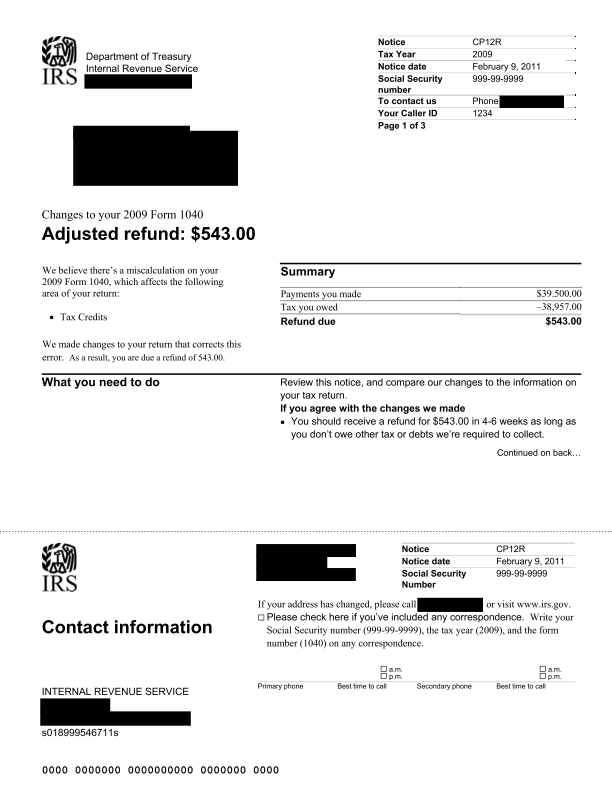

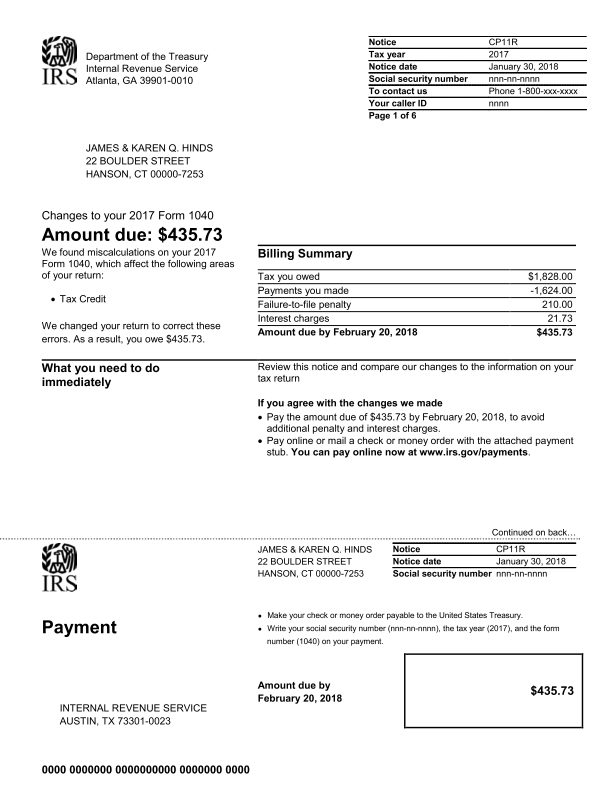

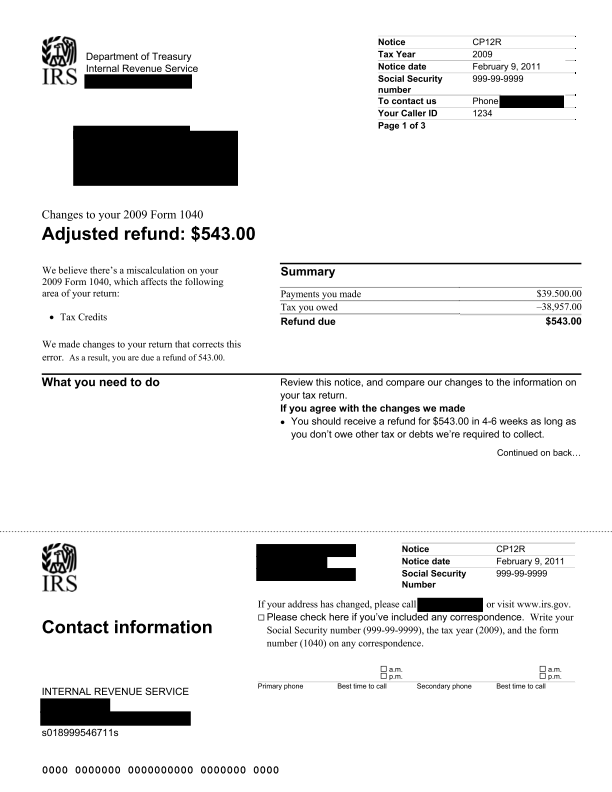

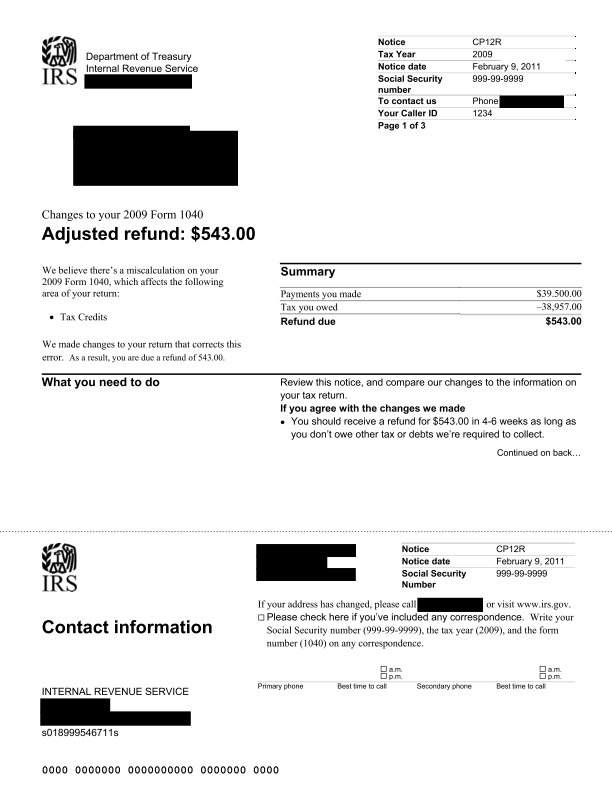

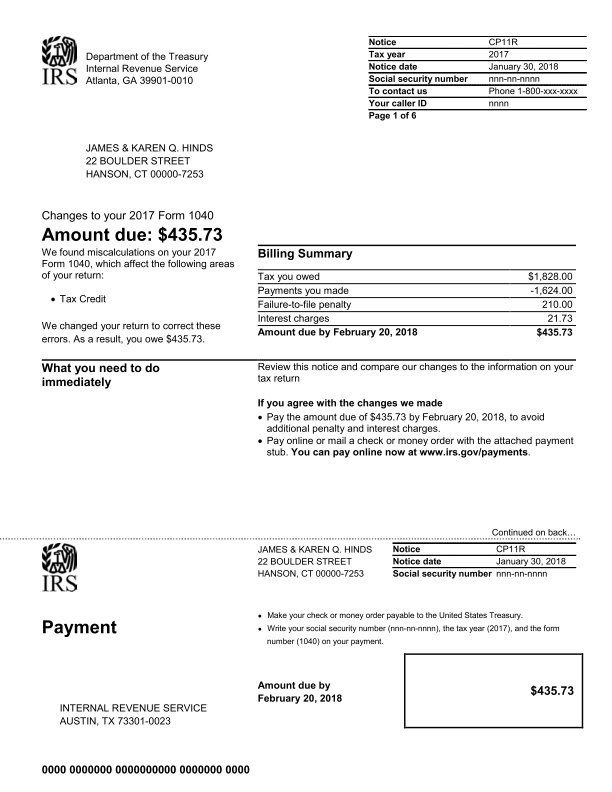

Contact Irs Recovery Rebate Credit

Contact Irs Recovery Rebate Credit – Taxpayers can get a tax rebate through the Recovery Rebate program. This allows them to get a refund on taxes, without the need to amend their tax returns. The IRS manages this program, and it’s cost-free. It is essential to familiarize yourself with the rules before you apply. These … Read more