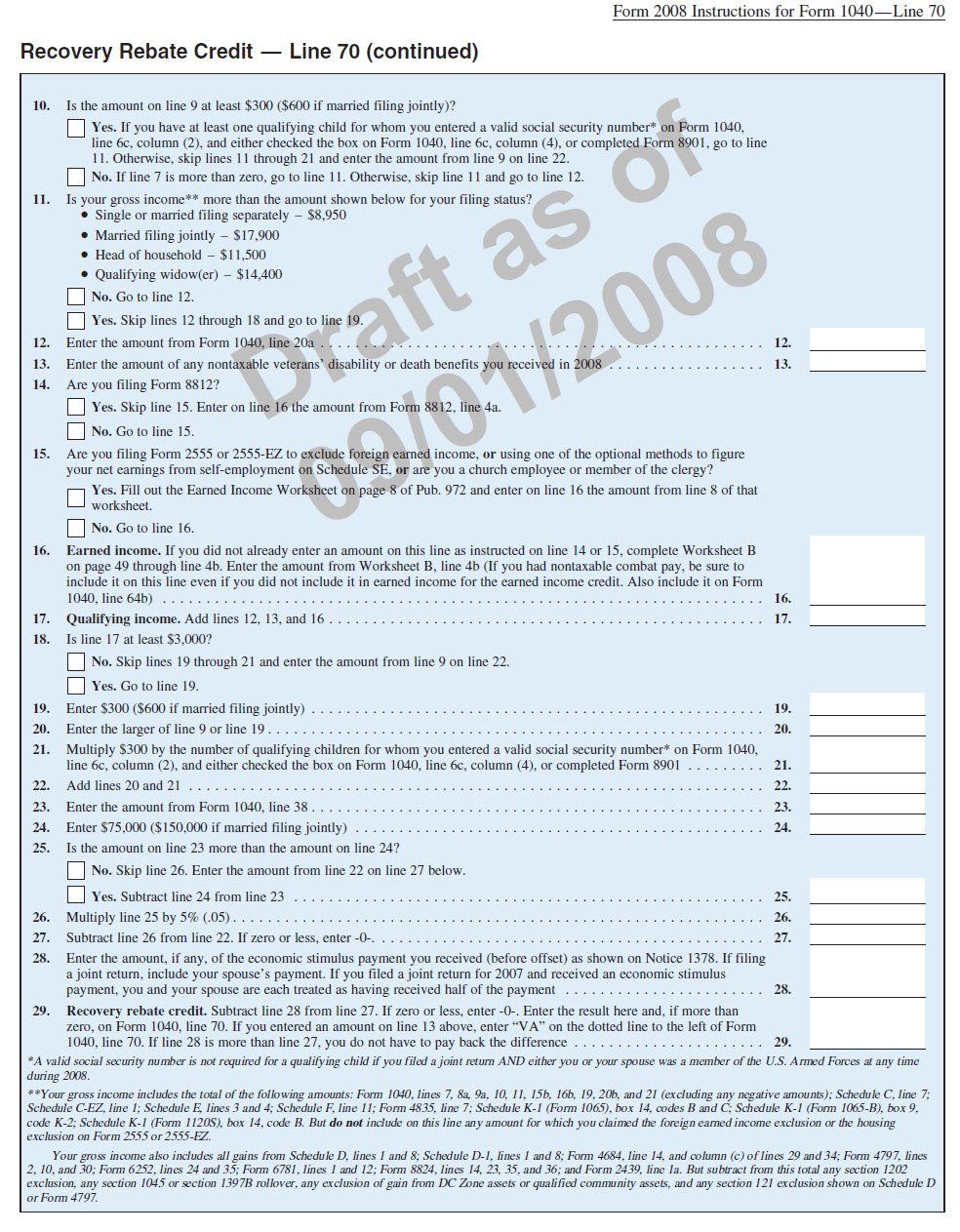

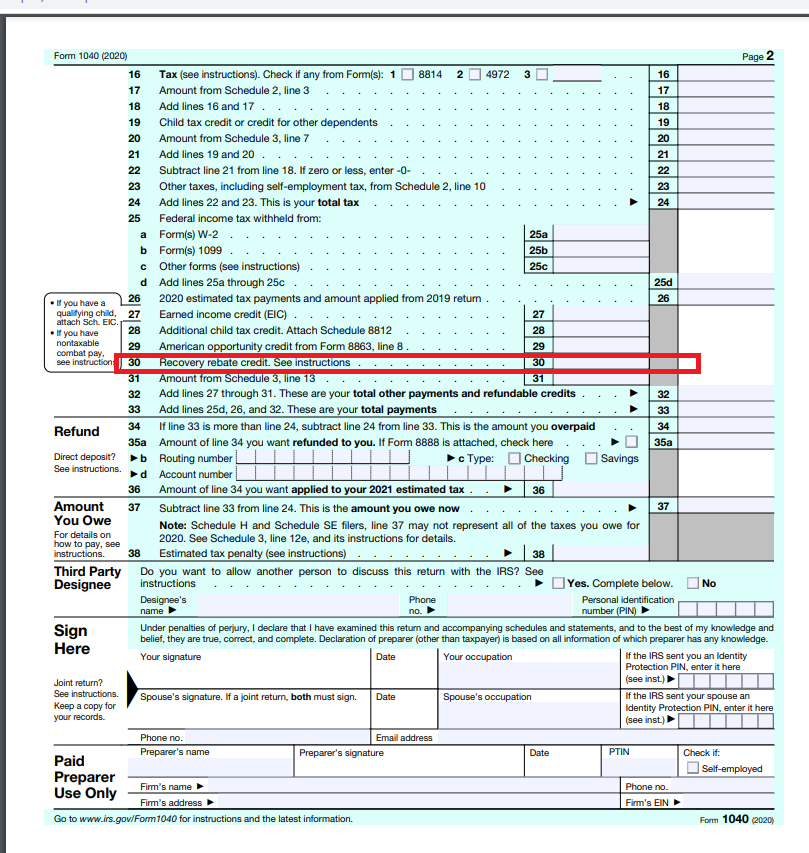

Irs Form 1040 Recovery Rebate Credit Instructions

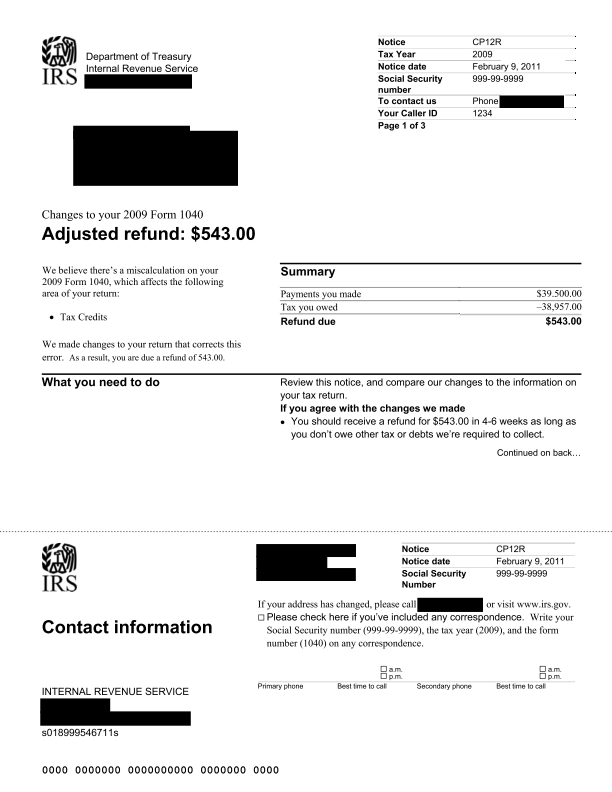

Irs Form 1040 Recovery Rebate Credit Instructions – The Recovery Rebate allows taxpayers to get a tax refund without having to adjust their tax returns. The IRS manages the program and it is a completely free service. It is, however, important to know the regulations and rules governing this program before you file. Here are … Read more