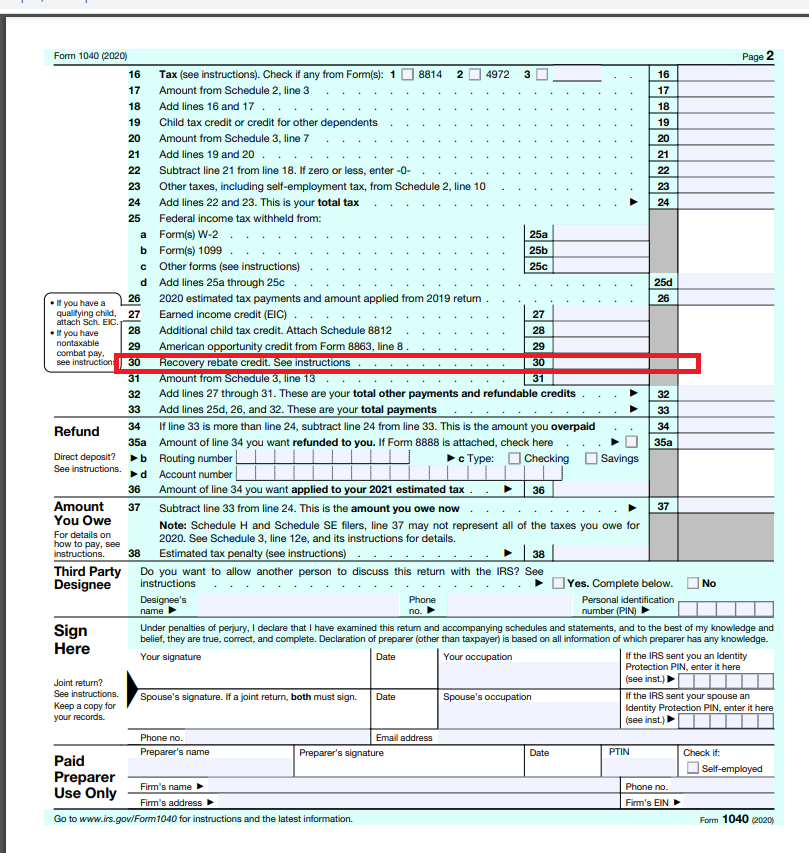

Recovery Rebate Credit Included In Tax Refund – A Recovery Rebate gives taxpayers an chance to get a refund on their tax without the need to alter their tax returns. The IRS administers this program and it’s cost-free. Prior to filing however, it’s crucial to be acquainted of the regulations and guidelines of this program. Here are a few points to learn about this program.

Recovery Rebate reimbursements don’t have to be adjusted.

Taxpayers who qualify are eligible to be eligible for Recovery Rebate credits advance. That means your tax refund won’t be affected if you owe more tax in 2020 compared to the year prior. Your income may determine the amount you get the recovery credit. Your credit rating will decrease to zero if the income exceeds $75,000. Joint filers who have spouses will be able to see their credit begin declining to $150,000. Members of the household and head of household will notice that their recovery rebate refunds begin dropping to $112,500.

Even if they didn’t receive all the stimulus funds but they still have the option of claiming tax recovery credits in 2020. In order to be eligible for this tax credit you must open an online IRS account and supply an exact copy of the amount that was given to them.

It doesn’t provide an opportunity to receive a tax refund.

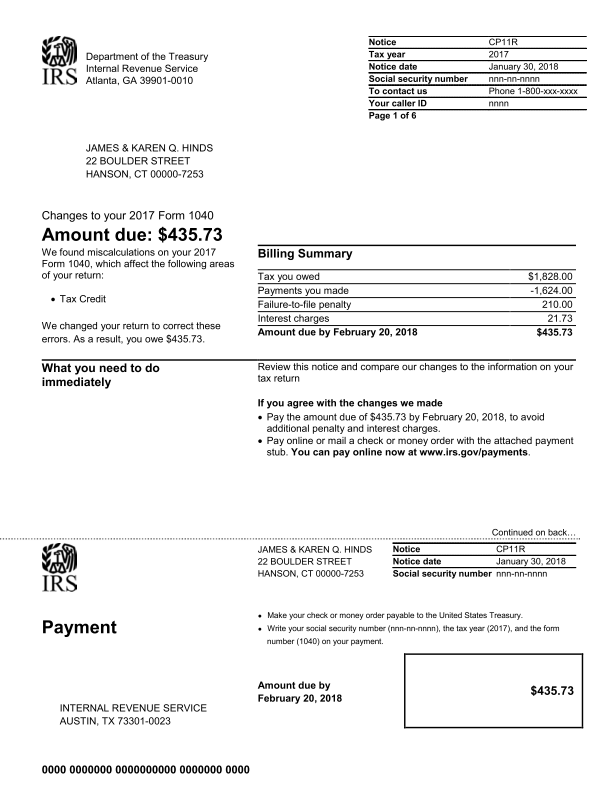

Although the Recovery Rebate doesn’t provide you with a tax return , it can provide tax credit. IRS has warned taxpayers against doing things wrong when applying for this stimulus cash. The IRS has also made errors in the application of the tax credits for children. If the credit isn’t used correctly it is possible that the IRS will notify you via email.

In 2021, Federal income tax returns are eligible for the Recovery Rebate. Each tax dependent is eligible to receive up to $1400 (married couples with 2 children) or up to $4200 (single filers).

It is also delayed by math errors and incorrect calculations.

If you receive a letter from the IRS issues a letter informing you that your tax return contains a math error It is crucial to spend some time to look over your information and make any corrections that are required. Incorrect information can cause your tax refund to be delayed. Fortunately, the IRS offers an extensive FAQ section to answer your questions.

There are several reasons why your recovery rebate may be delayed. A mistake in claiming tax credits for children or stimulus money is among the most frequent causes for a delay. The IRS cautions taxpayers to double check their tax returns and ensure they claim correctly every stimulus payment.