Recovery Rebate Calculator – The Recovery Rebate allows taxpayers to get a tax refund, without having to modify their tax returns. The IRS runs this program and it’s free. It is essential to familiarize yourself with the guidelines before applying. Here are a few points to be aware of about the program.

Recovery Rebate funds are not subject to adjustment.

In advance, taxpaying taxpayers eligible to are eligible to receive credit for recovery. There is no need to alter your refund if the tax bill is greater than your 2019 tax bill. However, depending on your income, your recovery credit might be reduced. Your credit rating will drop to zero if you earn more than $75,000. Joint filers with spouses will see credit start to decline at $150,000. Members of the household and head of household will begin to notice when their reimbursements for recovery rebates start dropping to $112,500.

Individuals who weren’t able to receive all of the stimulus funds may be eligible for recovery credits for tax refunds for 2020. They will need an IRS online account and an acknowledgement of all amounts they have received.

It doesn’t allow for a tax return

Although the Recovery Rebate will not give you a refund on your tax bill, it will grant you with tax credits. The IRS has issued warnings about mistakes in the application of this stimulus money. The child tax credit is another area where errors were committed. The IRS will send a letter to you if the credit was not used correctly.

The Recovery Rebate is available for federal income tax returns up to 2021. If you’re a married couple with two children , and qualify as a tax-dependent taxpayer, you could get as much as $1,400, or $4200 for single filers.

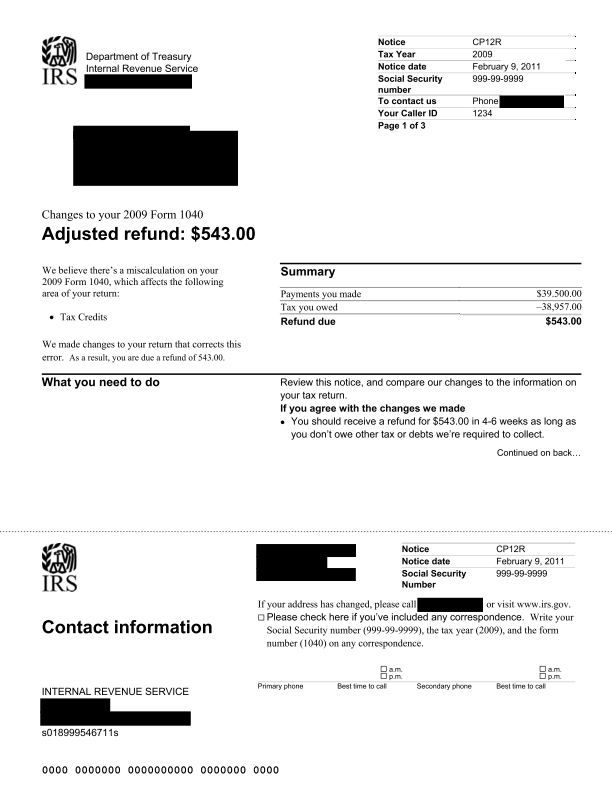

It is possible to delay it due to mistakes in math or calculations

If the IRS sends you a notice informing you that your tax return contains errors in math It is crucial to take the time to look over your information and make any necessary adjustments. A mistake in your information could result in a refund delay. The IRS provides extensive FAQs to answer your concerns.

There are a variety of reasons your Recovery Rebate could be delayed. The most frequent reason why your recovery rebate may delay is because there was a mistake in applying for the stimulus funds and the tax credits for children. The IRS has advised taxpayers to double-check tax returns to ensure that they claim each stimulus money properly.