Recovery Rebate Credit Error – The Recovery Rebate offers taxpayers the opportunity to receive a tax return with no tax return altered. The program is managed by the IRS and is a free service. It is important to be familiar with the regulations before applying. Here are a few facts about this program.

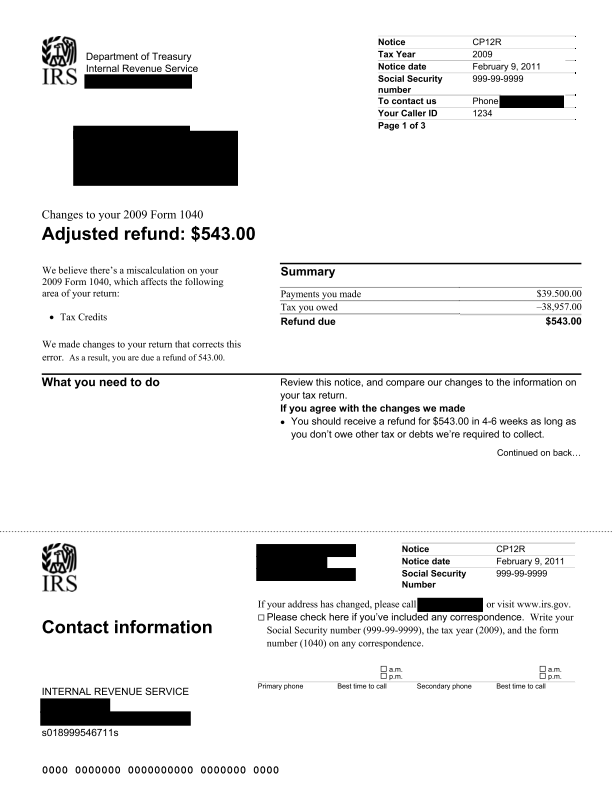

Refunds received from Recovery Rebate do not have to be adjusted

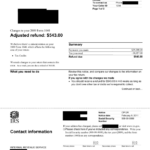

Eligible taxpayers are eligible to receive Recovery Rebate credits in advance. If you owe tax more in 2020 than in the year prior to it your refund is not adjusted. However, depending on your income, your recovery credit could be cut. If you earn over $75k, your credit could be reduced to zero. Joint filers and spouses will see credit start declining to $150,000. Heads and household members will begin to notice when their reimbursements for recovery rebates start to decrease to $112,500.

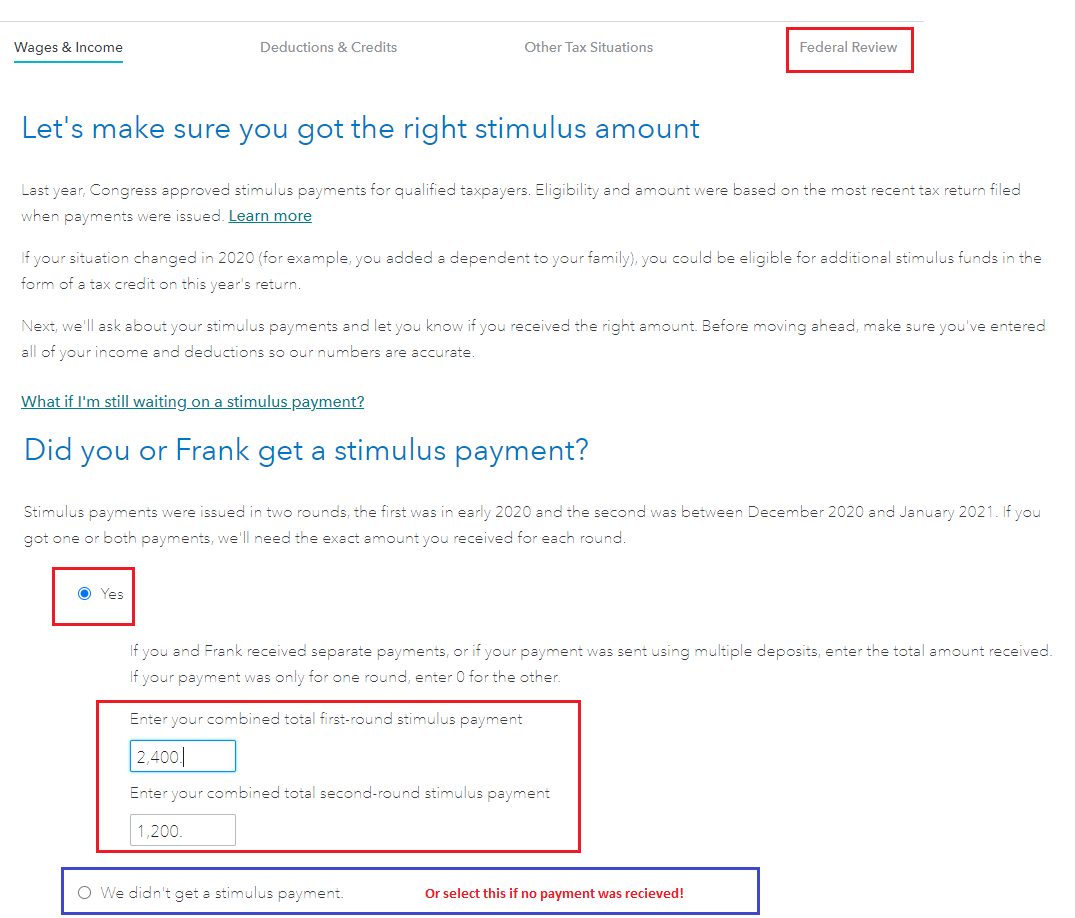

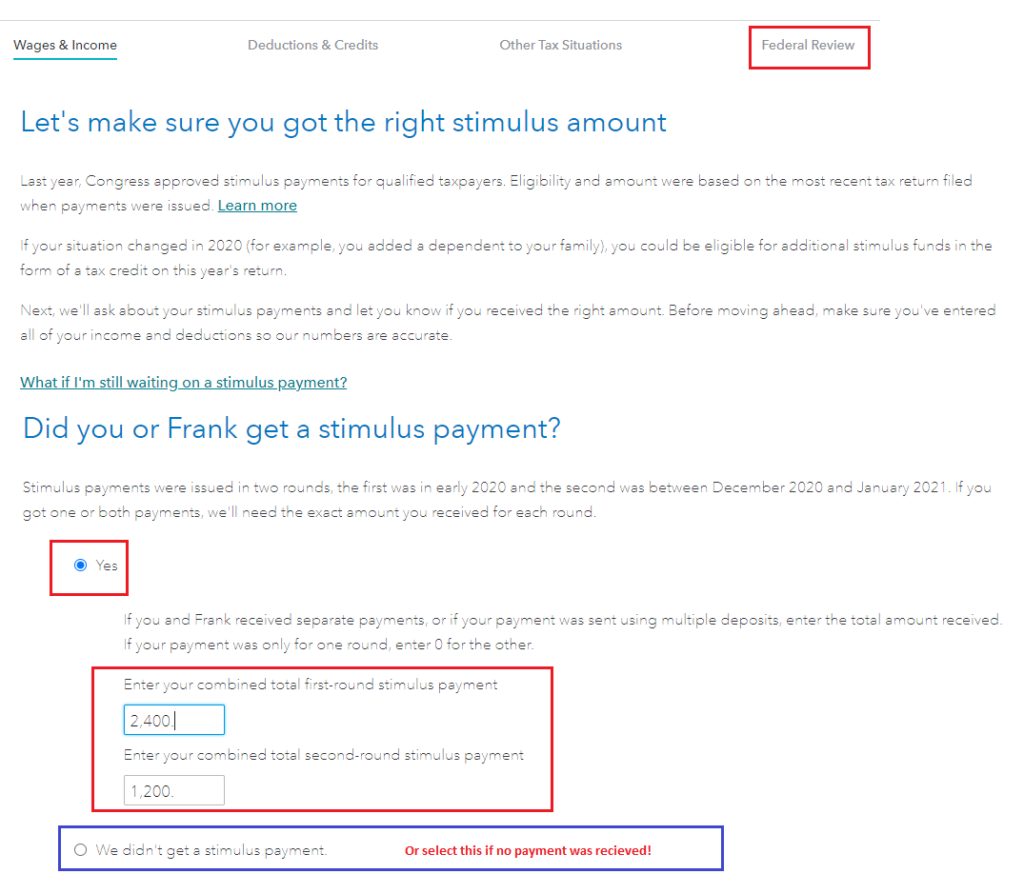

If they did not get all of the stimulus funds but they still have the option of claiming tax relief credits for 2020. To be eligible, they must have an account online with the IRS as well as a printed notice listing the total amount that was distributed to them.

It doesn’t offer a tax refund

While the Recovery Rebate doesn’t provide you with a tax return it does provide you a tax credit. IRS has cautioned people about the mistakes they made when applying for this stimulus funds. The tax credit for children is another area susceptible to mistakes. The IRS will issue a notice if the credit isn’t applied correctly.

The Recovery Rebate is available on federal income tax returns for 2021. Each tax dependent is eligible to receive up to $1400 (married couples with two children) or up to $4200 (single taxpayers).

It is possible to delay it due to mathematical errors or mistakes

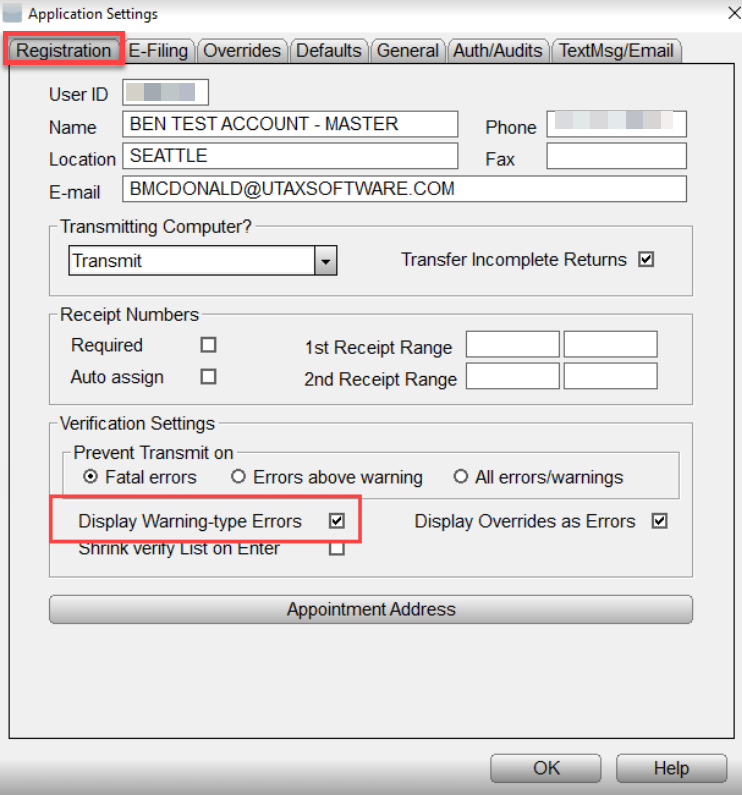

If you receive an official letter from the IRS informing you that there was a mathematical error in your tax returns, make sure you take some time to check and correct the error. The incorrect information could cause your tax refund to be delayed. The IRS offers extensive FAQs to answer your concerns.

There are a variety of reasons your recovery reimbursement could be delayed. Most common reason for delay is making a mistake with claiming tax credit or stimulus money. The IRS warns taxpayers to double-check tax returns to ensure that they correctly claim every stimulus payment.