Recovery Rebate Credit Letter 6475 – A Recovery Rebate gives taxpayers an opportunity to receive the tax deduction they earned without having to adjust the tax returns. The IRS runs this program and it’s completely free. However, prior to filing, it is crucial to understand the rules and regulations. Here are some specifics about this program.

Recovery Rebate refunds do not require adjustment

Eligible taxpayers are eligible to be eligible for Recovery Rebate credits advance. So, should you have more tax in 2020 than in 2019, you won’t have to adjust your tax refund. However, your recovery rebate credit could be reduced according to your income. If you earn more than $75k, your credit could decrease to zero. Joint filers who file jointly with a spouse will notice their credit beginning to decrease at $150,000, and heads of households will begin seeing their recovery rebate reductions fall to $112,500.

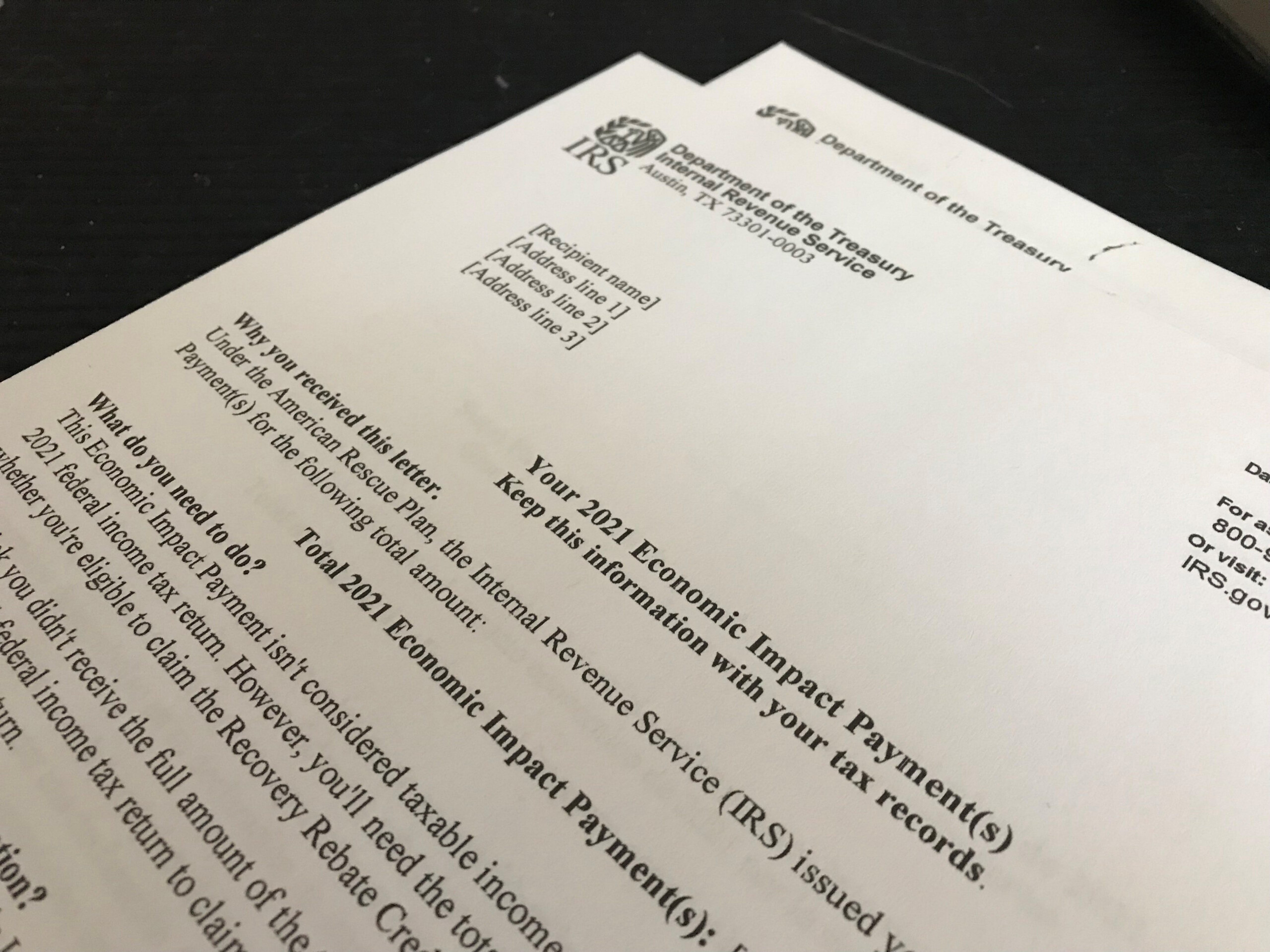

Individuals who didn’t receive full stimulus payments can get recovery rebates on their tax returns in 2020. You’ll need an IRS account online , as well as an official printed document stating the total amount they received.

It doesn’t offer an opportunity to receive a tax refund.

The Recovery Rebate is not a tax refund, however it offers tax credit. IRS has warned taxpayers about making mistakes when applying for the stimulus cash. There have been mistakes that have been made with regard to child tax credit. The IRS will issue a letter to you in the event that the credit is not properly applied.

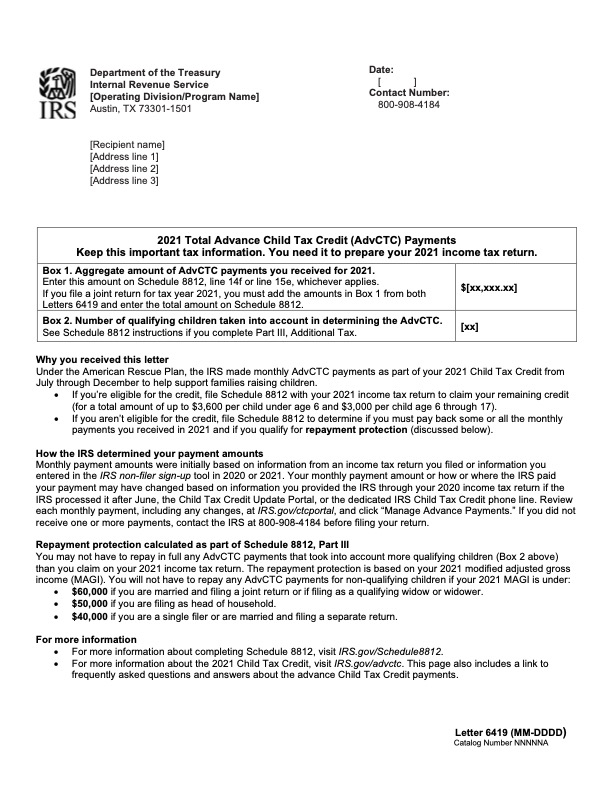

The Recovery Rebate can be applied to federal income tax returns from now to 2021. If you’re married couple with two children , and are tax-dependent taxpayer, you can get up to $1,400 or $4200 for filers who are single.

It may be delayed because of math errors or miscalculations

You should double-check your information and make any adjustments if you get a letter from IRS notifying you of a math error in the tax return. Incorrect information can result in your tax refund being delayed. You can find answers to your questions within the comprehensive FAQ section on IRS.

There are a variety of reasons your recovery rebate might be delayed. The most common cause for delay is due to a mistake made when the tax credits or stimulus funds. The IRS has advised taxpayers to double check their tax returns and to make sure that they’re correctly claiming each stimulus payment.