Recovery Rebate Check – The Recovery Rebate allows taxpayers to receive a tax refund without having to adjust their tax returns. The IRS administers the program and it is a completely free service. It is important to be familiar with the rules and regulations of the program before submitting. Here are some specifics about this program.

Recovery Rebate funds are not subject to adjustment.

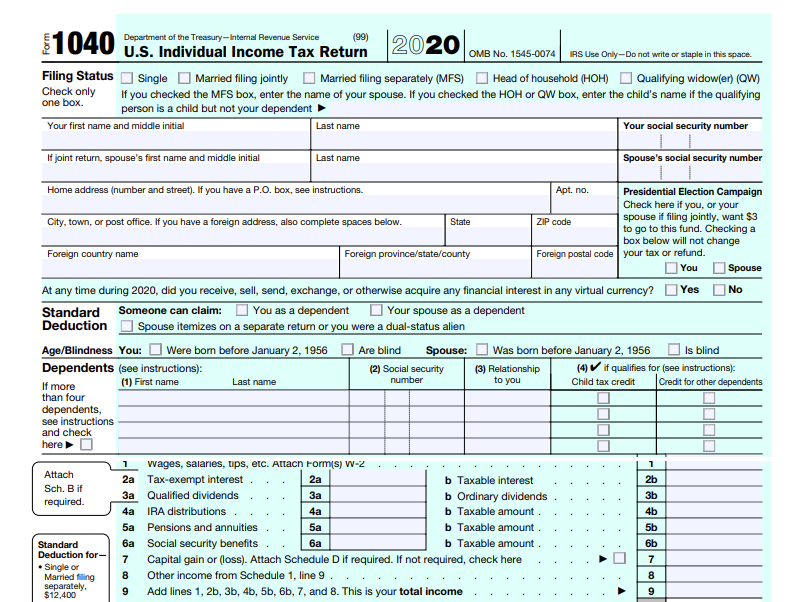

Taxpayers who qualify are eligible to get Recovery Rebate credits in advance. That means your tax refund won’t be affected even if you are owed more taxes in 2020 as compared to 2019. However, your recovery rebate credit will be diminished according to your income. Your credit score can fall to zero for those who make over $75,000. Joint filers who file jointly with their spouse will see their credit starting to decline to $150,000. Heads of household will begin to see their recovery rebate reimbursements decrease to $112,500.

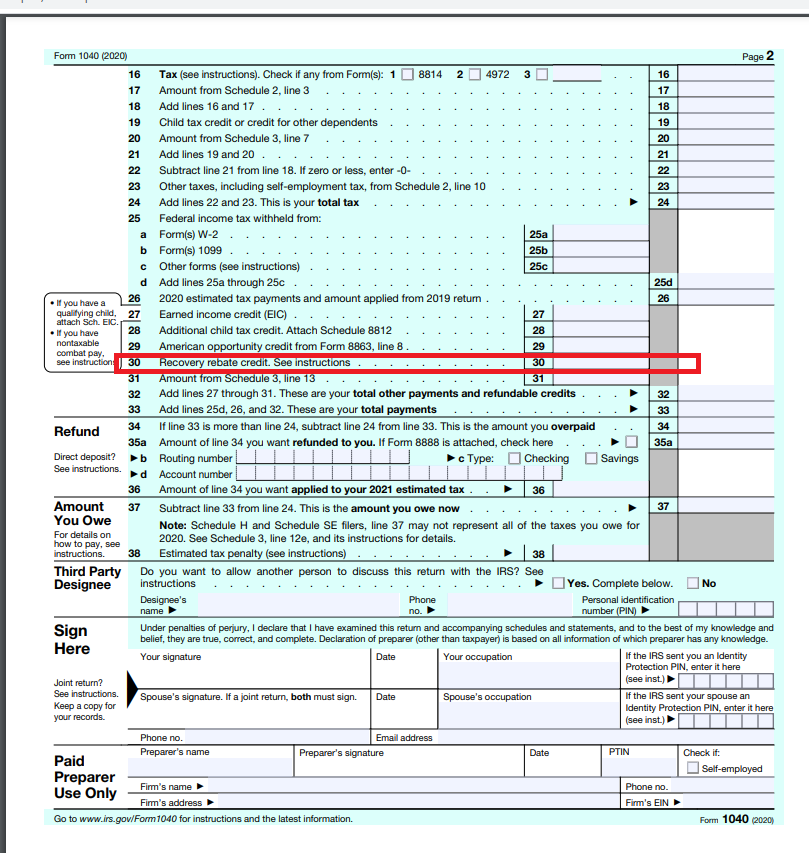

Even though they didn’t receive the full stimulus payment People can still claim refund rebate credits towards their taxes in 2020. They’ll require the IRS online account and an acknowledgement of all amounts they’ve received.

It doesn’t offer tax refunds

While the Recovery Rebate doesn’t provide you with a tax return , it will give you a tax credit. IRS has warned you about making mistakes when applying for the stimulus money. The IRS has also committed mistakes with the application of the child tax credits. If you fail to apply the credit in a proper manner The IRS may send you a notice.

The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021. You can get up to $1,400 for each tax dependent who is eligible (married couples with two children) and up to $4200 for single filers.

It is possible to delay it due to mathematical errors or miscalculations

If you receive a letter by the IRS stating that there was a mathematical error in your tax returns, take some time to check and correct it. The incorrect information could cause your tax refund to be delayed. There are answers to your questions within the vast FAQ section on IRS.

There are several reasons why your recovery refund could be delayed. Incorrectly claiming tax credits for children or stimulus money is one of the most frequently cited reasons for delays. The IRS has warned people to double-check their tax returns and ensure that they claim each stimulus check properly.