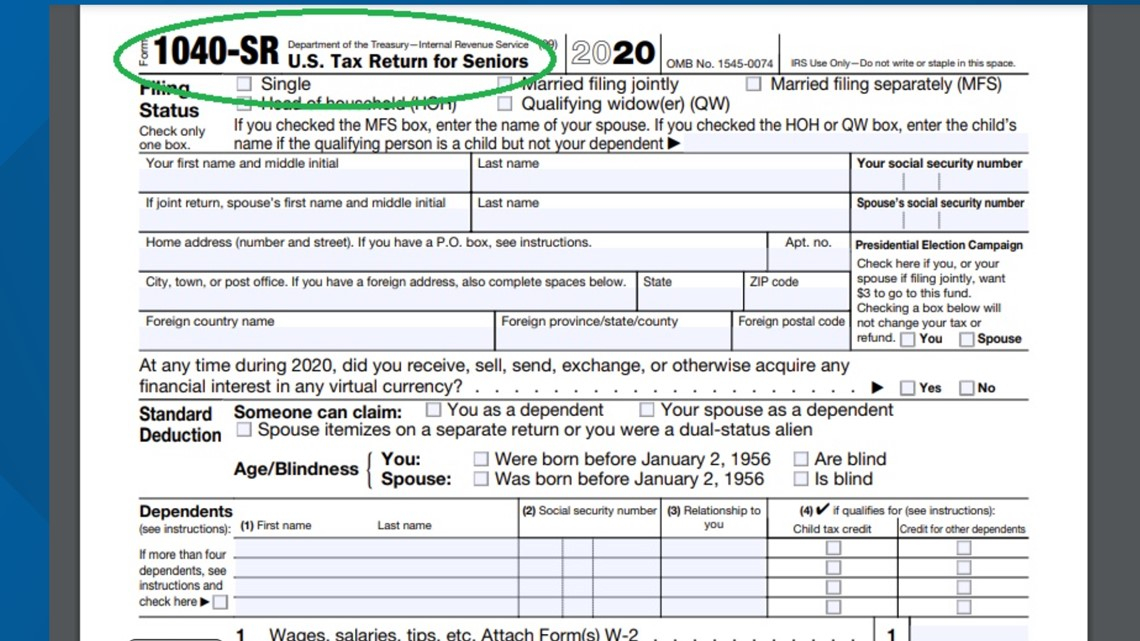

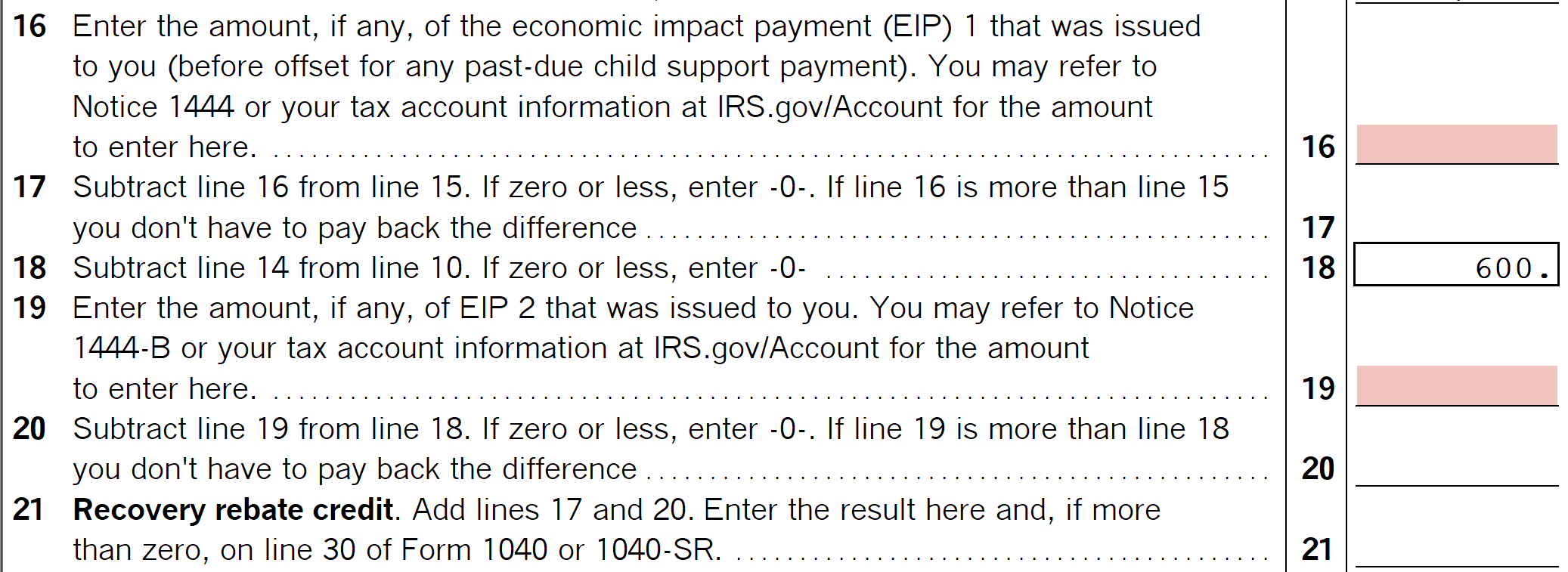

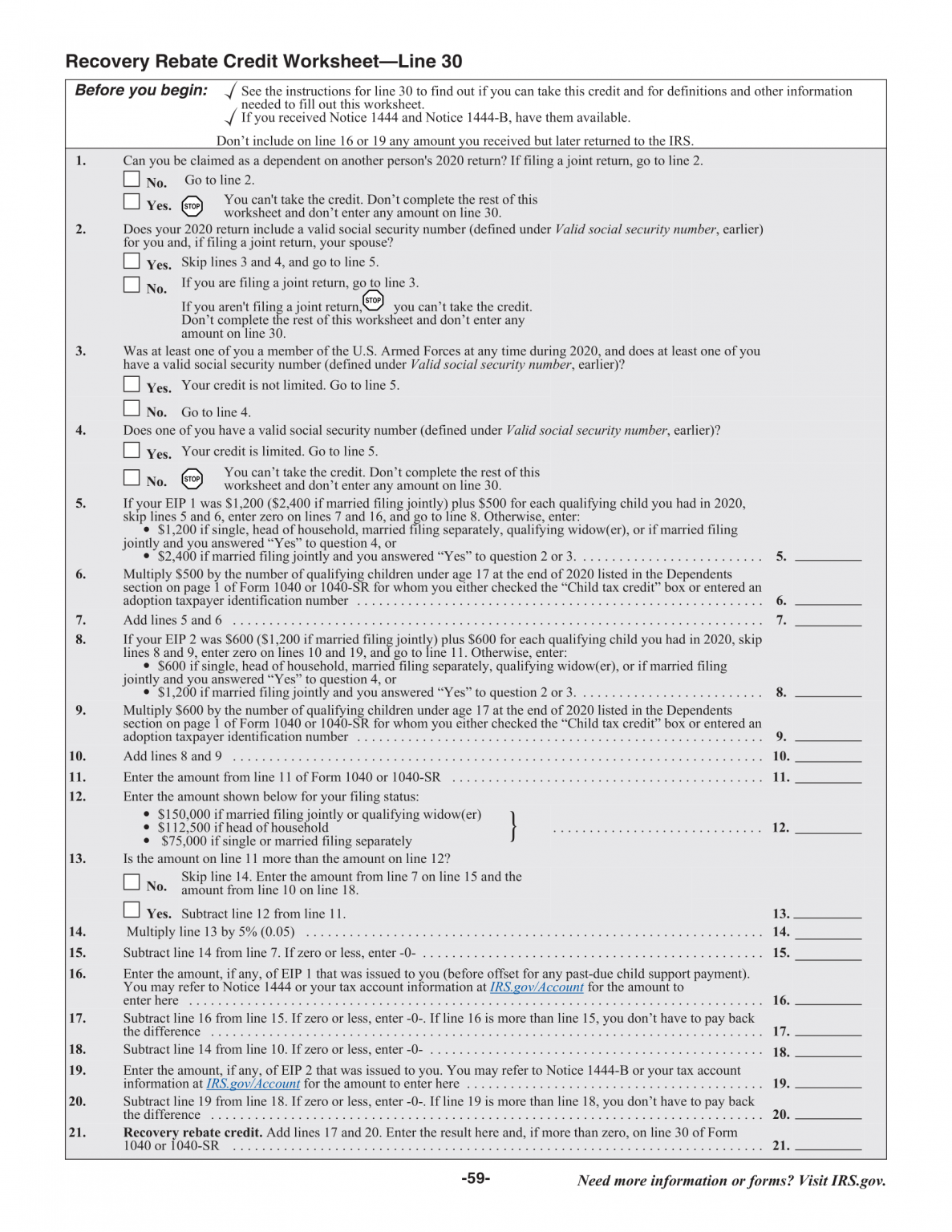

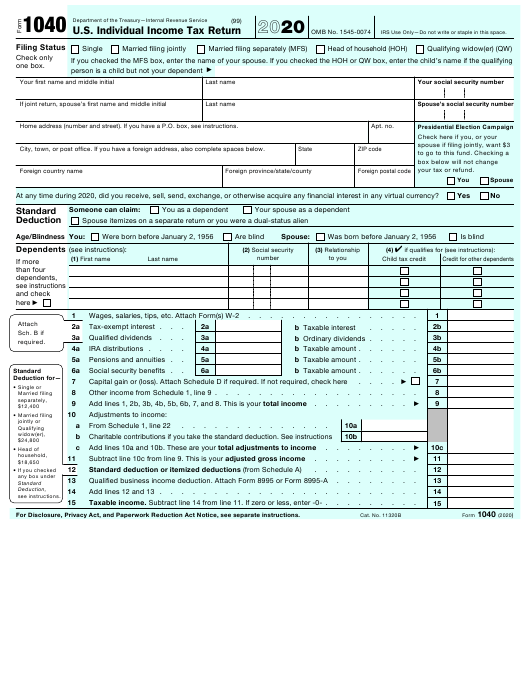

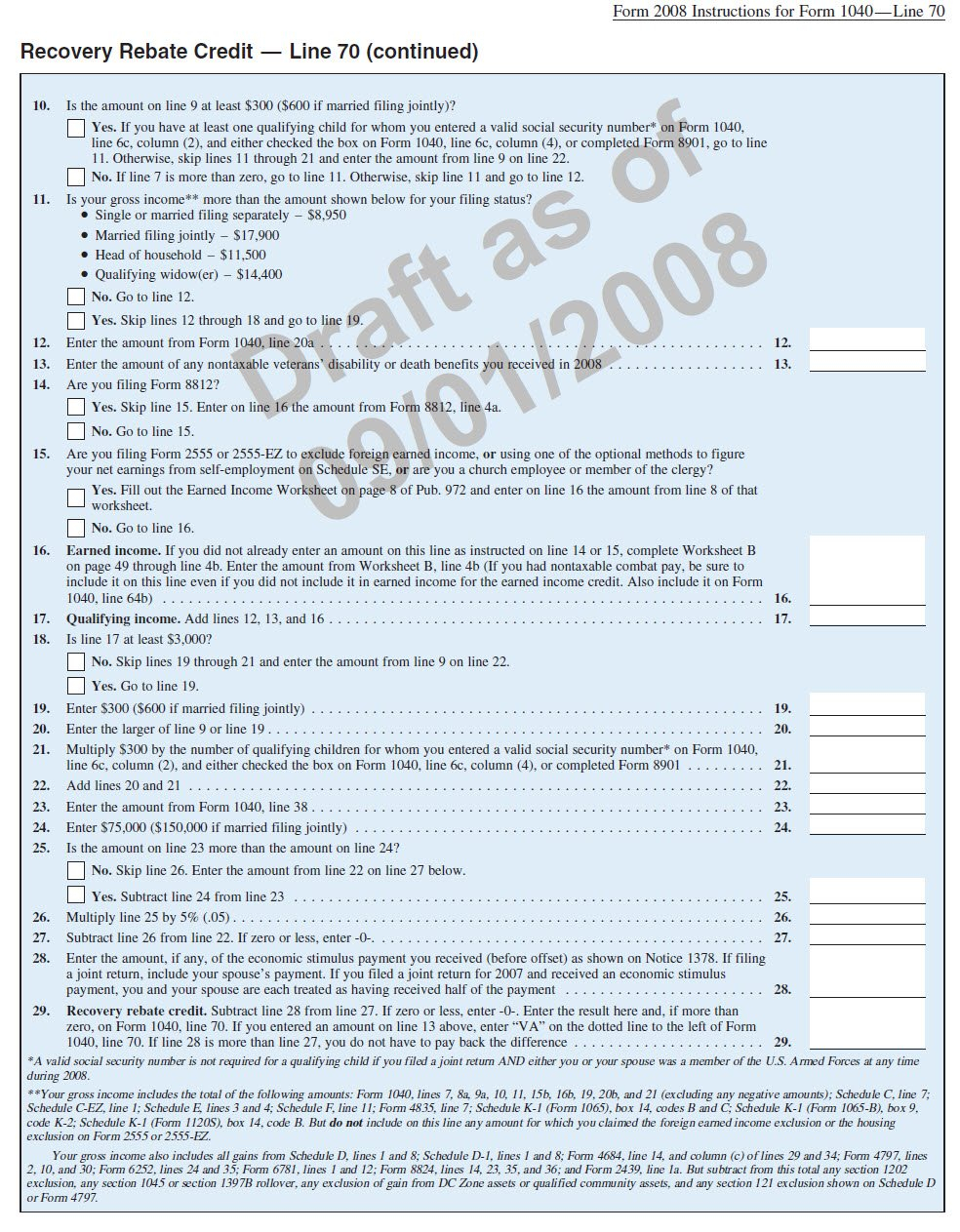

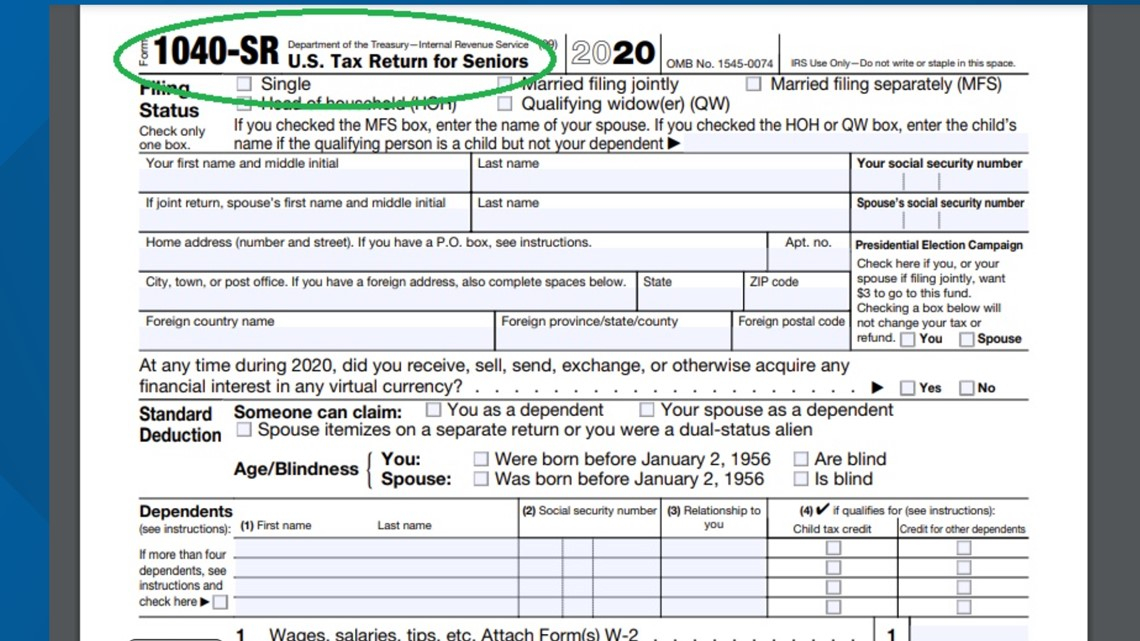

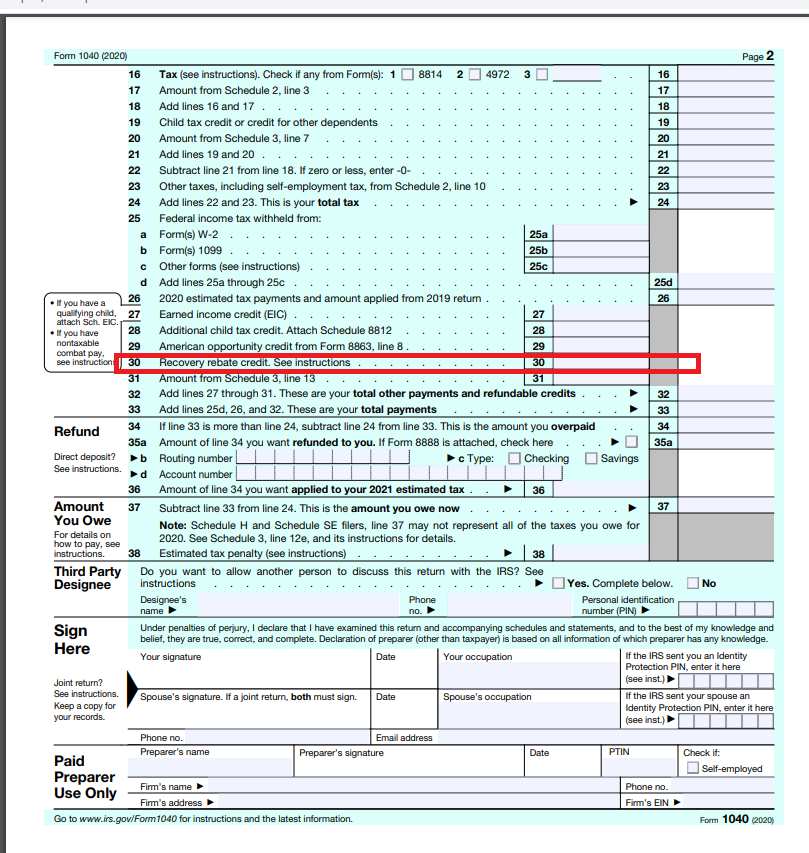

1040 Recovery Rebate Credit Form

1040 Recovery Rebate Credit Form – The Recovery Rebate gives taxpayers an possibility of receiving the tax deduction they earned without needing to modify their tax returns. This program is run by the IRS. It is free. It is crucial to know the guidelines and rules of the program prior to submitting. Here are a … Read more