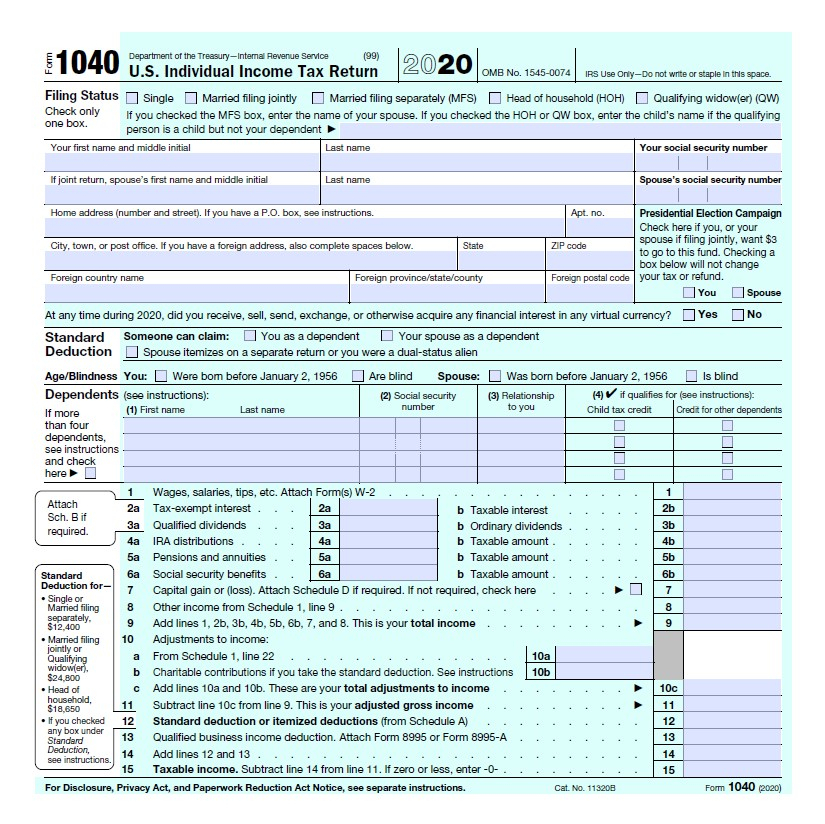

Recovery Rebate Credit On Your 2023 – A Recovery Rebate gives taxpayers an chance to get the tax deduction they earned without having to adjust the tax returns. This program is administered by the IRS. It is important to understand the guidelines before applying. Here are some details regarding this program.

Recovery Rebate Refunds are not subject to adjustment

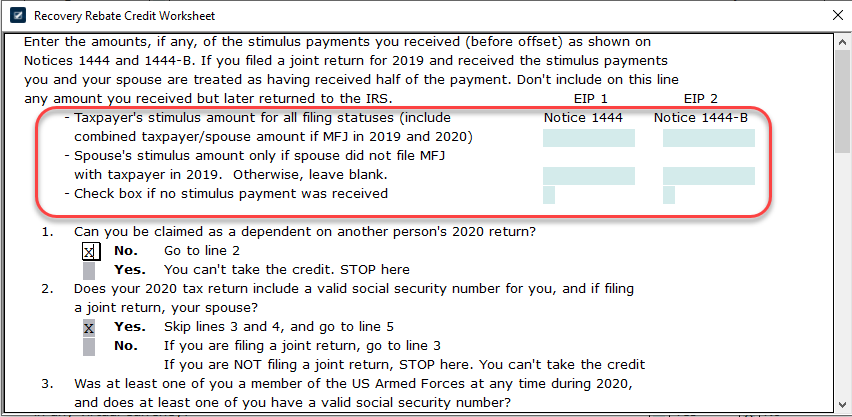

Taxpayers eligible for credits under the Recovery Rebate program will be informed in advance. You don’t have to adjust your refund if your 2020 tax bill is greater than the 2019 one. Your income will affect the amount of your recovery rebate credit. Your credit score will fall to zero for those who make over $75,000. Joint filers who have spouses will drop to $150,000. Heads of households will have their reimbursements for recovery rebates reduced to $112,500.

Even though they didn’t receive the full amount of stimulus individuals can still receive recovery rebate credits for their tax bills in 2020. To be eligible, they will require an IRS-registered online bank account along with a printed note detailing the total amount they will receive.

It does not provide an opportunity to receive a tax refund

Although the Recovery Rebate doesn’t provide you with tax returns, it can provide tax credit. IRS has warned you about doing things wrong when applying for this stimulus cash. The child tax credit is another area where mistakes have been made. If you fail to apply the credit properly, the IRS could send you a notice.

The Recovery Rebate is available for federal income tax returns through 2021. A qualified tax dependent can receive up $1,400 (married couples having two children) or $4200 (single tax filers).

It could be delayed by mathematical errors or miscalculations

If you get a letter telling you that the IRS has found a math error on your tax return, spend a few moments to review and amend the information. A mistake in your information could result in a delayed refund. The IRS offers a wide range of FAQs to help you answer any questions.

There are a variety of reasons your recovery rebate may be delayed. An error in the way you claim tax credits for children or stimulus funds is one of the most common reasons for a delay. The IRS encourages taxpayers to check their tax returns twice to ensure that every stimulus payment is being declared correctly.