Recovery Rebate Credit 2023 Meaning – The Recovery Rebate offers taxpayers the opportunity to receive the tax return they deserve with no tax return altered. The IRS manages this program, and it’s completely absolutely free. Prior to filing however, it’s essential to be familiar with the regulations and rules of the program. Here are some information about this program.

Recovery Rebate Refunds are not subject to adjustment

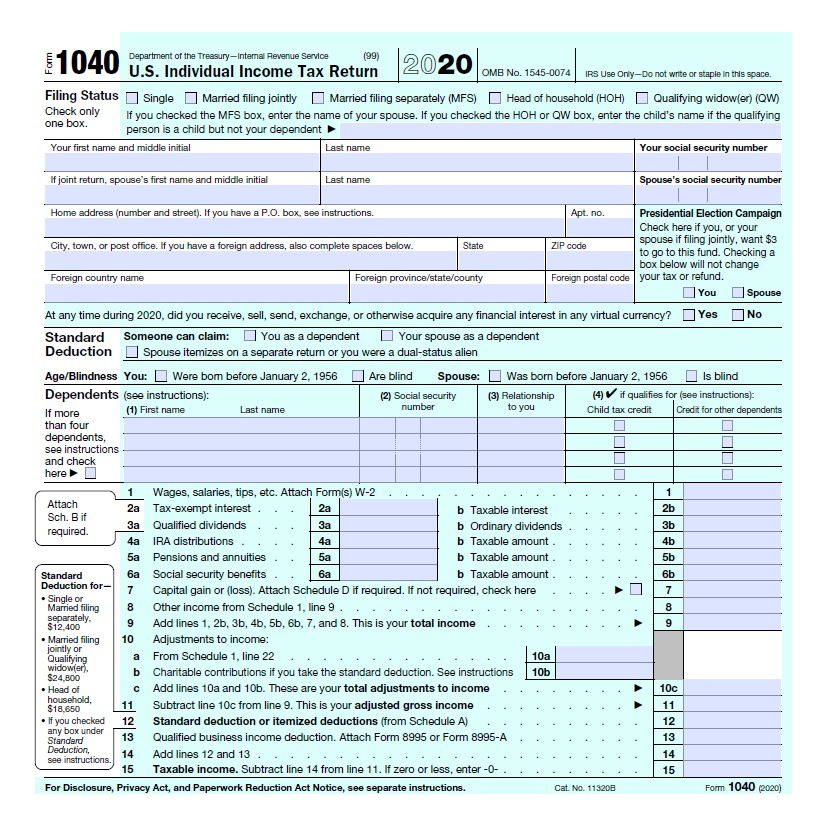

Taxpayers who are eligible for Recovery Rebate credits are notified prior to. That means your tax refund won’t be affected if you owe more tax in 2020 in comparison to 2019. However your rebate for recovery may reduce according to your income. Your credit score can drop to zero for those who make over $75,000. Joint filers who file jointly with their spouse will see their credit dipping at $150,000, and heads of household will begin to see their reimbursement reductions fall to $112,500.

The people who haven’t received all of the stimulus funds in 2020 may still be eligible for reimbursement rebate credits. In order to be eligible to claim this credit, they must create an online IRS account and provide proof of the amount that was given to them.

It is not able to be used for a tax return

The Recovery Rebate does not provide the tax-free status, but it does grant you a tax credit. IRS has issued warnings about mistakes made in claiming the stimulus cash. The tax credit for children is another area that is affected by errors. If the credit is not correctly applied, you will get an official letter from IRS.

The Recovery Rebate is available on federal income tax returns through 2021. Tax dependents can be eligible to receive as much as $1400 (married couples with two children) or up to $4200 (single filers).

It is possible to delay it due to mistakes in math or calculations

If you get a letter telling you that the IRS has found a math mistake on your tax return, it is recommended that you spend a few moments to review and amend your information. You might have to wait until you receive your refund if you provide inaccurate details. The IRS offers a wide range of FAQs to answer your questions.

There are many reasons your reimbursement for recovery may be delayed. The most frequent reason is that you’ve not done the right thing when you claim the stimulus funds or the child tax credit. The IRS cautions taxpayers to double check their tax returns and make sure they are claiming every stimulus payment.