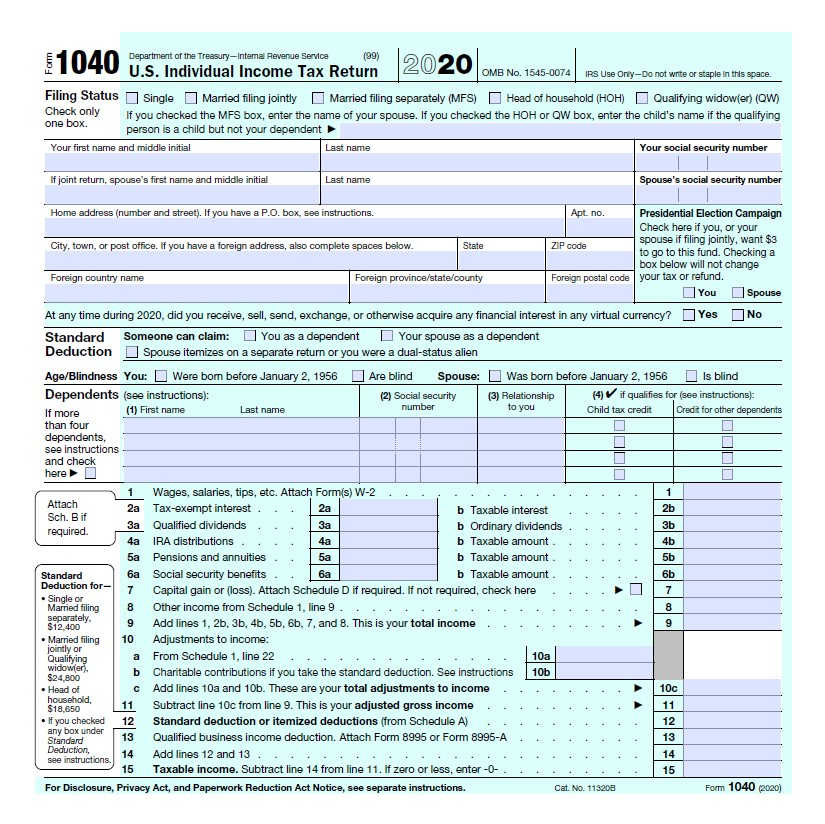

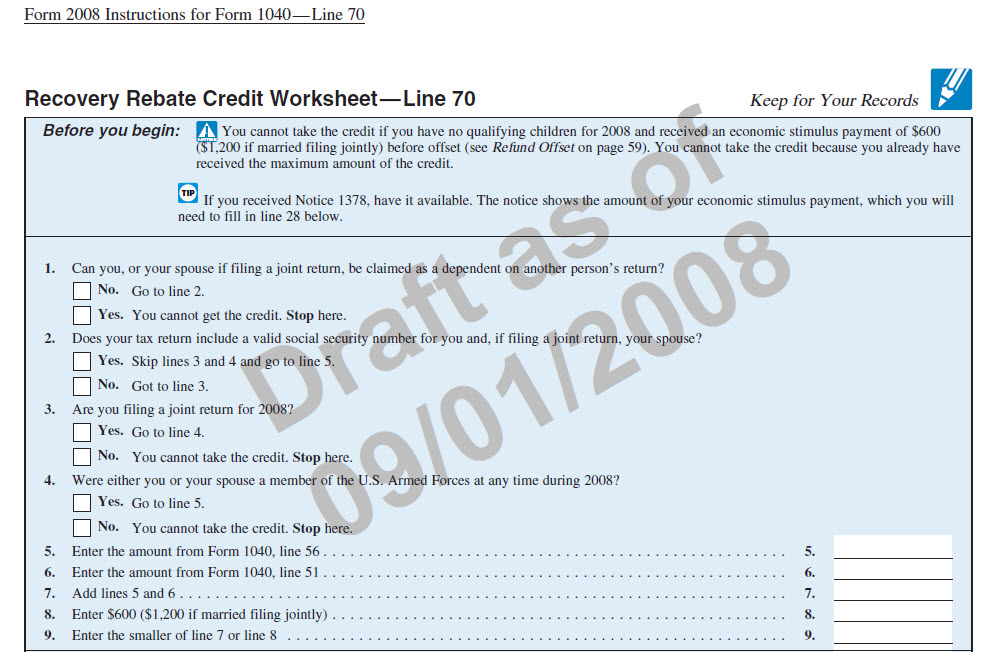

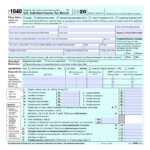

Recovery Rebate Worksheet For 2023 – The Recovery Rebate allows taxpayers to get a tax refund, without the need to alter the tax return. The IRS manages the program that is a no-cost service. But, before you file, it is crucial to be aware of the rules and regulations. Here are some details regarding this program.

Recovery Rebate refunds do not require adjustments

Recovery Rebate credits are distributed to taxpayers eligible for them in advance. There is no need to alter your refund if the tax bill is greater than the 2019 one. In accordance with your earnings, however your recovery credit might be reduced. Your credit score could drop to zero if your income exceeds $75,000. Joint filers with a spouse will see their credit start to decline at $150,000, while heads of household will see their recovery rebate refunds reduced to $112,500.

Individuals who didn’t receive full stimulus payments can still claim rebate credits for recovery for their taxes in 2020. In order to do this you must have an online account with the IRS and a physical notice detailing the amount distributed to them.

It is not able to offer a tax refund

Although the Recovery Rebate does NOT provide the tax return you need, it does provide tax credits. IRS has warned people about possible mistakes when claiming this stimulus money. The IRS also made errors in the application of the tax credits for children. If the credit isn’t properly used, you’ll receive an official letter from IRS.

The Recovery Rebate is available for federal income tax returns up to 2021. Tax dependents can be eligible for up to $1400 (married couples with two children) or up to $4200 (single taxpayers).

It may be delayed due to math mistakes or miscalculations

If you receive an official letter from the IRS notifying you that there is an error in maths in your tax returns, you should take some time to check and rectify the error. It could be necessary to wait until you receive your refund if you provide incorrect details. You can find answers to your questions in the vast FAQ section on IRS.

There are a variety of reasons why your recovery rebate might be delayed. The most common reason is that you have not done the right thing when you claim the stimulus money or child tax credit. The IRS has advised taxpayers to double-check their tax returns to ensure they claim every stimulus check correctly.