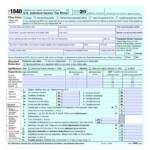

Recovery Rebate Credit On 1040 – A Recovery Rebate is an opportunity for taxpayers to receive a tax refund without adjusting their tax returns. The program is offered by the IRS. It is crucial to understand the guidelines before applying. These are just some facts about the program.

Recovery Rebate reimbursements don’t have to be adjusted.

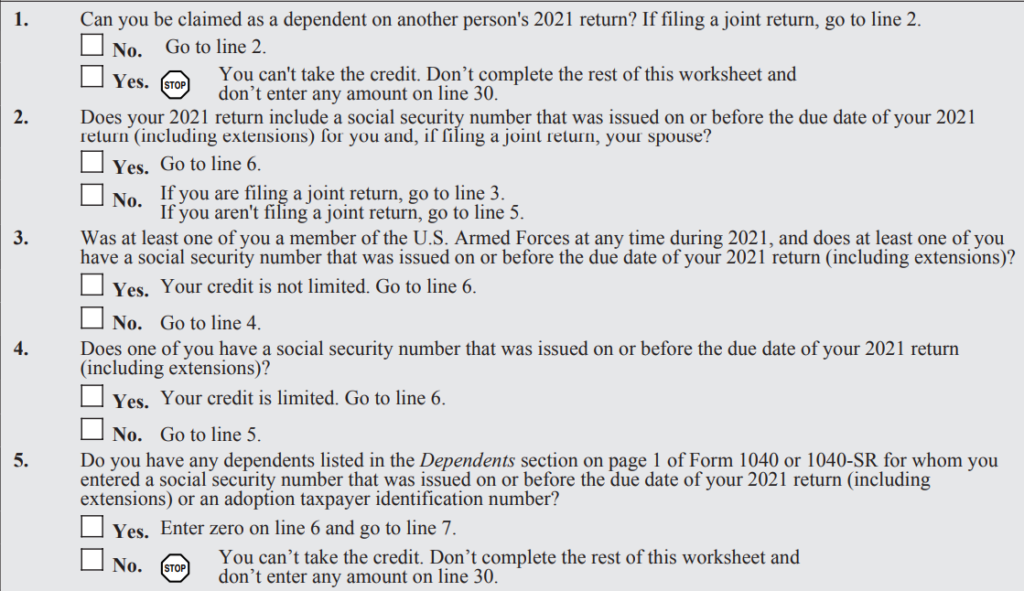

Taxpayers who qualify for Recovery Rebate credits will be informed in advance. This means that you don’t need to change the amount of your refund if owe higher taxes in 2020 than for the year 2019. Based on your income, however, your recovery credit credit might be reduced. Your credit score could drop to zero for those who make over $75,000. Joint filers who file jointly with a spouse will notice their credit dipping at $150,000, and heads of households will begin seeing their recovery rebate reductions fall to $112,500.

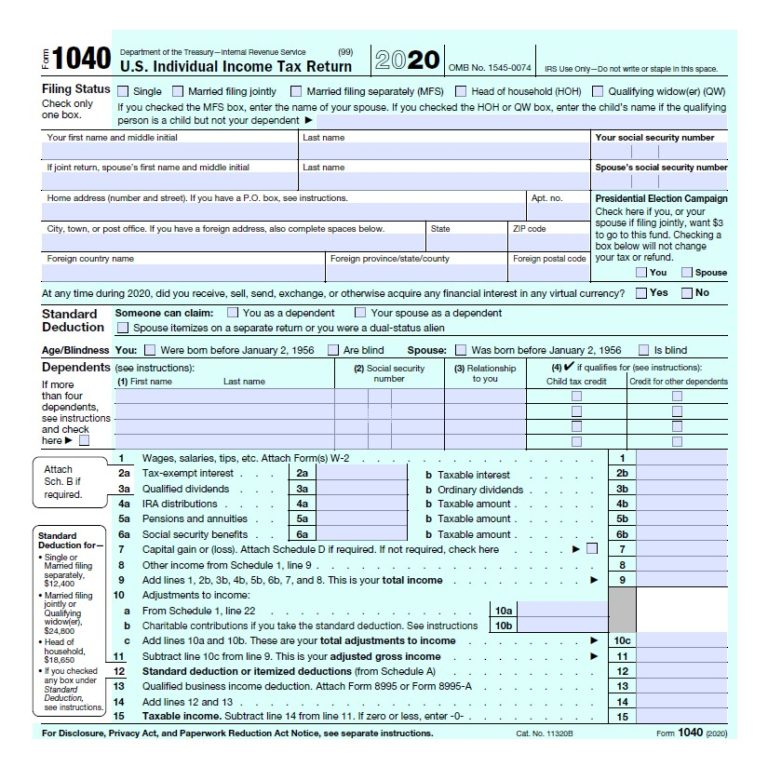

Individuals who didn’t receive full stimulus funds may be eligible for recovery rebate credits on their tax returns for 2020. To be eligible, they’ll need an IRS-registered online account along with a printed note detailing the total amount of money they received.

It doesn’t offer a tax refund

The Recovery Rebate does not provide the tax-free status, but it does grant you the tax credit. IRS has been advising people of their mistakes when applying for the stimulus funds. The IRS also made mistakes in the application of the child tax credits. The IRS will send a notice to you in the event that the credit has not been applied correctly.

In 2021 the federal tax returns on income are eligible for the Recovery Rebate. If you’re a married couple who have two children and count as tax-dependent taxpayer, you could receive upto $1,400 or upto $4200 for single filers.

It could be delayed due to mistakes in math or calculations

You should double-check your information and make any changes when you receive a notice from IRS stating that there is an error in the math of your tax return. You might have to wait for your refund if you provide incorrect information. You can find answers to your queries in the extensive FAQ section on IRS.

There are many reasons your Recovery Rebate may be delayed. Most often, the reason behind delays is due to a mistake made when the tax credits or stimulus funds. The IRS cautions taxpayers to double check their tax returns and ensure they are claiming each stimulus payment.