Recovery Rebate Irs Form – Taxpayers can get a tax rebate via the Recovery Rebate program. This allows them to get a refund on their taxes without needing to alter the tax return. The IRS runs this program and it is free. It is, however, crucial to understand the regulations and rules regarding this program before you file. These are only some facts about the program.

Recovery Rebate Refunds are not subject to adjustment

Eligible taxpayers are eligible to receive Recovery Rebate credits in advance. There is no need to alter your refund if your tax bill is greater than that of 2019. Your income may affect how much you receive the recovery credit. Your credit score will fall to zero if you earn more than $75,000. Joint filers with spouses will see their credit drop to $150,000. Heads of households will receive their rebates for recovery reduced to $112,500.

Individuals who didn’t receive full stimulus funds may be eligible for recovery rebate credits on their tax returns for 2020. You’ll need an IRS account online , as well as an official notice in writing stating the total amount they received.

It doesn’t provide any tax refund.

The Recovery Rebate is not a tax refund, but instead provides you with a tax credit. IRS has issued warnings regarding mistakes that are made when applying for the cash stimulus. Another area where mistakes were made is the child tax credit. The IRS will issue a notice if the credit is not applied correctly.

The Recovery Rebate is available for federal income tax returns until 2021. If you’re married couple who have two children , and count as tax-dependent taxpayer, you can receive upto $1,400 or upto $4200 for filers who are single.

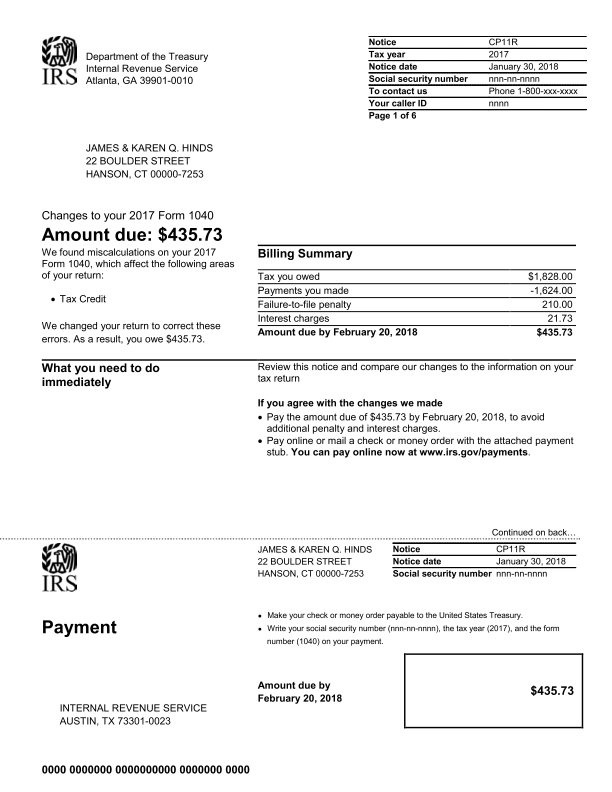

It is also delayed by math error or miscalculations

If you receive a notice with the message that the IRS has found a math mistake on your tax return, you should take a moment to review and amend the information. A mistake in your information could result in a delayed refund. The IRS has a wealth of FAQs available to assist you in answering any concerns.

There are many reasons your recovery reimbursement could be delayed. One of the most common is an error in the claim of stimulus funds or the child tax credit. The IRS has advised taxpayers to double-check their tax returns and to be sure they’re declaring each stimulus payment.