Recovery Rebate Credit For Person Who Died In 2023 – The Recovery Rebate allows taxpayers to receive a tax refund without having to adjust the tax return. This program is run by the IRS. It is free. It is nevertheless crucial to understand the rules and regulations regarding the program prior to filing. Here are some details about this program.

Refunds received from Recovery Rebate do not have to be adjusted

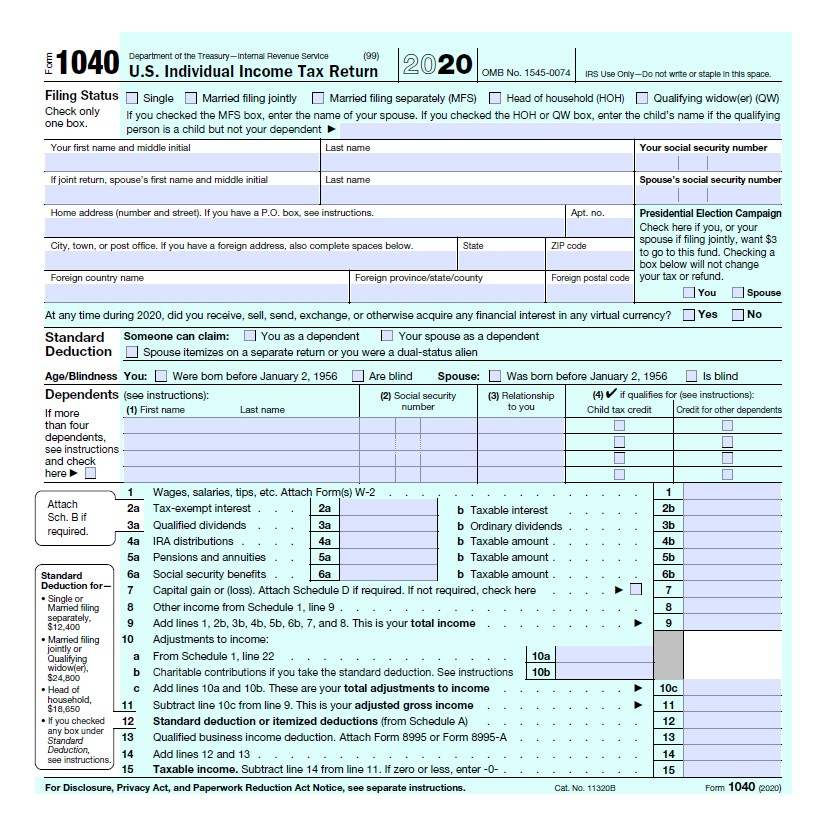

Eligible taxpayers are eligible to receive Recovery Rebate credits in advance. This means that you don’t need to adjust the amount of your tax refund if you owe higher taxes in 2020 than in 2019. Your income could affect how much you receive the recovery credit. Your credit rating will decrease to zero if your earnings exceeds $75,000. Joint filers with spouses will begin to decrease at $150,000, while heads of household will see their recovery rebate refunds reduced to $112,500.

Individuals who didn’t receive full stimulus payments could be eligible to claim recovery rebate credits on their tax returns for 2020. To be eligible, they’ll require an IRS-registered online bank account and a paper note detailing the total amount distributed to them.

It doesn’t offer tax refunds

While the Recovery Rebate will not give you a tax refund, it will give you taxes, it will provide you with tax credits. IRS has warned taxpayers about making mistakes when applying for the stimulus cash. The child tax credit is another area where mistakes have been made. If you fail to apply the credit correctly and correctly, the IRS might issue a notice.

The Recovery Rebate is available on federal income tax returns through 2021. You could receive up to $1,400 for each qualifying tax dependent (married couples with two children) and up to $4200 for single filers.

It is possible to delay it due to mathematical errors or miscalculations

If you are sent an official letter from the IRS informing you that there was an error in maths in the tax return, make sure you take some time to check and rectify it. Incorrect information can result in your tax refund being delayed. Fortunately there is a solution. IRS offers an extensive FAQ section to help you answer your questions.

There are a variety of reasons your recovery reimbursement could be delayed. The most common reason the reason your recovery refund could be delayed is because you made a mistake when applying for the stimulus funds and also the tax credits for children. The IRS warns taxpayers to double-check tax returns to ensure that they claim correctly every stimulus payment.