Recovery Rebate Credit Irs Instructions – Taxpayers can receive a tax rebate via the Recovery Rebate program. This permits them to get a refund on their tax obligations without needing to alter their tax returns. The program is provided by the IRS. It’s cost-free. However, it is important to know the regulations and rules for this program before you file. These are just a few facts about this program.

Recovery Rebate refunds do not require adjustments

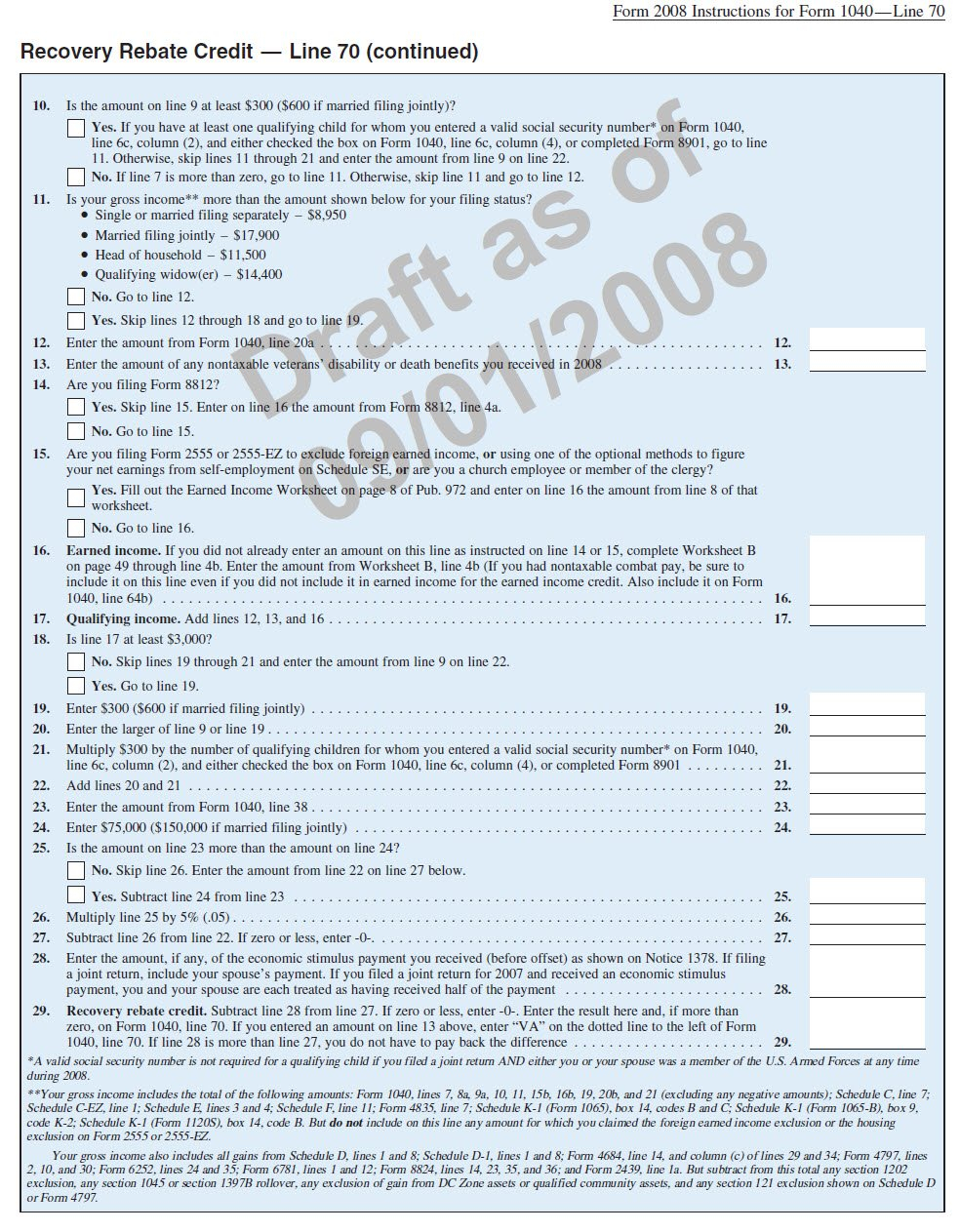

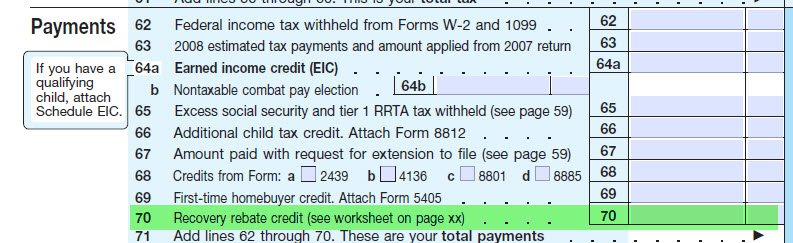

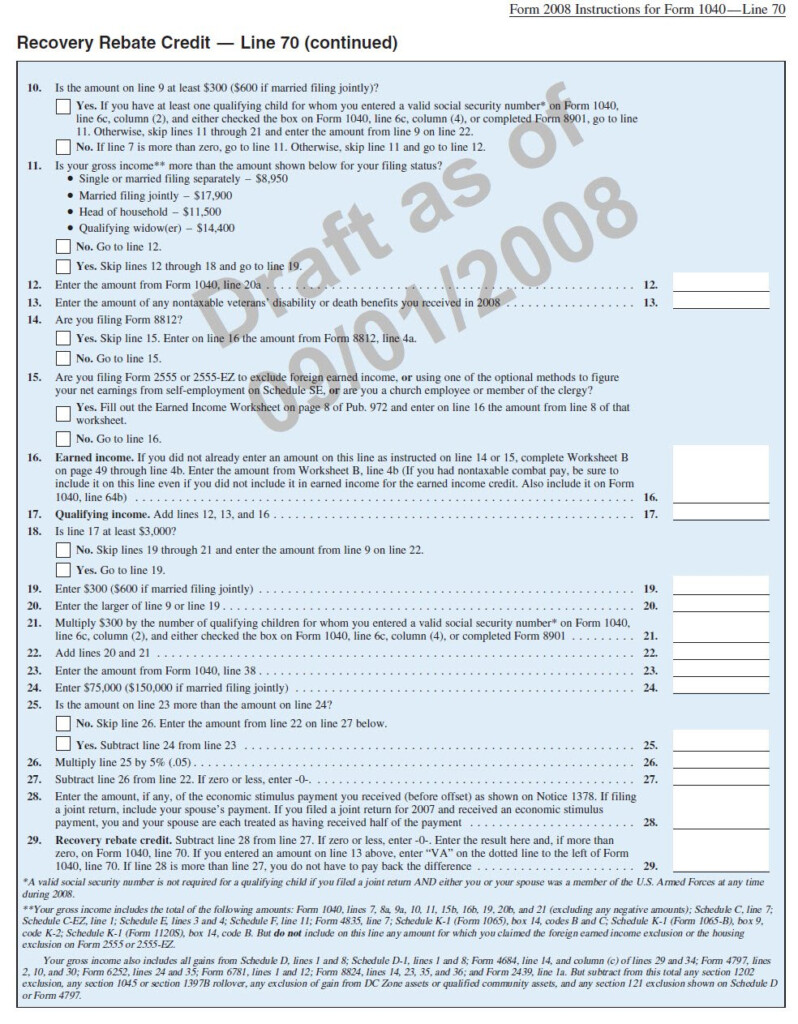

Taxpayers who are eligible for credits under the Recovery Rebate program are notified prior to. If you owe more tax in 2020 than you did in 2019 your refund will not be adjusted. In accordance with your earnings, however the recovery credit could be cut. If you earn over $75k, your credit could be reduced to zero. Joint filers with spouses will begin to decrease at $150,000 and heads of household will begin to receive their rebates for recovery reduced to $112,500.

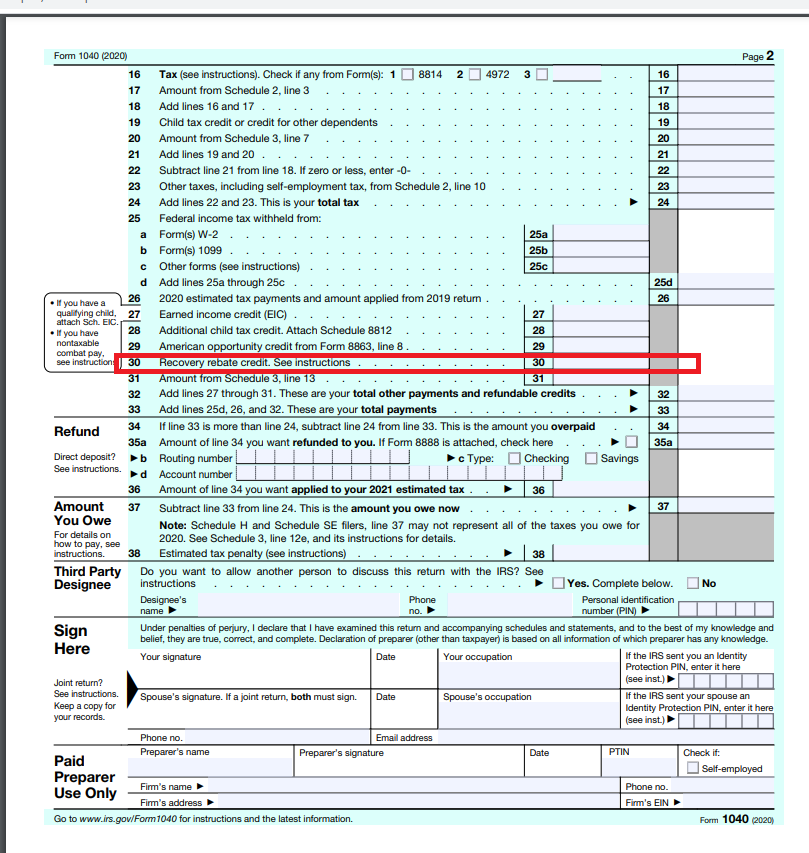

The people who haven’t received all of the stimulus funds in 2020 are still eligible to receive recovery rebate credits. You’ll need an IRS account on the internet and an official notice in writing stating the total amount they received.

It is not able to offer a tax refund

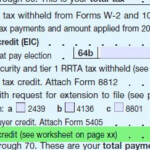

The Recovery Rebate is not a tax refund, but it gives you a tax credit. IRS has issued a warning about errors made when claiming the stimulus cash. Child tax credits are another area where errors were made. In the event that the credit isn’t properly applied, you will get an official letter from IRS.

The Recovery Rebate is available for federal income tax returns up to 2021. Tax dependents can be eligible to receive up to $1400 (married couples with 2 children) or up to $4200 (single filers).

It can also be delayed due to math mistakes and incorrect calculations.

If you receive a notice telling you that the IRS has discovered a mathematical error in you tax return, take a moment to check and correct your information. Incorrect information could cause your tax refund to be delayed. The IRS has a wealth of FAQs available to answer your questions.

There are many reasons your Recovery Rebate may be delayed. An error in the way you claim tax credits for children or stimulus funds is one of the most common reasons to delay your rebate. The IRS recommends that taxpayers double-check their tax returns in order to verify that each stimulus payment is being declared correctly.