Recovery Rebate Credit Eligibility 2022 – A Recovery Rebate gives taxpayers an opportunity to receive an income tax refund without needing to modify their tax returns. This program is administered by the IRS and is a no-cost service. It is important to be familiar with the rules before you apply. Here are some specifics about the program.

Recovery Rebate refunds do not require adjustments

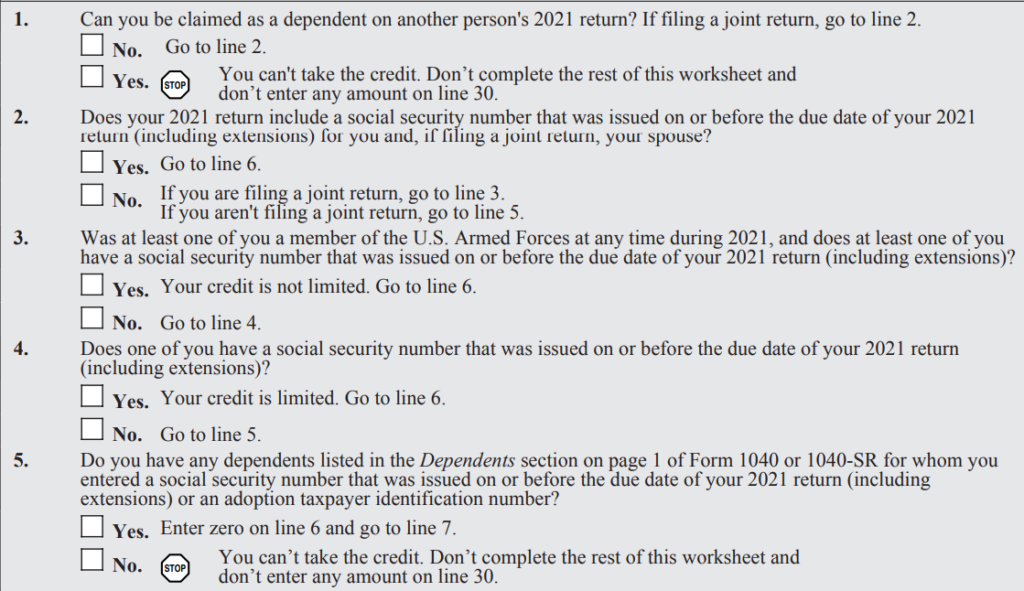

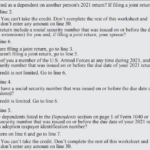

Taxpayers who qualify will be eligible to receive the Recovery Rebate credit prior to. This means you won’t need to adjust the amount of your refund if have higher tax obligations in 2020 than in 2019. Your income will influence the amount of your recovery rebate credit. Your credit rating will decrease to zero if your earnings exceeds $75,000. Joint filers who have spouses will be able to see their credit begin declining to $150,000. Members of the household and head of household will notice that their recovery rebate refunds begin to drop to $112,500.

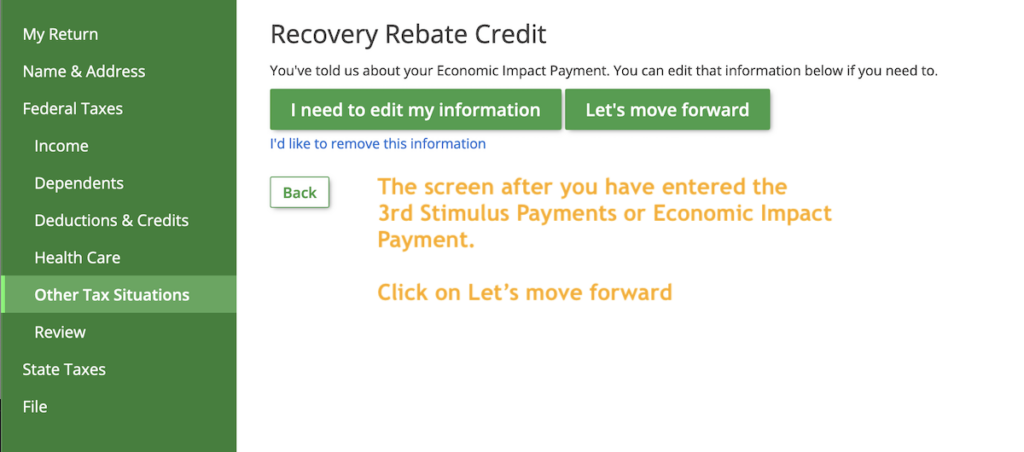

Individuals who did not receive all of the stimulus funds in 2020 are still eligible to receive credit for recovery rebates. You’ll need an IRS account online and a printed notice listing the total amount received.

It doesn’t provide tax refunds

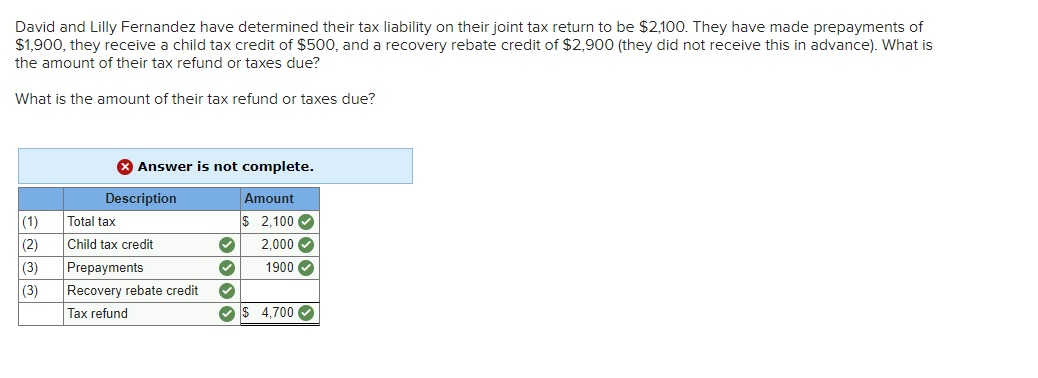

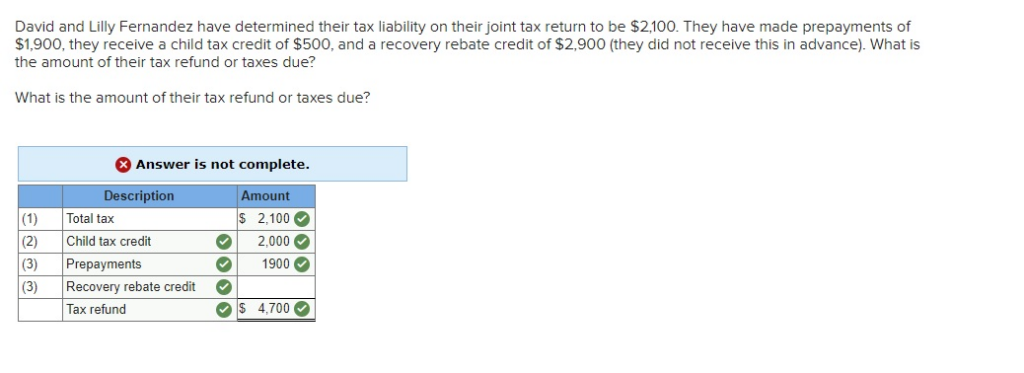

While the Recovery Rebate will not give you a tax refund, it will give you taxes, it will give taxpayers with tax credits. IRS has warned people about their mistakes in applying for this stimulus funds. Child tax credits are another area where mistakes have been made. If the credit isn’t applied correctly it is possible that the IRS will notify you via email.

The Recovery Rebate is available on federal income tax returns through 2021. Each tax dependent can be eligible to receive as much as $1400 (married couples with 2 children) or up to $4200 (single taxpayers).

It could also be delayed by math errors and incorrect calculations.

If you receive a letter informing you that the IRS has discovered a mathematical error in you tax return, you should spend a few moments to check and correct your information. The refund you receive could be delayed if you submit incorrect details. The IRS provides extensive FAQs to answer your questions.

There are a variety of reasons why your reimbursement for recovery could be delayed. The most common cause for delay is a miscalculation in the tax credits or stimulus funds. The IRS has advised taxpayers to double-check their tax returns and be sure they’re reporting each stimulus payout.