Irs Taking Recovery Rebate Credit

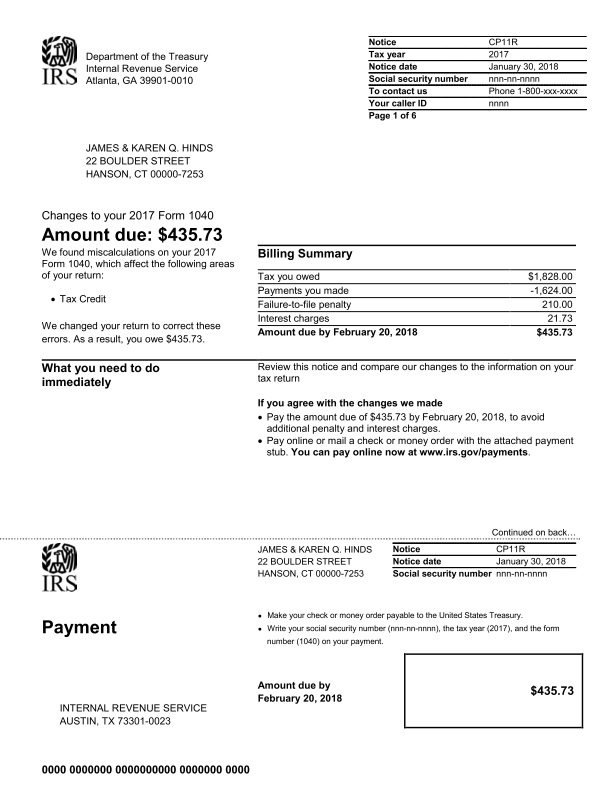

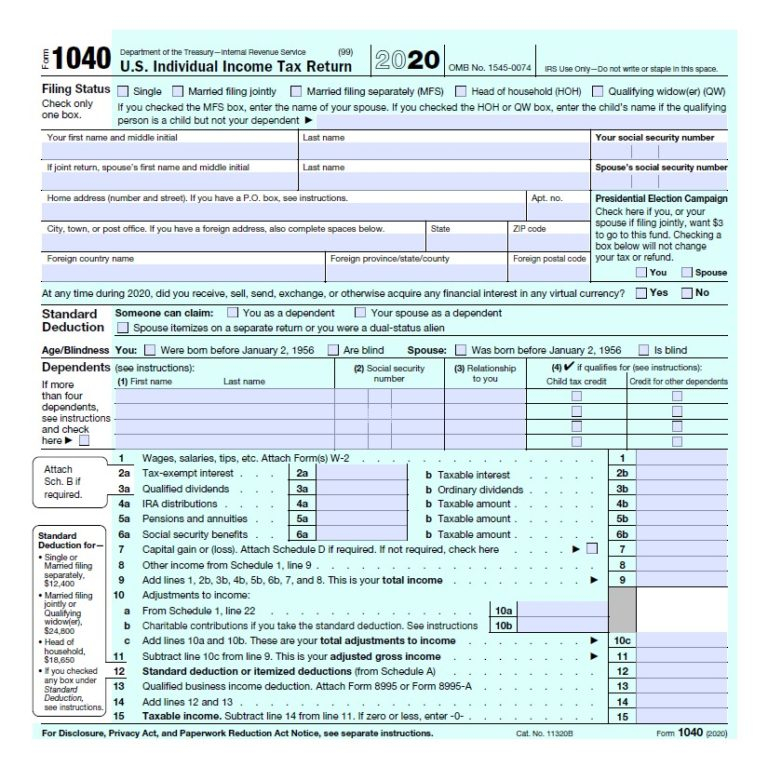

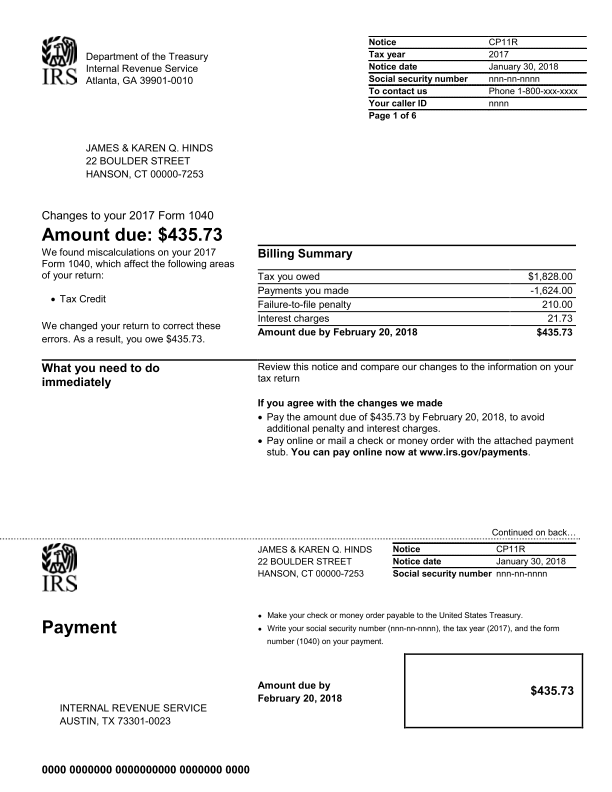

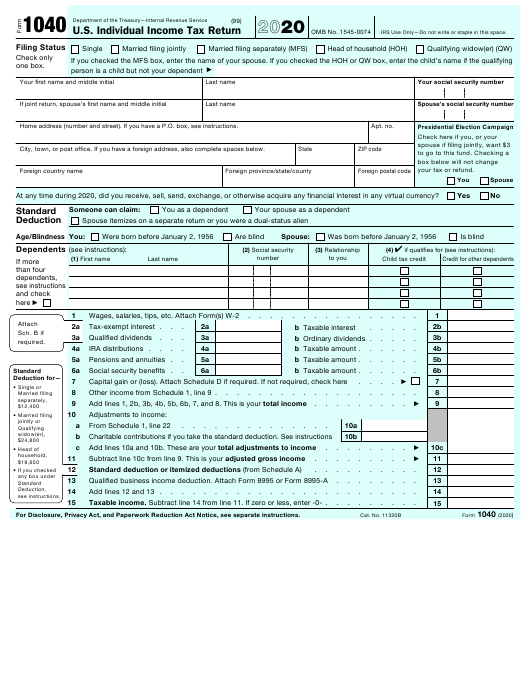

Irs Taking Recovery Rebate Credit – The Recovery Rebate is an opportunity for taxpayers to receive a tax refund without adjusting their tax returns. This program is run by the IRS and is a no-cost service. When you are filing, however, it is crucial to be acquainted with the rules and regulations of the program. … Read more