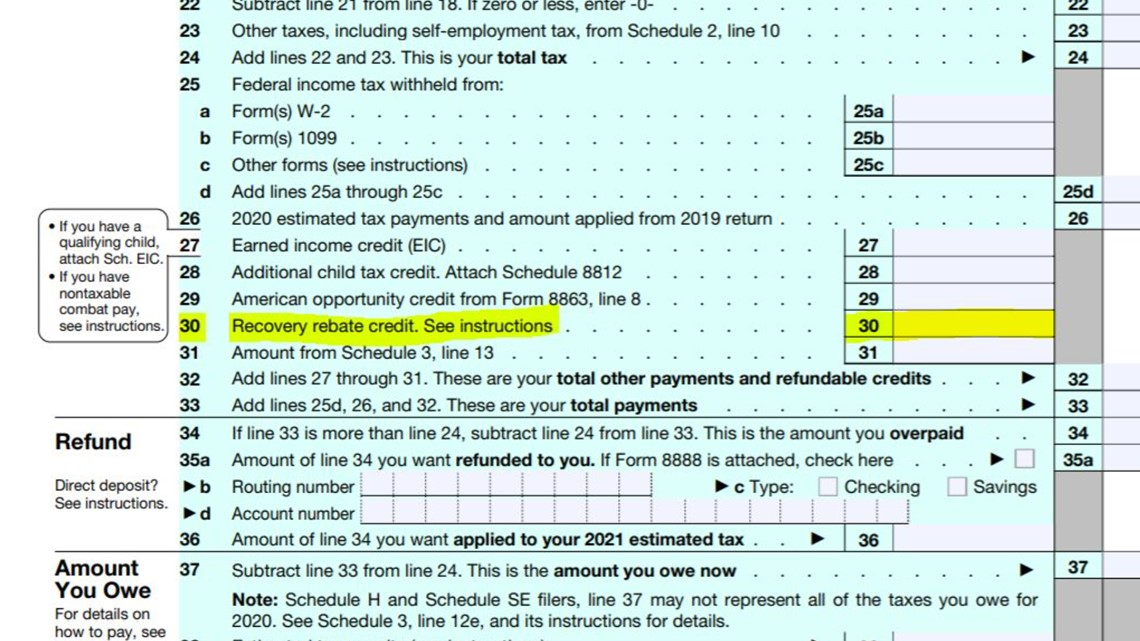

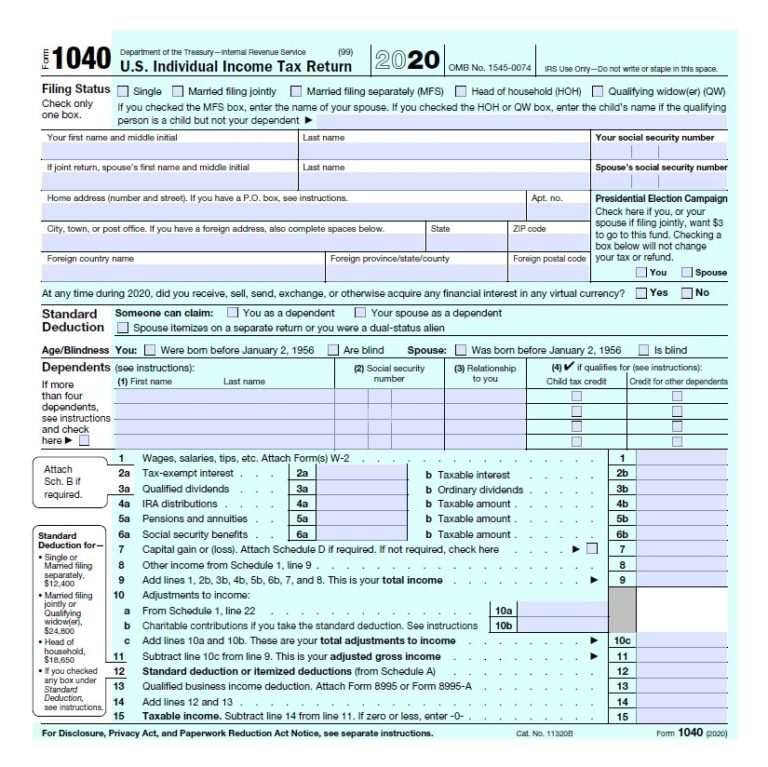

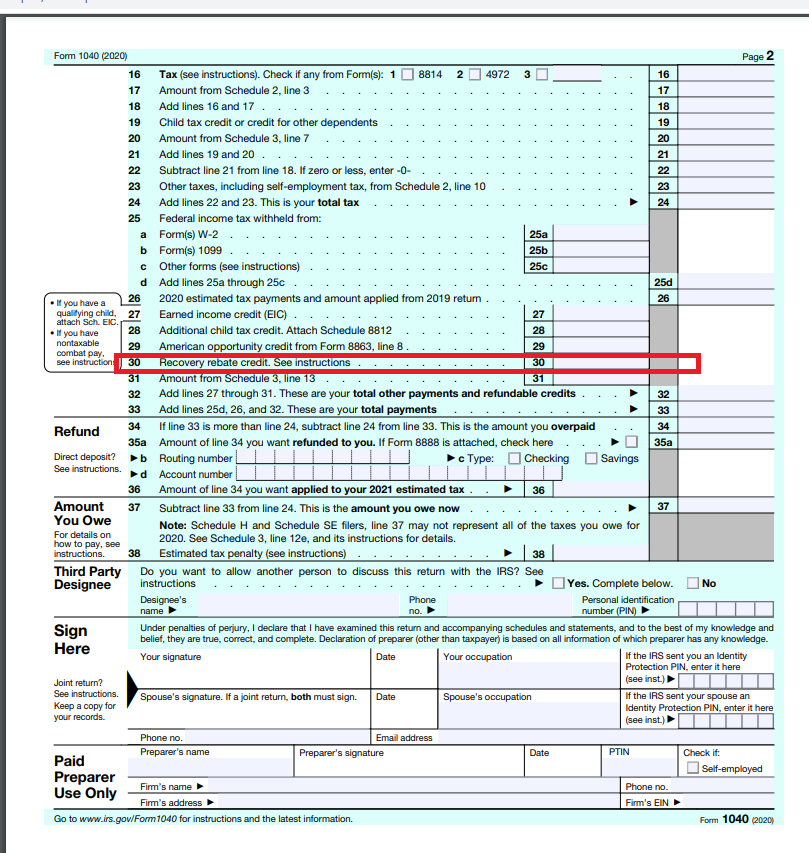

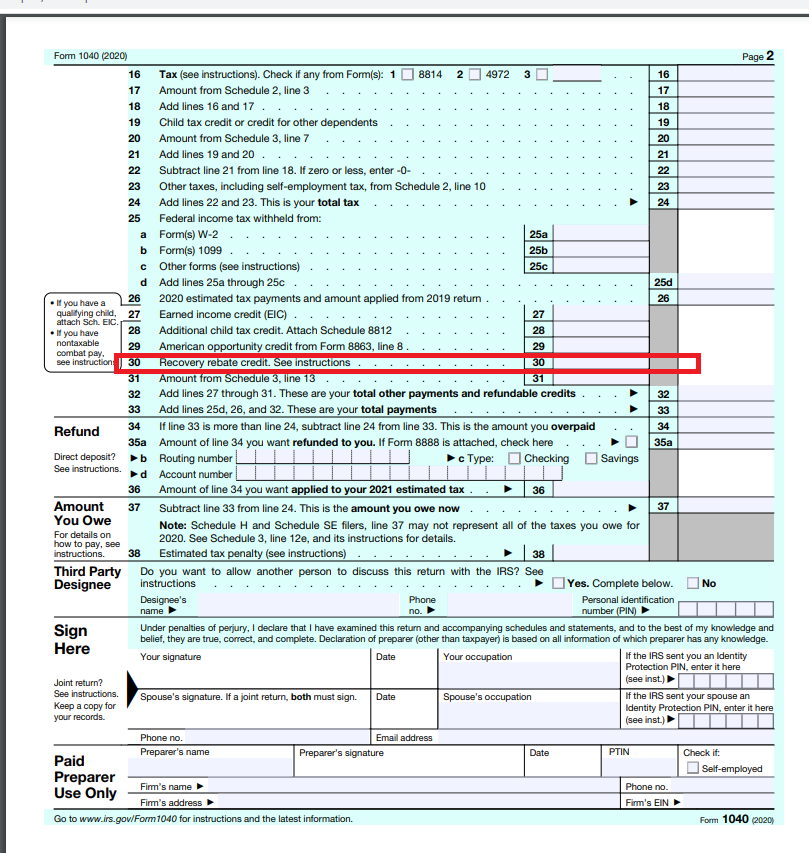

600 Recovery Rebate Credit

600 Recovery Rebate Credit – A Recovery Rebate is an opportunity taxpayers to claim an amount of tax refund without altering their tax return. The IRS manages this program, and it’s cost-free. It is nevertheless important to know the regulations and rules for this program before you file. Here are some details regarding this program. … Read more