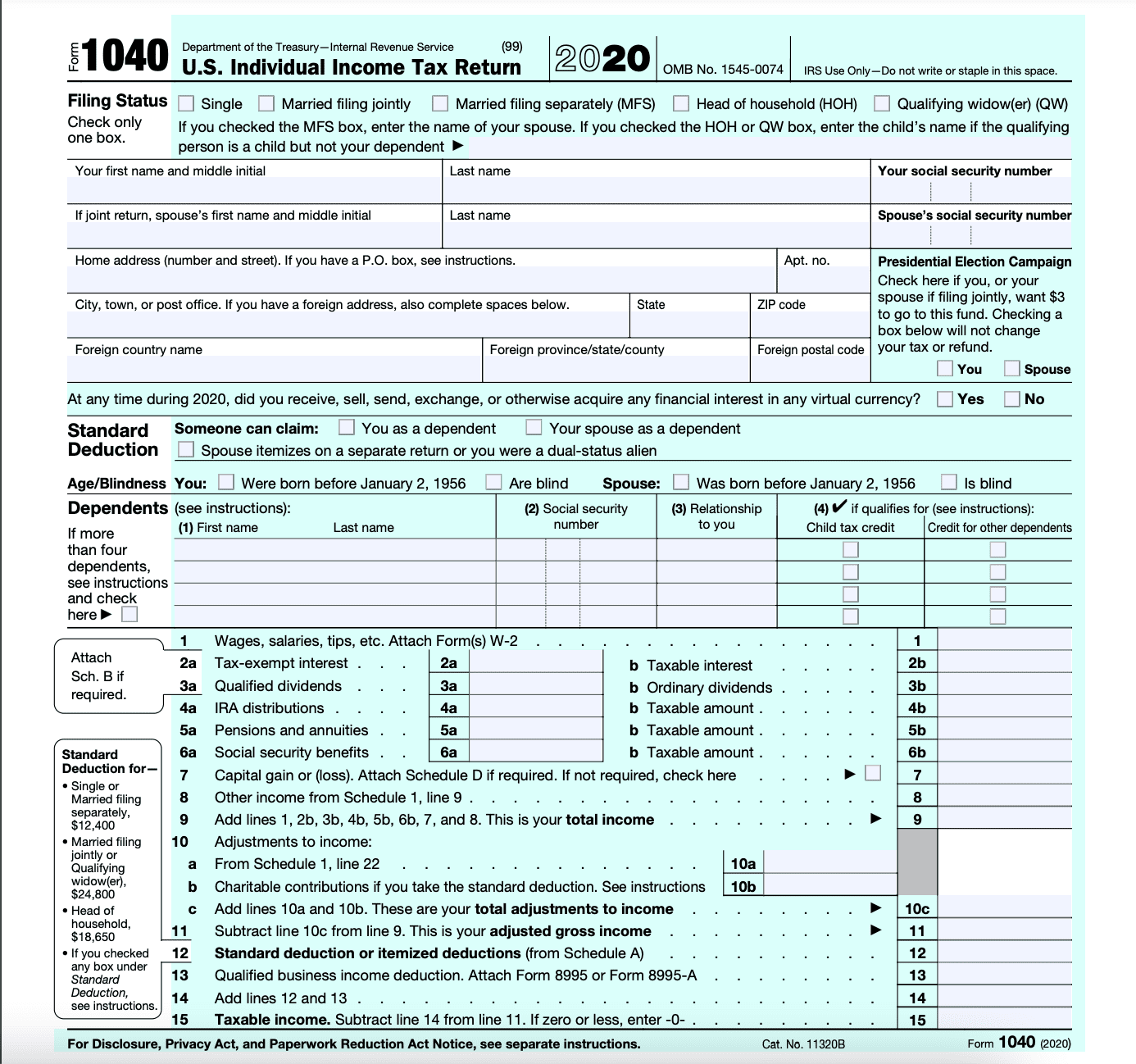

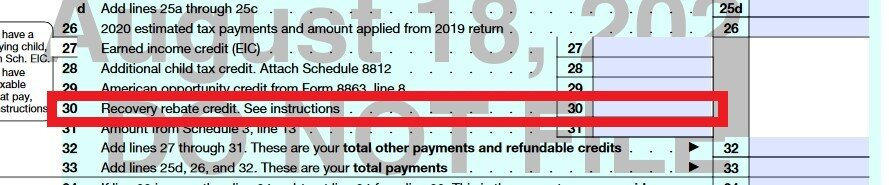

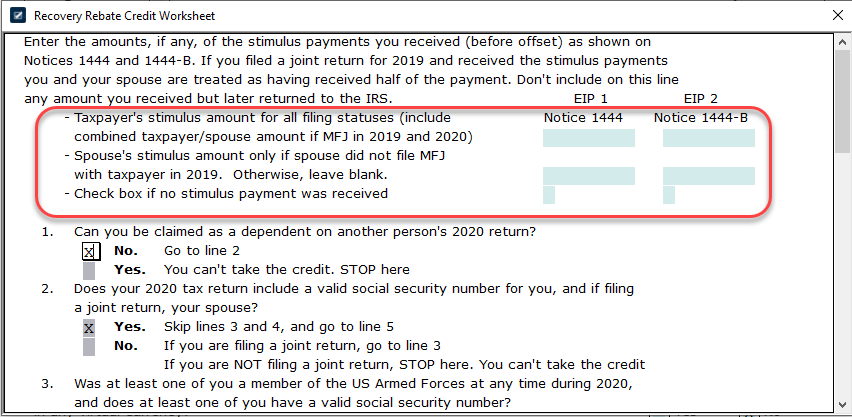

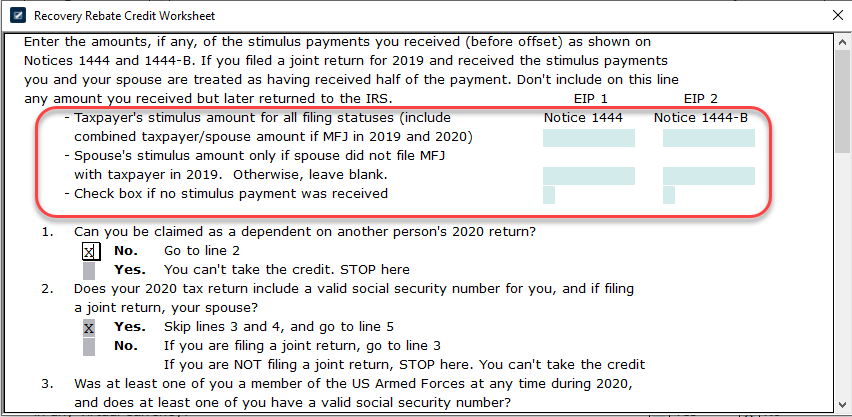

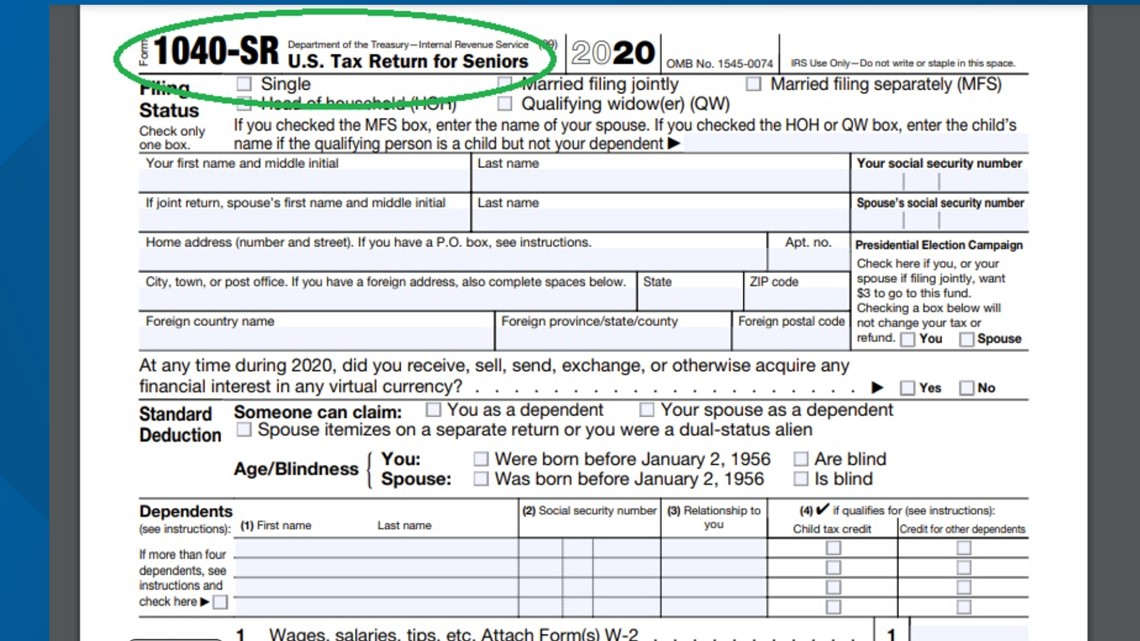

1040 Form Recovery Rebate Credit Instructions

1040 Form Recovery Rebate Credit Instructions – Taxpayers can get tax credits through the Recovery Rebate program. This permits them to receive a tax refund for taxes, without the need to amend the tax return. This program is provided by the IRS. However, before filing it is essential to understand the regulations and rules. These … Read more