Recovery Rebate Credit For Stimulus – The Recovery Rebate offers taxpayers the possibility of receiving an income tax return, with no tax return adjusted. This program is run by the IRS and is a free service. It is crucial to understand the regulations before applying. These are the essential facts you need to be aware of about the program.

Recovery Rebate Refunds are not subject to adjustment

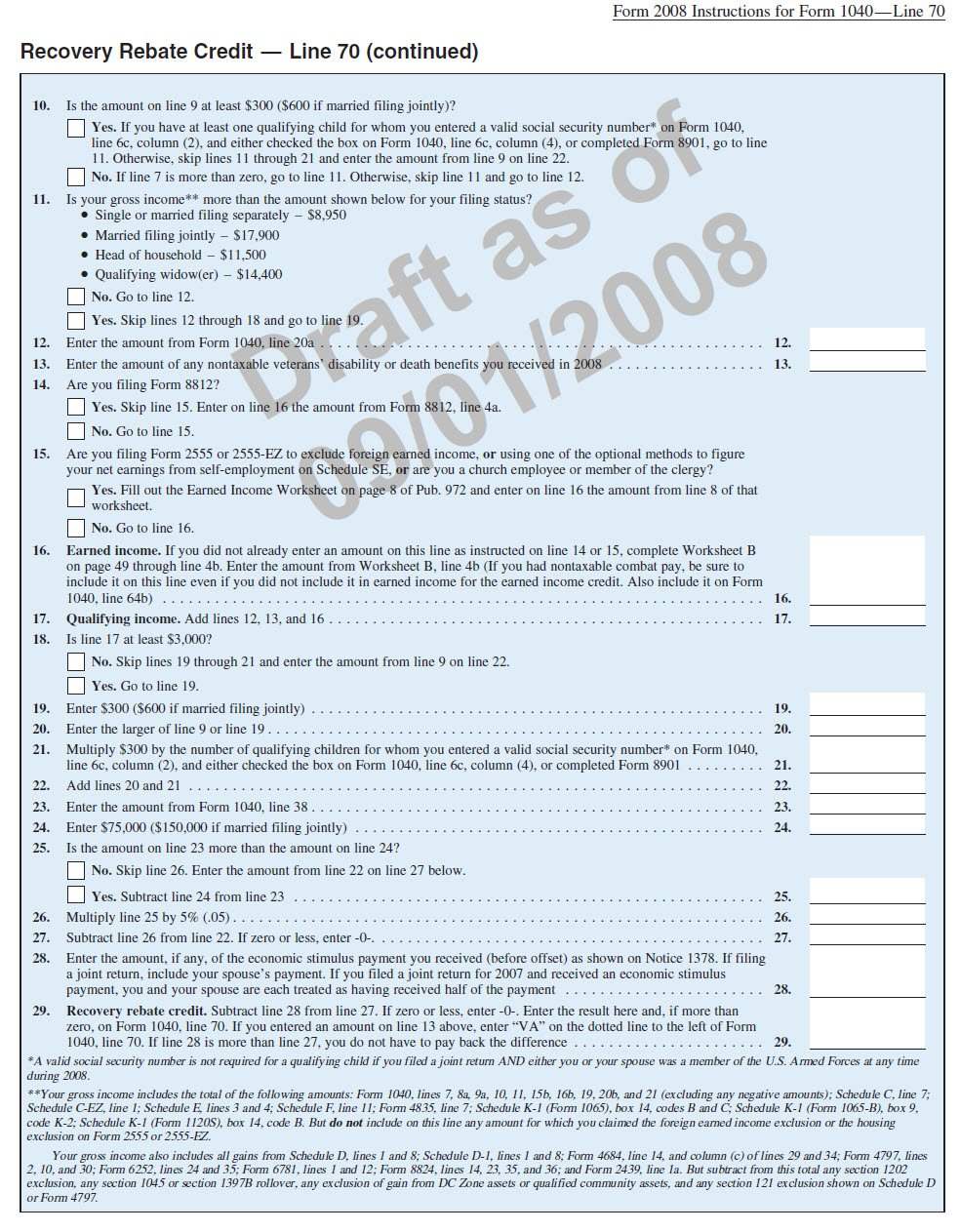

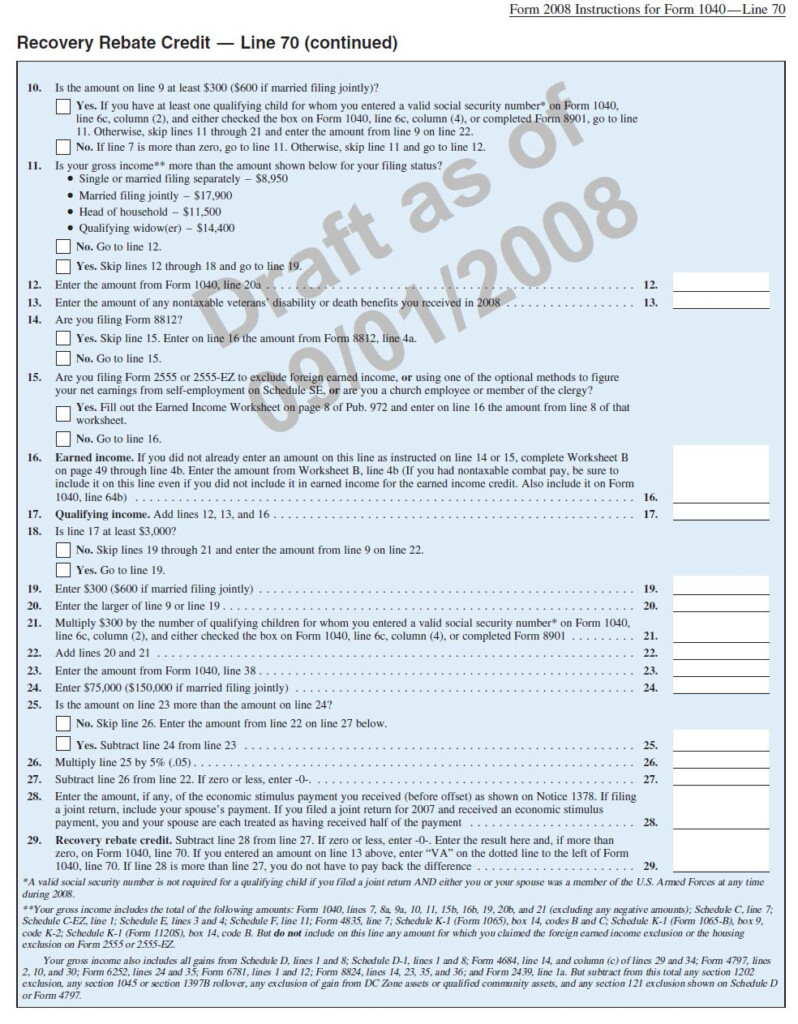

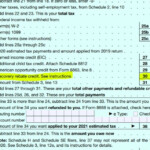

Recovery Rebate credits are paid to taxpaying taxpayers who are eligible in advance. That means even if you pay a higher tax in 2020 than in the year before, you will not be required to adjust your refund. Your income can determine the amount you get the recovery credit. If you earn over $75k, your credit will decrease to zero. Joint filers and spouses will see their credit begin to decline at $150,000. Members of the household and head of household will begin to notice when their recovery rebate refunds begin dropping to $112,500.

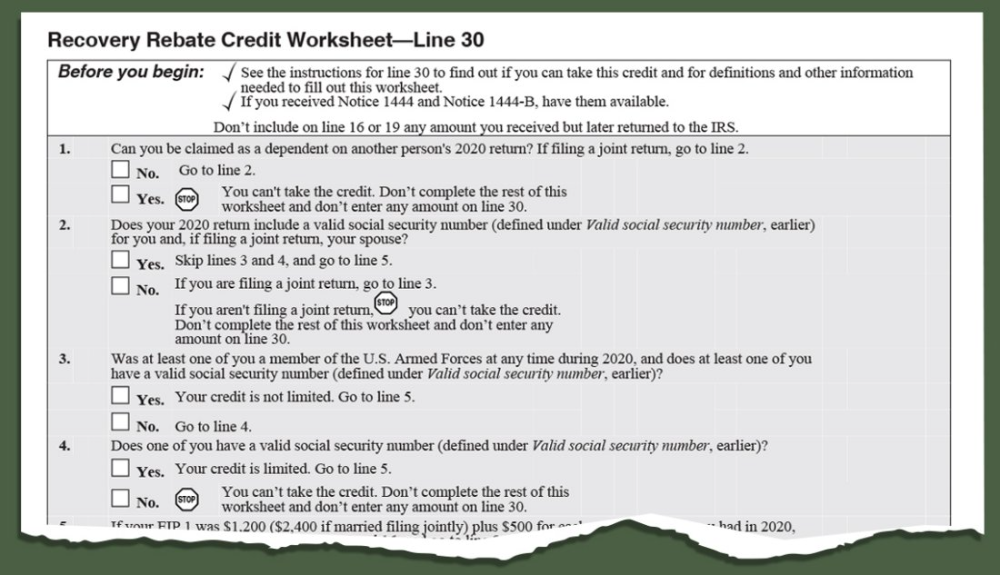

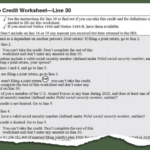

People who have not received full stimulus payments in 2020 can still receive recovery rebate credits. To be eligible for this tax credit, they must create an online IRS account and provide a copy of the amount that was paid to them.

It doesn’t allow for a tax return

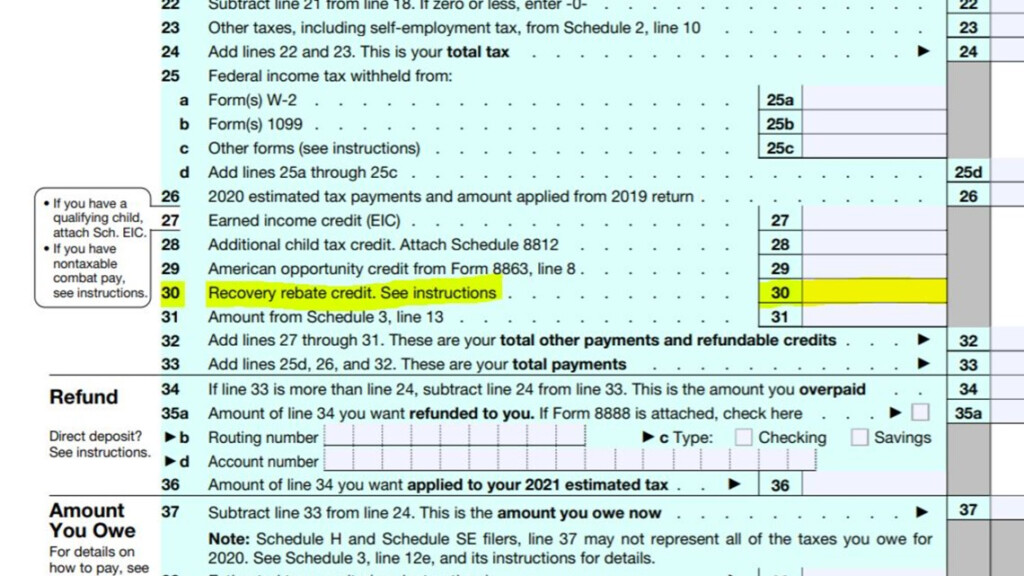

Although the Recovery Rebate doesn’t provide you with a tax return , it does provide you a tax credit. IRS has warned you about making mistakes when applying for this stimulus cash. There have been mistakes made in the area of child tax credit. If the credit isn’t used correctly then the IRS will send you an email.

For 2021, the Federal income tax returns for 2021 are eligible to receive the Recovery Rebate. If you are married and have at least two kids, you can get up to $1,400 and for single filers , up to $4200.

It can also be delayed by math errors and miscalculations

If the IRS issues a letter informing you that your tax return has a math error, it is important to take the time to look over your information and make any corrections that are required. If you do not provide accurate information, your tax refund may be delayed. There are answers to your questions in the vast FAQ section of IRS.

There are many reasons your recovery rebate might be delayed. The most common reason is that you have made a mistake when claiming the stimulus money or child tax credit. The IRS warns taxpayers to double-check tax returns and make sure they correctly claim each stimulus payment.