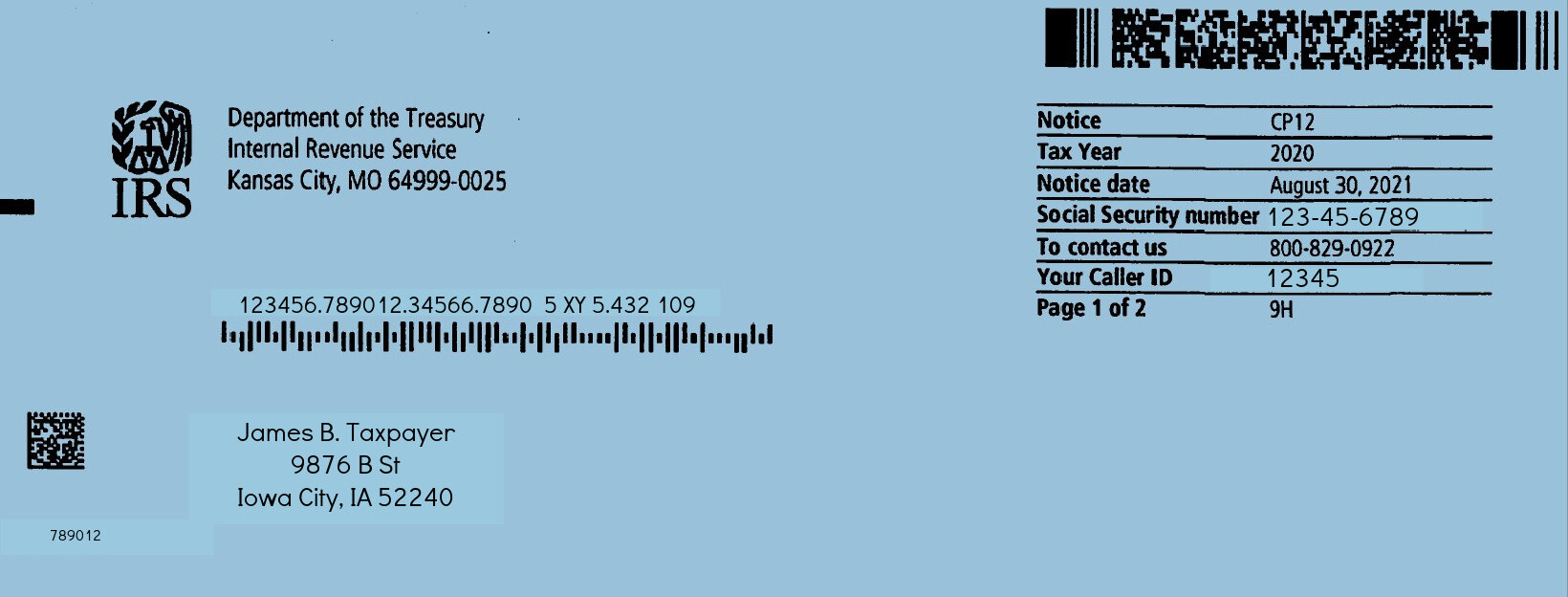

Recovery Rebate Credit On 2023 Return – A Recovery Rebate gives taxpayers an opportunity to receive an income tax refund without the need to alter their tax returns. The IRS runs this program and it’s completely absolutely free. It is essential to familiarize yourself with the guidelines before applying. These are only a few facts … Read more