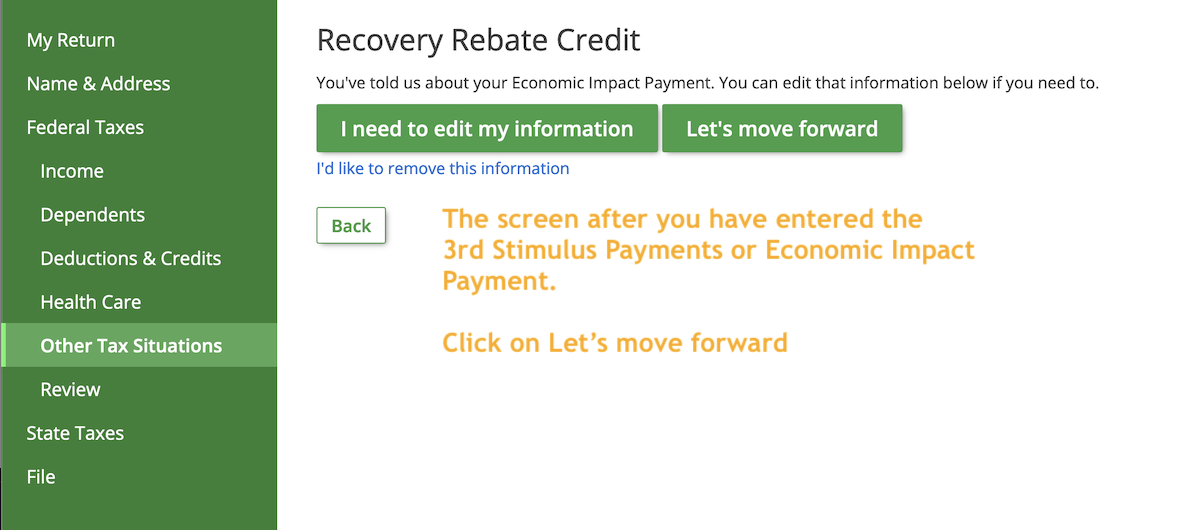

No Income Recovery Rebate Credit

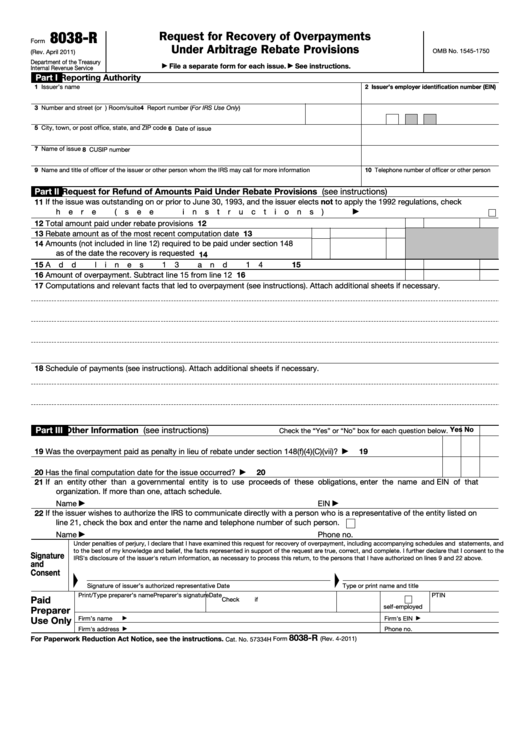

No Income Recovery Rebate Credit – The Recovery Rebate gives taxpayers an opportunity to receive an income tax refund without needing to modify their tax returns. The IRS administers this program and it’s cost-free. However, it is important to know the regulations and rules for the program prior to filing. These are just some of … Read more